🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Excavators Market

Excavators Market (By Vehicle Weight (<10, 11 to 45, 46>), By Engine Capacity (Up To 250 HP, 250-500 HP, More Than 500 HP), By Type (Wheel, Crawler), By Drive Type (Electric, ICE), By Region and Companies)

Jul 2024

Industrial Automation and Equipment

Pages: 190

ID: IMR1178

Excavators Market Overview

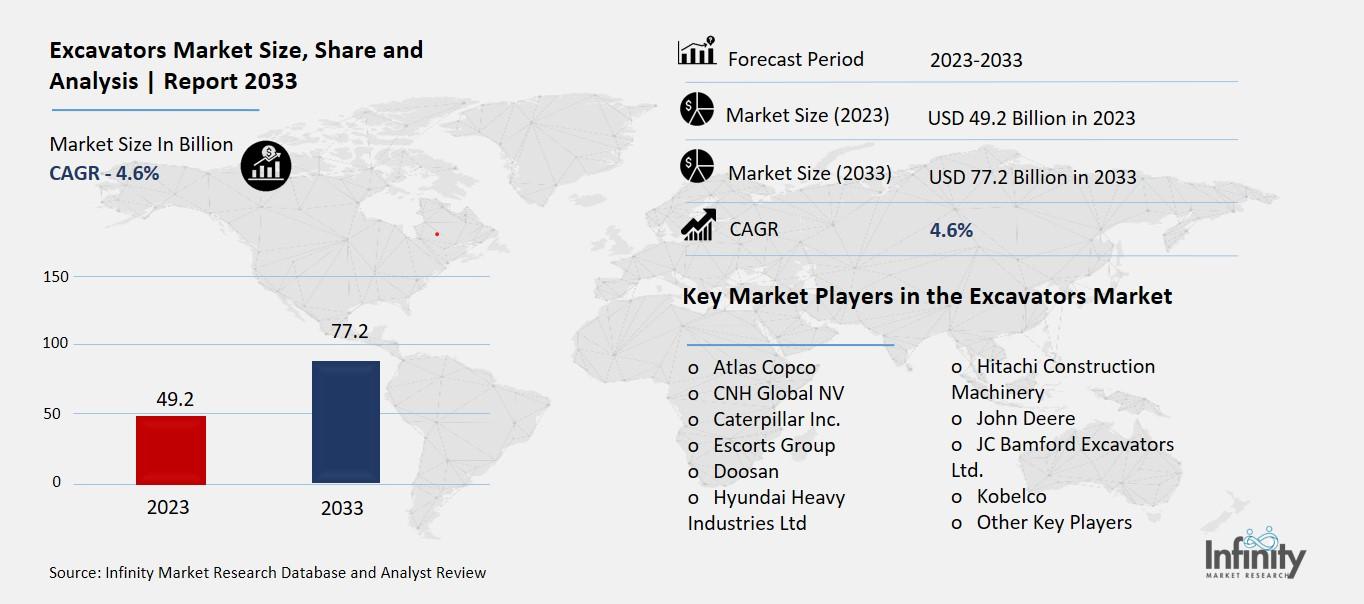

Global Excavators Market size is expected to be worth around USD 77.2 Billion by 2033 from USD 49.2 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2023 to 2033.

The excavators market refers to the industry that produces and sells excavators, which are heavy construction machines used for digging, moving earth, and other tasks such as demolition, material handling, and mining. Excavators are equipped with a boom, stick, bucket, and cab on a rotating platform, which allows them to perform a wide range of jobs in construction and infrastructure projects. The market includes various types of excavators, like mini, crawler, and wheeled excavators, each designed for specific tasks and environments.

The excavators market is experiencing growth due to increasing construction activities worldwide, particularly in emerging economies where infrastructure development is booming. Additionally, advancements in technology, such as the integration of GPS, advanced hydraulics, and telematics, are enhancing the efficiency and capabilities of excavators. These technological improvements not only make the machines more productive but also improve safety and reduce operating costs, further driving the market’s expansion. As the construction industry continues to evolve, the demand for versatile and efficient excavators is expected to rise.

