🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Fatty Alcohols Market

Fatty Alcohols Market Global Industry Analysis and Forecast (2024-2032) By Type (C6-C10, C12-C14, C16-C18, C20-C22), By Source (Natural, Synthetic), By Application (Detergents & Surfactants, Personal Care & Cosmetics, Plasticizers, Lubricants, Paints & Coatings, Others) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1716

Fatty Alcohols Market Synopsis

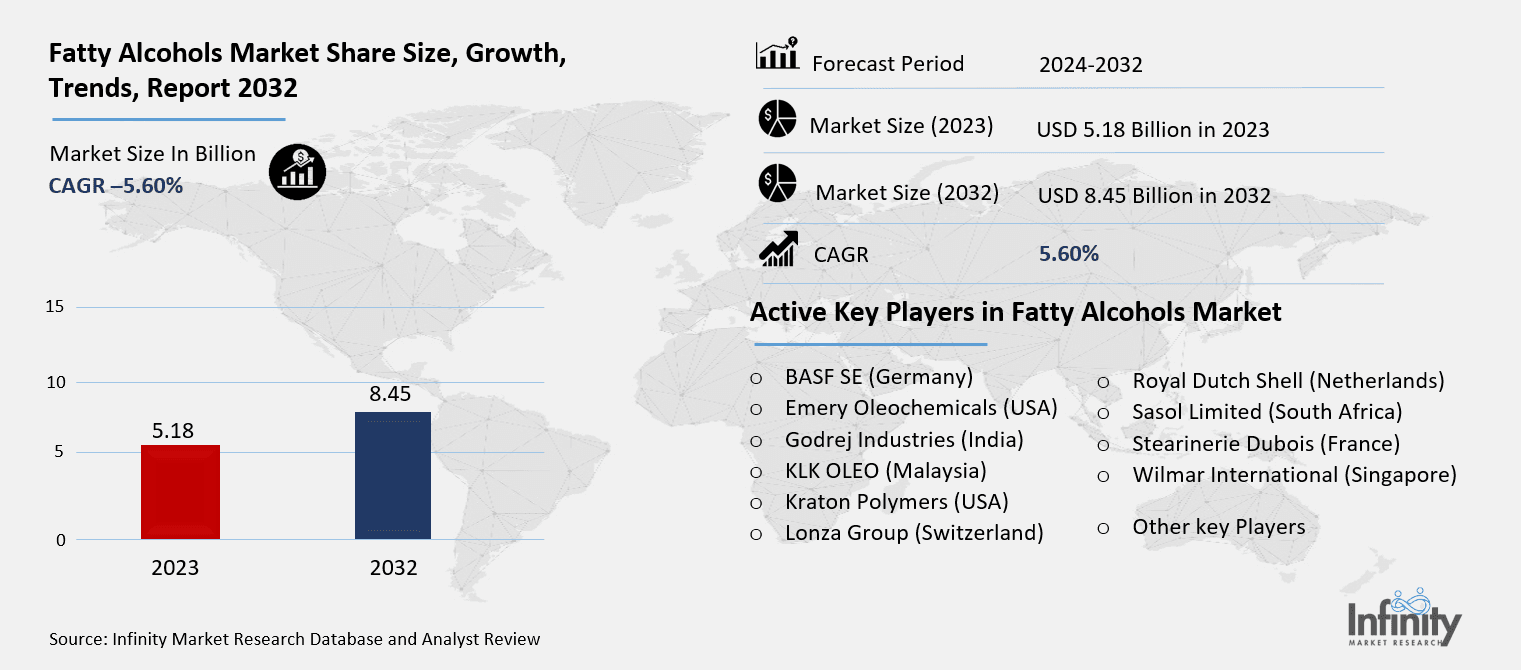

Fatty Alcohols Market Size Was Valued at USD 5.18 Billion in 2023, and is Projected to Reach USD 8.45 Billion by 2032, Growing at a CAGR of 5.60 % From 2024-2032.

Fatty alcohols marketplace comprises the synthesis, sale and consumption of the long chain alcohols which include natural or synthetic origin. These alcohols that are normally synthesised from fatty acids are widely used in several industries such as cosmetics, detergents plastics, lubricants and in production of, personal care products among others. They may be used in both industrially and domestically due to their flexibility, degradability, and recreational properties.

