🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Fibre Reinforced Plastic (FRP) Market

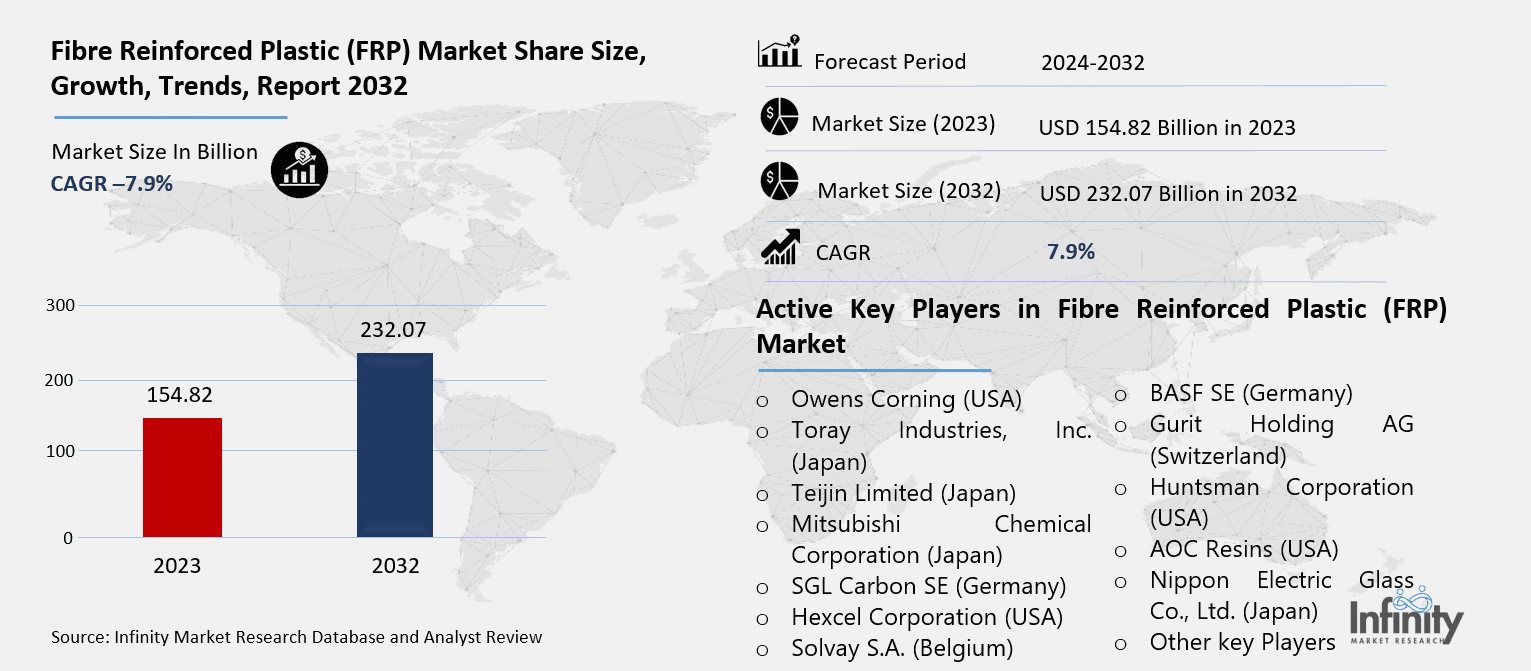

Fibre Reinforced Plastic (FRP) Market Global Industry Analysis and Forecast (2024-2032) By Type(Glass Fibre Reinforced Plastic (GFRP), Carbon Fibre Reinforced Plastic (CFRP), Aramid Fibre Reinforced Plastic (AFRP), Basalt Fibre Reinforced Plastic (BFRP)),By Resin Type(Polyester, Vinyl Ester, Epoxy, Polyurethane, Others),By Manufacturing Process(Hand Lay-Up, Spray Lay-Up, Filament Winding, Pultrusion, Compression Molding, Resin Transfer Molding (RTM), Injection Molding, Others),By End-Use Industry(Automotive & Transportation, Aerospace & Defense, Building & Construction, Electrical & Electronics, Marine, Renewable Energy (Wind Energy), Sporting Goods, Others) and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1834

Fibre Reinforced Plastic (FRP) Market Synopsis

Fibre Reinforced Plastic (FRP) Market Size Was Valued at USD 154.82 Billion in 2023, and is Projected to Reach USD 232.07 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.

