🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ethyl Acetate Market

Ethyl Acetate Market Global Industry Analysis and Forecast (2024-2033) by Application (Adhesives and Sealants, Paints & Coating Formulations, Process Solvents, Intermediates, Printing Ink, and Other Applications), End-Use Industry (Packaging, Construction, Automotive, Industrial & Dry Cleaning, Pharmaceuticals, and Other End-Use Industries), and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1930

Ethyl Acetate Market Synopsis

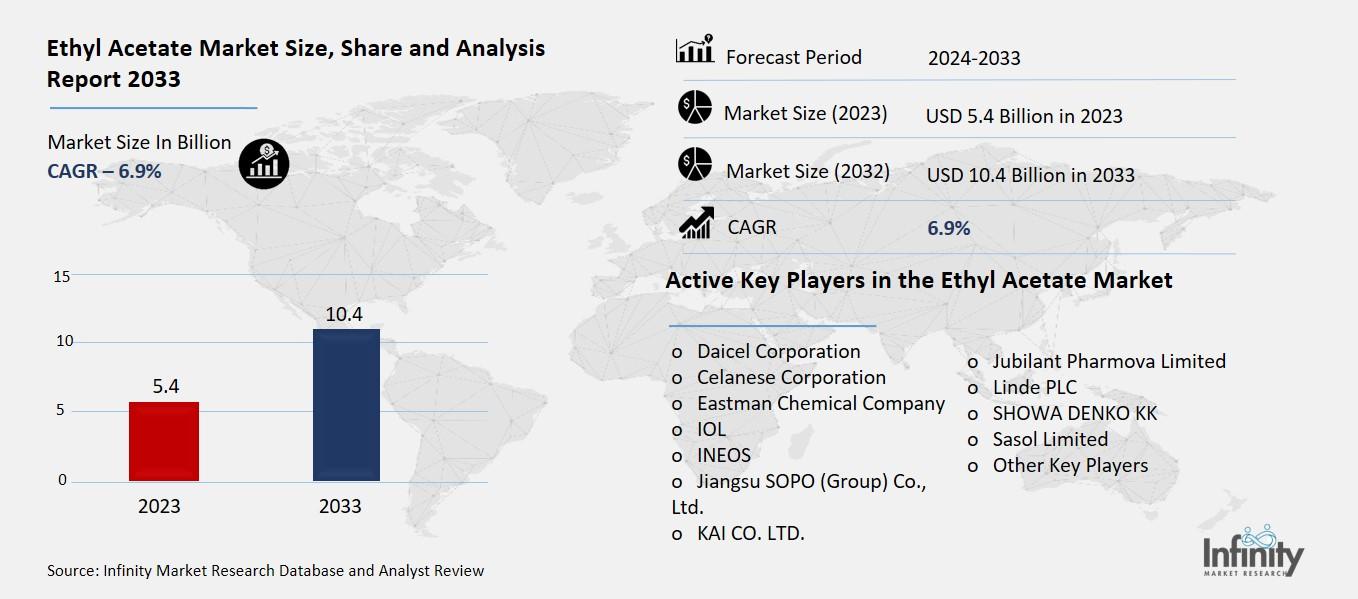

The Global Ethyl Acetate Market was valued at USD 5.4 billion in 2023 and is expected to grow from USD 5.7 billion in 2024 to USD 10.4 billion by 2033, reflecting a CAGR of 6.9% over the forecast period.

The steady growth in the ethyl acetate market draws from its numerous industrial applications within various industries. The colorless compound ethyl acetate provides its users with a sweet smell which serves numerous industries through applications such as paints, coatings and adhesives and inks and pharmaceuticals. The market grows because developing Asian economies need ethyl acetate to fulfill their expanding automotive and construction requirements and to support their industrial development. Recent industry trends focus on sustainable solvents with low volatile organic compounds which helps ethyl acetate rise as an alternative that poses less toxicity risks to the environment.

Ethyl Acetate Market Driver Analysis

Expansion of the Packaging Industry

Printing inks applied to packaging materials need increasing amounts of ethyl acetate to function as fundamental solvent ingredients in ink solutions. Rapid growth in food and beverage and cosmetics and consumer goods packaging segments requires durable inks with fast drying times which can successfully apply to plastics foils and paper in flexible packaging systems. The combination of fast drying abilities and superior solvent properties makes ethyl acetate suitable for producing high-quality printed materials with efficient flexographic and gravure printing processes. The evolving trend of decorative and detailed packaging designs that increase shelf appeal causes businesses to depend more heavily on inks based on ethyl acetate.

Ethyl Acetate Market Restraint Analysis

Strict Environmental and Safety Regulations

The volatile organic compound (VOC) ethyl acetate faces mounting regulatory challenges since North America and Europe maintain detailed environmental and occupational health standards. Ethyl acetate plays a part in ozone generation as well as smog development causing damage to both air quality and human wellness. The U.S. Environmental Protection Agency (EPA) together with the European Chemicals Agency (ECHA) have created strict regulatory framework for VOCs that includes ethyl acetate because it qualifies as a volatile organic compound. The established regulations might constrain its applications or force manufacturers to procure emission control and proper handling systems.

