🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Drone Flight Controller System Market

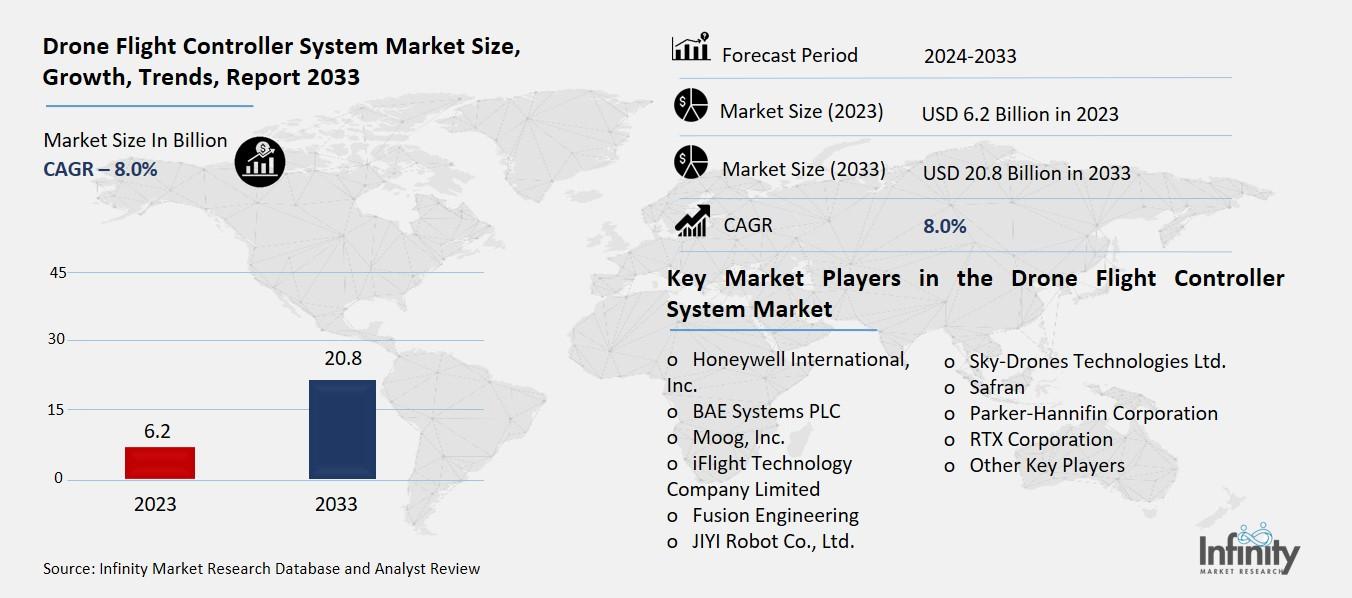

Global Drone Flight Controller System Market (By Application, Fixed-Wing Drone and Rotary Wing Drone; By Range of Operation, Short Range, Mid-Range, and Long Range; By End-Use, Military Aviation, Commercial Aviation, and Other End-Uses; By Sales Channel, Online and Offline; By Region and Companies), 2024-2033

Jan 2025

Aerospace and Defense

Pages: 138

ID: IMR1404

Drone Flight Controller System Market Overview

Global Drone Flight Controller System Market acquired the significant revenue of 6.2 Billion in 2023 and expected to be worth around USD 20.8 Billion by 2033 with the CAGR of 8.0% during the forecast period of 2024 to 2033. The drone flight controller system is one of the fast-growing categories in the overall unmanned aerial vehicle (UAV) market. Flight controllers are central to all drone functions as they are in charge of flight control, stability, and communication between the components inside the drone. These systems have advancement in sensor technology, integration of Artificial Intelligence and miniaturization and are now becoming highly sophisticated to support apart from military and industrial use, Civil sectors like agriculture, logistics, surveillance and recreation activities.