Drivers for the Excavators Market

Infrastructure Development

One of the main drivers for the excavators market is the expansion of infrastructure projects globally. Emerging nations are particularly active in building new roads, bridges, dams, and railways, which require extensive excavation and earthmoving tasks. Excavators are essential machinery for these activities, making them highly sought after in such projects. The continuous need for infrastructure improvement ensures a steady demand for excavators.

Rapid Urbanization

The rapid urbanization across the globe is significantly boosting the demand for excavators. As cities expand, new residential and commercial buildings are constructed, necessitating extensive site preparation and foundation excavation. This urban growth directly contributes to the increasing use of excavators, particularly in densely populated areas where efficient and precise digging is crucial.

Technological Advancements

Technological advancements in excavator design and functionality are driving market growth. Innovations such as fuel-efficient engines, enhanced safety features, and the integration of automation and telematics systems have made modern excavators more efficient and attractive to end-users. These improvements not only enhance performance but also reduce operational costs, making them a preferred choice for construction and mining companies.

Growth in the Mining Industry

The mining industry is another significant contributor to the demand for excavators. These machines are vital for various mining activities, including ore extraction and site development. With the mining sector's growth and the increasing need for minerals and metals, the demand for robust and efficient excavators has risen. The industry's expansion is a key factor in sustaining the excavators market.

Government Investments and Initiatives

Government investments in infrastructure and construction projects play a crucial role in driving the excavators market. Many governments are initiating public-private partnerships (PPPs) and funding projects in the energy and transportation sectors. These initiatives often include incentives, subsidies, and favorable fiscal policies that encourage the acquisition and use of advanced excavators.

Replacement Demand

The demand for excavators is also driven by the need to replace outdated machinery. As construction and mining companies strive to improve efficiency and safety, they are increasingly investing in new, high-tech excavators. This replacement cycle ensures a continuous demand for modern excavators, contributing to the overall market growth.

Restraints for the Excavators Market

High Initial Costs and Maintenance

One of the main restraints for the excavator market is the high initial cost of the machines. Excavators, especially advanced models with enhanced features, require significant investment. This can be a major barrier for small and medium-sized enterprises (SMEs) in the construction industry. Additionally, ongoing maintenance and repair costs add to the overall expense, making it challenging for smaller firms to justify the investment. These costs include not only routine servicing but also the potential need for expensive parts replacements and specialized labor for repairs.

Fluctuating Raw Material Prices

The cost of raw materials, such as steel, used in manufacturing excavators, can fluctuate significantly. These price changes directly impact the production costs of excavators. When raw material prices rise, manufacturers often have to increase the price of their equipment, which can lead to decreased demand. This volatility in raw material costs can cause uncertainty for manufacturers and buyers alike, affecting market stability and growth.

Environmental Regulations and Emission Standards

Stringent environmental regulations and emission standards are another significant restraint for the excavators market. Governments worldwide are implementing strict guidelines to reduce carbon emissions and environmental impact from heavy machinery. Meeting these standards often requires significant investment in research and development to create more efficient and environmentally friendly engines. This can drive up the costs of new models and make it difficult for manufacturers to adapt quickly to changing regulations, potentially slowing market growth.

Availability of Skilled Labor

Operating modern excavators, especially those with advanced technologies, requires skilled labor. There is a global shortage of trained operators who can efficiently handle these machines. This shortage can lead to project delays and increased labor costs, as companies may need to invest in training programs or pay higher wages to attract skilled operators. The lack of skilled labor can therefore be a significant barrier to the adoption of new and advanced excavators.

Economic Uncertainties and Market Fluctuations

Economic instability and fluctuations in the construction industry can greatly affect the demand for excavators. During economic downturns, construction activities slow down, leading to reduced demand for heavy machinery like excavators. Conversely, during economic booms, the market might experience rapid growth. This cyclical nature of the economy makes it difficult for manufacturers to maintain consistent production and sales levels, impacting their long-term planning and profitability.

Competition from Rental Services

The growing popularity of equipment rental services poses a challenge to the excavators market. Many construction companies prefer renting excavators instead of purchasing them outright, especially for short-term projects. Renting reduces the burden of high initial costs and maintenance responsibilities. This trend towards renting over purchasing can limit the potential market for new excavator sales, affecting manufacturers' revenue streams.

