🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Electric Vehicles and Fuel Cell Vehicles Market

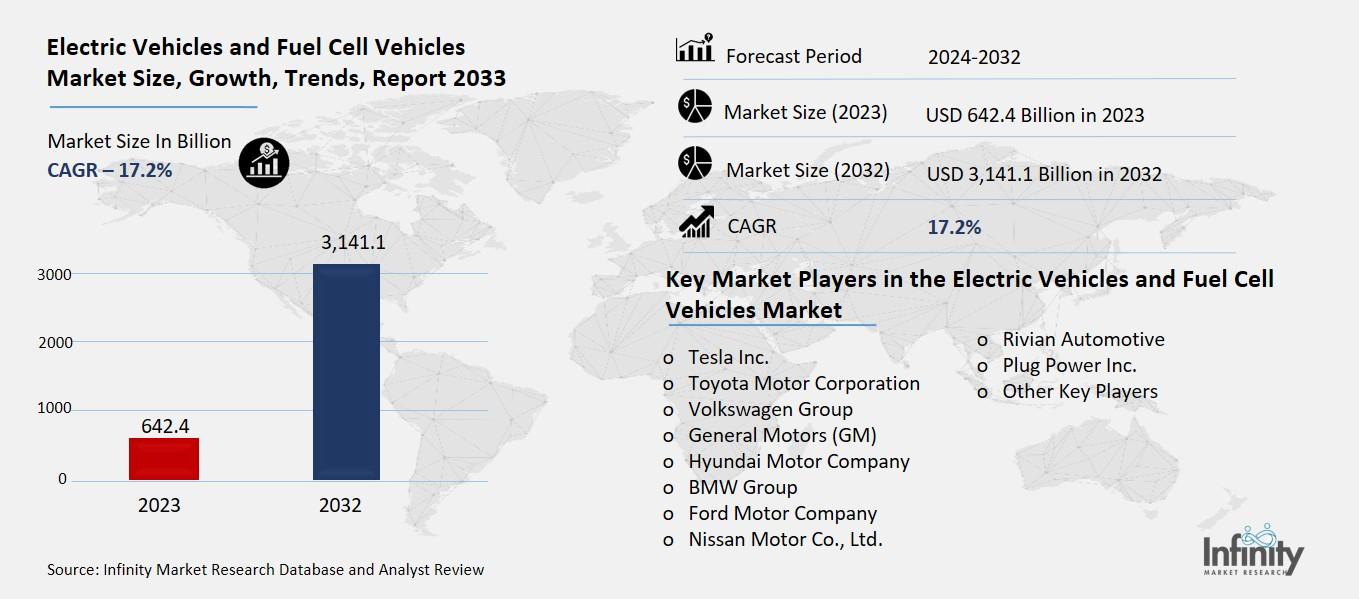

Global Electric Vehicles and Fuel Cell Vehicles Market (By Vehicle Type, Electric Vehicles and Fuel Cell Vehicles; By Power Source, Electric Battery and Hydrogen Fuel Cells; By End-Use Application, Private/Personal Vehicles, Commercial Fleets, and Public Transportation, By Region and Companies), 2024-2033

Feb 2025

Automobiles

Pages: 138

ID: IMR1772

Electric Vehicles and Fuel Cell Vehicles Market Overview

Global Electric Vehicles and Fuel Cell Vehicles Market acquired the significant revenue of 624.4 Billion in 2023 and expected to be worth around USD 3,141.1 Billion by 2033 with the CAGR of 17.2% during the forecast period of 2024 to 2033. The markets of electric vehicles, particularly passenger electric vehicles and fuel cell vehicles are relatively young niches within the automotive industry beneficiaries of which involve governments across the globe calling for adoption of sustainable energy sources and reduction in emissions. Electrical cars are propelled by batteries, recharged from an external source, and are acclaimed for their effectiveness as well as for their lack of exhaust pipes. Industry statistics show that there is a growing call for EVs because of developments in battery power, governmental incentives, and the pinch of the problems of the environment.

On the other hand, fuel cell vehicles utilize hydrogen to produce electrical energy through a process of electrolysis and the end product formed is water. Despite possessing longer driving ranges and shorter refueling times than that of many battery electric vehicles, FCVs still present several issues, these being; high costs of fuel cell systems and equipment, lack of accessible hydrogen refueling stations, and the effective generation of hydrogen.

