🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Fluorspar Market

Fluorspar Market (By Grade (Acidspar, Metspar, Ceramic Grade, Optical Grade, Lapidary Grade), By Variety (Antozonite, Blue John, Chlorophane, Yttrocerite, Yttrofluorite, Others), By Forms (Powder, Lump, Filter Cake), By Application (Aluminum Production, Steel Production, Hydrofluoric Acid, Concrete Additives, Lithium-Ion Battery, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 160

ID: IMR1122

Fluorspar Market Overview

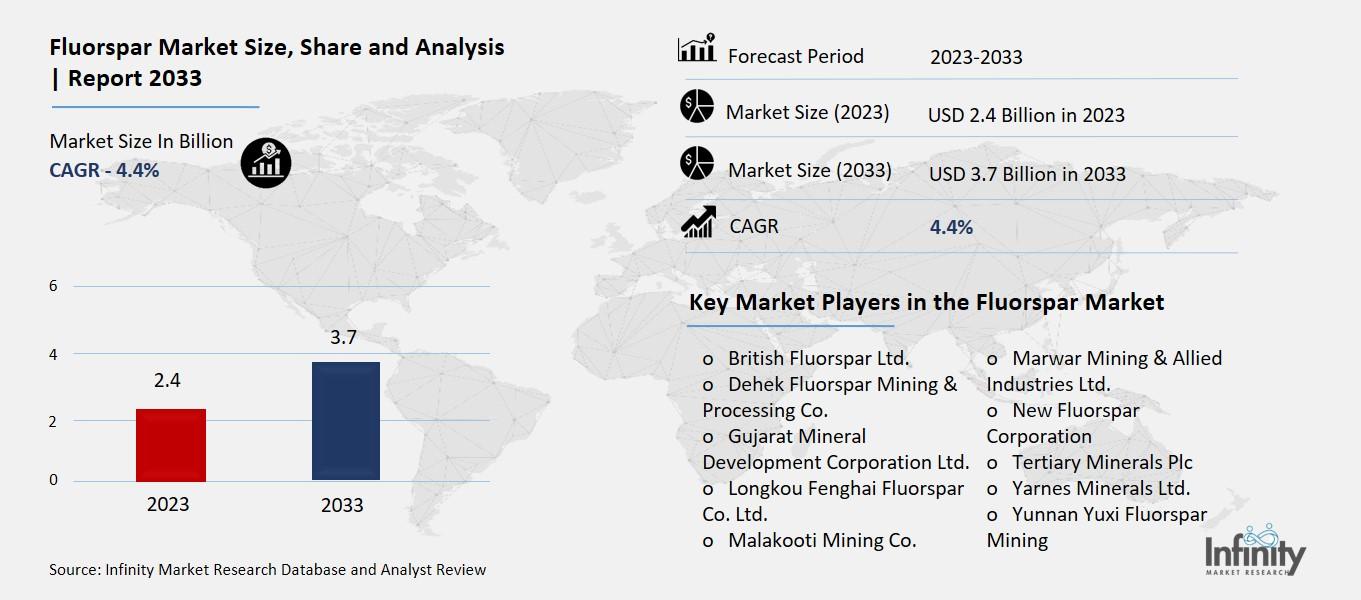

Global Fluorspar Market size is expected to be worth around USD 3.7 Billion by 2033 from USD 2.4 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2023 to 2033.

The Fluorspar Market is about the mining and selling of a mineral called fluorspar, also known as fluorite. This mineral is used in various industries, mainly because it contains fluoride, which is a key ingredient in many chemical processes. Fluorspar is used to make products like aluminum, steel, and hydrofluoric acid, which are essential in manufacturing and chemical industries.

Fluorspar comes in different grades, each suited for specific uses. The highest quality, acid-grade fluorspar, is used in the chemical industry to make hydrofluoric acid, while the lower grades are used in making glass, ceramics, and even as a flux in steel production. The demand for fluorspar is growing because it's critical for industrial processes, and as industries expand, the need for this versatile mineral increases.

Drivers for the Fluorspar Market

Increasing Steel and Aluminum Production

One of the primary drivers for the fluorspar market is the rising demand for steel and aluminum. Fluorspar plays a crucial role in the metallurgical industry, particularly in the production of steel and aluminum. It helps in removing impurities from molten metal, leading to better quality and durability. The global increase in construction activities and infrastructure development boosts the need for high-quality steel and aluminum, subsequently driving the demand for fluorspar. As countries continue to invest in large-scale infrastructure projects, this demand is expected to rise consistently.

