🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Global Industry Analysis and Forecast (2024-2032) By Application(Paints & Coatings, Cleaners & Detergents, Pharmaceuticals, Textiles, Printing Inks, Agrochemicals, Others),By End-Use Industry(Automotive, Construction, Healthcare, Chemicals, Textiles, Oil & Gas, Others),By Form(Liquid, Powder),By Distribution Channel(Direct Sales, Distributors & Wholesalers, Online Retail) and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1832

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Synopsis

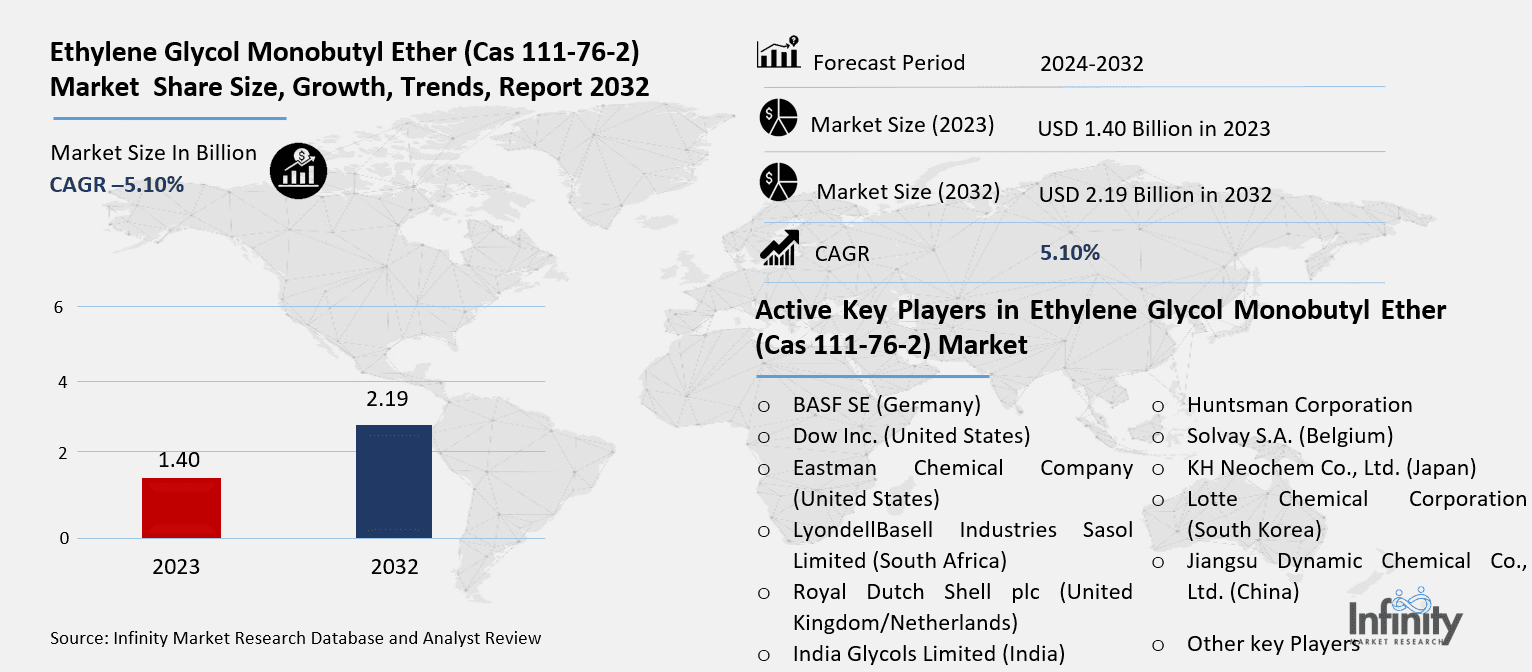

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Size Was Valued at USD 1.40 Billion in 2023, and is Projected to Reach USD 2.19 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

Widely utilized in both industrial and commercial uses, ethylene glycol monobutyl ether (CAS 111-76-2), sometimes referred to as 2-Butoxyethanol, is a glycol ether solvent. Its great solvency, low volatility, and good interaction with water and organic solvents define it. Because this chemical dissolves oils, greases, and resins so effectively, it finds uses in paints, coatings, cleaning goods, and many chemical formulations.