Opportunity in the Excavators Market

Technological Advancements

Technological advancements in the construction equipment sector, such as the development of autonomous and electric excavators, are creating significant opportunities. Autonomous excavators, equipped with advanced sensors and artificial intelligence, can perform tasks with high precision and efficiency, reducing the need for human intervention and lowering operational costs. Electric excavators, on the other hand, offer an eco-friendly alternative to traditional diesel-powered machines, meeting the growing demand for sustainable construction practices. These innovations are expected to drive market growth as companies seek to adopt more efficient and environmentally friendly equipment.

Infrastructure Development

The ongoing and upcoming infrastructure projects across the globe are a major opportunity for the excavators market. Governments and private entities are investing heavily in infrastructure development, including roads, bridges, railways, and urban development projects. For instance, significant infrastructure investments in regions like Asia-Pacific and the Middle East are expected to boost the demand for excavators. The increasing need for efficient and versatile construction equipment in these large-scale projects is likely to fuel market expansion.

Urbanization and Industrialization

Rapid urbanization and industrialization in developing countries are creating substantial growth opportunities for the excavator market. As cities expand and new industrial zones are established, the demand for construction equipment, including excavators, rises. The need to build residential complexes, commercial buildings, and industrial facilities drives the requirement for efficient excavation machinery. Countries such as China, India, and Brazil, experiencing high urbanization rates, are key markets where the demand for excavators is expected to surge.

Rental Services Growth

The growth of the construction equipment rental market is another significant opportunity for the excavators market. Many construction companies prefer renting equipment rather than purchasing it outright, primarily to avoid the high costs and maintenance expenses associated with ownership. The flexibility offered by rental services allows companies to access the latest equipment without significant capital investment. This trend is particularly prominent in regions with fluctuating construction activities, where the demand for rented excavators is high.

Expansion in Emerging Markets

Emerging markets offer vast untapped potential for the excavators market. Regions like Africa and Southeast Asia, which are witnessing increasing construction activities and economic development, present lucrative opportunities. Investments in infrastructure, mining, and agriculture in these regions are driving the demand for excavators. Companies expanding their operations and distribution networks in these emerging markets are likely to benefit from the growing demand for construction equipment.

Trends for the Excavators Market

Electrification and Hybrid Technology

The excavator market is seeing a significant shift towards electrification and hybrid technology. As environmental concerns grow, manufacturers are investing in electric and hybrid models to reduce emissions and meet stringent regulations. These new models not only help in reducing the carbon footprint but also offer cost savings in terms of fuel consumption and maintenance. Companies like Caterpillar and Hitachi are leading the way with innovative electric and hybrid excavators that promise enhanced efficiency and lower operational costs.

Integration of Advanced Technologies

Another major trend is the integration of advanced technologies such as automation, telematics, and the Internet of Things (IoT). Modern excavators are increasingly equipped with GPS, telematics, and autonomous operation capabilities. These technologies enhance productivity, improve precision, and reduce the need for manual labor. For instance, advanced telematics systems allow for real-time monitoring of equipment performance and predictive maintenance, which can prevent costly downtimes and extend the lifespan of the machinery.

Expansion in Rental Services

The demand for excavator rental services is rising, driven by the high costs of purchasing and maintaining new equipment. Rental services offer flexibility and cost-effectiveness, especially for small to medium-sized construction companies. This trend is supported by the growing infrastructure development and construction activities worldwide. Major players are expanding their rental fleets to cater to this increasing demand, providing a wide range of excavators to suit various project needs.

Focus on Operator Safety and Comfort

Manufacturers are increasingly focusing on enhancing operator safety and comfort. Modern excavators come with advanced safety features such as collision detection systems, better visibility, and ergonomic designs to reduce operator fatigue. Features like air-conditioned cabins, adjustable seats, and intuitive control systems are becoming standard to ensure a safer and more comfortable working environment. This focus on operator well-being not only boosts productivity but also attracts a skilled workforce.

Sustainable and Eco-friendly Practices

Sustainability is a key trend in the excavator market, with manufacturers adopting eco-friendly practices in their production processes. This includes the use of recyclable materials, energy-efficient manufacturing techniques, and the development of more energy-efficient machines. The move towards greener practices is not only driven by regulatory requirements but also by increasing consumer demand for sustainable products. This trend is expected to grow as more companies commit to reducing their environmental impact.