Ethyl Acetate Market Opportunity Analysis

Innovation in Green Solvent Technologies

Development of eco-friendly solvent making technologies creates a significant growth path for ethyl acetate market while gaining better regulatory approval. The rise of global environmental worries has induced industries to pursue eco-friendly solvent substitutes which satisfy performance requirements as well as regulatory standards. Scientists are developing bio-based ethyl acetate production through sustainable resource materials such as sugarcane and corn and biomass. Greener production methods based on bio-based resources help businesses decrease their dependence on petrochemicals while achieving lower carbon emission levels and improved biodegradability which confirms to VOC emission regulations and sustainability targets. Process optimization and catalytic technologies along with improvements in production mechanisms enable producers to decrease costs and increase energy efficiency.

Ethyl Acetate Market Trend Analysis

Increasing Use in Flexible Packaging and Ink Applications

The increased demand for processed and packaged food drives the market for printing inks through which ethyl acetate works as a crucial solvent. Food industry packaging serves dual roles as protective materials alongside functions for brand identification through labeling and delivery of necessary product information. Fast-drying inks with high efficiency must be used when printing on flexible packaging materials consisting of plastic films and laminates and foils that are frequently employed for food packaging purposes. Industrial ink producers use ethyl acetate because it gives outstanding dissolution power and quick drying time for resins and additives in formulated inks. The global consumption of packaged foods keeps growing because consumers adopted on-the-go and convenient lifestyle choices especially in emerging economies.

Ethyl Acetate Market Segment Analysis

The Ethyl Acetate Market is segmented on the basis of Application, End-Use Industry, and Application.

By Application

o Adhesives and Sealants

o Paints & Coating Formulations

o Process Solvents

o Intermediates

o Printing Ink

o Other Applications

By End-Use Industry

o Packaging

o Construction

o Automotive

o Industrial & Dry Cleaning

o Pharmaceuticals

o Other End-Use Industries

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

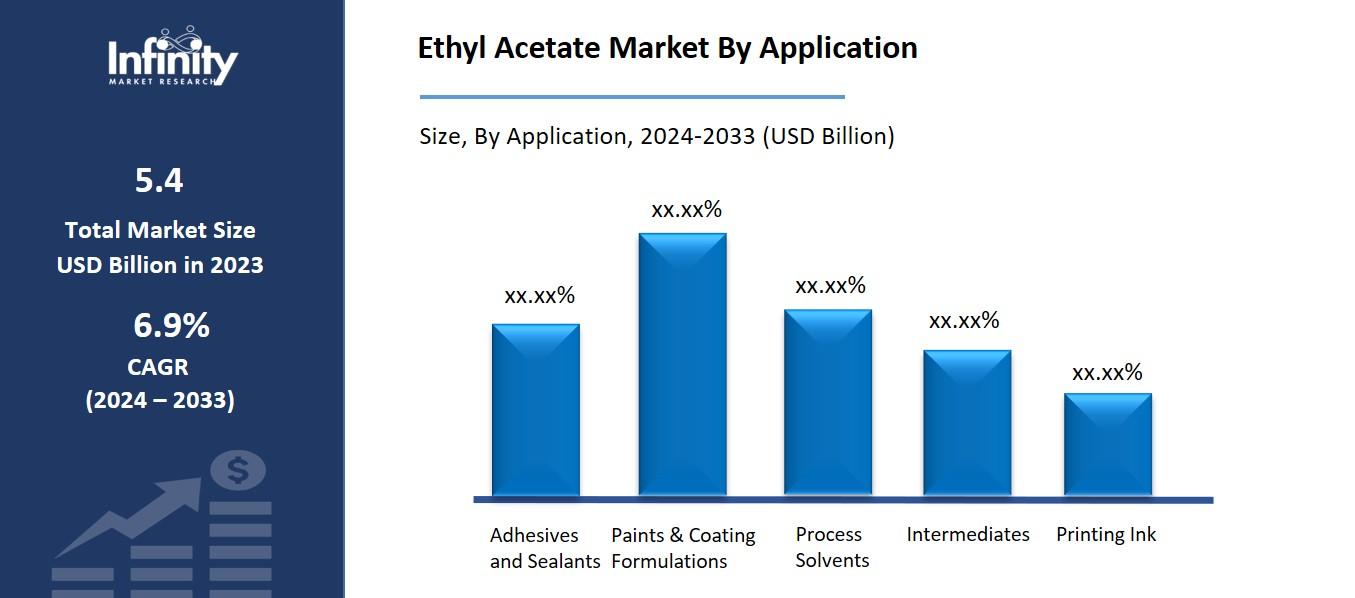

By Application, Paints & Coating Formulations Segment is Expected to Dominate the Market During the Forecast Period

The applications discussed in this research study, the paints & coating formulations segment is expected to account for the largest market share of ethyl acetate market in the forecast period. The rapid drying speed along with good solvent capabilities and reduced toxicity make ethyl acetate the preferred solvent in manufacturing formulations for coatings. Ethyl acetate provides excellent performance attributes for coating applications because it works perfectly in automotive and architectural and industrial and protective applications needing quick drying times and smooth finishes. Industrial transformation toward green solutions have accelerated because ethyl acetate provides better alternatives to less harmless solvents which follow current environmental standards and growing customer expectations for environmentally friendly products.