Rising demand in many sectors including paints and coatings, cleansers and detergues, medicines, textiles, and agrochemicals is driving consistent expansion in the global Ethylene Glycol Monobutyl Ether market. In chemical synthesis, this chemical is appreciated for its function as a solvent, dispersion agent, and intermediary. Growing demand for high-performance paints and coatings together with the developing building sector have driven market expansion. Furthermore strict rules on volatile organic compounds (VOCs) have pushed producers to investigate greener substitutes, which has resulted in ongoing product development.

Driven by fast industrialization and increasing demand in end-use sectors including automotive, building, and healthcare, the Asia-Pacific region is leading the market. Significant markets are also North America and Europe, where strict regulations influence the manufacturing and usage of Ethylene Glycol Monobutyl Ether. Nonetheless, the market has difficulties including changing raw material costs and legal limits on glycol ether use in some uses. Further expansion is predicted to be driven by technological developments and more research and development activities, so rendering the market dynamic and competitive.

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Outlook, 2023 and 2032: Future Outlook

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Trend Analysis

Trend: Rising Demand for Eco-Friendly Solvents

Industries are turning to environmentally friendly solvents, including bio-based substitutes to Ethylene Glycol Monobutyl Ether, as environmental issues get more important. Strict rules on emissions of volatile organic compounds (VOCs) enforced by regulatory authorities—especially in North America and Europe—are causing manufacturers to create greener formulations. To satisfy sustainability targets while preserving performance, companies are investigating the creation of bio-based glycol ethers generated from renewable resources, such plant-based alcohols.

The demand for eco-friendly goods is changing consumer tastes and driving companies to fund green chemical ideas. Demand for low-toxin, biodegradable solvents is driving this trend especially in the paints and coatings and cleaning industries. Although bio-based substitutes are still in their early phases, ongoing research and development projects should produce more practical, reasonably priced solutions in the next years.

Opportunity: Growth in the Construction Industry

The Ethylene Glycol Monobutyl Ether market, particularly in the paints & coatings segment, is presented with a substantial opportunity by the expanding construction sector. The demand for premium coatings and protective paints has increased as infrastructure projects all around and urbanization drives on. Benefiting from this development is ethylene glycol monobutylether, a necessary ingredient in paint compositions since of its great solubility and stability qualities.

Particularly in Asia-Pacific, developing nations are seeing a construction boom which drives demand for architectural coatings. Furthermore, the growing trend of low-VOC and environmentally friendly paints in developed areas provides glycol ether producers fresh opportunities to innovate and present compatible compositions. The need for effective solvents is further driven by the growing real estate and renovation operations, so generating profitable market possibilities.

Driver: Increasing Demand in Cleaning & Detergent Industry

Because of its strong degreasing and emulsification qualities, detergent industry is a main driver of the ethylene glycol monobutylether market. Including glass cleaners, surface degreasers, and disinfectants, this solvent is extensively utilized in household and commercial cleaners, so it is a vital ingredient for producers of cleaning products.

Particularly following the COVID-19 epidemic, the need for efficient cleaning products has increased in accordance with growing awareness of hygiene and strict cleanliness criteria. Further driving the market are the commercial and industrial sectors, which include manufacturing, hospitality, healthcare, and manufacturing; heavy-duty cleaners are therefore indispensable. The demand for Ethylene Glycol Monobutyl Ether is still great even as customer taste moves toward effective and multifarious cleaning products.

Restraints: Health & Environmental Concerns

Despite its widespread applications, Ethylene Glycol Monobutyl Ether faces regulatory and health concerns, limiting its market potential. Prolonged exposure to this chemical can cause skin irritation, respiratory issues, and potential toxicity risks, leading to regulatory scrutiny. Several countries have implemented restrictions or require stringent labeling and safety measures for products containing glycol ethers.

Moreover, environmental concerns related to the persistence of glycol ethers in the ecosystem have led to increasing research on alternatives. Companies are investing in low-toxicity and biodegradable solvent formulations to comply with regulations and maintain market relevance. These restrictions pose a challenge for manufacturers, necessitating continuous adaptation to evolving safety standards.

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Segment Analysis

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Segmented on the basis of Form, distribution channel, application and end user.

