🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Engineering Plastic Market

Engineering Plastic Market Global Industry Analysis and Forecast (2024-2033) by Product (Polyamide, Thermoplastics Polyesters, Acrylonitrile-Butadiene-Styrene, Polycarbonate, and Other Products), Application (Construction, Consumer Goods, Electrical & Electronics, Automotive, and Other Applications) and Region

Jun 2025

Chemicals and Materials

Pages: 138

ID: IMR2070

Engineering Plastic Market Synopsis

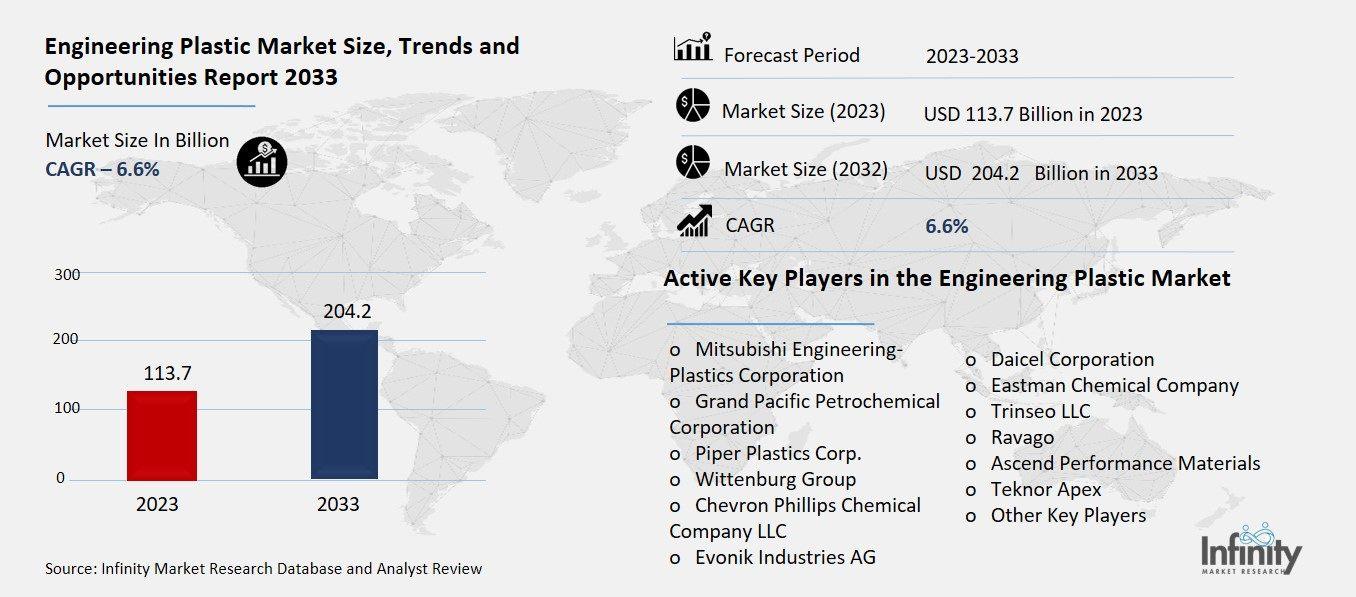

The global Engineering Plastic Market was valued at USD 106.6 billion in 2023 and is expected to grow from USD 113.7 billion in 2024 to USD 204.2 billion by 2033, reflecting a CAGR of 6.6% over the forecast period.

The engineering plastic market is the industry that manufactures, designs, and makes use of advanced plastics that outperform standard plastics. plycarbonate (PC), polyamide (PA), polyoxymethylene (POM), polyether ether ketone (PEEK), and acrylonitrile butadiene styrene (ABS) are popular plastics used in various difficult jobs in industries such as automotive, electronics, aerospace, buildings, healthcare, and industrial equipment. Both the car and electronics industries need components that are light, long-lasting, and affordable instead of metal parts, so the need for these materials is what drives the market. Because of better technology, higher demand for electric cars, and increased use of engineering plastics in today’s devices, the market is expected to grow further.