Growing Demand for Hydrofluoric Acid

Another significant driver is the growing demand for hydrofluoric acid, which is derived from fluorspar. Hydrofluoric acid is essential in the production of various chemicals and products, including refrigerants, pharmaceuticals, and fluoropolymers. The rise in industrial applications and the expanding pharmaceutical and chemical industries are increasing the need for hydrofluoric acid. This, in turn, spurs the demand for fluorspar, as it is a critical raw material in its production. The expanding market for air conditioning and refrigeration, particularly in developing regions, further contributes to this growth.

Expansion of the Automotive Industry

The automotive industry's expansion, especially in developing regions, significantly impacts the fluorspar market. Fluorspar is used in the manufacturing of aluminum, which is crucial for producing lightweight and fuel-efficient vehicles. As the automotive industry focuses more on reducing vehicle weight to improve fuel efficiency and reduce emissions, the demand for aluminum and, consequently, fluorspar, is increasing. The push towards electric vehicles (EVs) also drives this demand, as EV manufacturers look for materials that offer both strength and lightweight properties.

Technological Advancements in Fluorspar Processing

Technological advancements in fluorspar processing have made it more efficient and cost-effective, thereby driving market growth. Innovations in mining and refining processes have reduced production costs and improved the quality of fluorspar. These advancements allow producers to meet the high-quality standards required by industries such as chemicals, metallurgy, and ceramics. Improved efficiency in extraction and processing also helps in reducing the environmental impact, making it more sustainable and appealing to environmentally-conscious companies.

Increasing Applications in Other Industries

Beyond metallurgy and chemicals, fluorspar finds applications in various other industries, including ceramics, optics, and lapidary. Its unique properties make it valuable in producing high-quality glass, enamel, and other ceramic products. The growth of these industries, particularly in regions like Asia-Pacific, where manufacturing sectors are expanding, contributes to the increased demand for fluorspar. Additionally, fluorspar's use in high-end optical lenses and gemstones adds niche but significant demand, driven by advancements in technology and consumer preferences for high-quality products.

Government Support and Policies

Supportive government policies and initiatives also play a crucial role in driving the fluorspar market. Many governments are encouraging domestic mining and processing of minerals, including fluorspar, to reduce dependence on imports and boost local industries. Policies that promote sustainable mining practices and provide incentives for technological advancements in mineral processing help stimulate the market. Furthermore, the strategic importance of fluorspar in various industrial applications ensures continued government interest and support in its production and development.

Restraints for the Fluorspar Market

Environmental Concerns

One of the main restraints for the fluorspar market is environmental regulations. The extraction and processing of fluorspar can lead to significant environmental degradation. This includes issues like habitat destruction, water contamination, and dust emissions, which have prompted many countries to impose strict regulations on mining activities. For example, China, a major producer of fluorspar, has implemented stringent environmental policies that have reduced the number of active mining sites, thus impacting the global supply of fluorspar.

Supply Chain Disruptions

Another significant restraint is the disruption in the supply chain. Fluorspar mining and production are concentrated in a few regions, making the market vulnerable to geopolitical issues, trade restrictions, and logistical challenges. For instance, any political instability or trade disputes in key producing countries like China or Mexico can lead to supply shortages, affecting the availability and prices of fluorspar globally. These disruptions can hinder the steady supply of fluorspar required for various industrial applications.

High Production Costs

The high cost of production is another challenge for the fluorspar market. Mining and processing fluorspar require significant investment in technology and infrastructure. Additionally, the costs associated with meeting environmental regulations and ensuring worker safety further increase the overall production expenses. These high costs can deter new entrants and limit the expansion of existing players in the market, thereby restraining market growth.

Competition from Substitutes

Fluorspar faces competition from substitute materials, which is another restraint. For instance, in some applications, alternatives like synthetic cryolite and aluminum fluoride can be used instead of fluorspar. These substitutes can sometimes be more cost-effective or offer better performance, leading industries to opt for them over fluorspar. This competition can reduce the demand for fluorspar, impacting its market growth.

Fluctuating Market Demand

The demand for fluorspar is also subject to fluctuations based on the performance of end-use industries such as steel and aluminum production. Any downturn in these industries can lead to a reduced demand for fluorspar. For example, during economic recessions, the construction and automotive sectors often slow down, leading to lower steel production and, consequently, a decreased need for fluorspar. This cyclical demand can create uncertainties and volatility in the fluorspar market.

Opportunity in the Fluorspar Market

Growing Demand in Steel and Aluminum Industries

The fluorspar market is experiencing significant growth due to the rising demand in the steel and aluminum industries. Fluorspar is essential in producing these metals, as it enhances their quality by improving fluidity and reducing impurities. This is particularly important in emerging economies where infrastructure development and industrialization are rapidly advancing. The need for high-quality metals in the construction and manufacturing sectors is driving the demand for fluorspar, creating ample opportunities for market expansion.

