🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Emergency Mobile Substation Market

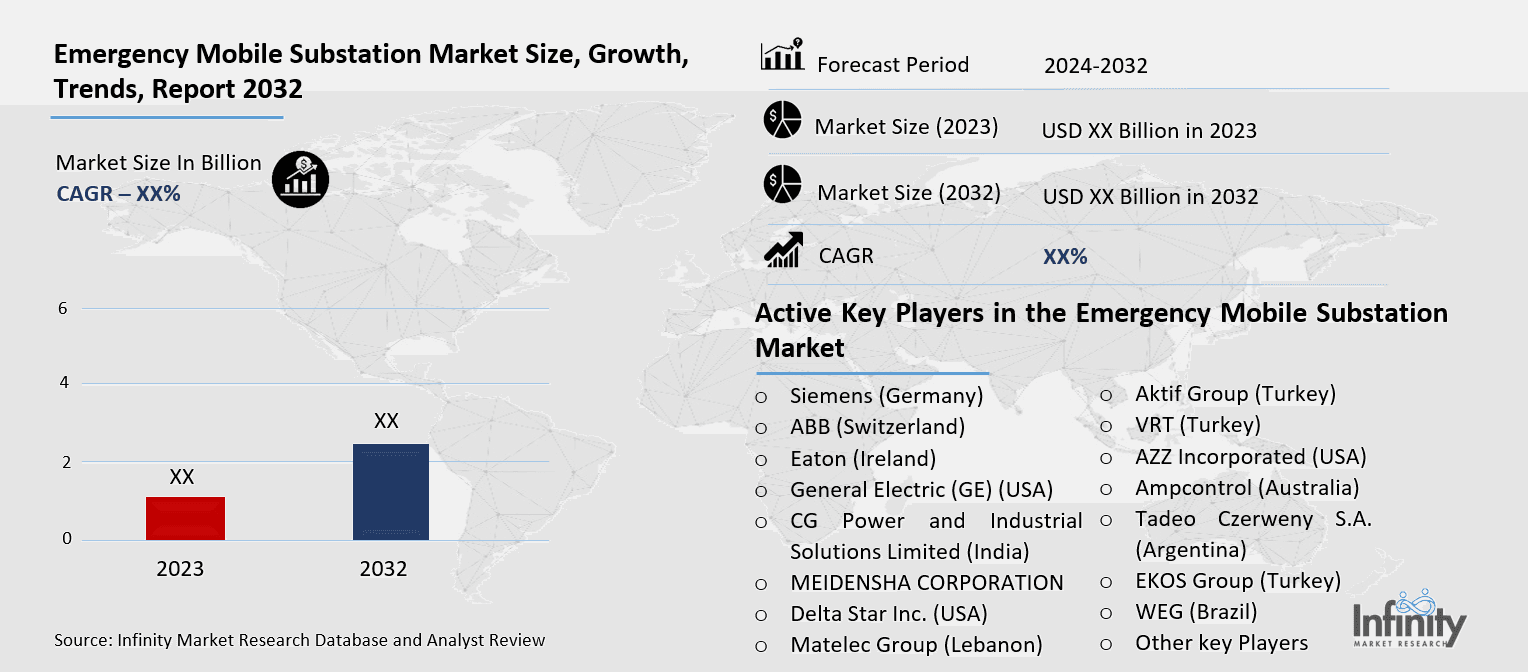

Emergency Mobile Substation Market Global Industry Analysis and Forecast (2024-2032) By Voltage Level (Low Voltage (Up to 1kV), Medium Voltage (1kV – 72.5kV), High Voltage (72.5kV – 245kV), Extra High Voltage (Above 245kV)) By, Application (Utility, Industrial, Commercial, Residential) By Mobility (Trailer Mounted, Truck Mounted, Skid Mounted) By Power Rating, (Below 25 MVA, 25-100 MVA, above 100 MVA) By End-User, Power Utilities, Renewable Energy Projects, Oil & Gas, Mining Industry, Transportation, Others (Defense, etc.) and Region

Feb 2025

Information and Communication Technology

Pages: 138

ID: IMR1799

Emergency Mobile Substation Market Synopsis

Emergency Mobile Substation Market acquired the significant revenue of XX Billion in 2023 and expected to be worth around USD XX Billion by 2032 with the CAGR of XX% during the forecast period of 2024 to 2032.