Engineering Plastic Market Driver Analysis

Growth in Electrical & Electronics Sector

The use of high-performance plastics is essential for the manufacturing of connectors, enclosures, and circuit boards in the electrical and electronics industry. They need to be made from materials that are heat-resistant, offer good electrical insulation, and stay strong under stress. The reasons engineers select PC, PPS, and PEI are their impressive stability to heat, resistance against fire, and inhibiting effects against chemicals and moisture. In connectors, they provide better and safer electrical links, and in enclosures, they protect delicate electronic parts from the outside environment. Polymer materials form a tough base for circuit boards that does not break down due to high temperatures. Because diodes are so light, they help reduce device sizes and increase efficiency, which is important in many uses from electronics for home to systems used in factories.

Engineering Plastic Market Restraint Analysis

Environmental Concerns and Regulations

Bauxite and alumina prices are notoriously volatile, affecting the Engineering Plastic Market. Geopolitical tensions, trade policies, and supply chain disruption are among the culprits driving up these metals. Bauxite is the main raw material in the production of aluminum, and it is produced from only a handful of areas, according to Australia, Guinea, and China. Any political unrest, export bans, or logistical bottlenecks in these regions can cause price fluctuations and supply shortages, not just for aluminum manufacturers in Russia and China but for those worldwide. Likewise, alumina (produced from bauxite) is subject to price volatility due to alterations in demand, energy costs and environmental regulations, leaving the industry unable to predict costs.

Engineering Plastic Market Opportunity Analysis

Innovation in Bioplastics and Recycling Technologies

The market for sustainable engineering plastics can grow a lot in the long run through research and development. As people pay more attention to environmental protection and choose green goods, manufacturers are starting to focus on making bio-based, recyclable, and low carbon materials. These alternatives act in the same way but are better for the environment than traditional engineering plastics. Modern progress in polymer chemistries and how we recycle allows for materials that can be recycled many times or produced from renewable plant-based materials. It helps companies save the planet and also creates new prospects in fields such as automotive, electronics, and packaging, as being environmentally friendly and legal is coming to play a key role in business competition. Consequently, the work in R&D for sustainable engineering plastics is needed to address environmental issues and also to help the companies grow in the marketplace.

Engineering Plastic Market Trend Analysis

Focus on Sustainable and Recyclable Materials

More and more companies in the engineering plastics market are choosing to use green building materials and close their recycling loops to be more sustainable. The main reasons these efforts are taking place are rising concerns about our environment, increasing pressure from regulators, and more request from people and industries for eco-friendly materials. In order to avoid fossil fuels and reduce carbon emissions, plastics made from renewable sources such as corn starch and cellulose are becoming available. Likewise, closed-loop recycling tries to bring used plastic materials back into the system, eliminating waste and saving resources. It means using products that are easy to separate and recycle, and it also requires building supportive infrastructure for recovering waste materials. They enable manufacturers to be more environmentally friendly, protect their reputation, follow green rules, and stay ahead in an eco-conscious industry.

Engineering Plastic Market Segment Analysis

The Engineering Plastic Market is segmented on the basis of Product, Processing Method, and Application.

By Product

o Polyamide

o Thermoplastics Polyesters

o Acrylonitrile-Butadiene-Styrene

o Polycarbonate

o Other Products

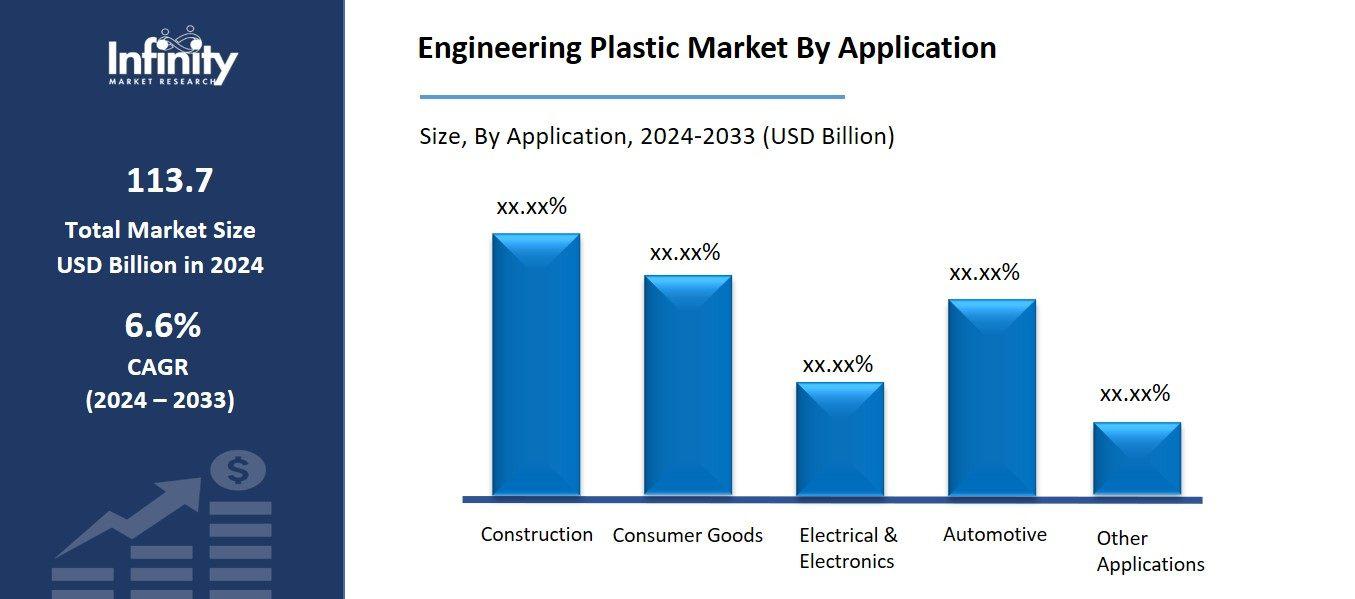

By Application

o Construction

o Consumer Goods

o Electrical & Electronics

o Automotive

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product, Acrylonitrile-Butadiene-Styrene Segment is Expected to Dominate the Market During the Forecast Period

The products discussed in this research study, the acrylonitrile-butadiene-styrene segment is expected to account for the largest market share of engineering plastic market in the forecast period. The combination of its strength, resistance to impacts, and workability with technology makes ABS useful for many everyday objects. Due to its durability, lightness, and the ability to create complex forms, ABS is widely found in auto, consumer electronics, construction, and appliance industries. Because ABS has superior surface appearance and dimension, it is suitable for both style and support features. The lower price of ABS than many other engineering plastics is another reason it is widely accepted. Demand for better, cost-effective materials from emerging countries, along with more industrial development, has helped ABS lead the industry.

By Application, the Automotive Segment is Expected to Held the Largest Share

By application, the automotive segment is expected to hold the largest share of the engineering plastic market during the forecast period. The need for light, strong, and superior materials in cars is pushing the textile industry to excel in this field. Plastics recycling used in engineering are chosen for making many parts of a car because they are strong, heat proof, and remain stable in the presence of chemicals. As more electric vehicles are used, advanced plastic materials that suit battery systems, are light, and can provide insulation are needed and are becoming more sought after. Besides, increasing attention to making vehicles lighter and greener is driving more companies to switch from metal to plastic, making the automotive industry a key player in engineering plastics.

Engineering Plastic Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the engineering plastic market over the forecast period, driven by strong industrial infrastructure, advanced manufacturing capabilities, and high demand from key end-use sectors such as automotive, aerospace, electronics, and healthcare. Various car and aircraft makers in the area use engineering plastics to produce effective and lightweight parts for their products. In addition, the participation of major material science companies and constant efforts in R&D help advance plastic materials that are both sustainable and superior in their performance. The encouragement from lawmakers for energy efficiency and the environment is motivating more use of engineering plastics instead of traditional materials. Equally important, as electric cars rise and electronics industries in the U.S. and Canada continue to develop, the need for engineering plastics keeps increasing, helping North America take a leading position in the global industry.