The main drivers have been higher consumer appetite for self-guided drones, new and favorable policies for more UAVs, and a wider applicability of end-to-end deliveries and asset inspections. Competitive pressures are high with concentration on making refinement in precision, refining interfaces, and allowing integration with other technologies such as 5G and IoT.

Drivers for the Drone Flight Controller System Market

Rising Demand for Drones Across Industries

A drone flight controller system is, therefore, quickly becoming popular in different areas such as farming, shipping, defense, and media among others due to its effectiveness. In agriculture, highly controlled drones help with precision farming for purposes of crop monitoring, watering and use of fertilizers. In generic logistics these systems enhance efficient and cheap ways of transporting products especially to those regions that are usually difficult to access in tackling issues to do with inventory and checking super stock.

For the defense purposes, drones are extremely useful in surveillance and mapping, target acquisition, and operations, which relay visuals in real time with relatively higher chances of injury to humans. In the same way, in media and entertainment, the versatility of drones is that they unlock inventive opportunities: acquiring the best aerial shots and various perspectives, which was always difficult or expensive to shoot before.

Restraints for the Drone Flight Controller System Market

Technical Limitations

Power management remains a significant challenge for drone flight controller systems, as limited battery capacity directly impacts flight duration. High energy demands from motors, sensors, and onboard electronics often strain existing battery technologies, reducing operational efficiency. This limitation is particularly critical for applications requiring extended flights, such as agricultural mapping or large-scale industrial inspections. Furthermore, the additional weight of payloads, like cameras or delivery packages, exacerbates energy consumption, further curtailing flight times. Addressing this issue requires advancements in battery technology, such as the development of lighter, higher-capacity batteries or alternative energy sources like hydrogen fuel cells.

Opportunity in the Drone Flight Controller System Market

Customized Solutions for Niche Applications

The demand for drone systems tailored to specific industries, such as mining and renewable energy, is witnessing significant growth as businesses recognize the advantages of customized solutions. In the mining sector, drones equipped with industry-specific flight controllers are transforming operations by enabling precise mapping of terrains, monitoring equipment, and assessing environmental conditions. These drones help improve safety by reducing the need for personnel to operate in hazardous areas, while also enhancing efficiency in resource exploration and extraction processes.

In renewable energy, drones are increasingly being deployed for tasks like inspecting wind turbines, solar panels, and hydroelectric infrastructure. Tailored flight controllers equipped with specialized sensors allow for detailed data collection, enabling predictive maintenance and operational optimization. These customized systems reduce downtime, cut inspection costs, and improve the reliability of renewable energy assets.

Trends for the Drone Flight Controller System Market

Miniaturization and Lightweight Designs

Advances in compact designs are revolutionizing the drone industry by enabling the development of smaller, more efficient UAVs. Miniaturization of components such as flight controllers, sensors, and communication modules allows manufacturers to build drones that are lighter, more agile, and capable of operating in confined or hard-to-reach spaces. This progress is particularly valuable in applications like indoor inspections, urban delivery services, and wildlife monitoring, where larger drones may be impractical. Compact designs also reduce material costs and simplify transport and deployment, making drones more accessible for commercial and consumer use.

The development of lightweight flight controllers is a key innovation contributing to improved battery efficiency and payload capacity in drones. By reducing the overall weight of the drone, these controllers decrease energy consumption during flight, extending operational durations and optimizing power use. This improvement is crucial for applications that require long-range or endurance capabilities, such as surveying or search-and-rescue missions.

Segments Covered in the Report

By Application

o Fixed-Wing Drone

o Rotary-Wing Drone

By Range of Operation

o Short Range

o Mid-Range

o Long Range

By End-Use

o Military Aviation

o Commercial Aviation

o Other End-Uses

By Sales Channel

o Online

o Offline

Segment Analysis

By Application Analysis

On the basis of application, the market is divided into fixed-wing drone and rotary wing drone. Among these, rotary wing drone segment acquired the significant share in the market owing to their versatility and operational flexibility. These drones are highly maneuverable, capable of vertical takeoff and landing (VTOL), and can hover in place, making them ideal for a wide range of applications. In industries such as agriculture, surveillance, construction, and logistics, rotary-wing drones excel in tasks that require precision and close-range operations, such as crop monitoring, aerial inspections, and last-mile delivery.