Owing to the higher demand for bio-degradable surfactants and emulsifiers in particular in the personal care, household and automotive sectors, the fatty alcohols market has shown a progressive growth rate. Fatty alcohols are obtained from natural resources as well as from synthetic sources, and find vast applications as detergents, cosmetic agents, and lubricants. Due to rising application of sustainability and environmentally friendly heavy weight consumer products as the trend for renewable raw materials market for fatty alcohols will increase further in the future.

An increasing concern for environmental pollutants from chemicals used in consumer products and growing requirements by regulatory authorities to embrace bio products support the growth of fatty alcohols. Others are the steady increases in end use applications like personal care, construction and agriculture. However, issues on the raw materials for production and fluctuations in supply chains are still existing factors impacting the market.

Fatty Alcohols Market Outlook, 2023 and 2032: Future Outlook

Fatty Alcohols Market Trend Analysis

Green Shift, The Rise of Natural Fatty Alcohols

Another dynamic seen on fatty alcohols market is that more and more companies choose natural and renewable raw materials instead of synthetic ones. This phenomenon is arising from the application of regulations and increased consumer concern over environment conservation and sustainability. Manufacturers are now eyeing natural fatty alcohols prepared from renewable feedstock such as palm and coconut oil due to increased awareness for environment friendly products.

Second, the high growth rate for fatty alcohols in personal care and cosmetics is another notable requirement. These alcohols are incorporated in formulations they act as emulsifiers, thickeners and surfactants as well as imparting texture and stabilization of personal care products including shampoos lotions and soaps.

Eco-Friendly Surge, Demand for Biodegradable Ingredients

High demand of fatty alcohols as raw material in a numerous sectors and industries as well as high demand of biodegradable products have remained as the key driving forces of the market. With pressure created by environmental issues, industries are shifting their attention to minimizing their dependence on products derived from petrochemicals. Fatty alcohols are biodegradable in nature and are preferred over synthetic chemicals because of which fatty alcohols are used in cosmetics, cleaning and personal care industries.

Furthermore, the rise in the application of the fatty alcohols in producing bio-based surfactants also boosts the market. With the increasing number of firms that are changing from employing hazardous substances in their products, fatty alcohols are critical for developing green detergents, cleaning materials, and industrial chemicals.

Supply Chain Shake-up, The Impact of Raw Material Fluctuations

One of the highest risks for the fatty alcohols market is the volatility of their prices, especially with regard to the plant-based oils, on which the alcohols in question are based. Due the fact that most fatty alcohols are produced from palm, coconut and other vegetable oils, any fluctuation in the supply or price of these basic materials will have a a direct influence on the costs of production and the market.

Another restraint is the threats posed by new synthetic alcohol competition. The increasing demand for natural fatty alcohols is still constrained by synthetic alcohols accessibility, and thus the cost of the product still remains high to many producers in search of plant-based fatty alcohols.

Sustainability at the Forefront, New Frontiers for Fatty Alcohols

The company needs to focus of such sectors as personal care items and cosmetics to note the increasing market potential due to the increased demand of natural and non-hazardous product ingredients. Since the awareness of common consumer goods containing chemicals, more and more manufacturers are seeking for bio friendly fatty alcohols instead of petrochemical based ingredients.

The second emerging area includes creation of new applications for fatty alcohols in innovative markets for bio-based plastics and automotive industry. The increasing requirement of bio-based and biodegradable materials, particularly in the chemical, personal care, cosmetic, pharmaceutical, and Oleochemical industries creates attractive opportunities for the use of fatty alcohols in new innovative products, thus contributing to environmental sustainability.

Fatty Alcohols Market Segment Analysis

Fatty Alcohols Market Segmented on the basis of By Type, By Source and By Application.