Regional Growth and Market Expansion

The Asia-Pacific region, particularly China and India, is experiencing significant growth in the excavators market. This is due to rapid urbanization, infrastructure development, and increased mining activities. Similarly, North America and Europe are also seeing steady growth driven by technological advancements and the replacement of older machinery with newer, more efficient models. Market players are expanding their presence in these regions through strategic partnerships, mergers, and acquisitions to tap into the growing demand.

Segments Covered in the Report

By Vehicle Weight

o <10

o 11 to 45

o 46>

By Engine Capacity

o Up To 250 HP

o 250-500 HP

o More Than 500 HP

By Type

o Wheel

o Crawler

By Drive Type

o Electric

o ICE

Segment Analysis

By Vehicle Weight Analysis

In 2023, the above 46 weight category dominated the market and generated 33.9% of worldwide revenue. A few of the elements driving the segment growth are the rapid construction of infrastructure in both developed and emerging nations. Strong and effective excavation equipment is now required due to the building of large-scale infrastructure projects including roads, bridges, and urban development plans. Furthermore, the need for strong excavators has grown significantly as the emphasis on updating transportation infrastructure and developing metropolitan areas has increased.

Likewise, throughout the forecast period, excavators weighing less than ten are anticipated to increase at the fastest rate. The rising need for small, adaptable gear in urban construction projects has led to a considerable global trend toward excavators with truck weights under 10 tons. Space limits present a significant issue for projects in highly populated locations, where their mobility and ability to navigate limited spaces make them crucial. Construction companies looking for the best performance without sacrificing precision and agility are drawn to lightweight excavators due to their enhanced hydraulic capabilities, ergonomic design, and integration of cutting-edge telematics systems.

By Engine Capacity Analysis

In 2023, the segment with up to 250 HP had the biggest revenue share of the market. Commercial and residential construction projects are among the primary factors that are cultivating a good outlook for the sector. Excavators with engine capacities up to 250 HP are widely used in large-scale port, highway, and mining construction projects worldwide. The growing use of automated excavators is driving the segment's expansion. These excavators lower labor expenses and allow remote operation tracking. Additional growth-promoting factors include a range of product enhancements, such as the utilization of fuel cell-powered electric motors to power excavators. Because fuel cells are more efficient and portable than diesel engines, the machine's overall capacity is increased and the operator's cabin area is expanded.

The strong expansion of the international building and infrastructure development industries has increased demand for excavators with 250–500 horsepower engines. With more nations focusing on modernizing and expanding their transportation networks, there is a greater demand for strong excavators. Construction projects can move more quickly because of these machines' increased horsepower capacity, which is necessary for managing heavy-duty operations like large-scale excavation, demolition, and earthmoving.

By Type Analysis

Wheel excavators dominated the market in 2023 because demand for them is expected to rise as waste management becomes more and more necessary in the industrial sectors. The necessity for adaptable construction equipment has been fueled by the growing trend of urbanization and the ensuing need for upgraded and modern urban infrastructure. Wheel excavators are essential for urban building projects because of their compact shape and improved maneuverability, particularly in densely populated regions where space limits pose a serious issue. They are the best option for a variety of construction tasks, including trenching, digging, and material handling, because of their compact design and agility in crowded urban areas.

During the predicted period, there will likely be an increase in demand for crawler excavators. Crawler excavators are easier to move about and more stable because of their undercarriage weight, which increases productivity. As a result, this aspect is probably going to support market expansion. It is anticipated that technology advancements such as the increased power output of air-to-water intercooler engines would drive up demand for crawler excavators. Features such as a dedicated swing pump, load-sensing hydraulics, work-toll flexibility, unique riding control, and a cooling fan powered by hydraulics are driving the market's growth. The fact that crawler excavators are inappropriate for steep terrain due to the ground's low traction and the high maintenance costs are among the reasons impeding the growth of the global crawler market.

By Drive Type Analysis

2023 saw the ICE sector lead the market. An increase in government programs and road projects globally is expected to boost demand for excavators. Excavators are becoming more and more in demand as a result of growing industrialization and urbanization, which are driving up building activity. Excavators are expected to see market expansion throughout the projection period, driven primarily by continuous residential construction and infrastructure development. Furthermore, the market is expected to expand more quickly due to the widespread usage of excavators in the building, maintenance, and restoration of gas pipelines and electric transmission networks.