Comprising a polymer matrix reinforced with glass, carbon, aramid, or basalt, Fibre Reinforced Plastic (FRP) is a composite material. Widely employed in sectors like aerospace, automotive, construction, and renewable energy, it is renowned for its great strength-to---weight ratio, corrosion resistance, and longevity. Often thermoset resins like epoxy, polyester, or vinyl ester, the polymer matrix ties the fibres together to give structural integrity and load-bearing capacity.

Because of its great mechanical qualities and adaptability, fiber reinforced plastic (FRP) has become rather popular in many different sectors. Increased acceptance of the material comes from its capacity to offer high tensile strength, lightweight composition, and resistance to environmental elements including moisture, corrosion, and compounds. Applications where conventional materials like steel and aluminum fall short of the necessary durability, efficiency, and cost-effectiveness call for FRP composites. The fast evolution of cutting-edge manufacturing technologies including automated fiber placement, pultrusion, and resin transfer molding has improved the production efficiency of FRP materials even further, thereby increasing their availability and customizing power for many uses.

Industries that need long-service life high-performance materials fuel the demand for FRP. In the aerospace industry, for example, Carbon Fiber Reinforced Plastic (CFRP) is used widely to lower aircraft weight, increase fuel economy, and strengthen structural integrity. In the automotive industry, too, the use of lightweight FRP composites improves fuel economy and reduces carbon emissions. Because Glass Fibre Reinforced Plastic (GFRP) has great strength and fatigue resistance, the renewable energy sector—especially wind energy—rely on it for producing wind turbine blades. Furthermore, FRP's importance in building is growing; uses for it range from structural beams to corrosion-resistant pipelines to bridge reinforcements.

The FRP market suffers problems including high production costs and recyclability concerns notwithstanding all the advantages. Especially in cost-sensitive businesses, the expense of raw materials—especially carbon and aramid fibers—remains a major obstacle to general adoption. Furthermore, the environmental effect of FRP waste disposal raises significant issues that drive more study on sustainable composite substitutes and recycling techniques. With continuing technical developments, government assistance, and industry cooperation, the market is likely to see constant expansion and increasing relevance in many different spheres all around.

Fibre Reinforced Plastic (FRP) Market Outlook, 2023 and 2032: Future Outlook

Fibre Reinforced Plastic (FRP) Market Trend Analysis

Trend: Growing Adoption of Sustainable and Recyclable FRP Composites

The FRP market is seeing a change toward environmentally friendly and recyclable composite materials as sustainability projects and environmental issues gather steam. Although their strength and durability are well-known, traditional FRP composites have difficulties being disposed of and recyclable. Manufacturers are concentrating on creating thermoplastic and bio-based composites that have better recyclability while also preserving mechanical qualities in order to solve this problem. Companies are also funding creative recycling techniques as solvolysis and pyrolysis, which let polymer resins and fibres be recovered for use in fresh projects.

The automotive and aerospace sectors, where authorities are enforcing rigorous waste management and carbon footprint reduction, clearly show the drive for sustainable FRP solutions. For car components, for instance, manufacturers are progressively using thermoplastic-based FRP to provide simpler end-of- life recycling. Analogous research on innovative composite formulas that lower environmental impact without sacrificing performance is being done by aerospace producers. Companies investing in green FRP technologies should get a competitive edge in the market as the demand for sustainable materials increases.

Opportunity: Expansion in Infrastructure and Construction Sector

Particularly in the building industry, the increasing demand for infrastructure development offers a major possibility for the FRP market. FRP materials are being increasingly used for bridge reinforcements, structural components, and corrosion-resistant applications in line with growing urbanization and demand for robust infrastructure. While FRP composites provide exceptional durability, low maintenance costs, and longer service life, traditional materials including steel and concrete are prone to degradation over time. In order to improve structural performance and lifetime, governments and commercial companies are progressively including FRP-based solutions into building projects.

Apart from bridges and constructions, FRP is increasingly being used in pipelines, subterranean utilities, maritime constructions. For demanding conditions, including coastal and offshore construction, FRP's lightweight character and corrosion resistance make it the perfect material. Moreover, developments in pre-fabrication and pultrusion technologies are simplifying the integration of FRP materials into building projects, therefore lowering installation time and project expenses generally. The FRP market is likely to gain greatly from its growing acceptance in this industry as infrastructure expenditures keep rising internationally.

Driver: Growing Demand from the Automotive Industry

Driven by the demand for lightweight and fuel-efficient automobiles, the automotive sector is among the main forces behind the FRP market. Advanced FRP composites—especially Glass Fibre Reinforced Plastic (GFRP) and Carbon Fibre Reinforced Plastic (CFRP)—are being used by automakers to light vehicles and increase general efficiency. Lighter vehicles run less fuel, which reduces carbon emissions and helps to comply with strict environmental laws. Through their exceptional crash resistance and impact absorption qualities, FRP materials also improve vehicle safety.

FRP components are being used by electric vehicle (EV) makers more and more to maximize battery range and vehicle performance. CFRP's lightweight qualities help to offset the extra weight of EV batteries, therefore enhancing energy economy and driving range. The automotive industry is likely to generate significant demand for FRP materials in the next years as the market for hybrid and electric cars keeps expanding.

Restraints: High Production and Raw Material Costs

The great expense of FRP materials still limits market expansion even with their benefits. Particularly expensive to manufacture, carbon and aramid fibers make CFRP and AFRP composites costly for mass-market uses. Further driving production costs are the complex manufacturing techniques, including resin infusion and autoclave curing, which call for specific tools and trained workers.

These cost considerations restrict the acceptance of FRP in price-sensitive sectors, where conventional materials as steel and aluminum remain the favored choice due of affordability. Although economies of scale and manufacturing methods are progressively lowering costs, price is still a major obstacle to general use particularly in underdeveloped countries.

Fibre Reinforced Plastic (FRP) Market Segment Analysis

Fibre Reinforced Plastic (FRP) Market Segmented on the basis of Type, Resin Type, Manufacturing Process and End User Industry .

By Type

o Glass Fibre Reinforced Plastic (GFRP)

o Carbon Fibre Reinforced Plastic (CFRP)

o Aramid Fibre Reinforced Plastic (AFRP)

o Basalt Fibre Reinforced Plastic (BFRP)

By End User

o Automotive & Transportation

o Aerospace & Defense

o Building & Construction

o Electrical & Electronics

o Marine

o Renewable Energy (Wind Energy)

o Sporting Goods

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Glass Fibre Reinforced Plastic (GFRP) segment is expected to dominate the market during the forecast period

Because of its low cost, great strength, and adaptability for many uses, glass fiber reinforced plastic (GFRP) rules the FRP industry. In the building, automotive, and wind energy sectors—where lightweight and corrosion resistance is absolutely vital—it is extensively applied. Although more costly, Carbon Fibre Reinforced Plastic (CFRP) is perfect for high-performance uses in aerospace and motorsports since it provides great strength and rigidity. Commonly utilized in ballistic protection and aerospace applications, A pyramid fiber reinforced plastic (AFRP) is well-known for its impact resistance and heat resistance. Because of its natural fibre content and great thermal resistance, basalt fibre reinforced plastic (BFRP) is becoming popular as a green substitute.

By End User Industry, Automotive & Transportation segment expected to held the largest share

Because they demand lightweight and high-strength components, the automobile and aerospace industries consume FRP materials most of all. Using FRP for bridges, pipelines, and corrosion-resistant construction, the building sector is another big end consumer. Specifically wind energy depends on FRP for making lightweight and robust turbine blades. FRP's great performance and durability help the sectors of marine, electrical, and athletic products as well.

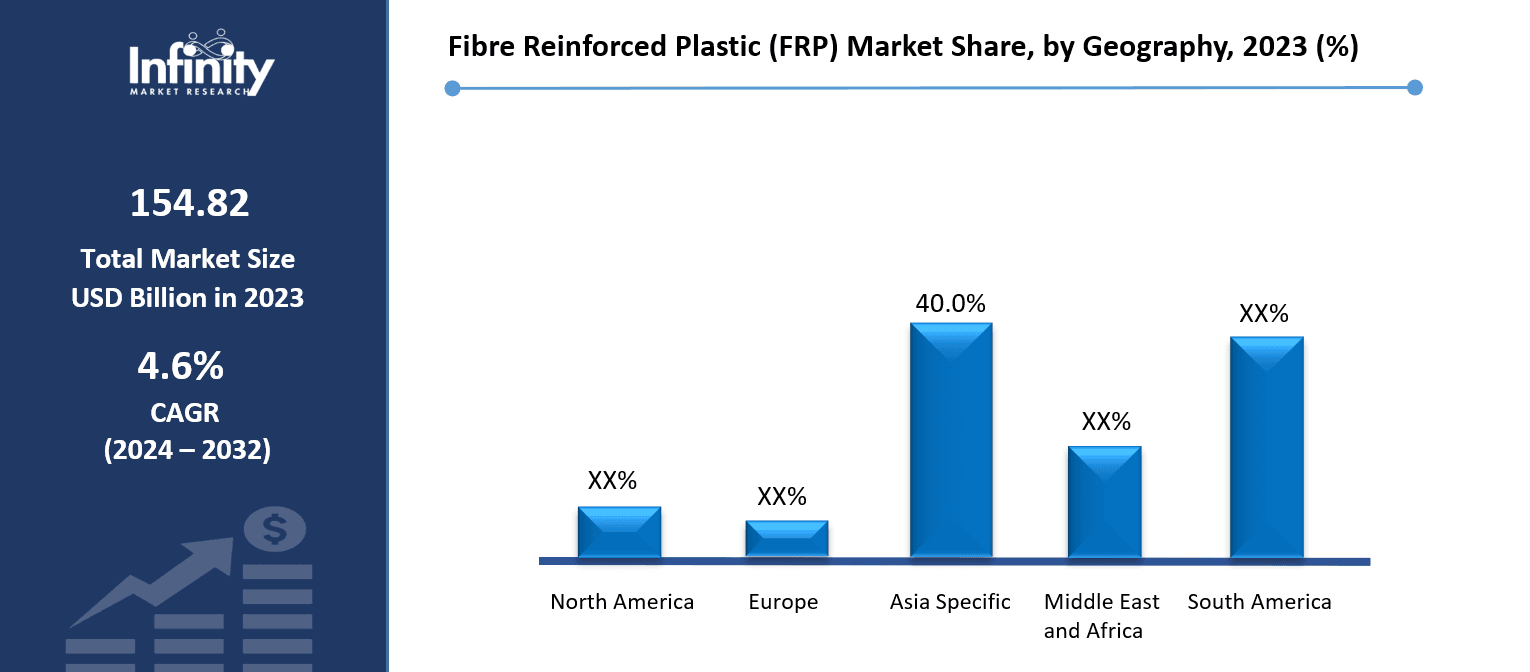

Fibre Reinforced Plastic (FRP) Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

Driven by its established automotive and aerospace sectors, North America rules the Fiber-Reinforced Polymer (FRP) market. Important producers in the area extensively spend in research and development to improve the performance of FRP materials, which makes them perfect for high-strength, lightweight uses. Because of its durability and corrosion resistance, big infrastructure projects including commercial buildings and bridges have further raised demand for FRP composites. Strong supply chains in the area and technological developments help to underline its leadership in the market.

Furthermore very important in determining the FRP industry are strict environmental rules applied in North America. Especially in the transportation industry, government measures encouraging fuel efficiency and carbon emission reduction have sped the acceptance of lightweight FRP materials. FRP is being used by automakers and aerospace industry more and more to increase structural efficiency and fuel economy. Moreover, the growing focus on recyclability and sustainability in materials science is encouraging creativity in the fabrication of FRP, so guaranteeing ongoing market expansion in the area.

Fibre Reinforced Plastic (FRP) Market Share, by Geography, 2023 (%)

Active Key Players in the Fibre Reinforced Plastic (FRP) Market

o Owens Corning (USA)

o Toray Industries, Inc. (Japan)

o Teijin Limited (Japan)

o Mitsubishi Chemical Corporation (Japan)

o SGL Carbon SE (Germany)

o Hexcel Corporation (USA)

o Solvay S.A. (Belgium)

o BASF SE (Germany)

o Gurit Holding AG (Switzerland)

o Huntsman Corporation (USA)

o AOC Resins (USA)

o Nippon Electric Glass Co., Ltd. (Japan)

o Other key Players

Key Industry Developments in the Fibre Reinforced Plastic (FRP) Market

· May 2023 – Avient Corporation expanded its production line for OnForce and Complēt long fiber reinforced thermoplastic composites in Asia Pacific. This new line will help the company meet the increasing demand related to composite materials.

Global Fibre Reinforced Plastic (FRP) Market Scope

|

Global Fibre Reinforced Plastic (FRP) Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 154.82 Billion |

|

Forecast Period 2024-32 CAGR: |

4.6% |

Market Size in 2032: |

USD 232.07 Billion |

|

Segments Covered: |

By Type |

· Glass Fibre Reinforced Plastic (GFRP) · Carbon Fibre Reinforced Plastic (CFRP) · Aramid Fibre Reinforced Plastic (AFRP) · Basalt Fibre Reinforced Plastic (BFRP) | |

|

By End User Industry |

· Automotive & Transportation · Aerospace & Defense · Building & Construction · Electrical & Electronics · Marine · Renewable Energy (Wind Energy) · Sporting Goods · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing Demand from the Automotive Industry | ||

|

Key Market Restraints: |

· High Production and Raw Material Costs | ||

|

Key Opportunities: |

· Expansion in Infrastructure and Construction Sector | ||

|

Companies Covered in the report: |

· Owens Corning (USA), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Corporation (Japan), SGL Carbon SE (Germany), Hexcel Corporation (USA), Solvay S.A. (Belgium), BASF SE (Germany), Gurit Holding AG (Switzerland) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Fibre Reinforced Plastic (FRP) Market research report?

Answer: The forecast period in the Fibre Reinforced Plastic (FRP) Market research report is 2024-2032.

2. Who are the key players in the Fibre Reinforced Plastic (FRP) Market?

Answer: Owens Corning (USA), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Corporation (Japan), SGL Carbon SE (Germany), Hexcel Corporation (USA), Solvay S.A. (Belgium), BASF SE (Germany), Gurit Holding AG (Switzerland) and Other Major Players.

3. What are the segments of the Fibre Reinforced Plastic (FRP) Market?

Answer: The Fibre Reinforced Plastic (FRP) Market is segmented into Type, Resin Type, Manufacturing Process, End User Industry and region. By Type, the market is categorized into Glass Fibre Reinforced Plastic (GFRP), Carbon Fibre Reinforced Plastic (CFRP), Aramid Fibre Reinforced Plastic (AFRP), Basalt Fibre Reinforced Plastic (BFRP).By Resin Type, the market is categorized into Polyester, Vinyl Ester, Epoxy, Polyurethane, Others.By Manufacturing Process, the market is categorized into Hand Lay-Up, Spray Lay-Up, Filament Winding, Pultrusion, Compression Molding, Resin Transfer Molding (RTM), Injection Molding, Others.By End-Use Industry, the market is categorized into Automotive & Transportation, Aerospace & Defense, Building & Construction, Electrical & Electronics, Marine, Renewable Energy (Wind Energy), Sporting Goods, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Fibre Reinforced Plastic (FRP) Market?

Answer: Comprising a polymer matrix reinforced with glass, carbon, aramid, or basalt, Fibre Reinforced Plastic (FRP) is a composite material. Widely employed in sectors like aerospace, automotive, construction, and renewable energy, it is renowned for its great strength-to---weight ratio, corrosion resistance, and longevity. Often thermoset resins like epoxy, polyester, or vinyl ester, the polymer matrix ties the fibres together to give structural integrity and load-bearing capacity.

5. How big is the Fibre Reinforced Plastic (FRP) Market?

Answer: Fibre Reinforced Plastic (FRP) Market Size Was Valued at USD 154.82 Billion in 2023, and is Projected to Reach USD 232.07 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.