By Type

o Detergents & Surfactants

o Personal Care & Cosmetics

o Plasticizers

o Lubricants

o Paints & Coatings

o Others

By Application

o Detergents & Surfactants

o Personal Care & Cosmetics

o Plasticizers

o Lubricants

o Paints & Coatings

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, C6-C10 segment is expected to dominate the market during the forecast period

Faty alcohols are subdivided according to the number of carbon atoms in their alkyl groups and the role that the number of carbon atoms plays in determining the applicability of the substance cannot be under estimated. The C6-C10 fatty alcohols are preferred for personal care products mainly because of the shorter fatty chain and capacity to emulsify. C12-C14 fatty alcohols are widely used in washing and cleaning agents, C16-C18 fatty alcohols are popular in plastics, plasticizers and other industrial uses. C20-C22 fatty alcohols contain the longest carbons lengths among all the mentioned fatty alcohols and utilized in the so-called ‘luxury’ uses such as cosmetics and personal care products due to high stability and emulsification performance in its uses.

By Source, Natural segment expected to held the largest share

Fatty alcohols are obtained through natural products and could also be chemically produced. It is obtained from plant-based oils such as palm oil and coconut oil, which are both readily renewable as well as biodegradable. Synthetic fatty alcohols, on the other hand are usually prepared by the hydrogenation of fatty acids obtained from petroleum stock. The natural segment, in recent years, has comparable growth as the consumer demand for the ecological and bio-organic products has increased; the synthetic segment remains important as the products are inexpensive and can be produced in large quantities.