Drivers for the Electric Vehicles and Fuel Cell Vehicles Market

Government Regulations and Incentives

Higher stringency standards globally are also positively influencing the uptake of electric vehicle (EVs) and fuel cell vehicle (FCVs). The governments and regulatory authority are increasingly putting targets on emission reductions in a bid to lower air pollution and fight climate change. Such measures can be the restrictions on CO₂ emissions per kilometre as well as the requirements for car manufacturers to electrify their offer. In addition, to the above measures, most governments provide different incentives such as subsidies, tax credits and other fiscal incentives to reduce the costs of EVs and FCVs. Such incentives may be in form of direct purchase grants; low registration fees; tax credits; and low tolls among others. Also, some jurisdictions offer incentives like stations for charging or refueling from a standard gas station for any electric car by free or subsidized.

Restraints for the Electric Vehicles and Fuel Cell Vehicles Market

Infrastructure Challenges

The limited availability of charging stations for electric vehicles (EVs) remains a significant barrier to widespread adoption. While the number of charging points is growing, many regions, especially rural and less-developed areas, lack sufficient infrastructure to meet the increasing demand. This creates "range anxiety," where potential users fear running out of charge without access to nearby stations. Additionally, inconsistent charging standards and long wait times at stations further hinder the user experience.

Similarly, fuel cell vehicles (FCVs) face challenges due to insufficient hydrogen refueling infrastructure. Hydrogen refueling stations are expensive to build and maintain, and their global network remains sparse, primarily concentrated in specific regions like parts of Europe, Japan, and California.

Opportunity in the Electric Vehicles and Fuel Cell Vehicles Market

Corporate Fleet Electrification

The growing trend of businesses adopting electric vehicles (EVs) and fuel cell vehicles (FCVs) for their fleets is driven by a combination of cost-saving opportunities, regulatory pressures, and corporate sustainability goals. Many companies are transitioning their delivery trucks, vans, and company cars to EVs and FCVs to reduce operational emissions and align with global sustainability targets. These vehicles not only help businesses lower their carbon footprint but also benefit from lower fuel and maintenance costs over time.

Simultaneously, there is a rising demand for sustainable logistics and last-mile delivery solutions, particularly in e-commerce and urban delivery sectors. With cities increasingly imposing restrictions on emissions and noise in urban areas, EVs and FCVs offer an ideal alternative for ensuring efficient, clean, and quiet deliveries.

Trends for the Electric Vehicles and Fuel Cell Vehicles Market

Expansion of Charging Networks

The deployment of ultra-fast charging stations globally is a key trend aimed at addressing one of the primary concerns of electric vehicle (EV) users: long charging times. Ultra-fast chargers, capable of delivering significant power (up to 350 kW or more), can recharge an EV battery to 80% capacity in 15-30 minutes, significantly reducing downtime compared to conventional charging methods. These stations are being strategically installed along highways, urban centers, and high-traffic areas to support long-distance travel and everyday use. Governments, automakers, and private energy companies are investing heavily in expanding these networks to enhance accessibility and convenience for EV users.

Segments Covered in the Report

By Vehicle Type

o Electric Vehicles

o Fuel Cell Vehicles

By Power Source

o Electric Battery

o Hydrogen Fuel Cells

By End-Use Application

o Private/Personal Vehicles

o Commercial Fleets

o Public Transportation

Segment Analysis

By Vehicle Type Analysis

On the basis of vehicle type, the market is divided into electric vehicles and fuel cell vehicles. Among these, electric vehicles segment acquired the significant share in the market owing to its widespread adoption and extensive technological advancements. EVs have gained substantial traction owing to their relatively well-established infrastructure, including a growing global network of charging stations, and their lower operational costs compared to conventional vehicles. Additionally, EVs benefit from significant government incentives, such as tax rebates, subsidies, and exemptions from road tolls, which make them more accessible to consumers. The advancements in battery technology, leading to improved range and faster charging times, have also contributed to the dominance of the EV segment.

By Power Source Analysis

On the basis of power source, the market is divided into electric battery and hydrogen fuel cells. Among these, electric battery segment held the prominent share of the market due to its widespread adoption and the significant advancements in battery technology. Electric batteries are the primary power source for electric vehicles (EVs), which have gained considerable traction globally due to their affordability, established infrastructure, and lower operational costs.