Emergency Mobile Substation market encompasses companies that design and manufacture temporary power distribution stations which enable fast deployment for emergency power supply during outages or disaster situations or system breakdowns. These mobile power units contain vital electrical components including transformers alongside circuit breakers together with control systems which allow them to run substations in temporary substations or supply backup to primary substation facilities. Emergency mobile substations act as essential tools for maintaining power grid stability by delivering power in distant regions alongside disaster zones through their rapid deployment methods which combine fast response and strong power handling capabilities while regional maintenance work is underway.

As a key power transmission market sector the Emergency Mobile Substation segment delivers essential rapid response power restoration capabilities during outages and grid failures. Mobile substations provide critical electrical power backup required for periods of emergency as well as natural disasters and infrastructure maintenance needs. Extreme weather events have become more frequent and the need for reliable power infrastructure drive the ongoing growth of this market. These mobile substations function as fast power restoration tools that help maintain service to damaged locations until full permanent repairs become available.

The growth of the mobile substation market was supported by technological improvements in their design as well as innovative developments in substation engineering. The current mobile substation design provides a combination of portability and power efficiency together with responsive applications for changing demand levels. The units provide flexible capabilities for adjusting voltage levels through advanced monitoring equipment which supports safe operation alongside efficient power delivery to grids. Substation technology continues to advance by integrating renewable energy sources with smart grid systems which delivers extended operational benefits.

Industrial sectors including utilities alongside oilaoil and large-scale manufacturing institutions need mobile substations because of their operational requirements. Political organizations together with private sector entities spend ample funds to strengthen their infrastructure against unforeseen power disruptions by developing solutions which maintain continuous power provision. Market expansion for emergency mobile substations appears predictable because these systems become increasingly adopted both by new energy infrastructure markets with unstable grids and by established nations aiming to advance their energy infrastructure.

Mobile substation market growth faces obstacles because procurement costs are high and specialized labor is necessary for both installation and maintenance activities. The market shows promise for continued growth because decision-makers increasingly value electricity reliability and feel the necessity for emergency preparations. In evolving energy systems with renewable integration and smart grids the role of mobile substations will expand to become essential for ensuring grid stability along with resilience.

Emergency Mobile Substation Market Trend Analysis

Trend

Adoption of Advanced Technologies Enhancing Mobile Substation Efficiency

Modern Emergency Mobile Substation implementation continues to escalate due to the mainstream adoption of advanced systems which involve digital control mechanisms and remote surveillance technologies. The implementation of these innovative technologies leads to improved mobile substation reliability and operational efficiency that enables performance analysis in real-time and predictive maintenance approaches. These technologies enable mobile substations to identify upcoming problems that could cause failures thereby minimizing operational downtime and accelerating emergency response. Remote monitoring helps utilities operate electronic substations from remote locations which ultimately reduces operating expenses and minimizes on-site staff requirements.

The increasing deployment of renewable energy requires adaptable grid solutions where mobile substations prove to be a straightforward solution. The changing power landscape where solar and wind generate more energy creates a rising requirement for substations that connect seamlessly with these intermittent power sources. Mobile substations create the needed adaptable framework for renewable energy integration into existing power grids which strengthens both grid reliability and adaptability. The mobile substation market continues to expand due to its ability to adapt to the changing energy needs which energy providers now actively pursue.

Opportunity

Growing Demand for EMS Units in the Face of Natural Disasters

The increased occurrence of serious climatic events such as hurricanes flood and wildfires has exposed the high sensitivity of conventionally installed power systems and distribution substations. The emergency power backup system provided by EMS units delivers swift and effective power restoration service for areas with damaged or under maintenance infrastructure. Manufacturers experience growing demand for mobile substations because these deployment-capable systems provide essential power backup in critical disaster areas. The increasing demand creates a substantial business opportunity for manufacturers who can enhance EMS unit performance while optimizing deployment systems to respond to variable needs.

