🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Electric Mobility Scooter Market

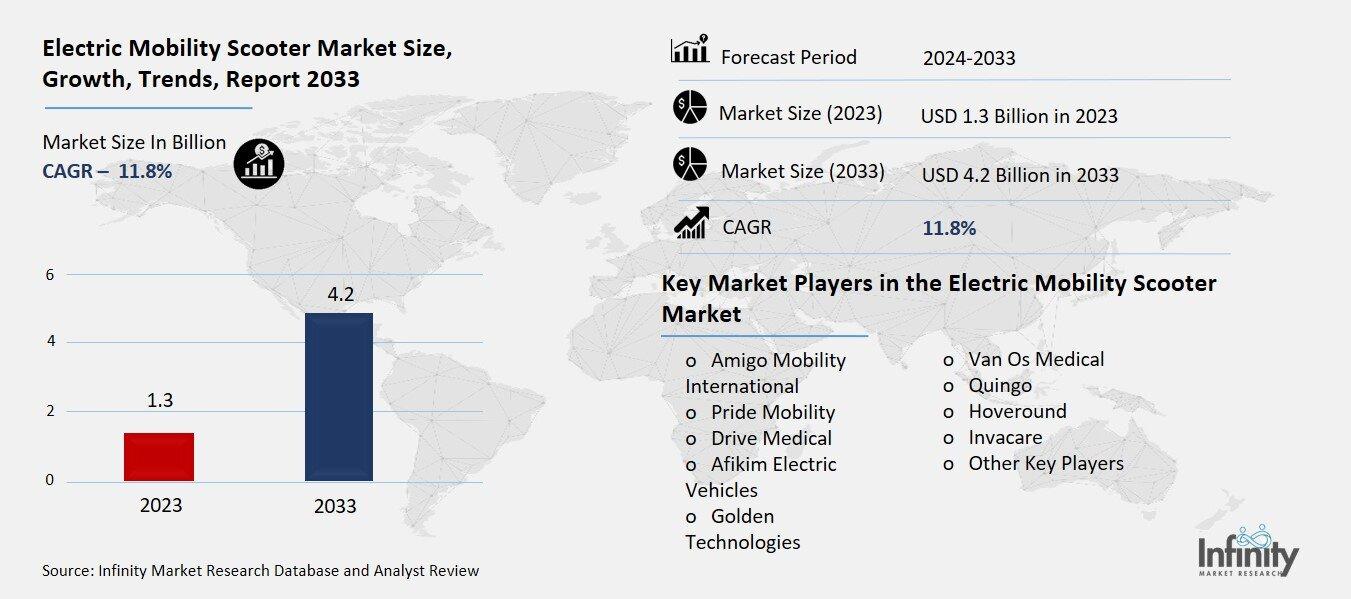

Global Electric Mobility Scooter Market (By Product Type, 2-Wheel Electric Scooters, 3-Wheel Electric Scooters, 4-Wheel Electric Scooters, and Other Product Types; By Type, Boot Scooters, Pavement Scooters, and Road Scooters; By Battery Type, Sealed Lead Acid (SLA), Lithium-ion Batteries, and Nickel Metal Hydride (NiMH), By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1265

Electric Mobility Scooter Market Overview

Global Electric Mobility Scooter Market acquired the significant revenue of 1.3 Billion in 2023 and expected to be worth around USD 4.2 Billion by 2033 with the CAGR of 11.8% during the forecast period of 2024 to 2033. The global electric mobility scooter market is rather vibrant due to increasing demand for electric mobility scooters as convenient means of transportation for elderly and physically challenged persons. Through innovations in battery capacity improvement, increased safety styles and light weight structures, these scooters have been made more efficient and friendly to use.

Moreover, the factors of or urbanization and the issues regarding environment have led more consumers in favor of electric scooter than the fuel based mobility scooters. The market has been divided into foldable and non-foldable products, battery type and the type of users where the healthcare sector is more active.

Drivers for the Electric Mobility Scooter Market

Growing Awareness of Mobility Solutions

A rising interest in mobility solutions for the disable or those with restricted mobility is particularly boosting the uptake of electric mobility scooters. Since there is a trend toward the inclusion of people in the society, the focus on increasing the accessibility of various facilities for persons with reduced mobility is also of great importance. Assistive technologies, such as electric scooters, that are used by people with disabilities have medical approval or recommendations, with government authorities, healthcare institutions, and non-governmental organizations providing information about the liberating effect of mobility in today’s society for those with mobility issues.

This awareness is being amplified by healthcare professionals who often recommend these scooters as part of rehabilitation or long-term care plans, particularly for individuals with conditions such as arthritis, multiple sclerosis, or injuries that limit movement. Furthermore, improved accessibility in public spaces and the availability of insurance coverage for mobility devices are making it easier for individuals to access and afford these scooters.

