🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Dry Bulk Shipping Market

Dry Bulk Shipping Market By Community Type (Iron Ore, Grains, Coal, Steel, Cement, and Other Community Types), By Vessel Type (Capesize, Panamax, Handysize, and Other Vessel Types), By Region (North America, Europe, APAC, South America and MEA), Key Market Players- Forecast (2024-2033)

Jun 2024

Packaging and Transports

Pages: 139

ID: IMR1085

Dry Bulk Shipping Market Overview

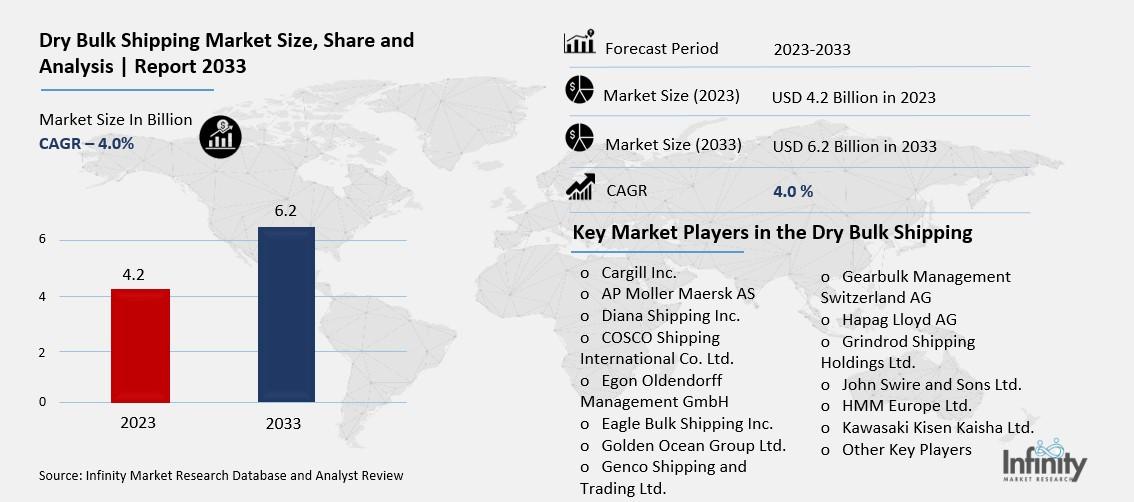

The Dry Bulk Shipping Market size is expected to be valued at USD 4.2 billion in 2023 and is anticipated to reach upto 6.2 billion in 2033, exhibiting a CAGR of 4.0% during the forecast period from 2024 to 2033.

The dry bulk shipping market is a vital component of global trade, facilitating the transportation of commodities such as coal, iron ore, grains, and other raw materials in large quantities. Characterized by the movement of unpackaged, homogeneous cargo, this sector operates through a fleet of specialized vessels, including bulk carriers, which are designed to efficiently transport bulk cargo across oceans and waterways. The dynamics of the dry bulk shipping market are heavily influenced by economic trends, as demand for raw materials fluctuates with industrial production, construction activities, and agricultural harvests worldwide.

Moreover, the dry bulk shipping market is subject to cyclical trends, characterized by periods of boom and downturn, driven by supply-demand imbalances and fleet expansion cycles. Despite facing challenges such as overcapacity, regulatory compliance, and environmental concerns, the dry bulk shipping industry remains indispensable to the global economy, ensuring the efficient movement of essential commodities and contributing to the interconnectedness of international trade.

Segment Overview

By Community Type Analysis

On the basis of community type segment, the market is divided into packaging and equipment. The iron ore segment is expected to dominate the market during the forecast period with the 32% of market revenue. Iron ore, a crucial raw material in steel production, commands a significant share of dry bulk shipping demand due to its widespread use in construction, manufacturing, and infrastructure development. As economies around the world continue to urbanize and industrialize, the demand for steel remains robust, driving substantial volumes of iron ore shipments. Moreover, emerging markets' burgeoning infrastructure projects and ongoing urbanization efforts fuel the demand for steel, further bolstering the iron ore segment's prominence in the dry bulk shipping market.