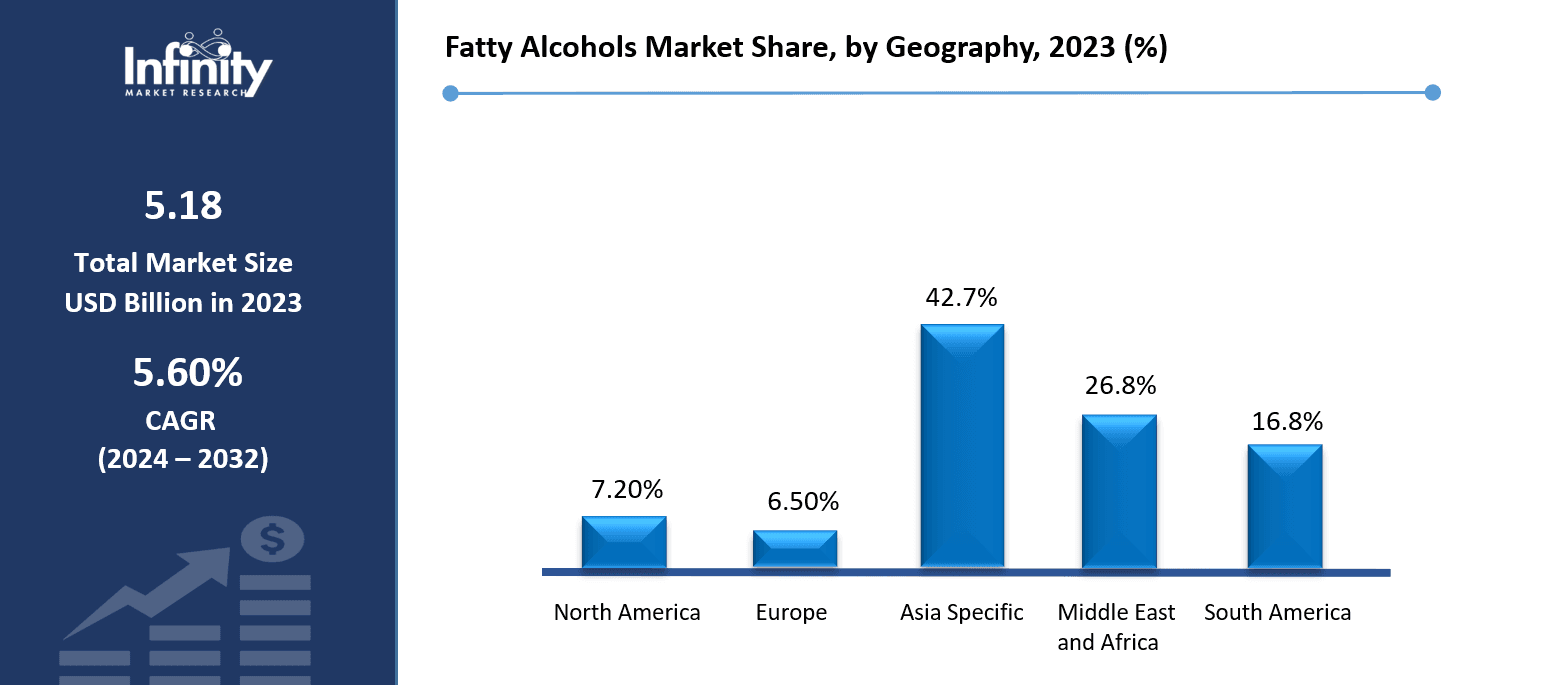

Fatty Alcohols Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The major market for fatty alcohols is the Asia Pacific region and holds the largest market share. This is mainly due to higher production of palm and coconut oils in Malaysia, Indonesia and Philippines, which are major feed stock for fatty alcohols. the growth of an industrial base together with rising demand of plastic products from industries such personal care, cleaning products and construction also gives the region a dominant market share.

In addition, Asia Pacific comprises many large production sites of fatty alcohols to support affordable costs and significant production scale. The people of the region are now increasingly using environmentally sustainable and renewable products this has continued to fuel the market for fatty alcohols that Evonik this making it a market leader.

Fatty Alcohols Market Share, by Geography, 2023 (%)

Active Key Players in the Fatty Alcohols Market

o BASF SE (Germany)

o Emery Oleochemicals (USA)

o Godrej Industries (India)

o KLK OLEO (Malaysia)

o Kraton Polymers (USA)

o Lonza Group (Switzerland)

o Royal Dutch Shell (Netherlands)

o Sasol Limited (South Africa)

o Stearinerie Dubois (France)

o Wilmar International (Singapore)

o Other key Players

Global Fatty Alcohols Market Scope

|

Global Fatty Alcohols Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.18 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60 % |

Market Size in 2032: |

USD 8.45 Billion |

|

Segments Covered: |

By Type |

· C6-C10 · C12-C14 · C16-C18 · C20-C22 | |

|

By Source |

· Natural · Synthetic | ||

|

By Application |

· Detergents & Surfactants · Personal Care & Cosmetics · Plasticizers · Lubricants · Paints & Coatings · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· From Household to Industrial, Fatty Alcohols' Expanding Role | ||

|

Key Market Restraints: |

· Synthetic Alternatives, The Competitive Edge of Cost-Effectiveness | ||

|

Key Opportunities: |

· Unlocking Potential, Fatty Alcohols in Emerging Industries | ||

|

Companies Covered in the report: |

· Sasol Limited (South Africa), KLK OLEO (Malaysia), Stearinerie Dubois (France), Lonza Group (Switzerland), Wilmar International (Singapore), BASF SE (Germany), Kraton Polymers (USA), Godrej Industries (India), Royal Dutch Shell (Netherlands), Emery Oleochemicals (USA) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Fatty Alcohols Market research report?

Answer: The forecast period in the Fatty Alcohols Market research report is 2024-2032.

2. Who are the key players in the Fatty Alcohols Market?

Answer: Sasol Limited (South Africa), KLK OLEO (Malaysia), Stearinerie Dubois (France), Lonza Group (Switzerland), Wilmar International (Singapore), BASF SE (Germany), Kraton Polymers (USA), Godrej Industries (India), Royal Dutch Shell (Netherlands), Emery Oleochemicals (USA) and Other Major Players.

3. What are the segments of the Fatty Alcohols Market?

Answer: The Fatty Alcohols Market is segmented into By Type, By Source, By Application and region. By Type, the market is categorized into C6-C10, C12-C14, C16-C18, C20-C22. By Source, the market is categorized into Natural, Synthetic. By Application, the market is categorized into Detergents & Surfactants, Personal Care & Cosmetics, Plasticizers, Lubricants, Paints & Coatings, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Fatty Alcohols Market?

Answer: Fatty alcohols marketplace comprises the synthesis, sale and consumption of the long chain alcohols which include natural or synthetic origin. These alcohols that are normally synthesised from fatty acids are widely used in several industries such as cosmetics, detergents plastics, lubricants and in production of, personal care products among others. They may be used in both industrially and domestically due to their flexibility, degradability, and recreational properties.

5. How big is the Fatty Alcohols Market?

Answer: Fatty Alcohols Market Size Was Valued at USD 5.18 Billion in 2023, and is Projected to Reach USD 8.45 Billion by 2032, Growing at a CAGR of 5.60 % From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.