Recent Development

In August 2022, SABIC, a leading company in diversified chemicals, expanded its engineering plastics portfolio by introducing four new grades of LNP CRX polycarbonate (PC) copolymer resins. These chemically resistant grades are specifically developed to improve performance and durability across a variety of applications in industries such as automotive, electronics, and healthcare.

In March 2022, BASF SE set up new production facilities for engineering plastics at its Zhanjiang Verbund site in Guangdong province, southern China. With an annual production capacity of 60,000 metric tons, these facilities aim to address the growing demand for engineering plastics in the region.

Active Key Players in the Engineering Plastic Market

o Mitsubishi Engineering-Plastics Corporation

o Grand Pacific Petrochemical Corporation

o Piper Plastics Corp.

o Wittenburg Group

o Chevron Phillips Chemical Company LLC

o Daicel Corporation

o Eastman Chemical Company

o Trinseo LLC

o Ravago

o Ascend Performance Materials

o Other Key Players

Global Engineering Plastic Market Scope

|

Global Engineering Plastic Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 106.6 Billion |

|

Market Size in 2024: |

USD 113.7 Billion | ||

|

Forecast Period 2024-33 CAGR: |

6.6% |

Market Size in 2033: |

USD 204.2 Billion |

|

Segments Covered: |

By Product |

· Polyamide · Thermoplastics Polyesters · Acrylonitrile-Butadiene-Styrene · Polycarbonate · Other Products | |

|

By Application |

· Construction · Consumer Goods · Electrical & Electronics · Automotive · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growth in Electrical & Electronics Sector | ||

|

Key Market Restraints: |

· Environmental Concerns and Regulations | ||

|

Key Opportunities: |

· Innovation in Bioplastics and Recycling Technologies | ||

|

Companies Covered in the report: |

· Mitsubishi Engineering-Plastics Corporation, Grand Pacific Petrochemical Corporation, Piper Plastics Corp., and Wittenburg Group, and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Engineering Plastic Market Research report?

Answer: The forecast period in the Engineering Plastic Market Research report is 2024-2033.

2. Who are the key players in the Engineering Plastic Market?

Answer: Mitsubishi Engineering-Plastics Corporation, Grand Pacific Petrochemical Corporation, Piper Plastics Corp., and Wittenburg Group, and Other Key Players.

3. What are the segments of the Engineering Plastic Market?

Answer: The Engineering Plastic Market is segmented into Product, Application, and Regions. By Product, the market is categorized into Polyamide, Thermoplastics Polyesters, Acrylonitrile-Butadiene-Styrene, Polycarbonate, and Other Products. By Application, the market is categorized into Construction, Consumer Goods, Electrical & Electronics, Automotive, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Engineering Plastic Market?

Answer: The engineering plastic market deals with a group of plastics made to perform better in more challenging applications that require improved strength, temperature resistance, and resistance to chemicals. Polycarbonate (PC), polyamide (PA), polyethylene terephthalate (PET), and acrylonitrile butadiene styrene (ABS) are well suited for use in tough and demanding sectors such as industry and commerce, unlike other commodity plastics. Since polymers can stand in for metal parts, cut down on product weight, and make things more durable, they are commonly used in automotive, electronics, aerospace, construction, and medical fields. More people are buying electronics, promoting the trend of smaller parts, boosting interest in electric vehicles, and trying to reduce the waste of materials.

5. How big is the Engineering Plastic Market?

Answer: The global engineering plastic market was valued at USD 106.6 billion in 2023 and is expected to grow from USD 113.7 billion in 2024 to USD 204.2 billion by 2033, reflecting a CAGR of 6.6% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.