Throughout the forecast period, the electric drive type segment is expected to develop at the fastest rate. The increased dedication to lowering carbon emissions and battling climate change is one of the major factors driving the electric excavator market. Excavators are among the many pieces of electric construction equipment that are becoming more and more popular as a result of governments and businesses throughout the world placing a greater emphasis on environmental preservation and sustainability. The movement toward greener, cleaner construction methods is thought to hinge heavily on electric excavators.

Regional Analysis

With over 39.8% of the market share in 2023, Asia Pacific dominated the industry. Better economic times and rapid infrastructure development in places like China, India, and South Korea are helping the construction sector. Due to the presence of large manufacturers and their ongoing attempts to create new production plants, China dominated the market. The demand for markets in China has increased as a result of ongoing, significant projects like the Shanghai Metro Line 23: Phase I, the Foshan Metro Line 4: Phase I, the Liuzhou-Wuzhou Railway Line, the Zhongwei Ji'an Natural Gas Pipeline project, the Shanghai Chip Manufacturing Plant, and the Belt and Road Initiative, among others. Moreover, expanding mining operations in nations like China, Vietnam, Thailand, India, and China are fostering market expansion.

The market is expected to increase significantly in Europe. The increasing focus on urban development and rehabilitation is credited with driving the expansion of the European market. European nations have invested heavily in improving their cities and public utilities, with an emphasis on building new residential areas and extending transit networks. In the construction sector, there is a steady need for excavators due to urbanization and infrastructural expansion. This adaptable equipment is necessary for a variety of jobs that are crucial to these projects, like trenching and foundation excavation.

Competitive Analysis

The leading excavator manufacturers are putting a lot of effort into expanding their product lines. They are adding cutting-edge technology to their offerings, like automation, machine learning (ML), and the Internet of Things (IoT). In addition, prominent industry participants are proactively exploring avenues for growth via mergers, acquisitions, and further tactics to optimize their sources of income.

Recent Developments

May 2023: To bolster its position in the market for compact machines, Hyundai Construction Equipment Co. Ltd. Europe introduced the HX65A crawler excavator and the HW65A wheeled excavator. The Hyundai Stage V compliant diesel engine, proportional joysticks with ram-lock on the joystick, higher swing speed and torque, and powerful 48.5kW and 248Nm of torque were all features of the HW65A and HX65A.

March 2023: Hitachi Construction Machinery Co., Ltd. introduced the ZX130-7 and ZX160LC-7 excavators, which are the next-generation models. These goods are full-sized excavators made to efficiently finish a wide range of jobs on construction sites. For better performance and fuel efficiency, they have comfort improvements that combat weariness and improvements to the hydraulic system.

Key Market Players in the Excavators Market

o CNH Global NV

o Escorts Group

o Doosan

o Hyundai Heavy Industries Ltd

o Hitachi Construction Machinery

o JC Bamford Excavators Ltd.

o Kobelco

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 49.2 Billion |

|

Market Size 2033 |

USD 77.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Vehicle Weight, Engine Capacity, Type, Drive Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Atlas Copco, CNH Global NV, Caterpillar Inc., Escorts Group, Doosan, Hyundai Heavy Industries Ltd, Hitachi Construction Machinery, John Deere, JC Bamford Excavators Ltd., Kobelco, Other Key Players |

|

Key Market Opportunities |

Technological Advancements |

|

Key Market Dynamics |

Infrastructure Development |

📘 Frequently Asked Questions

1. What would be the forecast period in the Excavators Market?

Answer: The forecast period in the Excavators Market report is 2024-2033.

2. How much is the Excavators Market in 2023?

Answer: The Excavators Market size was valued at USD 49.2 Billion in 2023.

3. Who are the key players in the Excavators Market?

Answer: Atlas Copco, CNH Global NV, Caterpillar Inc., Escorts Group, Doosan, Hyundai Heavy Industries Ltd, Hitachi Construction Machinery, John Deere, JC Bamford Excavators Ltd., Kobelco, Other Key Players

4. What is the growth rate of the Excavators Market?

Answer: Excavators Market is growing at a CAGR of 4.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.