🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Fluorochemicals Market

Fluorochemicals Market (By Product (Fluorocarbon, Fluoropolymer, Specialty & Inorganic, Other Types), By Application (Refrigerant, Aluminium Production, Blowing Agent, Surfactant, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 202

ID: IMR1143

Fluorochemicals Market Overview

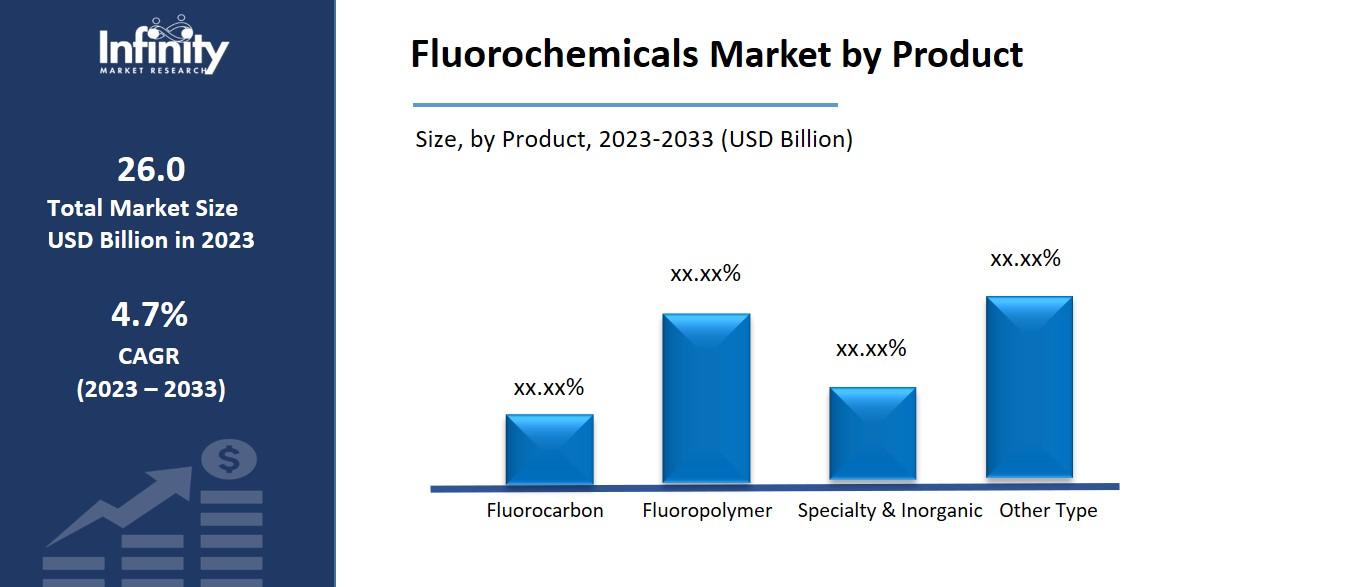

Global Fluorochemicals Market size is expected to be worth around USD 43.2 Billion by 2033 from USD 26.0 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2023 to 2033.

The Fluorochemicals Market includes chemicals made from fluorine; a type of element found in nature. These chemicals are used in various industries like refrigerants, coatings, and pharmaceuticals. Fluorochemicals are known for their ability to resist heat, chemicals, and electricity, making them useful in products that need these properties. For example, they're used in air conditioners to keep things cool and in non-stick coatings to make cooking easier.

In recent years, the Fluorochemicals Market has grown because of increased demand in industries like electronics and automotive. This growth is driven by the need for more efficient and environmentally friendly products. Companies are also developing new types of fluorochemicals that are safer and more effective, which is expected to continue driving the market forward.