By Vessel Type Analysis

On the basis of vessel type segment, the market is divided into capesize, panamax, handysize, and other vessel types. The capesize segment is anticipated to hold the prominent market share of 34.1% in the overall market. Capesize vessels, named after their ability to navigate the Cape of Good Hope and Cape Horn routes, are among the largest bulk carriers globally, primarily designed to transport iron ore and coal over long distances. Their immense size and cargo capacity make them indispensable for servicing major trade routes, particularly those connecting resource-rich regions like Brazil and Australia to industrial powerhouses in Asia. As the global demand for raw materials continues to grow, driven by urbanization, infrastructure development, and industrial production, the reliance on capesize vessels for efficient and cost-effective transportation becomes increasingly pronounced. Furthermore, the flexibility of capesize vessels to adapt to changing market dynamics, such as shifts in trade patterns and fluctuations in commodity prices, further solidifies their dominance in the dry bulk shipping market.

Market Segments

By Community Type

o Iron Ore

o Grains

o Coal

o Steel

o Cement

o Other Community Types

By Vessel Type

o Capesize

o Panamax

o Handysize

o Other Vessel Types

Regional Overview

North America

o The US

o Canada

Europe

o Germany

o United Kingdom

o France

o Italy

o Spain

o Rest of Europe

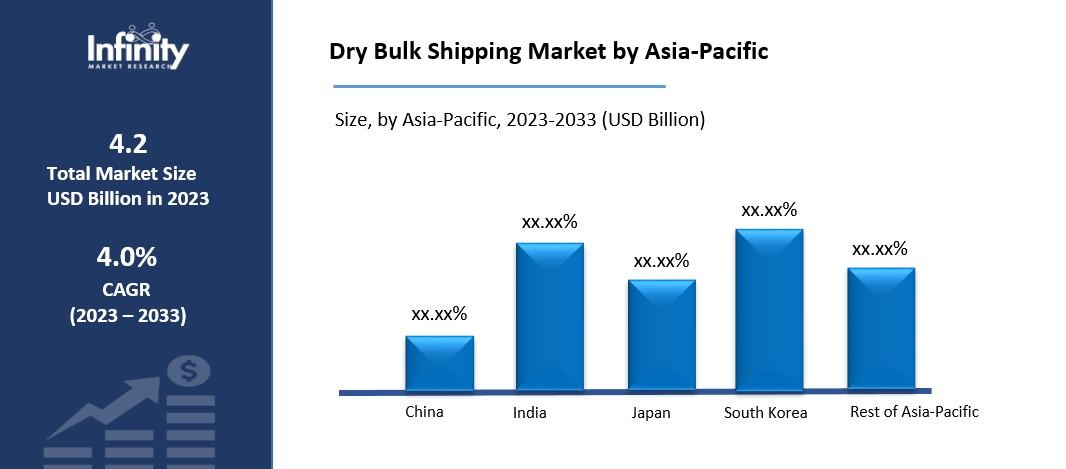

Asia-Pacific

o China

o India

o Japan

o South Korea

o Rest of Asia-Pacific

South America

o Brazil

o Argentina

o Rest of South America

Middle East and Africa

o GCC

o South Africa

o Rest of MEA

Driver's

Global Demand for Raw Materials

The continuous global demand for commodities such as coal, iron ore, and grains serves as a fundamental driver of the dry bulk shipping market. This demand is underpinned by several interconnected factors that fuel economic activity on a global scale.

Economic growth plays a pivotal role in driving demand for raw materials. As economies expand, there is an increased need for infrastructure development, manufacturing, and construction activities, all of which rely heavily on commodities like coal and iron ore. These materials are essential for the production of steel, which forms the backbone of infrastructure projects ranging from buildings to bridges to railways. Similarly, grains are essential for feeding growing populations, especially in urbanized areas where demand for food is high.