By Range of Operation Analysis

On the basis of range of operation, the market is divided into operation, short range, mid-range, and long range. Among these, mid-range segment held the prominent share of the market due to its balanced capabilities in terms of range, functionality, and cost-effectiveness. Mid-range drones typically operate within a range of 5 to 20 kilometers, making them well-suited for a wide variety of commercial and industrial applications. These include agricultural surveying, infrastructure inspection, search-and-rescue missions, and environmental monitoring.

Their ability to cover substantial distances without requiring the extensive infrastructure or high costs associated with long-range drones makes them particularly attractive to industries with moderate operational needs. Additionally, mid-range drones often feature advanced flight controllers capable of supporting sophisticated payloads such as high-resolution cameras, LiDAR, and thermal imaging sensors.

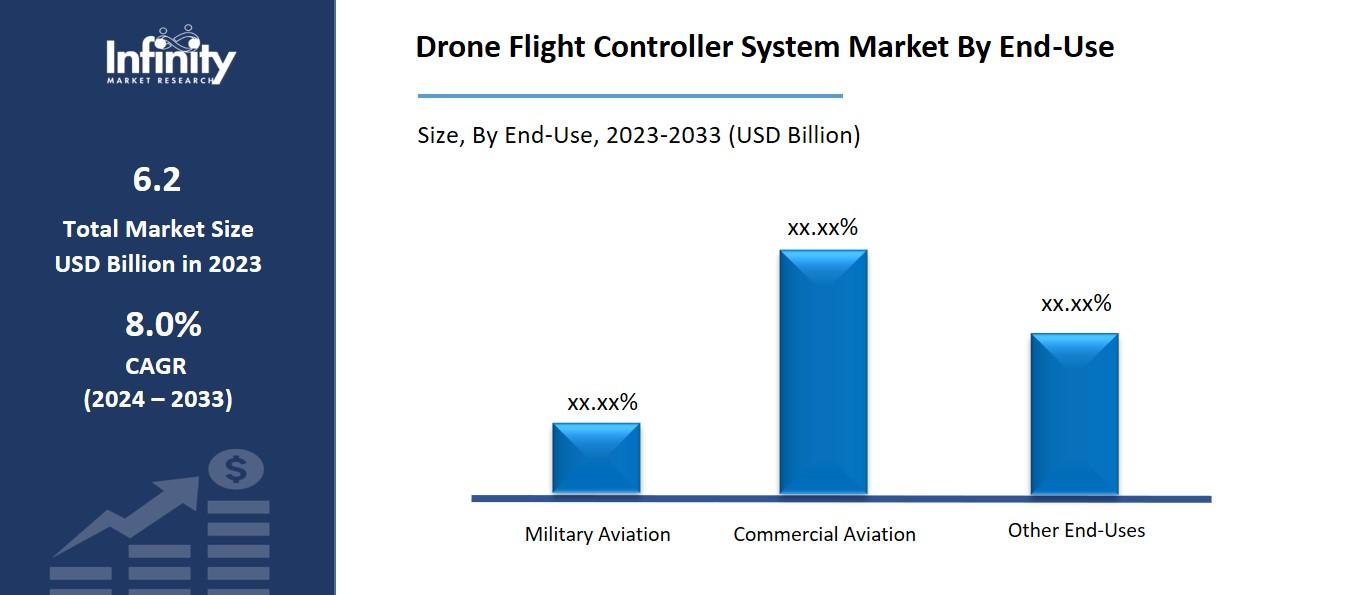

By End-Use Analysis

On the basis of end-use, the market is divided into military aviation, commercial aviation, and other end-uses. Among these, military aviation segment held the significant share of the market. Military applications prioritize advanced capabilities, such as autonomous navigation, precision targeting, and real-time intelligence gathering, which are made possible by sophisticated flight controller systems. These drones are used for surveillance, reconnaissance, combat missions, and border monitoring, offering unparalleled advantages in reducing risks to personnel and enhancing mission effectiveness.