Additionally EMS providers intensify efforts to unite mobile substations with renewable energy technologies alongside smart grids to meet growing challenges. Mobile substations provide emergency power and promote grid stability by combining with renewable energy sources as national power systems adopt renewables. Introduction of smart features that enable real-time monitoring and allow remote-control can help EMS providers deliver better reliability along with improved efficiency levels. Manufacturers targeting evolving modern energy requirements have an appealing business opportunity because they integrate smart grids with emergency response and renewable energy systems.

Emergency Mobile Substation Market Segment Analysis

Emergency Mobile Substation Market Segmented on the basis of By Voltage Level, By Application, By Mobility, By Power Rating, By End-User.

By Voltage Level

o Low Voltage (Up to 1kV)

o Medium Voltage (1kV – 72.5kV)

o High Voltage (72.5kV – 245kV)

o Extra High Voltage (Above 245kV)

By Application

o Utility

o Industrial

o Commercial

o Residential

By Mobility

o Trailer Mounted

o Truck Mounted

o Skid Mounted

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Voltage Level, Extra High Voltage (Above 245kV) segment is expected to dominate the market during the forecast period

Extra high voltage (EHV) systems, defined as voltages above 245kV, are integral to the transmission of electricity over long distances. These systems are essential for connecting large-scale power generation plants to national grids and for facilitating the transmission of electricity across countries and continents. EHV transmission lines allow electricity to travel over vast geographical areas with minimal energy loss, making them crucial for ensuring efficient power delivery. This is particularly important in regions where energy production occurs in remote areas, such as wind farms in rural or offshore locations, while consumption is concentrated in urban centers. The ability to transmit high amounts of power efficiently reduces the need for multiple substations, thus lowering overall infrastructure costs.

The demand for extra high voltage systems is increasingly driven by global energy trends, particularly the integration of renewable energy sources into national grids. As countries prioritize energy security and the transition to clean energy, the need for robust EHV networks grows. These systems facilitate the connection of renewable energy plants, such as large wind farms and solar parks, to the main grid, helping to balance supply and demand while addressing the intermittency of renewable sources. Furthermore, as nations continue to expand cross-border energy exchanges and pursue decarbonization goals, EHV transmission networks play a critical role in enhancing grid stability and fostering international energy cooperation. This growing emphasis on renewable energy integration and cross-border connectivity is expected to continue driving the adoption of extra high voltage infrastructure globally.

By End-User, Power Utilities segment expected to held the largest share

Power utilities are essential players in the energy sector, as they are responsible for the generation, transmission, and distribution of electricity on a large scale. The demand for electrical equipment—across high, medium, and low-voltage ranges—has been growing steadily due to several factors. One of the key drivers is the ongoing modernization of power grids. Utilities are increasingly investing in smart grids, automation, and advanced monitoring systems to improve efficiency, reduce downtime, and accommodate new technologies. The integration of renewable energy sources, such as solar and wind, has also led to the need for more flexible and resilient power systems, as these sources require advanced equipment to handle their variable output and connect to the grid seamlessly. Additionally, utilities are adapting to growing power demands spurred by urbanization and population growth, requiring upgraded infrastructure to meet the increased energy consumption.

The expansion of electrical systems is further accelerated by the global push for sustainability and energy security. As power utilities strive to integrate more renewable energy, they are also upgrading their networks to handle the increased complexity of distributed energy sources. This includes the adoption of high and medium-voltage systems to facilitate efficient long-distance power transmission from renewable energy plants to end consumers. Moreover, as urban areas expand and industrialization continues in developing economies, utilities are working to ensure reliable and stable power supply to these growing regions. As a result, the need for high-capacity, durable electrical equipment in power utilities remains critical, positioning them as the largest consumers of such equipment in the energy sector.