Restraints

Periods of Oversupply and Downturns

The cyclicality inherent in the dry bulk shipping market presents a significant restraint, primarily manifested in periods of oversupply and downturns. During these phases, an excess of vessel capacity relative to demand emerges, leading to intense competition among shipping companies. This oversupply dynamic exerts downward pressure on freight rates, as carriers vie for limited cargo volumes, resulting in a decline in revenue per voyage. Consequently, the profitability of dry bulk shipping operators is adversely affected, as they struggle to cover operating costs and debt obligations amidst dwindling income.

Moreover, lower vessel utilization rates exacerbate the profitability challenge during downturns. With fewer cargoes available to transport and increased idle time for vessels, the efficiency of the fleet diminishes. Vessels may sit idle at ports or sail at less than optimal speeds to conserve fuel costs, further eroding profitability. Additionally, the maintenance costs associated with idle vessels remain a financial burden for shipowners, adding to the overall strain on profitability.

Opportunity

Growing Demand for Eco-friendly Shipping Solutions

The growing demand for eco-friendly shipping solutions presents a significant opportunity for the dry bulk shipping market to innovate and adapt to evolving environmental regulations and consumer preferences. This shift towards sustainability is driven by increasing awareness of climate change, environmental degradation, and the need for responsible corporate practices. As a result, there is a growing market for alternative fuel propulsion systems, energy-efficient technologies, and emission reduction measures within the maritime industry.

One of the key opportunities lies in the development and adoption of alternative fuel propulsion systems. As governments worldwide implement stricter regulations to reduce greenhouse gas emissions from shipping, there is a growing demand for cleaner-burning fuels such as liquefied natural gas (LNG), biofuels, and hydrogen. These alternative fuels offer the potential to significantly reduce carbon dioxide (CO2) and sulfur oxide (SOx) emissions compared to traditional marine fuels like heavy fuel oil. Dry bulk shipping companies that invest in and adopt these alternative propulsion systems can gain a competitive edge by offering more environmentally friendly transportation solutions to their customers.

Trends

Digitalization and Automation

The increasing adoption of technologies such as artificial intelligence (AI), the Internet of Things (IoT), and blockchain represents a significant trend in the dry bulk shipping market, revolutionizing various aspects of fleet management, cargo tracking, and logistics optimization.

Artificial intelligence plays a crucial role in enhancing fleet management practices within the dry bulk shipping industry. AI-powered predictive analytics algorithms enable shipping companies to forecast vessel maintenance needs, optimize route planning, and improve fuel efficiency. By analyzing vast amounts of data collected from sensors onboard vessels and historical performance metrics, AI algorithms can identify patterns and trends to inform decision-making processes. This predictive maintenance approach helps minimize downtime, reduce maintenance costs, and enhance overall fleet reliability and performance.

The Internet of Things (IoT) facilitates real-time monitoring and tracking of cargo throughout the shipping process, from loading at the port of origin to unloading at the destination port. Moreover, blockchain technology offers a secure and transparent platform for managing transactions and documentation within the dry bulk shipping ecosystem.

Regional Analysis

Asia Pacific Region dominated the Market with the Highest Revenue Share

APAC acquired the majority of share of 37% of dry bulk shipping market. The region's rapid economic growth, fueled by industrialization and urbanization, has led to a substantial increase in demand for commodities such as coal, iron ore, and grains, which are essential for infrastructure development and manufacturing activities. Additionally, APAC's strategic geographical location makes it a crucial hub for maritime transportation, serving as a gateway for trade between East and West. Major ports in countries like China, Japan, South Korea, and India handle vast volumes of bulk cargo, attracting shipping companies and logistics providers to establish a strong presence in the region.

Furthermore, APAC's growing population and rising standards of living drive demand for consumer goods and agricultural products, further boosting the need for efficient dry bulk shipping services. As APAC continues to experience economic expansion and trade growth, its dominance in the dry bulk shipping market is expected to persist, presenting opportunities for stakeholders to capitalize on the region's vibrant maritime trade and investment potential.

Competitive Analysis

A competitive analysis of the dry bulk shipping market reveals a landscape characterized by intense rivalry among key players, strategic alliances, and continuous innovation. Competition within the market is primarily driven by factors such as fleet size, service quality, geographical coverage, and cost-effectiveness. Leading shipping companies vie for market share by offering a diverse range of vessel types, including capesize, panamax, and handysize carriers, to cater to varying customer requirements and cargo volumes. Additionally, companies compete on the basis of operational efficiency, leveraging advanced technologies such as artificial intelligence, IoT, and blockchain to optimize fleet management, cargo tracking, and logistics operations. Strategic alliances and partnerships play a crucial role in enhancing competitiveness, enabling companies to expand their market reach, share resources, and achieve economies of scale. Moreover, differentiation strategies focused on sustainability and environmental stewardship, such as the adoption of eco-friendly propulsion systems and emission reduction measures, serve as key drivers of competitive advantage in the market.

Key Players

Various key players in the global Dry Bulk Shipping market are:

o Diana Shipping Inc.

o COSCO Shipping International Co. Ltd.

o Egon Oldendorff Management GmbH

o Eagle Bulk Shipping Inc.

o Golden Ocean Group Ltd.

o Genco Shipping and Trading Ltd.

o Gearbulk Management Switzerland AG

o Hapag Lloyd AG

o Grindrod Shipping Holdings Ltd.

o John Swire and Sons Ltd.

o HMM Europe Ltd.

o Kawasaki Kisen Kaisha Ltd.

o Other Key Players

Recent Development

In December 2023, Wisdom Marine and Synergy Marine Group have collaborated to establish a joint venture known as Wisdom Synergy Ship Management (WSSM), which specializes in the management of Wisdom Marine's dry bulk vessels. With its headquarters based in Indonesia, WSSM operates through primary operational hubs located in Taiwan and India.

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 4.2 Bn |

|

Market Size 2033 |

USD 6.2 Bn |

|

Compound Annual Growth Rate (CAGR) |

4.0% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Community Type- Packaging and Equipment, & By Vessel Type- Pre Combustion and Post Combustion |

|

Key Players |

Cargill Inc., AP Moller Maersk AS, Diana Shipping Inc., COSCO Shipping International Co. Ltd., Egon Oldendorff Management GmbH, Eagle Bulk Shipping Inc., Golden Ocean Group Ltd., Genco Shipping and Trading Ltd., Gearbulk Management Switzerland AG, Hapag Lloyd AG, Grindrod Shipping Holdings Ltd., John Swire and Sons Ltd., HMM Europe Ltd., Kawasaki Kisen Kaisha Ltd., and Other Key Players. |

📘 Frequently Asked Questions

1. How much is the Dry Bulk Shipping Market in 2023?

Answer: The Dry Bulk Shipping Market size was valued at USD 137.4 Billion in 2023.

2. What would be the forecast period in the Dry Bulk Shipping Market?

Answer: The forecast period in the Dry Bulk Shipping Market report is 2023-2033.

3. Who are the key players in the Dry Bulk Shipping Market?

Answer: Cargill Inc., AP Moller Maersk AS, Diana Shipping Inc., COSCO Shipping International Co. Ltd., Egon Oldendorff Management GmbH, Eagle Bulk Shipping Inc., Golden Ocean Group Ltd., Genco Shipping and Trading Ltd., Gearbulk Management Switzerland AG, Hapag Lloyd AG, Grindrod Shipping Holdings Ltd., John Swire and Sons Ltd., HMM Europe Ltd., Kawasaki Kisen Kaisha Ltd., and Other Key Players.

4. What is the growth rate of the Dry Bulk Shipping Market?

Answer: Dry Bulk Shipping Market is growing at a CAGR of 4.0% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.