By Sales Channel Analysis

On the basis of sales channel, the market is divided into online and offline. Among these, offline segment held the most of the share of the market. Offline channels, such as specialty stores, distributors, and authorized dealerships, offer buyers the opportunity to receive expert guidance, hands-on demonstrations, and after-sales support, which are critical for complex or high-stakes applications like defense, industrial inspections, and large-scale agricultural operations. Additionally, offline channels facilitate tailored solutions and consultations, which are often necessary for businesses or government agencies seeking specific functionalities or integrations in flight controller systems.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 35.1% of the market. The United States, in particular, leads the market, driven by strong demand in both commercial and military sectors. The region is home to significant investments in drone technology across industries such as defense, agriculture, logistics, and entertainment, contributing to the growth of the market.

In the defense sector, North America’s military forces extensively use UAVs for surveillance, reconnaissance, and tactical operations, pushing the demand for advanced flight controller systems. Additionally, the commercial sector benefits from a favorable regulatory environment, including FAA regulations that have been evolving to accommodate and promote drone use for businesses. The high level of technological innovation, robust infrastructure, and a strong presence of leading drone manufacturers and tech companies further solidify North America’s dominance in the market.

Competitive Analysis

The competitive landscape of the drone flight controller system market is marked by the presence of several key players, including established aerospace and defense companies, as well as specialized drone manufacturers and technology firms. These companies compete on factors such as technological innovation, product quality, pricing, and customer support. Major players are heavily investing in research and development to enhance the capabilities of their flight controllers, incorporating advanced features like AI-powered navigation, improved power management, and integration with emerging technologies such as 5G and IoT.

Recent Developments

In November 2023, AIBOT awarded Honeywell a contract to supply its Compact Fly-By-Wire (cFBW) system, which will be used in AIBOT's fully electric vertical takeoff and landing (eVTOL) aircraft.

Key Market Players in the Drone Flight Controller System Market

o Honeywell International, Inc.

o BAE Systems PLC

o Moog, Inc.

o iFlight Technology Company Limited

o Fusion Engineering

o JIYI Robot Co., Ltd.

o Sky-Drones Technologies Ltd.

o Safran

o Parker-Hannifin Corporation

o RTX Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 6.2 Billion |

|

Market Size 2033 |

USD 20.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

8.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Application, Range of Operation, End-Use, Sales Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Honeywell International, Inc., BAE Systems PLC, Moog, Inc., iFlight Technology Company Limited, Fusion Engineering, JIYI Robot Co., Ltd., Sky-Drones Technologies Ltd., Safran, Parker-Hannifin Corporation, RTX Corporation, and Other Key Players. |

|

Key Market Opportunities |

Customized Solutions for Niche Applications |

|

Key Market Dynamics |

Rising Demand for Drones Across Industries |

📘 Frequently Asked Questions

1. Who are the key players in the Drone Flight Controller System Market?

Answer: Honeywell International, Inc., BAE Systems PLC, Moog, Inc., iFlight Technology Company Limited, Fusion Engineering, JIYI Robot Co., Ltd., Sky-Drones Technologies Ltd., Safran, Parker-Hannifin Corporation, RTX Corporation, and Other Key Players.

2. How much is the Drone Flight Controller System Market in 2023?

Answer: The Drone Flight Controller System Market size was valued at USD 6.2 Billion in 2023.

3. What would be the forecast period in the Drone Flight Controller System Market?

Answer: The forecast period in the Drone Flight Controller System Market report is 2024-2033.

4. What is the growth rate of the Drone Flight Controller System Market?

Answer: Drone Flight Controller System Market is growing at a CAGR of 8.0% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.