Restraints for the Electric Mobility Scooter Market

Limited Battery Range

While improving, battery range and charging infrastructure remain significant constraints in the electric mobility scooter market, particularly for long-distance use. Many current models of electric scooters are designed for short commutes or indoor use, with battery ranges that typically vary from 10 to 25 miles on a single charge. This limited range can restrict users who require mobility support over longer distances, such as outdoor recreational activities or extended travel within urban environments. Additionally, the availability of charging stations specifically designed for mobility scooters is still underdeveloped in most regions, making it challenging for users to recharge their devices conveniently during extended outings.

Opportunity in the Electric Mobility Scooter Market

Expansion in Emerging Markets

Rising healthcare spending and the growing elderly population in emerging economies present significant growth opportunities for the electric mobility scooter market. As countries in regions like Asia-Pacific, Latin America, and parts of Africa continue to experience economic development, governments are increasing healthcare budgets to improve the quality and accessibility of medical care. This enhanced spending is driving investments in assistive technologies, including electric mobility scooters, which are becoming a key solution for aging populations dealing with mobility challenges.

Emerging economies, particularly in countries like China, India, and Brazil, are seeing rapid growth in their elderly populations due to improving life expectancy and declining birth rates. With this demographic shift, there is a growing demand for products that support independent living and improve the quality of life for seniors.

Trends for the Electric Mobility Scooter Market

Increasing demand for foldable and portable electric scooters

The increasing demand for foldable and portable electric scooters that can be easily transported is emerging as a key trend in urban areas. As city dwellers face challenges like traffic congestion, limited parking, and a growing emphasis on sustainable transportation, compact and portable mobility solutions are gaining popularity. Foldable electric scooters, in particular, offer users the convenience of navigating urban environments with ease, as they can be quickly folded and carried onto public transport, stored in small apartments, or stowed in vehicles. This portability makes them ideal for short commutes, errands, or leisure activities where flexibility and ease of movement are paramount.

Segments Covered in the Report

By Product Type

o 2-Wheel Electric Scooters

o 3-Wheel Electric Scooters

o 4-Wheel Electric Scooters

o Other Product Types

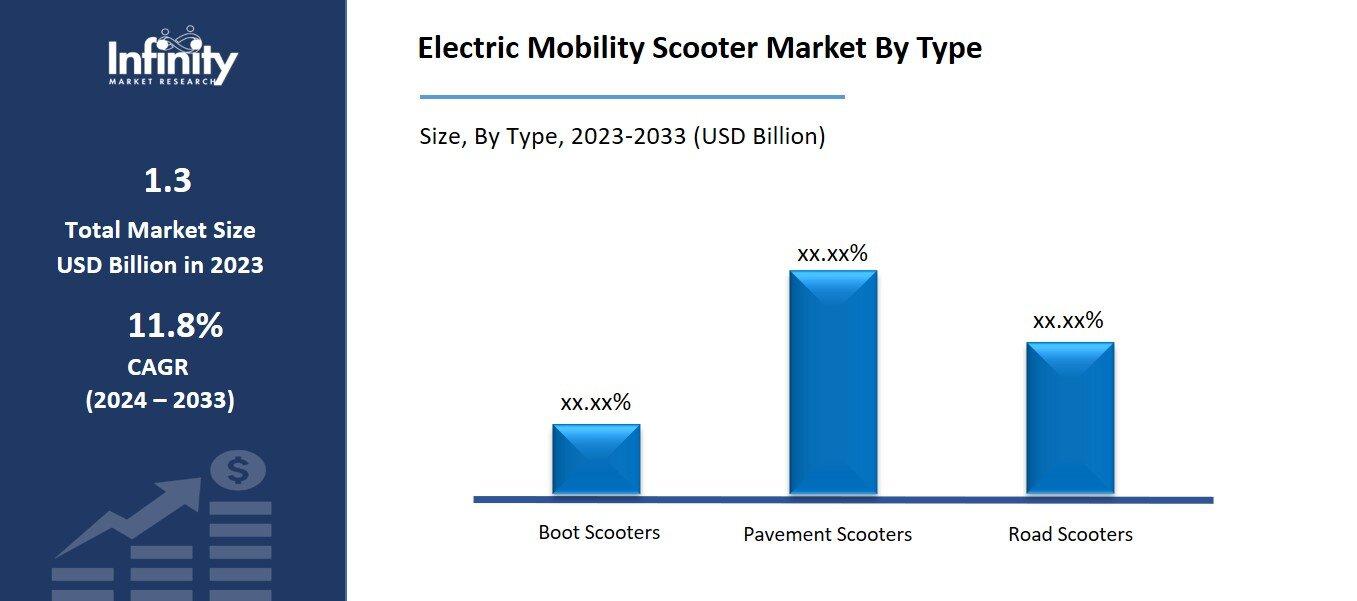

By Type

o Boot Scooters

o Pavement Scooters

o Road Scooters

By Battery Type

o Sealed Lead Acid (SLA)

o Lithium-ion Batteries

o Nickel Metal Hydride (NiMH)