Drivers for the Fluorochemicals Market

Rising Need for Fire Safety and Chemical Resistance

There is a rising need for fire safety and chemical resistance solutions across industries, which is driving the demand for fluorochemicals. Fluoropolymers, a type of fluorochemical, are known for their exceptional resistance to heat, chemicals, and corrosion. They are used in manufacturing fire extinguishing agents, protective coatings for electronic components, and chemical-resistant linings for industrial equipment. The ability of fluorochemicals to withstand extreme conditions while maintaining their integrity and performance makes them indispensable in applications where safety and reliability are paramount.

Growing Demand for Fluoropolymers in Electronics and Automotive Industries

The electronics and automotive industries are significant drivers of the Fluorochemicals Market, particularly in the demand for fluoropolymers. Fluoropolymers, such as polytetrafluoroethylene (PTFE) and fluorinated ethylene propylene (FEP), are widely used in the production of cables, semiconductors, automotive parts, and coatings due to their electrical insulation properties, low friction coefficient, and resistance to chemicals and temperature extremes. The increasing adoption of electronic devices and electric vehicles further fuels the demand for fluorochemicals to enhance performance and reliability in these advanced applications.

Expanding Applications in Healthcare and Pharmaceuticals

Fluorochemicals find expanding applications in the healthcare and pharmaceutical industries, driven by their biocompatibility and inertness. Fluorinated gases and compounds are used in medical imaging technologies like magnetic resonance imaging (MRI) and positron emission tomography (PET) scans for their ability to enhance image clarity and reduce patient exposure to radiation. Fluoropolymers are also used in medical devices, such as catheters and implants, for their non-stick properties and compatibility with biological fluids, contributing to improved patient outcomes and healthcare safety.

Regulatory Support and Environmental Regulations

Regulatory support and environmental regulations play a crucial role in driving the Fluorochemicals Market towards sustainable practices. International agreements, such as the Montreal Protocol and the Kyoto Protocol, regulate the production and use of fluorinated gases to mitigate their impact on climate change and ozone depletion. Manufacturers are investing in research and development to develop eco-friendly alternatives and improve the environmental footprint of fluorochemicals. Regulatory compliance and adoption of green technologies are becoming increasingly important factors shaping the market dynamics and driving innovation in fluorochemical applications.

Technological Advancements and Innovation

Technological advancements and ongoing innovation in fluorochemical formulations are driving market growth. Research efforts are focused on developing next-generation fluorochemicals with improved performance characteristics, such as lower global warming potential (GWP), enhanced efficiency, and reduced environmental impact. Advanced manufacturing techniques and materials science innovations are enabling manufacturers to meet evolving customer demands for safer, more sustainable, and higher-performing fluorochemical products. These advancements are expanding the scope of fluorochemical applications across industries and opening new opportunities for market expansion.

Restraints for the Fluorochemicals Market

Environmental Concerns and Public Awareness

Environmental concerns and increasing public awareness about the negative impacts of fluorochemicals on the environment and human health pose significant restraints on the market. Fluorinated gases, such as hydrofluorocarbons (HFCs), are potent greenhouse gases with high global warming potentials (GWPs) when released into the atmosphere. These gases contribute to climate change and ozone depletion, prompting regulatory agencies and environmental advocacy groups to advocate for stricter controls and phase-outs of certain fluorochemicals. Public perception and consumer preferences are shifting towards sustainable and eco-friendly alternatives, pressuring manufacturers to innovate and transition towards greener technologies and products.

High Costs of Development and Compliance

The high costs associated with the development, testing, and regulatory compliance of fluorochemical products present significant barriers to entry and expansion in the market. Manufacturers must invest in advanced technologies and R&D efforts to improve the environmental profile of fluorochemicals and meet evolving regulatory standards. Additionally, obtaining regulatory approvals and certifications for new fluorochemical formulations and applications involves extensive documentation, testing, and validation processes, which can be time-consuming and expensive. These high upfront costs deter smaller companies from entering the market and limit the ability of existing players to introduce new products quickly.

