🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Drug Discovery Services Market

Drug Discovery Services Market Global Industry Analysis and Forecast (2024-2033) by Type (Chemistry Services and Biology Services), Process (Target Validation, Target Selection, Lead Optimization, Hit-To-Lead Identification, and Candidate Validation), End-User (Academic Institutes, Pharmaceutical & Biotechnology Companies, and Other End-Users) and Region

Jun 2025

Healthcare

Pages: 138

ID: IMR2068

Drug Discovery Services Market Synopsis

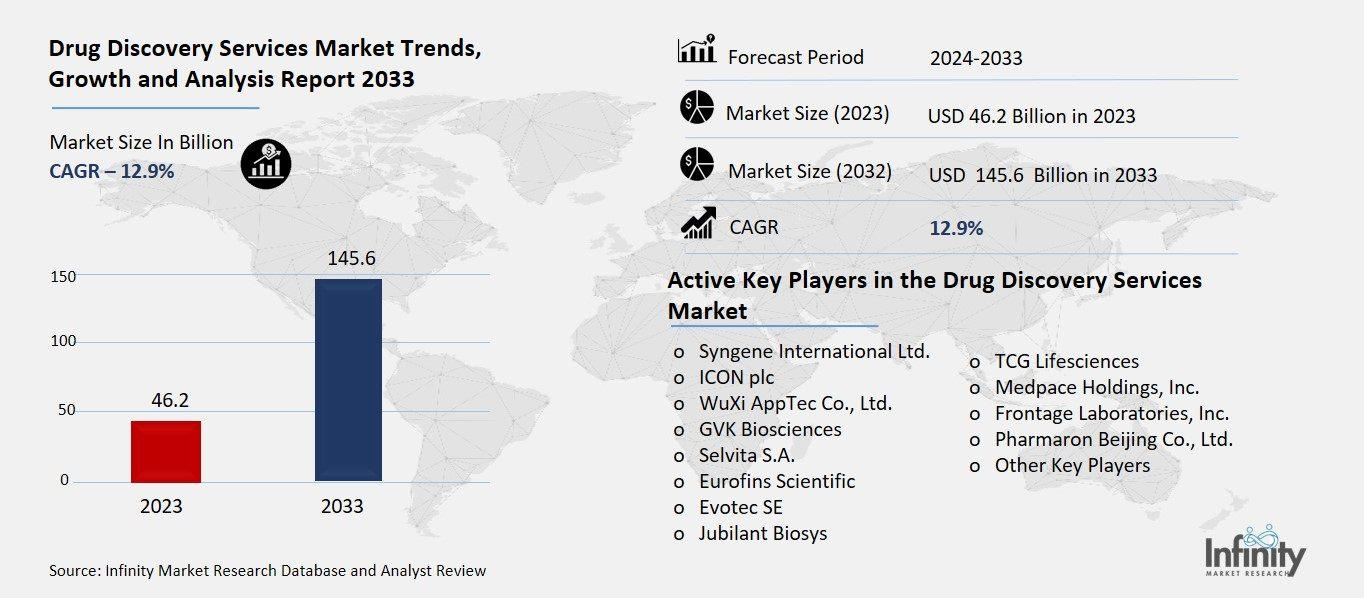

The Global Drug Discovery Services Market was valued at USD 40.7 billion in 2023 and is expected to grow from USD 46.2 billion in 2024 to USD 145.6 billion by 2033, reflecting a CAGR of 12.9% over the forecast period.

The drug discovery services market is defined as the market that offers outsourced services to pharmaceutical, biotechnology and academic institutions to aid in the process of drug identification and development of new drug candidates. The range of these services run across the whole spectrum of early-stage drug development, such as target identification and validation, hit-to-lead studies, lead optimization, and preclinical testing. The market is pushed by the growth in R&D expenditures and drug development complexity and the escalating need in specialized knowledge and advanced technologies including AI, high-throughput screening, and computational chemistry. Outsourcing enables firms to speed time-lines, cut-down on expenditure and concentrate on the essentials.

Drug Discovery Services Market Driver Analysis

Rising R&D Expenditure by Pharma & Biotech Companies

Drug discovery services market is experiencing a high growth as more funds are being channelled towards drug research to find new therapies. Firms in the pharmaceutical and biotechnology sectors are investing massive resources in the development of new cures to complicated and chronic illnesses like cancer, Alzheimer, and autoimmune diseases. The drug development process is increasingly becoming longer and expensive thus the high demand of outsourcing to specialized service providers. Through outsourcing, firms are able to utilize modern technologies, scientific skills as well as efficient infrastructure without necessarily making huge capital investments.

Drug Discovery Services Market Restraint Analysis

Intellectual Property (IP) and Data Security Concerns

The fear of intellectual property (IP) theft and data security breach often makes pharmaceutical and biotechnology companies reluctant to outsource core research and development activities. Drug discovery is proprietary information (molecular structure, biological target, and confidential research data) that is crucial to competition. When such sensitive data is transmitted to third party service providers, particularly international boundaries, risk of unauthorized access, misuse or data leaks rise. This is a significant risk to companies that are driven by innovation because loss of IP may imply financial losses, legal issues, and reputational problems.

Drug Discovery Services Market Opportunity Analysis

Rising Demand for Personalized Medicine

Increasing focus on personalized medicine is also augmenting the demand in drug discovery services to a large extent. Personalized or precision medicine is based on the creation of individual drugs depending on the genetic features of a person, his/her lifestyle, and peculiarities of the disease. With the regime of healthcare moving beyond a one-shoe-fits-all model and towards more targeted therapies, pharmaceutical companies are becoming more dependent on specialized service providers to perform genomic analysis, biomarker discovery and targeted compound screening. They involve the use of high technologies and skills that many companies would rather obtain by means of outsourcing. Use of pharmacogenomics in drug discovery can create more effective and safer drugs and this is expected to grow this segment of service.

Drug Discovery Services Market Trend Analysis

Integration of Artificial Intelligence in Drug Discovery

Artificial Intelligence (AI) and deep learning is changing the drug discovery scene since they can predict molecular interactions, target binding affinities, and drug efficacy faster and more accurately. These technologies interrogate large collections of data, whether chemical libraries or genomic data, to predict which compounds have the potential to become drugs and to remove ineffective compounds as early as possible in the pipeline. AI limits the time-consuming and expensive trial-and-error experiments by modeling the interaction between molecules and biological targets. Also, deep learning models have the potential to reveal latent patterns and correlations that might be missed by more traditional approaches and thus enhance lead optimization, toxicity prediction, and patient stratification.

Drug Discovery Services Market Segment Analysis

The Drug Discovery Services Market is segmented on the basis of Type, Process, and End-User.

By Type

o Chemistry Services

o Biology Services

By Process

o Target Validation

o Target Selection

o Lead Optimization

o Hit-To-Lead Identification

o Candidate Validation

By End-User

o Academic Institutes

o Pharmaceutical & Biotechnology Companies

o Other End-Users

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Chemistry Services Segment is Expected to Dominate the Market During the Forecast Period

The types discussed in this research study, the chemistry services segment is expected to account for the largest market share of drug discovery services market in the forecast period. Medicinal and synthetic chemistry dominance is explained by the essentiality of these portions of drug discovery at the early hit identification, lead generation, and lead optimization measures. Chemistry services are associated with designing, synthesis and modification of chemical compounds with the aim to enhance their pharmacological attributes, strength, selectivity and safety margin. Another driver of the segment is the rising demand of new small molecules combined with the tendency of outsourcing such complex processes to specialized contract research organizations (CROs).

By Process, the Lead Optimization Segment is Expected to Held the Largest Share

The lead optimization segment is likely to dominate the market. The step is essential in developing promising compounds (hits) into viable drug candidates by enhancing their efficacy, selectivity, pharmacokinetics and safety properties. Lead optimization is a process which consists of repeated rounds of synthesis and screening to improve the performance of a molecule and to reduce the likely toxicity and side effects. This process is complex and resource intensive, which is forcing pharmaceutical and biotechnology companies to outsource this process to specialized service providers.

By End-User, the Pharmaceutical & Biotechnology Companies Segment is Expected to Held the Largest Share

In the drug discovery services market, pharmaceutical and biotechnology companies are expected to account for the largest share by end-user during the forecast period. These are the main innovators of drugs and they outsource discovery services to cut time-to-market, reduce their R&D expenses and tap specialized technologies and skills. With the growth of drug pipelines, particularly of complex and targeted therapeutics, pharma and biotech companies are outsourcing lead identification, optimization and preclinical studies to contract research organizations (CROs).