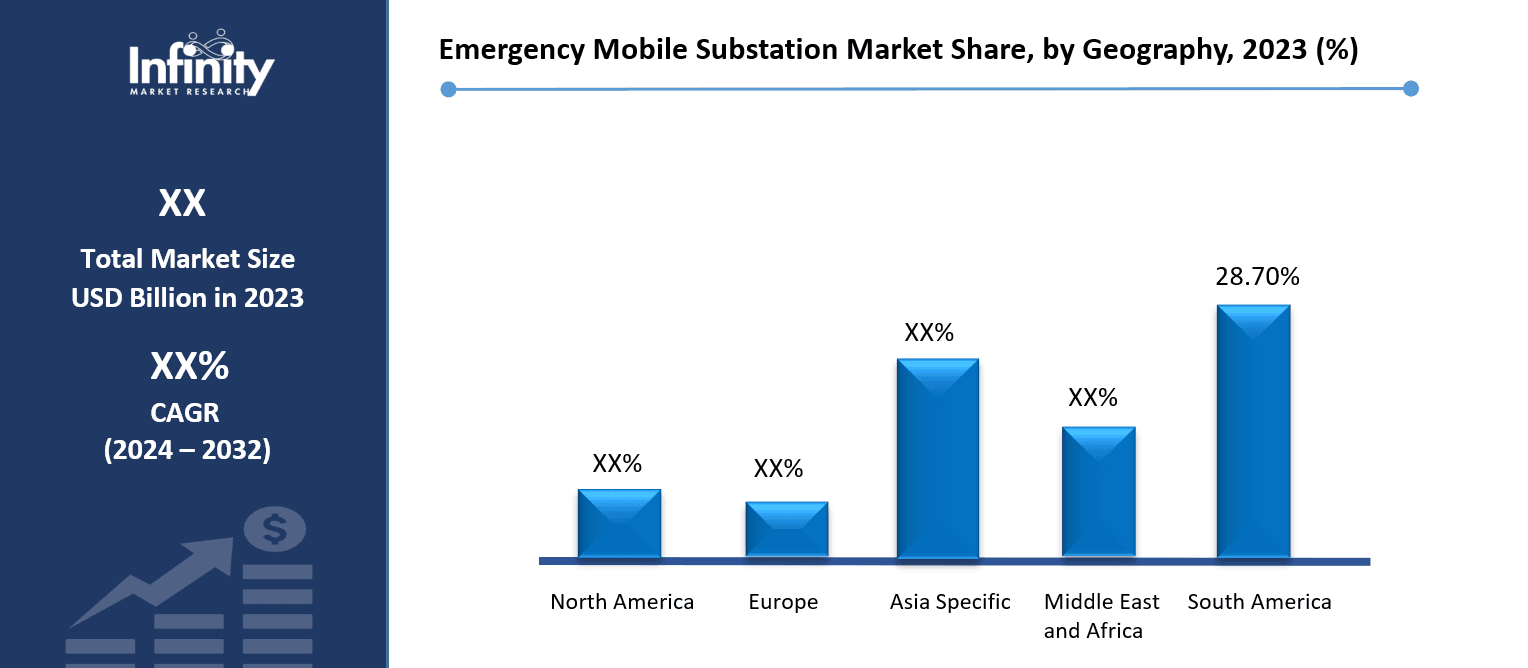

Emergency Mobile Substation Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

The Emergency Mobile Substation market in North America continues to grow quickly throughout the United States and Canada because emergency power supply systems are gaining demand and critical rapid power recovery is required after natural disasters ravage utilities. Power outages caused by natural disasters including hurricanes, wildfires and storms create such wide-ranging disruptions to the grid that mobile substations become essential for rapid grid restoration. As part of their disaster response strategy the United States emergency management agencies collaborate with utility companies and grid operators to develop emergency management systems which restore power quickly when disturbances strike. New requirements for rapid power restoration emerge from daily operations and critical infrastructure needs while the escalating grid dependence on electricity heightens the urgency for fast response.

Progressive designs of mobile substations together with advancements in technology drive North American market growth. Modern mobile substations achieve better power system responses in diverse power emergencies because engineers focused on improving the combination of three essential factors: performance capabilities, flexibility, and movement effectiveness. Modernization investments targeting the power grid show a clear upward trend as smart grid technology implementation becomes more prevalent. The connectivity between power networks and systems has boosted substantial EMS market expansion because rigorous adaptable power systems are required to handle interruptions. The power infrastructure resilience leadership of North America benefits from these recent developments.

