🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Fluorite Market

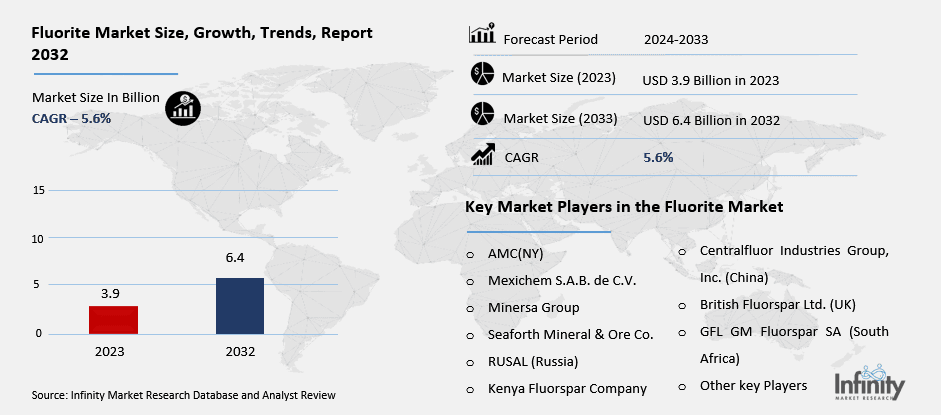

Fluorite Market Global Industry Analysis and Forecast (2024-2032) By Grade (Acid Grade, Ceramic Grade, Metallurgical Grade), By Application (Chemical Industry, Metallurgical Industry, Glass Industry, Others), By End-Use Industry ( Chemicals, Steel, Cement, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1541

Fluorite Market Synopsis

Fluorite Market Size Was Valued at USD 3.9 Billion in 2023, and is Projected to Reach USD 6.4 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

Fluorite, or more specifically known as fluorspar, is an important industrial mineral of calcium fluoride (CaF2). The distinctive ability to transmit light, the high purity and availability in many types assures NSPD its strategic position as an essential material in chemical, metallurgical and ceramics industries.

The market for fluorite is gradually maturing and gradually increasing due to its importance in industrial and commercial products. Fluorite is valuable in the chemical industry mainly as a source of hydrofluoric acid, a raw material for the synthesis of many chemicals among which are the refrigerants, medicines, and polymers. The metallurgical industry also uses large quantities of fluorite as a flux in the purification of metals during metallurgical refining. In addition, fluorite is also applied to prepare opalescent and special glasses which are part of decorative and utilitarian objects in the glass industry.

The new-generation buyers of fluorite are the emerging economies owing to increased industrialization and urbanization, from developing infrastructure, vehicles, and consumer durables. These activities in turn stimulate fluorite demand in steel making, aluminum refining and other metallurgical applications. However, factors like the environmental issue around mining as well as the volatility of raw material prices presents constraints to this market. However, increased awareness and technological innovation in the mining and processing of fluorite leads to cost control and enhanced quality hence the market’s sustainable development.

Fluorite Market Outlook, 2023 and 2032: Future Outlook

Fluorite Market Trend Analysis

Trend: Rising Demand in Green Refrigerants

The global shift towards environmentally sustainable solutions has sparked a significant trend in the fluorite market: the increasing call for green refrigerants. In recent years, as most international regulatory agencies continue to set demanding standards for the removal of ODS and HFCs, HFOs and other green refrigerants have emerged. These refrigerants use hydrofluoric acid obtained from acid-grade fluorite indicating its significance.

It is worth mentioning that the trends observed in the report are especially visible in the EU and North America with a sound environmental legislative basis. Manufacturers will concentrate on improving the production capacity of fluorite in order to meet the demand of environment friendly refrigerants that is expected to emerge from the ban on the conventional chemicals. Therefore, the use of environmentally friendly refrigerants dovetails with the global drive toward anti climatic change initiative and energy efficient cooling systems adding more demand for high purity fluorite.

Opportunity: Expansion in Emerging Economies

Flourite market’s growth prospects are high especially from the emerging economies of Asia-Pacific region. Urban and industrial expansions related to populous countries like the Chinese, Indians and the South Asian nations steadily boost demand in steel, aluminum and glasses industries mainly use fluorite. The construction processes as well as the automotive industries escalating in the global market will continue to enhance the demand for the metallurgical and ceramic-grade fluorite.