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into 2-wheel electric scooters, 3-wheel electric scooters, 4-wheel electric scooters, and other product types. Among these, 4-wheel electric scooters segment held the prominent share of the market due to their enhanced stability, safety, and comfort. These scooters are particularly favored by elderly individuals and those with significant mobility challenges, as the four-wheel design provides better balance and support compared to 2-wheel or 3-wheel alternatives.

The superior weight distribution and stability of 4-wheel models make them ideal for both indoor and outdoor use, including on uneven surfaces or longer trips. Additionally, these scooters often come with more advanced features such as larger seats, stronger motors, and increased battery capacity, which cater to users seeking more comfort and reliability in their mobility solutions.

By Type Analysis

On the basis of type, the market is divided into boot scooters, pavement scooters, and road scooters. Among these, pavement scooters segment acquired the significant share in the market owing to their versatility, ease of use, and ideal balance between portability and performance. Pavement scooters are designed for use on sidewalks and pedestrian areas, making them perfect for users who need mobility assistance in urban and residential environments. These scooters typically offer a moderate speed, sufficient battery range for daily errands or short trips, and are more compact and lightweight than road scooters, making them easier to store and transport.

By Battery Type Analysis

On the basis of battery type, the market is divided into sealed lead acid (SLA), lithium-ion batteries, and nickel metal hydride (NiMH). Among these, sealed lead acid (SLA) batteries held the prominent share of the market due to their affordability and durability. SLA batteries are widely used because they are cost-effective, making them a popular choice for many mobility scooters, especially in budget-friendly models. These batteries are reliable and robust, with a long history of use in various industries, providing users with a balance of performance and cost.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of the market. Government initiatives, healthcare subsidies, and insurance coverage that support the purchase of mobility aids have also contributed to the market's growth in North America. The region's well-established healthcare system plays a crucial role, with healthcare providers frequently recommending mobility scooters as part of rehabilitation or long-term care solutions.

Furthermore, North America’s robust distribution networks and widespread availability of technologically advanced scooters ensure consumers have access to a wide range of options, including high-performance models with enhanced features such as improved battery life, comfort, and safety.

Competitive Analysis

The electric mobility scooter market is highly competitive, characterized by the presence of several key players, each striving to gain a larger market share through innovation, product differentiation, and strategic partnerships. Leading companies such as Pride Mobility Products Corp., Drive DeVilbiss Healthcare, Invacare Corporation, and Golden Technologies dominate the market by offering a broad range of products that cater to various user needs, from basic models to high-end scooters with advanced features like longer battery life, enhanced comfort, and superior safety systems. These companies often leverage their strong distribution networks and brand recognition to maintain a competitive edge.

Recent Developments

In 2019, Permobil, a leading company in advanced rehabilitation technology, launched its front-wheel drive electric wheelchair.

Key Market Players in the Electric Mobility Scooter Market

o Amigo Mobility International

o Pride Mobility

o Drive Medical

o Afikim Electric Vehicles

o Golden Technologies

o Van Os Medical

o Quingo

o Hoveround

o Invacare

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.3 Billion |

|

Market Size 2033 |

USD 4.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

11.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Product Type, Battery Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Amigo Mobility International, Pride Mobility, Drive Medical, Afikim Electric Vehicles, Golden Technologies, Van Os Medical, Quingo, Hoveround, Invacare, and Other Key Players |

|

Key Market Opportunities |

Expansion in Emerging Markets |

|

Key Market Dynamics |

Growing Awareness of Mobility Solutions |

📘 Frequently Asked Questions

1. Who are the key players in the Electric Mobility Scooter Market?

Answer: Amigo Mobility International, Pride Mobility, Drive Medical, Afikim Electric Vehicles, Golden Technologies, Van Os Medical, Quingo, Hoveround, Invacare, and Other Key Players

2. How much is the Electric Mobility Scooter Market in 2023?

Answer: The Electric Mobility Scooter Market size was valued at USD 1.3 Billion in 2023.

3. What would be the forecast period in the Electric Mobility Scooter Market?

Answer: The forecast period in the Electric Mobility Scooter Market report is 2023-2033.

4. What is the growth rate of the Electric Mobility Scooter Market?

Answer: Electric Mobility Scooter Market is growing at a CAGR of 11.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.