Emergency Mobile Substation Market Share, by Geography, 2023 (%)

Active Key Players in the Emergency Mobile Substation Market

o Siemens (Germany)

o ABB (Switzerland)

o Eaton (Ireland)

o General Electric (GE) (USA)

o CG Power and Industrial Solutions Limited (India)

o MEIDENSHA CORPORATION (Japan)

o Delta Star Inc. (USA)

o Matelec Group (Lebanon)

o Efacec (Portugal)

o TGOOD (Hong Kong)

o NARI Group (China)

o Aktif Group (Turkey)

o VRT (Turkey)

o AZZ Incorporated (USA)

o Ampcontrol (Australia)

o Tadeo Czerweny S.A. (Argentina)

o EKOS Group (Turkey)

o WEG (Brazil)

o Other key Players

Global Emergency Mobile Substation Market Scope

|

Global Emergency Mobile Substation Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

|

By Voltage Level |

· Low Voltage (Up to 1kV) · Medium Voltage (1kV – 72.5kV) · High Voltage (72.5kV – 245kV) · Extra High Voltage (Above 245kV) | |

|

By Application |

· Utility · Industrial · Commercial · Residential | ||

|

By Mobility |

· Trailer Mounted · Truck Mounted · Skid Mounted | ||

|

By Power Rating |

· Below 25 MVA · 25-100 MVA · Above 100 MVA | ||

|

By End-User |

· Power Utilities · Renewable Energy Projects · Oil & Gas · Mining Industry · Transportation · Others (Defense, etc.) | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing Need for Uninterrupted Power Supply | ||

|

Key Market Restraints: |

· High Capital Investment and Production Costs | ||

|

Key Opportunities: |

· Growing Demand for EMS Units in the Face of Natural Disasters | ||

|

Companies Covered in the report: |

· Siemens (Germany), ABB (Switzerland), Eaton (Ireland), General Electric (GE) (USA), CG Power and Industrial Solutions Limited (India), MEIDENSHA CORPORATION (Japan), Delta Star Inc. (USA), Matelec Group (Lebanon), Efacec (Portugal), TGOOD (Hong Kong), NARI Group (China), Aktif Group (Turkey), VRT (Turkey), AZZ Incorporated (USA), Ampcontrol (Australia), Tadeo Czerweny S.A. (Argentina), EKOS Group (Turkey), WEG (Brazil), and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Emergency Mobile Substation Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the Emergency Mobile Substation Market?

Answer: Siemens (Germany), ABB (Switzerland), Eaton (Ireland), General Electric (GE) (USA), CG Power and Industrial Solutions Limited (India), MEIDENSHA CORPORATION (Japan), Delta Star Inc. (USA), Matelec Group (Lebanon), Efacec (Portugal), TGOOD (Hong Kong), NARI Group (China), Aktif Group (Turkey), VRT (Turkey), AZZ Incorporated (USA), Ampcontrol (Australia), Tadeo Czerweny S.A. (Argentina), EKOS Group (Turkey), WEG (Brazil), and Other Major Players.

3. What are the segments of the Emergency Mobile Substation Market?

Answer: The Emergency Mobile Substation Market is segmented into By Voltage Level, By Application, By Mobility, By Power Rating, By End-User and region. By Voltage Level, the market is categorized into Low Voltage (Up to 1kV), Medium Voltage (1kV – 72.5kV), High Voltage (72.5kV – 245kV), Extra High Voltage (Above 245kV). By, Application the market is categorized into Utility, Industrial, Commercial, Residential. By Mobility, the market is categorized into Trailer Mounted, Truck Mounted, Skid Mounted. By Power Rating, the market is categorized into Below 25 MVA, 25-100 MVA, above 100 MVA. By End-User, Power Utilities, Renewable Energy Projects, Oil & Gas, Mining Industry, Transportation, Others (Defense, etc.). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Emergency Mobile Substation Market?

Answer: Emergency Mobile Substation market encompasses companies that design and manufacture temporary power distribution stations which enable fast deployment for emergency power supply during outages or disaster situations or system breakdowns. These mobile power units contain vital electrical components including transformers alongside circuit breakers together with control systems which allow them to run substations in temporary substations or supply backup to primary substation facilities. Emergency mobile substations act as essential tools for maintaining power grid stability by delivering power in distant regions alongside disaster zones through their rapid deployment methods which combine fast response and strong power handling capabilities while regional maintenance work is underway.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.