Health and Safety Concerns

Health and safety concerns associated with certain fluorochemicals pose challenges to market growth. Fluorinated compounds, such as per- and polyfluoroalkyl substances (PFAS), are persistent in the environment and can bioaccumulate in organisms, potentially posing risks to human health and ecosystems. Occupational exposure to fluorochemicals during manufacturing processes or through improper handling can also pose health risks to workers. As a result, regulatory agencies and industry stakeholders are increasingly focused on assessing the toxicity and long-term health impacts of fluorochemicals, leading to stricter regulations and risk management measures.

Competitive Pressure and Market Saturation

Competitive pressure and market saturation within the fluorochemicals industry present challenges for manufacturers and suppliers. The market is dominated by a few multinational companies with established product portfolios and extensive distribution networks. Intense competition among these players leads to price wars, margin pressures, and aggressive marketing strategies to maintain market share. Additionally, the availability of substitute materials and technologies, such as natural refrigerants and alternative coatings, further intensifies competition and limits the growth potential for traditional fluorochemical products.

Opportunity in the Fluorochemicals Market

Expansion of Automotive and Aerospace Applications

The automotive and aerospace industries offer promising opportunities for fluorochemicals, particularly in the development of lightweight materials, advanced coatings, and high-performance lubricants. Fluoropolymers, such as polytetrafluoroethylene (PTFE) and fluorinated elastomers, are increasingly used in automotive components, such as seals, gaskets, and hoses, due to their durability, chemical resistance, and low friction properties. In aerospace applications, fluorochemicals are utilized in aircraft manufacturing for their ability to withstand extreme temperatures, and corrosive environments, and reduce fuel consumption through improved aerodynamics and engine efficiency. The expansion of these industries globally presents opportunities for fluorochemical manufacturers to innovate and supply specialized materials that enhance performance and sustainability.

Rising Demand in Electronics and Semiconductor Manufacturing

The electronics and semiconductor industries represent a growing market opportunity for fluorochemicals, driven by the increasing demand for high-performance materials and components. Fluorinated gases, such as sulfur hexafluoride (SF6), are used in semiconductor manufacturing processes for their superior dielectric properties and ability to insulate electrical equipment. Fluoropolymers are also integral in electronic applications for their thermal stability, chemical resistance, and non-stick properties, contributing to the reliability and longevity of electronic devices. As technological advancements in electronics continue to evolve, there is a heightened demand for fluorochemicals that enable miniaturization, enhance reliability, and support the development of next-generation electronic products.

Emerging Opportunities in Healthcare and Pharmaceuticals

Fluorochemicals offer emerging opportunities in the healthcare and pharmaceutical sectors due to their biocompatibility, inertness, and unique chemical properties. Fluorinated gases are utilized in medical imaging technologies, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans, to improve diagnostic accuracy and patient outcomes. Fluoropolymers are also employed in medical devices and drug delivery systems for their non-stick surfaces, biocompatibility, and resistance to biological fluids. With increasing investments in healthcare infrastructure and advancements in medical technology, there is a growing demand for fluorochemicals that support innovation in diagnostics, treatment, and patient care.

Advancements in Renewable Energy and Energy Storage

Advancements in renewable energy technologies and energy storage systems present new opportunities for fluorochemicals in applications such as solar panels, batteries, and fuel cells. Fluorinated materials are utilized in photovoltaic modules to improve light transmission, increase efficiency, and enhance durability against environmental factors. In energy storage, fluorinated electrolytes and membranes are employed to enhance the performance and longevity of lithium-ion batteries and fuel cells, supporting the transition towards cleaner and more sustainable energy solutions. As governments and industries prioritize renewable energy initiatives, there is a growing market opportunity for fluorochemicals that enable efficient energy generation, storage, and utilization.

Trends for the Fluorochemicals Market

Rise of Green Chemistry and Bio-based Fluorochemicals

The rise of green chemistry and bio-based fluorochemicals is another significant trend in the market. Green chemistry principles promote the design and development of chemical products and processes that minimize environmental impact and enhance sustainability. Bio-based fluorochemicals derived from renewable sources, such as plant-based feedstocks or bio-waste, are gaining traction as viable alternatives to petroleum-based fluorochemicals. These bio-based materials offer potential benefits, including reduced carbon footprint, improved biodegradability, and lower toxicity profiles compared to conventional fluorochemicals. As advancements in biochemistry and biotechnology continue to evolve, the market for bio-based fluorochemicals is expected to expand, driven by consumer demand for environmentally friendly products and regulatory incentives supporting sustainable innovations.

Technological Advancements in Fluoropolymer Applications

Technological advancements in fluoropolymer applications are driving innovation and market growth in the Fluorochemicals Market. Fluoropolymers, such as polytetrafluoroethylene (PTFE) and perfluoroalkoxy alkane (PFA), are valued for their exceptional properties, including high thermal stability, chemical resistance, low friction coefficient, and non-stick characteristics. Recent technological advancements have led to the development of advanced fluoropolymer formulations tailored for specific industrial applications, such as automotive, electronics, and coatings. These advancements enable manufacturers to meet evolving customer demands for high-performance materials that enhance product reliability, durability, and efficiency in harsh operating environments.

Increasing Demand in Emerging Economies

There is an increasing demand for fluorochemicals in emerging economies, driven by rapid industrialization, urbanization, and infrastructure development. Emerging markets in Asia-Pacific, Latin America, and Africa are witnessing growing investments in construction, automotive manufacturing, electronics production, and consumer goods industries, all of which contribute to the demand for fluorochemical products. Rising disposable incomes, expanding middle-class populations, and government initiatives to improve infrastructure and living standards further stimulate market growth in these regions. Manufacturers are leveraging these opportunities by expanding their production capacities, establishing local partnerships, and tailoring product offerings to meet the specific needs and preferences of emerging market consumers.

Integration of Fluorochemicals in Advanced Manufacturing Processes

The integration of fluorochemicals in advanced manufacturing processes is a trend shaping the market landscape. Fluorinated gases, such as sulfur hexafluoride (SF6), are essential in semiconductor manufacturing for their unique electrical insulation properties and critical role in etching and cleaning processes. Fluoropolymers are increasingly used in additive manufacturing (3D printing) for their compatibility with diverse materials and ability to create complex geometries with high precision. The adoption of fluorochemicals in advanced manufacturing technologies supports innovation, efficiency, and scalability in production processes across various industries, driving market demand for specialized fluorochemical applications.

Focus on Product Differentiation and Customization

There is a growing focus on product differentiation and customization in the Fluorochemicals Market as manufacturers seek to meet diverse customer requirements and gain competitive advantage. Companies are investing in research and development to create tailored fluorochemical solutions that address specific industry challenges, improve product performance, and enhance operational efficiencies. Customized formulations of fluorochemicals, such as blends, dispersions, and functional additives, enable manufacturers to offer unique value propositions and capture niche market segments. This trend toward product innovation and customization underscores the dynamic nature of the fluorochemicals industry and its capacity for continual growth and adaptation to changing market demands.

Segments Covered in the Report

By Product

o Fluorocarbon

o Fluoropolymer

o Specialty & Inorganic

o Other Type

By Application

o Refrigerant

o Aluminium Production

o Blowing Agent

o Surfactant

o Other Applications

Segment Analysis

By Type Analysis

The fluorochemicals market is divided into four segments based on product: specialty & inorganic, fluoropolymer, fluorocarbon, and others. In terms of revenue, the fluorocarbon segment dominated the market in 2023, accounting for over 64.7% of the total share. Due to stringent regulations in the US and Canada aimed at phase-out of CFC and HCFC compounds, fluorocarbon is expected to lose market share to replacements made of polymers and inorganic compounds.

Over the projected period, fluoropolymers are anticipated to increase at a notable rate, with a volume compound annual growth rate of 9.6%. Due to characteristics including high tensile strength and electrical insulation, there will likely be a growing need for fluoropolymers in the electronics, automotive, and construction sectors, which will propel segment expansion throughout the projected period.

By Application Analysis

The fluorochemicals market is divided into several segments based on their applications, including refrigerant, aluminum production, blowing agents, surfactants, and others. The refrigerant sector dominated the market in 2023, accounting for over 54.7% of total revenue. The market is expected to increase as a result of the increasing installation of HVAC systems in automobiles and the growing significance of clean air systems in manufacturing.

Fluorochemicals are used to make the refrigerants HFCs, CFCs, and HCFCs that are sold. Additionally, they find extensive use in the refrigeration sector in areas such as HVAC, defrost systems, self-chilling beverage cans, and refrigerated equipment.

Regional Analysis

In 2023, the North American Fluorochemicals Market held a 44.9% share of the market. North America boasts an established industrial infrastructure that includes resources for research and development, modern manufacturing facilities, and a thriving chemical sector. With a robust supply chain and a lengthy history of producing fluorochemicals, the area has a competitive edge over other players in the industry. Furthermore, the market for fluorochemicals in the United States had the most market share, while the market for armor materials in Canada had the quickest rate of growth in the North American area.

The market share of fluorochemicals in Europe is the second greatest. To reduce greenhouse gas emissions and protect the environment, Europe has been at the forefront of enacting stringent environmental laws and policies. The F-Gas Regulation, which controls the use and emissions of fluorinated gases, including fluorochemicals, has been vigorously supported by the European Union (EU). The adoption of greener substitutes and the demand for fluorochemicals in the local market have both been impacted by these laws. In addition, the European region's fastest-growing market for fluorochemicals was the UK, while Germany had the biggest market share.

Competitive Analysis

Prominent industry participants are making significant R&D investments to broaden their product offerings, hence contributing to the further expansion of the Fluorochemicals market. To increase their market share, market players are also engaging in a range of calculated strategic actions. Notable developments in this regard include the introduction of new products, contracts, mergers and acquisitions, increased investment, and cooperation with other businesses. The Fluorochemicals sector needs to provide affordable products to grow and thrive in an increasingly competitive and developing market environment.

Recent Developments

In April 2019: Chemours partnered with UET to address the challenge of storing renewable energy as the use of fluoropolymers in the production and storage of renewable energy grows.

In 2021: The Kynar PVDF (polyvinylidene fluoride) line from Arkema is introduced. All of the carbon in the new grades is renewable and comes from bio-feedstock generated from crude tall oil.

Key Market Players in the Fluorochemicals Market

o Daikin Chemicals

o SRF Limited

o 3M

o Gujarat Fluorochemicals Limited

o The Chemours Company

o Solvay

o Arkema SA

o DIC Corporation

o Alufluor AB

o Halocarbon Products Corporation

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 26.0 Billion |

|

Market Size 2033 |

USD 43.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Daikin Chemicals, SRF Limited, 3M, Gujarat Fluorochemicals Limited, The Chemours Company, Solvay, Arkema SA, DIC Corporation, Alufluor AB, Halocarbon Products Corporation, Other Key Players |

|

Key Market Opportunities |

Expansion of Automotive and Aerospace Applications |

|

Key Market Dynamics |

Growing Demand for Fluoropolymers in Electronics and Automotive Industries |

📘 Frequently Asked Questions

1. Who are the key players in the Fluorochemicals Market?

Answer: Daikin Chemicals, SRF Limited, 3M, Gujarat Fluorochemicals Limited, The Chemours Company, Solvay, Arkema SA, DIC Corporation, Alufluor AB, Halocarbon Products Corporation, Other Key Players

2. How much is the Fluorochemicals Market in 2023?

Answer: The Fluorochemicals Market size was valued at USD 26.0 Billion in 2023.

3. What would be the forecast period in the Fluorochemicals Market?

Answer: The forecast period in the Fluorochemicals Market report is 2023-2033.

4. What is the growth rate of the Fluorochemicals Market?

Answer: Fluorochemicals Market is growing at a CAGR of 4.7% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.