Expansion in the Chemical Industry

The chemical industry presents a substantial opportunity for the fluorspar market. Fluorspar is a critical raw material for producing hydrofluoric acid, which is used in various applications such as refrigerants, polymers, and pharmaceuticals. The growing demand for these products, driven by advancements in technology and increasing consumer needs, is expected to boost the demand for fluorspar. Companies investing in fluorspar extraction and processing are likely to benefit significantly from this trend, as the chemical industry continues to expand globally.

Emerging Markets and Regional Growth

Emerging markets, particularly in the Asia-Pacific region, offer significant growth prospects for the fluorspar market. Countries like China and India are experiencing rapid industrial growth, leading to increased demand for fluorspar in steelmaking, aluminum production, and other industrial processes. Additionally, the presence of key fluorspar mining companies in these regions ensures a steady supply, further fueling market growth. The strategic initiatives by governments to develop infrastructure and promote industrialization are expected to create substantial opportunities for market players.

Technological Advancements and Sustainable Practices

Technological advancements in mining and processing techniques are creating new opportunities in the fluorspar market. Innovations that improve extraction efficiency and reduce environmental impact are becoming increasingly important. The adoption of sustainable practices, such as reducing greenhouse gas emissions and promoting recycling, aligns with global environmental goals and opens up new markets for eco-friendly products. Companies that invest in green technologies and sustainable practices are likely to gain a competitive edge in the fluorspar market.

Strategic Partnerships and Expansions

Strategic partnerships and expansions are crucial for capitalizing on the opportunities in the fluorspar market. Collaborations between mining companies, chemical manufacturers, and technology firms can lead to the development of new applications and products, enhancing market growth. For instance, companies entering into joint ventures to explore new mining sites or investing in research and development for advanced processing methods can significantly boost their market presence. These strategic moves not only increase production capacity but also help in tapping into new markets and customer bases.

Trends for the Fluorspar Market

Increasing Demand in the Metallurgical Industry

One of the most significant trends in the fluorspar market is its rising demand in the metallurgical industry. Fluorspar is primarily used as a flux to remove impurities in the production of steel and aluminum. This role is crucial as it improves the fluidity of slag, enhancing the quality of the final metal product. The increasing global production of steel, especially in countries like China and India, is driving the demand for fluorspar. As infrastructure projects and industrial activities continue to grow, particularly in emerging economies, the need for high-quality metals boosts fluorspar consumption.

Growth in the Chemical Sector

The chemical industry is another major driver of fluorspar demand. Fluorspar is a key raw material for producing hydrofluoric acid, which is extensively used in the manufacturing of refrigerants, polymers, and various other chemicals. With the rising demand for these products, the chemical sector's need for fluorspar is expected to see significant growth. This trend is particularly strong in regions with robust industrial bases and high production capabilities, such as North America and parts of Asia-Pacific.

Expansion in the Asia-Pacific Region

The Asia-Pacific region is projected to dominate the fluorspar market during the forecast period. This dominance is due to the region's extensive use of fluorspar in steel and aluminum production, driven by strong industrial growth in countries like China, Japan, and India. China's focus on infrastructure development and its position as a leading steel producer significantly contribute to the high demand for fluorspar. Additionally, the strategic initiatives in various countries to reduce dependency on imports and boost local production are expected to further fuel market growth in this region.

Shift Towards Eco-Friendly Applications

There is a growing trend towards using environmentally friendly products in various industries, and the fluorspar market is no exception. The production of hydrofluorocarbons (HFCs), which are critical for refrigeration and air conditioning, is seeing a shift towards more eco-friendly alternatives like hydrofluoroolefins (HFOs). This shift is driven by increasing regulatory pressures to reduce greenhouse gas emissions. As a result, the demand for fluorspar, which is used in producing these eco-friendly refrigerants, is expected to rise, particularly in regions like North America that are focused on sustainable practices.

Technological Advancements and Innovations

Technological advancements and innovations in mining and processing fluorspar are also influencing market trends. Improved mining techniques and processing technologies are enhancing the efficiency and quality of fluorspar production. This not only meets the growing demand but also reduces environmental impact and production costs. Companies are investing in research and development to find more efficient ways to extract and process fluorspar, which is likely to lead to further market growth and new applications for this versatile mineral.

Strategic Partnerships and Acquisitions

Finally, strategic partnerships and acquisitions among key market players are shaping the fluorspar market. Companies are collaborating to enhance their production capabilities and expand their market reach. For example, recent acquisitions in the fluorspar industry have aimed at strengthening supply chains and increasing production capacity. These strategic moves are essential for companies to stay competitive in the growing market and meet the increasing demand from various end-use industries.

Segments Covered in the Report

By Grade

- Acidspar

- Metspar

- Ceramic Grade

- Optical Grade

- Lapidary Grade

By Variety

- Antozonite

- Blue John

- Chlorophane

- Yttrocerite

- Yttrofluorite

- Others

By Forms

- