🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Drug Eluting Balloons Market

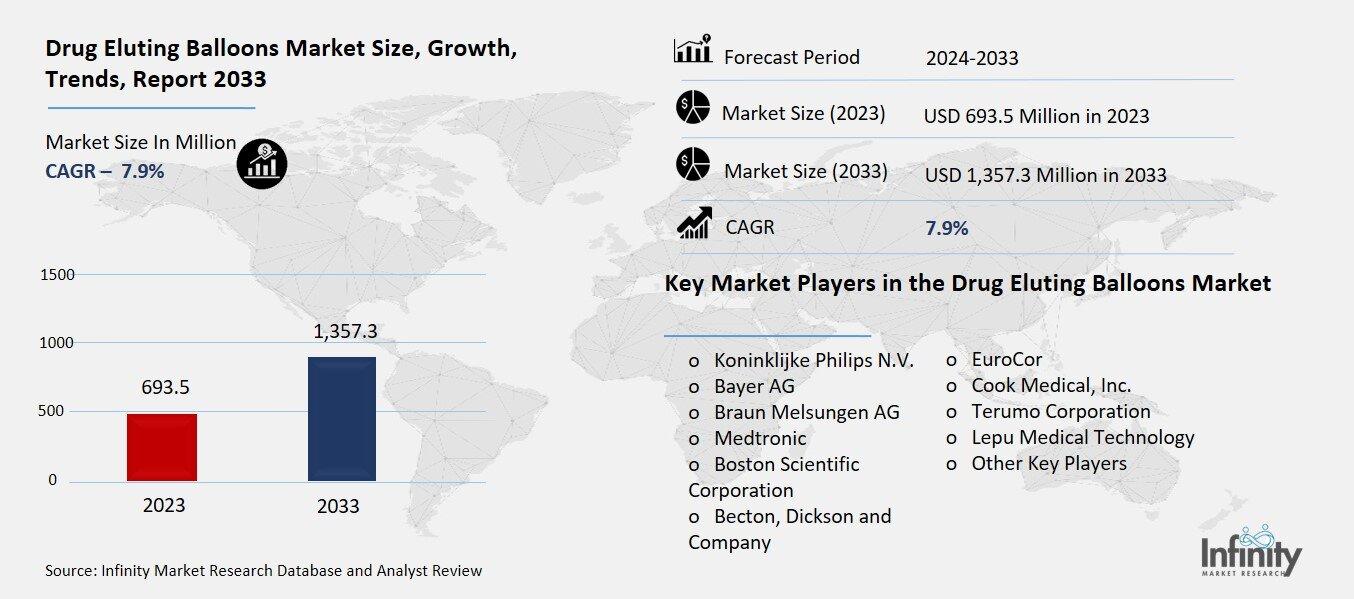

Global Drug Eluting Balloons Market (By Product, Peripheral Drug Eluting Balloon, Coronary Drug Eluting Balloon, and Other Products; By Technology, TransPax, Paccocath, FreePac, EnduraCoat, and Other Technologies; By End-User, Hospitals, Ambulatory Surgical Centers, and Other End-Users, By Region and Companies), 2024-2033

Nov 2024

Healthcare

Pages: 138

ID: IMR1303

Drug Eluting Balloons Market Overview

Global Drug Eluting Balloons Market acquired the significant revenue of 693.5 Million in 2023 and expected to be worth around USD 1,357.3 Million by 2033 with the CAGR of 7.9% during the forecast period of 2024 to 2033. The DEB market is an emerging segment of the medical devices sector, focused on non-surgical cardiovascular interventions. DEBs are drug eluting balloons with therapeutic drugs that when inflated within the narrowed or blocked arteries, deliver the drugs to the inner lining of the arteries to prevent restenosis. This technology offers an effective intervention that can be used instead of stents when long-term device placement is not ideal. The increasing number of cardiovascular diseases, coupled with a global increase in the geriatric population and diabetes and obesity-related issues, will also boost the need for DEBs.

Further, these devices are employed more in treating the PAD since they provide certain advantages over conventional angioplasty in that they may lessen the repetition of the procedure. This is due to government support and innovations such as enhanced drug substance and drug delivery systems.

Drivers for the Drug Eluting Balloons Market

Increasing Cardiovascular Disease Prevalence

The growth of cardiovascular diseases worldwide especially in the aging population has economically pushed the development of newer technologies including DEBs. With a growing world population of people with extended life spans, CAD along with PAD and plethora other diseases such as diabetes, hypertension, and obesity amongst others frequently attributes to cardiovascular diseases. While traditional approach to treating coronary artery disease such as stenting and bypass surgery are effective they pose considerable risks and effectiveness is deem limited especially in the elderly patients who may develop more complications due to their age or longer recovery periods.

DEBs represent an endovascular approach that integrates angioplasty and local drug delivery to address the arterial walls to circumvent restenosis without implantation of stent. This approach greatly advantages older patients, as it saves them from future procedures; may decrease inflammation levels; and also doesn’t necessitate the use of blood thinners for years, as stents do.

Restraints for the Drug Eluting Balloons Market

Stringent Regulatory Frameworks

Complex regulatory approval processes, particularly in regions like the U.S. and Europe, pose significant challenges for the drug-eluting balloons (DEB) market. Regulatory bodies, such as the FDA in the United States and the European Medicines Agency (EMA), enforce stringent safety and efficacy standards that manufacturers must meet before DEBs can reach the market. This involves extensive clinical trials, rigorous documentation, and compliance with various regulatory protocols, which can be both time-consuming and costly. These requirements, while essential for patient safety, often lead to extended approval timelines, delaying product launches and limiting the availability of innovative DEB solutions.

Opportunity in the Drug Eluting Balloons Market

Applications Beyond Cardiovascular Treatments

Expanding research into drug-eluting balloons (DEBs) for treating conditions beyond traditional coronary applications is unlocking new growth opportunities within the market. Peripheral artery disease (PAD), which affects blood flow to the limbs, particularly the legs, is a widespread and increasingly common condition that can lead to severe complications if untreated. DEBs present a promising treatment option for PAD by delivering targeted drugs to affected areas, reducing the likelihood of restenosis (re-blocking of arteries) without leaving behind a permanent stent that might lead to long-term complications. Similarly, DEBs offer potential benefits in cases of in-stent restenosis, a recurrent issue where previously placed stents in arteries begin to narrow again. For patients who have experienced multiple interventions, DEBs can be a less invasive alternative, as they reduce the need for additional stent placements and the associated risks of repetitive surgical procedures.

Trends for the Drug Eluting Balloons Market

Shift Toward Drug-Coated Therapies

The preference for drug-coated therapies, such as drug-eluting balloons (DEBs), is on the rise, primarily due to their targeted approach and potential to reduce the need for long-term medication. Unlike traditional stents, which are permanent implants that hold arteries open mechanically, DEBs deliver therapeutic drugs directly to the affected artery during inflation. This approach allows the drugs to be absorbed by the arterial walls, helping to prevent restenosis (re-narrowing) without leaving behind any permanent foreign material. For patients, this means fewer risks associated with implant-related complications, such as inflammation or the need for repeated interventions.

Additionally, by minimizing the physical presence in the artery, DEBs may reduce the necessity for prolonged use of antiplatelet or anticoagulant medications, which are often prescribed with stents to prevent blood clots but can lead to side effects with long-term use.

Segments Covered in the Report

By Product

o Peripheral Drug Eluting Balloon

o Coronary Drug Eluting Balloon

o Other Products

By Technology

o TransPax

o Paccocath

o FreePac

o EnduraCoat

o Other Technologies

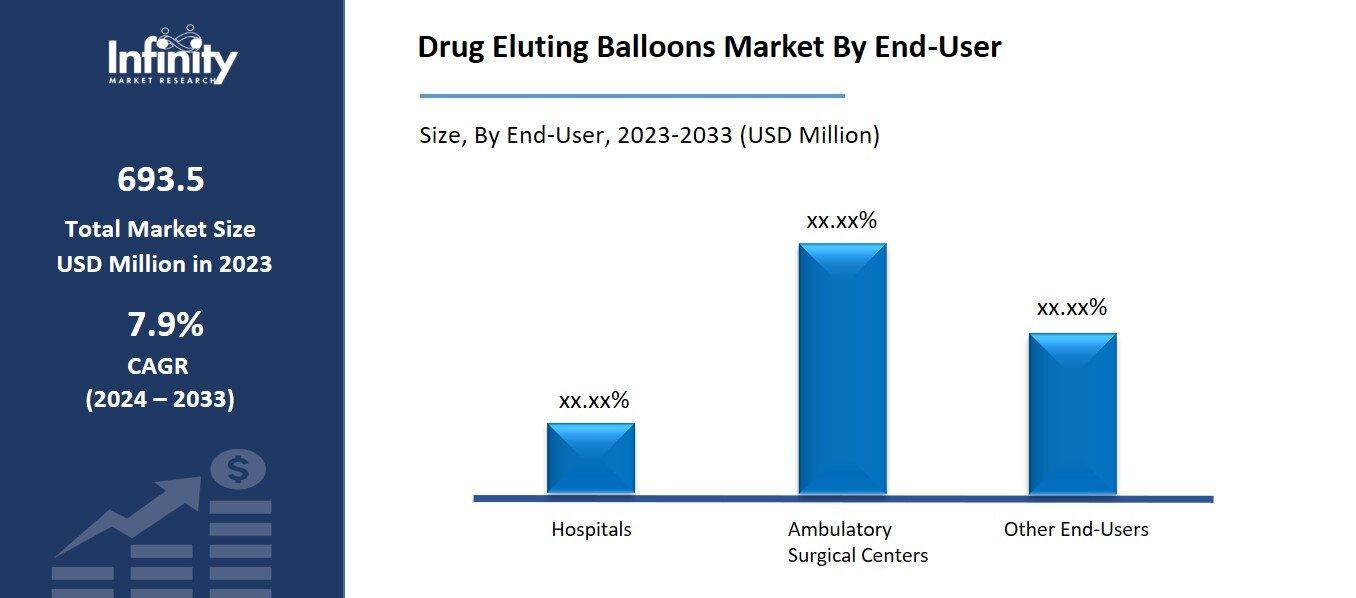

By End-User

o Hospitals

o Ambulatory Surgical Centers

o Other End-Users

Segment Analysis

By Product Analysis

On the basis of product, the market is divided into peripheral drug eluting balloon, coronary drug eluting balloon, and other products. Among these, peripheral drug eluting balloon segment acquired the significant share in the market owing to the rising prevalence of peripheral artery disease (PAD) and its associated complications. PAD, which affects blood flow in the limbs, especially the lower extremities, has become increasingly common with aging populations and the global rise in diabetes and obesity rates. Peripheral DEBs provide a minimally invasive treatment option, delivering localized medication to arterial walls, which helps prevent restenosis without the need for permanent implants. This reduces the need for frequent re-interventions and mitigates the risks associated with traditional stents.

By Technology Analysis

On the basis of technology, the market is divided into transpax, paccocath, freepac, enduracoat, and other technologies. Among these, transpax segment held the prominent share of the market due to its advanced drug delivery technology and proven effectiveness in minimizing restenosis rates. TransPax technology is distinguished by its innovative drug-coating method, which enables a more efficient and consistent release of the therapeutic agent directly to the arterial walls. This targeted delivery improves the balloon's efficacy in preventing re-narrowing of blood vessels while minimizing drug loss during insertion and inflation.

By End-User Analysis

On the basis of end-user, the market is divided into hospitals, ambulatory surgical centers, and other end-users. Among these, hospitals segment held the prominent share of the market. Hospitals are typically equipped with advanced medical infrastructure, including catheterization labs and imaging equipment, which are essential for DEB procedures. Additionally, hospitals employ highly trained cardiovascular specialists and interventional radiologists who are skilled in complex minimally invasive procedures, making them the preferred setting for DEB treatments. Hospitals also serve as the primary centers for emergency cardiovascular care, often managing high volumes of patients with severe and complex conditions like coronary artery disease (CAD) and peripheral artery disease (PAD), which commonly require DEB interventions.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market owing to a combination of advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and favorable reimbursement policies. The region has a high incidence of coronary artery disease (CAD) and peripheral artery disease (PAD), driven by lifestyle factors like sedentary habits, high rates of obesity, and an aging population. These factors create a consistent demand for effective minimally invasive treatments, such as DEBs.

Additionally, North America is home to several leading medical device manufacturers and research institutions that contribute to technological advancements and clinical research in DEB technology, further fueling market growth.

Competitive Analysis

The competitive analysis of the drug-eluting balloons (DEB) market reveals a dynamic and rapidly evolving landscape dominated by key players such as Medtronic, Boston Scientific, and B. Braun. These established companies leverage their extensive research and development capabilities, robust distribution networks, and strong brand recognition to maintain market leadership. They are investing significantly in innovation to enhance DEB technologies, focusing on improved drug formulations and advanced delivery systems to address the growing demand for minimally invasive cardiovascular treatments. In addition, the market is witnessing the entry of emerging players that introduce niche products tailored to specific medical needs, particularly in the peripheral artery disease segment, increasing competition and offering more choices for healthcare providers.

Recent Developments

In September 2022, Advanced NanoTherapies obtained US FDA approval for its SirPlux Duo Drug Coated Balloon, designed specifically for treating coronary artery disease in vessels with a diameter of less than 3.0 mm.

In May 2022, MedAlliance's SELUTION SLR drug-eluting balloon granted FDA investigational device exemption approval. The SELUTION SLR is designed to offer controlled, sustained drug release specifically for below-the-knee applications in the treatment of peripheral artery disease.

Key Market Players in the Drug Eluting Balloons Market

o Koninklijke Philips N.V.

o Bayer AG

o Braun Melsungen AG

o Medtronic

o Boston Scientific Corporation

o Becton, Dickson and Company

o EuroCor

o Cook Medical, Inc.

o Terumo Corporation

o Lepu Medical Technology

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 693.5 Million |

|

Market Size 2033 |

USD 1,357.3 Million |

|

Compound Annual Growth Rate (CAGR) |

7.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Technology, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Koninklijke Philips N.V., Bayer AG, Braun Melsungen AG, Medtronic, Boston Scientific Corporation, Becton, Dickson and Company, EuroCor, Cook Medical, Inc., Terumo Corporation, Lepu Medical Technology, and Other Key Players. |

|

Key Market Opportunities |

Applications Beyond Cardiovascular Treatments |

📘 Frequently Asked Questions

1. Who are the key players in the Drug Eluting Balloons Market?

Answer: Koninklijke Philips N.V., Bayer AG, Braun Melsungen AG, Medtronic, Boston Scientific Corporation, Becton, Dickson and Company, EuroCor, Cook Medical, Inc., Terumo Corporation, Lepu Medical Technology, and Other Key Players.

2. How much is the Drug Eluting Balloons Market in 2023?

Answer: The Drug Eluting Balloons Market size was valued at USD 693.5 Million in 2023.

3. What would be the forecast period in the Drug Eluting Balloons Market?

Answer: The forecast period in the Drug Eluting Balloons Market report is 2024-2033.

4. What is the growth rate of the Drug Eluting Balloons Market?

Answer: Drug Eluting Balloons Market is growing at a CAGR of 7.9% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.