By End-Use Industry, the Automotive Segment is Expected to Held the Largest Share

The Automotive segment is expected to hold the largest share of the ethyl acetate market during the forecast period, primarily driven by its critical role in the automotive paints and coatings sector. Ethyl acetate functions effectively as an automotive coating solvent because of its adjustable drying speed and solvent strength and reduced hazardous properties. The automotive field demands durable and attractive automotive coatings because vehicles need protection against both environmental wear and corrosion and scratches. The properties of quick drying in ethyl acetate combine perfectly with production efficiency improvements alongside top-notch paint quality outcomes and finish quality requirements.

Ethyl Acetate Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is expected to dominate the ethyl acetate market during the forecast period, driven by several key factors. The automotive sector together with packaging production as well as paints and coatings manufacturing and consumer goods industries operate out of this area where they heavily depend on ethyl acetate. Key growth drivers include the rapid industrialization together with urbanization and expanding manufacturing base which exists in China, India, Japan and South Korea.

Ethyl acetate demands continue to rise because the automotive market expansion and heightened need for processed foods and packaged items drive printing ink and coating and adhesive requirements. Asia-Pacific sees increasing construction and infrastructure projects which require ethyl acetate as a crucial paint and coating solvent because of its growing demand.

Recent Development

In February 2023, Celanese Corporation launched sustainable versions of several acetyl chain materials, branded as ECO-B, which contain mass balance bio-content. These products enable the transition from fossil-based to renewable materials.

In October 2022, IOL Chemicals and Pharmaceuticals received approval from the European Union to supply ethyl acetate, a widely used chemical. The company has been producing ethyl acetate since 1996 and exports it to more than 40 countries.

Active Key Players in the Ethyl Acetate Market

o Daicel Corporation

o Celanese Corporation

o Eastman Chemical Company

o IOL

o INEOS

o Jiangsu SOPO (Group) Co., Ltd.

o KAI CO. LTD.

o Jubilant Pharmova Limited

o Linde PLC

o SHOWA DENKO KK

o Sasol Limited

o Other Key Players

Global Ethyl Acetate Market Scope

|

Global Ethyl Acetate Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Billion |

|

Market Size in 2024: |

USD 5.7 Billion | ||

|

Forecast Period 2024-33 CAGR: |

6.9% |

Market Size in 2033: |

USD 10.4 Billion |

|

Segments Covered: |

By Application |

· Adhesives and Sealants · Paints & Coating Formulations · Process Solvents · Intermediates · Printing Ink · Other Applications | |

|

By End-Use Industry |

· Packaging · Construction · Automotive · Industrial & Dry Cleaning · Pharmaceuticals · Other End-Use Industries | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Expansion of the Packaging Industry | ||

|

Key Market Restraints: |

· Strict Environmental and Safety Regulations | ||

|

Key Opportunities: |

· Innovation in Green Solvent Technologies | ||

|

Companies Covered in the report: |

· Daicel Corporation, Celanese Corporation, Eastman Chemical Company, IOL and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Ethyl Acetate Market Research report?

Answer: The forecast period in the Ethyl Acetate Market Research report is 2024-2033.

2. Who are the key players in the Ethyl Acetate Market?

Answer: Daicel Corporation, Celanese Corporation, Eastman Chemical Company, IOL and Other Key Players.

3. What are the segments of the Ethyl Acetate Market?

Answer: The Ethyl Acetate Market is segmented into Application, End-Use Industry, Application, and Regions. By Application, the market is categorized into Adhesives and Sealants, Paints & Coating Formulations, Process Solvents, Intermediates, Printing Ink, and Other Applications. By End-Use Industry, the market is categorized into Packaging, Construction, Automotive, Industrial & Dry Cleaning, Pharmaceuticals, and Other End-Use Industries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Ethyl Acetate Market?

Answer: The ethyl acetate market represents the worldwide industry that manufactures distributes and sells colorless flammable liquid ethyl acetate which has a fruity smell. Due to its solvent properties ethyl acetate finds extensive use throughout a variety of chemical operations in the production of paints and coatings and adhesive development as well as printing ink manufacturing and pharmaceutical production and cosmetics creation. Raw material suppliers and manufacturers as well as distributors serve with end-users make up the key participants within the market.

5. How big is the Ethyl Acetate Market?

Answer: The Global Ethyl Acetate Market was valued at USD 5.4 billion in 2023 and is expected to grow from USD 5.7 billion in 2024 to USD 10.4 billion by 2033, reflecting a CAGR of 6.9% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.