Also, the measures undertaken by governments across the world to support domestic manufacturing companies and enhancing infrastructure have been helpful across the market. Fluorite producing economies are expanding thereby improving their fluorite production through fundatments of mining projects as well as partnerships with international suppliers. Besides satisfying the internal market, this expansion also makes these regions important exporters in the export market.

Driver: Growing Demand in the Chemical Industry

The demand for fluorite in the chemical industry coupled with the rise of the industry’s uses for fluorite as a material are also prominent factors. Acid-grade fluorite is used almost exclusively in the production of hydrofluoric acid, which in turn is used to produce diverse compounds including fluoropolymers, agrochemicals and pharmaceuticals. The increasing market for these downstream products on its own is pushing the demand for high-purity fluorite.

The demand in fluorite is also being boosted by the trends towards the usage of innovative substances in electronics, including in renewable energy, as well as in specialty chemicals. For example, uses fluorine-based compounds in the manufacture of lithium-ion batteries and photovoltaic cells used in electric vehicles and solar energy systems, respectively thereby meaning that fluorite is critical to renewable energy sources.

Restraints: Environmental Concerns and Mining Regulations

Fluorite market has major threats in the form of environmental issues and legal restrictions on mining activities. Opinions of environmental non-governmental organizations and groups of concerned people have often been that mining, especially the extraction of fluorite, brings with it the likely hood of deforestation, soil degradation and water pollution. These concerns have led to the enactment of sharp effective environmental policies enveloping mining and enhanced compliance expenses for the mining industries.

For another thing, the high grade fluorite reserves remain erratic an element which complicates the market further. Executives have sought to apply sustainable mining systems and consider new resources to address concerns on environmental degradation. Still, this implies significant expenditures, which have a negative impact on the smaller participants and the generally restrained development of the market.

Fluorite Market Segment Analysis

Fluorite Market Segmented on the basis of grade, application and end user.

By Type

o Acid Grade

o Ceramic Grade

o Metallurgical Grade

By Application

o Chemical Industry

o Metallurgical Industry

o Glass Industry

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Grade, Acid Grade segment is expected to dominate the market during the forecast period

According to the application, the market can be broadly categorized in to acid grade fluorite, ceramic grade fluorite, and metallurgical grade fluorite. Acid-grade fluorite remains the largest product on the market thanks to the fundamental application of fluorite in the production of hydrofluoric acid in the chemical industry. This grade needs high purity and is therefore the highest demand of this product especially in the developed nations because they have the enhanced chemical industries.

Ceramic-grade and metallurgical-grade fluorite, although of less importance compared to other types, are very significant in their respective areas of usage. Ceramic grade fluorite is applied to the production of enamel and ornamental glasses while metallurgical grade fluorite acts as a flux in steel making and aluminum. These grades have high demand correlation to the growth of these industries, thus counterbalancing the distribution across the market.

By Application, Chemical Industry segment expected to held the largest share

Current uses for Fluorite include in chemical, metallurgical, and glass industries, as well as others. The chemical industry is still the largest market for fluorite as this material is used for the preparation of hydrofluoric acid that is used in further products. The metallurgical industry uses fluorite mainly in order to enhance the ability to make refined metals especially steel and aluminum.

In glass industry, fluorite is used to produce special kind of glasses which possess special optical characteristics. Other uses are in cement, ceramics and as an ornamental stone for gem purposes. Fluorite being used in a wide variety of sectors greatly contributes to demand sustainability, and therefore is good for the market.

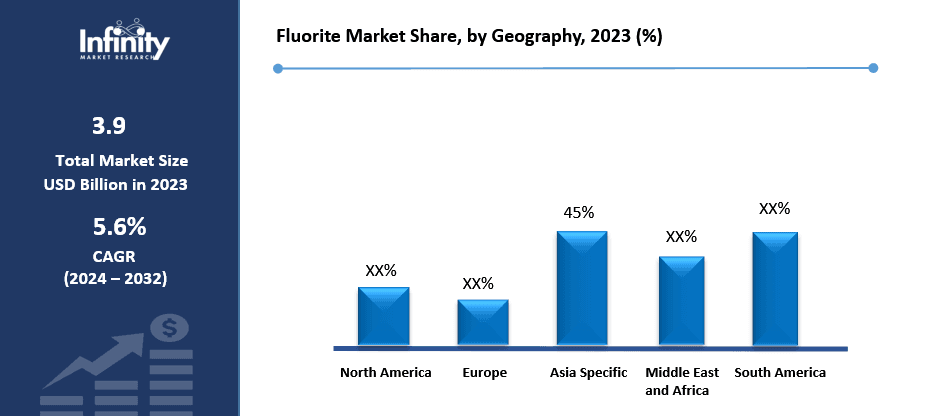

Fluorite Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia-Pacific region becomes the most influential segment of the fluorite market because of the large production and consumption, especially in China and India. China is the largest producer and exporter of fluorite and its position determines the position of the world market. Fluorite exporters continue to meet the increasing demand for fluorite in steel and metallurgy, aluminium, chemicals and other industries due to the industrialisation, urbanisation and expansion of infrastructure the region.

Besides, Asia-Pacific has policies and investments on mining projects making the market more secure and strong. He admitted that the region will remain the leader in terms of production because of lower costs of production, large reserves and increasing industrialization.

Fluorite Market Share, by Geography, 2023 (%)

Active Key Players in the Fluorite Market

o AMC(NY)

o Mexichem S.A.B. de C.V.

o Minersa Group

o Seaforth Mineral & Ore Co. (USA)

o RUSAL (Russia)

o Kenya Fluorspar Company (Kenya)

o Centralfluor Industries Group, Inc. (China)

o British Fluorspar Ltd. (UK)

o GFL GM Fluorspar SA (South Africa)

o Other key Players

Global Fluorite Market Scope

|

Global Fluorite Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.9 Billion |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 6.4 Billion |

|

Segments Covered: |

By Grade |

· Acid Grade · Ceramic Grade · Metallurgical Grade | |

|

By Application |

· Chemical Industry · Metallurgical Industry · Glass Industry · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing Demand in the Chemical Industry | ||

|

Key Market Restraints: |

· Environmental Concerns and Mining Regulations | ||

|

Key Opportunities: |

· Expansion in Emerging Economies | ||

|

Companies Covered in the report: |

· AMC(NY) , China Kings Resources Group Co., Ltd. (China), Mexichem S.A.B. de C.V. (Mexico), Zhejiang Sanmei Chemica Industry Co., Ltd. (China), Mongolrostsvetmet LLC (Mongolia), Minersa Group (Spain),Masan Resources Corporation (Vietnam), Seaforth Mineral & Ore Co. (USA), RUSAL (Russia), and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Fluorite Market research report?

Answer: The forecast period in the Fluorite Market research report is 2024-2032.

2. Who are the key players in the Fluorite Market?

Answer: AMC(NY) , China Kings Resources Group Co., Ltd. (China), Mexichem S.A.B. de C.V. (Mexico), Zhejiang Sanmei Chemica Industry Co., Ltd. (China), Mongolrostsvetmet LLC (Mongolia), Minersa Group (Spain),Masan Resources Corporation (Vietnam), Seaforth Mineral & Ore Co. (USA), RUSAL (Russia), and Other Major Players.

3. What are the segments of the Fluorite Market?

Answer: The Fluorite Market is segmented into Grade, Application, End User and region. By Grade, the market is categorized into Acid Grade, Ceramic Grade, Metallurgical Grade. By Application, the market is categorized into Chemical Industry, Metallurgical Industry, Glass Industry, Others. By End-Use Industry, the market is categorized into Chemicals, Steel, Cement, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Fluorite Market?

Answer: Fluorite, or more specifically known as fluorspar, is an important industrial mineral of calcium fluoride (CaF2). The distinctive ability to transmit light, the high purity and availability in many types assures NSPD its strategic position as an essential material in chemical, metallurgical and ceramics industries.

5. How big is the Fluorite Market?

Answer: Fluorite Market Size Was Valued at USD 3.9 Billion in 2023, and is Projected to Reach USD 6.4 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.