By Form

o Liquid

o Powder

By Application

o Paints & Coatings

o Cleaners & Detergents

o Pharmaceuticals

o Textiles

o Printing Inks

o Agrochemicals

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Form, Liquid segment is expected to dominate the market during the forecast period

Two forms of ethylene glycol monobutyl ether are liquid and powder. Because of its great solubility, simplicity of handling, and wide use in paints, coatings, and industrial cleaning uses—the liquid form rules the market. Excellent performance in dispersion agents, emulsifiers, and chemical intermediates makes liquid glycol ethers a desirable choice in many different sectors.

Though less often used, the powder form has niche uses in specialized formulations like agrochemicals and medications. In particular industrial uses, its advantages include controlled release characteristics, increased shelf life, and simplicity of storage. Although the market for powder-based glycol ethers is still small, continuous research into new uses could increase their use going forward.

By Application, Paints & Coatings segment expected to held the largest share

Although paints and coatings and cleaners and detergents are the main uses, ethylene glycol monobutyl ether finds application in many others. This solvent improves flow, leveling, and film development in the paints and coatings sector, therefore enhancing the application characteristics of paints. Its application in oil-based and water-based formulations makes it a main component for producers looking for performance-oriented solutions.

Ethylene Glycol Monobutyl Ether is absolutely important in the cleaners & detergues section for surface cleaning, stain removal, and degreasing. Rising demand for residential and industrial cleaning products keeps driving expansion. Leveraging the chemical's flexible solvency and emulsifying qualities, other uses include pharmaceuticals, textiles, printing inks, and agrochemicals also help to expand markets.

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Regional Insights:

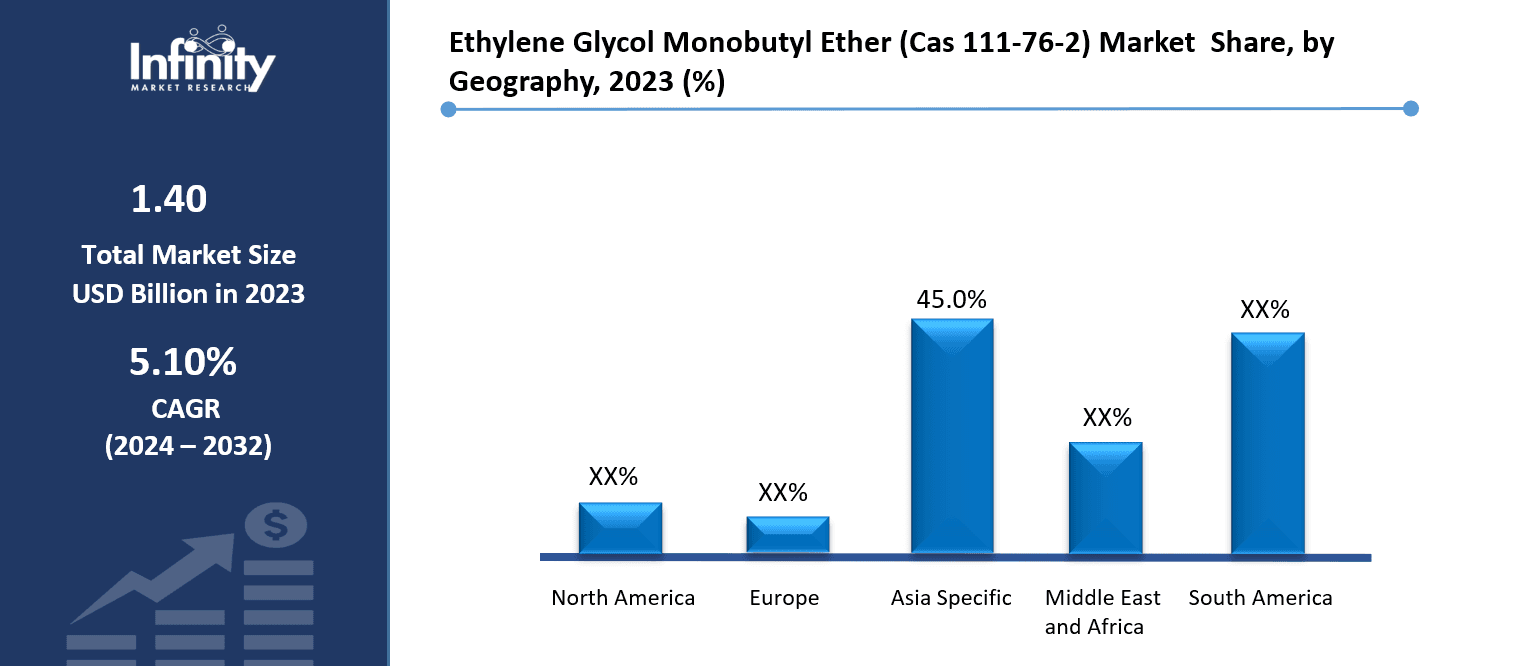

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by fast industrialization, urbanization, and great demand from end-use sectors, the Asia-Pacific region rules the Ethylene Glycol Monobutyl Ether market. Leading in manufacturing and consumption are nations including China, India, and Japan; major chemical producers are increasing their capacity to meet rising regional demand.

Demand has been greatly stimulated by growing automobile and textile manufacture as well as by the building frenzy in developing nations. Furthermore, Asia-Pacific is a good market for glycol ethers because of big manufacturing hubs and rather lax rules when compared to North America and Europe. This area is likely to keep its leadership role in the next years given ongoing industrial growth and infrastructure improvements.

Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Share, by Geography, 2023 (%)

Active Key Players in the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market

o BASF SE (Germany)

o Dow Inc. (United States)

o Eastman Chemical Company (United States)

o LyondellBasell Industries (Netherlands)

o Sasol Limited (South Africa)

o Royal Dutch Shell plc (United Kingdom/Netherlands)

o India Glycols Limited (India)

o Huntsman Corporation (United States)

o Solvay S.A. (Belgium)

o KH Neochem Co., Ltd. (Japan)

o Lotte Chemical Corporation (South Korea)

o Jiangsu Dynamic Chemical Co., Ltd. (China)

o Other key Players

Global Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Scope

|

Global Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.40 Billion |

|

Forecast Period 2024-32 CAGR: |

5.10% |

Market Size in 2032: |

USD 2.19 Billion |

|

Segments Covered: |

By Form |

· Liquid · Powder | |

|

By Application |

· Paints & Coatings · Cleaners & Detergents · Pharmaceuticals · Textiles · Printing Inks · Agrochemicals · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increasing Demand in Cleaning & Detergent Industry | ||

|

Key Market Restraints: |

· Health & Environmental Concerns | ||

|

Key Opportunities: |

· Growth in the Construction Industry | ||

|

Companies Covered in the report: |

· BASF SE (Germany), Dow Inc. (United States), Eastman Chemical Company (United States), LyondellBasell Industries (Netherlands), Sasol Limited (South Africa), Royal Dutch Shell plc (United Kingdom/Netherlands), India Glycols Limited (India) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market research report?

Answer: The forecast period in the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market research report is 2024-2032.

2. Who are the key players in the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market?

Answer: BASF SE (Germany), Dow Inc. (United States), Eastman Chemical Company (United States), LyondellBasell Industries (Netherlands), Sasol Limited (South Africa), Royal Dutch Shell plc (United Kingdom/Netherlands), India Glycols Limited (India) and Other Major Players.

3. What are the segments of the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market?

Answer: The Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market is segmented into Form, Distribution Channel, Application, End User and region. By Application, the market is categorized into Paints & Coatings, Cleaners & Detergents, Pharmaceuticals, Textiles, Printing Inks, Agrochemicals, Others. By End-Use Industry, the market is categorized into Automotive, Construction, Healthcare, Chemicals, Textiles, Oil & Gas, Others. By Form, the market is categorized into Liquid, Powder. By Distribution Channel, the market is categorized into Direct Sales, Distributors & Wholesalers, Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market?

Answer: Widely utilized in both industrial and commercial uses, ethylene glycol monobutyl ether (CAS 111-76-2), sometimes referred to as 2-Butoxyethanol, is a glycol ether solvent. Its great solvency, low volatility, and good interaction with water and organic solvents define it. Because this chemical dissolves oils, greases, and resins so effectively, it finds uses in paints, coatings, cleaning goods, and many chemical formulations.

5. How big is the Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market?

Answer: Ethylene Glycol Monobutyl Ether (Cas 111-76-2) Market Size Was Valued at USD 1.40 Billion in 2023, and is Projected to Reach USD 2.19 Billion by 2032, Growing at a CAGR of 5.10% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.