The rapid development of lithium-ion batteries, solid-state batteries, and other energy storage technologies has improved energy density, reduced charging times, and extended vehicle range, making EVs increasingly appealing to consumers and businesses alike.

By End-Use Application Analysis

On the basis of end-use application, the market is divided into private/personal vehicles, commercial fleets, and public transportation. Among these, private/personal vehicles segment held the prominent share of the market. The increasing affordability of electric vehicles (EVs), supported by advancements in battery technology and government incentives such as purchase subsidies and tax exemptions, has driven significant growth in the private vehicle segment. Personal EVs dominate the market as they cater to a wide consumer base and are widely available across various price points, offering options for both budget-conscious and premium buyers.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 34.1% of the market, driven by the rapid adoption of electric vehicles (EVs) in countries like China, Japan, and South Korea. China, in particular, plays a pivotal role as the largest EV market globally, supported by strong government policies, substantial subsidies, and a well-established domestic manufacturing ecosystem for batteries and EVs. The region also benefits from the presence of key market players, extensive production capabilities, and a growing network of charging infrastructure.

Japan and South Korea contribute significantly to the market with their advancements in both electric battery and hydrogen fuel cell technologies. These nations are at the forefront of fuel cell vehicle (FCV) development, supported by substantial investments in hydrogen infrastructure. The region's dominance is further fueled by increasing urbanization, rising environmental awareness, and the push for reducing reliance on fossil fuels, making Asia-Pacific a hub for innovation and growth in the EV and FCV markets.

Competitive Analysis

The competitive analysis of the electric vehicle (EV) and fuel cell vehicle (FCV) markets reveals a dynamic and rapidly evolving landscape, with numerous players vying for market share across various segments. Key global automakers such as Tesla, BYD, Volkswagen, General Motors, and Nissan dominate the EV market, leveraging their expertise in battery technology, vehicle design, and strategic partnerships with charging infrastructure providers. Tesla, for instance, has established a significant lead in the EV market, benefiting from its innovative technologies, brand recognition, and extensive Supercharger network. At the same time, automakers like Toyota and Hyundai lead the FCV segment, focusing on hydrogen fuel cell technology, which offers long driving ranges and shorter refueling times compared to battery-powered EVs.

Recent Developments

In September 2024, BMW, in collaboration with Toyota, introduced a hydrogen-powered fuel cell electric vehicle.

Key Market Players in the Electric Vehicles and Fuel Cell Vehicles Market

o Tesla Inc.

o Toyota Motor Corporation

o Volkswagen Group

o General Motors (GM)

o Hyundai Motor Company

o BMW Group

o Ford Motor Company

o Nissan Motor Co., Ltd.

o Rivian Automotive

o Plug Power Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 642.4 Billion |

|

Market Size 2033 |

USD 3,141.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

17.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Vehicle Type, Power Source, End-Use Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Tesla Inc., Toyota Motor Corporation, Volkswagen Group, General Motors (GM), Hyundai Motor Company, BMW Group, Ford Motor Company, Nissan Motor Co., Ltd., Rivian Automotive, Plug Power Inc., and Other Key Players. |

|

Key Market Opportunities |

Corporate Fleet Electrification |

|

Key Market Dynamics |

Government Regulations and Incentives |

📘 Frequently Asked Questions

1. How much is the Electric Vehicles and Fuel Cell Vehicles Market in 2023?

Answer: The Electric Vehicles and Fuel Cell Vehicles Market size was valued at USD 642.4 Billion in 2023.

2. What would be the forecast period in the Electric Vehicles and Fuel Cell Vehicles Market report?

Answer: The forecast period in the Electric Vehicles and Fuel Cell Vehicles Market report is 2023-2033.

3. Who are the key players in the Electric Vehicles and Fuel Cell Vehicles Market?

Answer: Tesla Inc., Toyota Motor Corporation, Volkswagen Group, General Motors (GM), Hyundai Motor Company, BMW Group, Ford Motor Company, Nissan Motor Co., Ltd., Rivian Automotive, Plug Power Inc., and Other Key Players.

4. What is the growth rate of the Electric Vehicles and Fuel Cell Vehicles Market?

Answer: Electric Vehicles and Fuel Cell Vehicles Market is growing at a CAGR of 17.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.