Drug Discovery Services Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is projected to dominate the drug discovery services market throughout the forecast period, owing to its well-established pharmaceutical industry, robust R&D infrastructure, and high healthcare expenditure. There are also a number of major pharmaceutical and biotechnology firms in the region that spend considerable sums in drug research and often outsource early-stage discovery to contract research organizations (CROs). Moreover, existence of sophisticated technologies, talented scientific human resources, and favourable regulatory systems, especially in the United States, also enhance market development. Funding of research programs by the governments and the private sector as well as increasing use of AI, genomics, and precision medicine also make North America take the leading position. This coupled with the presence of robust innovation and strategic partnering makes the region a centre of drug discovery services.

Recent Development

In November 2023, Evotec and Bayer formed a new strategic partnership aimed at accelerating the discovery and development of novel drugs across multiple therapeutic areas.

In September 2023, Several contract research organizations (CROs) announced new collaborations with pharmaceutical and biotechnology companies to deliver drug discovery services. For instance, Syneos Health revealed a partnership with AstraZeneca to support drug discovery efforts across various therapeutic areas.

Active Key Players in the Drug Discovery Services Market

o Syngene International Ltd.

o ICON plc

o WuXi AppTec Co., Ltd.

o GVK Biosciences

o Selvita S.A.

o Eurofins Scientific

o Evotec SE

o Jubilant Biosys

o TCG Lifesciences

o Medpace Holdings, Inc.

o Frontage Laboratories, Inc.

o Pharmaron Beijing Co., Ltd.

o Other Key Players

Global Drug Discovery Services Market Scope

|

Global Drug Discovery Services Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 40.7 Billion |

|

Market Size in 2024: |

USD 46.2 Billion | ||

|

Forecast Period 2024-33 CAGR: |

12.9% |

Market Size in 2033: |

USD 145.6 Billion |

|

Segments Covered: |

By Type |

· Chemistry Services · Biology Services | |

|

By Process |

· Target Validation · Target Selection · Lead Optimization · Hit-To-Lead Identification · Candidate Validation | ||

|

By End-User |

· Academic Institutes · Pharmaceutical & Biotechnology Companies · Other End-Users | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising R&D Expenditure by Pharma & Biotech Companies | ||

|

Key Market Restraints: |

· Intellectual Property (IP) and Data Security Concerns | ||

|

Key Opportunities: |

· Rising Demand for Personalized Medicine | ||

|

Companies Covered in the report: |

· Syngene International Ltd., ICON plc, WuXi AppTec Co., Ltd., GVK Biosciences and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Drug Discovery Services Market Research report?

Answer: The forecast period in the Drug Discovery Services Market Research report is 2024-2033.

2. Who are the key players in the Drug Discovery Services Market?

Answer: Syngene International Ltd., ICON plc, WuXi AppTec Co., Ltd., GVK Biosciences and Other Key Players.

3. What are the segments of the Drug Discovery Services Market?

Answer: The Drug Discovery Services Market is segmented into Type, Process, End-User, and Regions. By Type, the market is categorized into Chemistry Services and Biology Services. By Process, the market is categorized into Target Validation, Target Selection, Lead Optimization, Hit-To-Lead Identification, and Candidate Validation. By End-User, the market is categorized into Academic Institutes, Pharmaceutical & Biotechnology Companies, and Other End-Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Drug Discovery Services Market?

Answer: The market of drug discovery services is the part of the healthcare and pharmaceutical industry, where different parts of the drug discovery process are outsourced to specialized service companies. Such services encompass target identification, assay development, high-throughput screening, lead optimization as well as preclinical research activities. Drug companies (pharmaceutical and biotechnology) frequently turn to these outside partners to accelerate drug development, cut costs and tap into technologies and expertise.

5. How big is the Drug Discovery Services Market?

Answer: The Global Drug Discovery Services Market was valued at USD 40.7 billion in 2023 and is expected to grow from USD 46.2 billion in 2024 to USD 145.6 billion by 2033, reflecting a CAGR of 12.9% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.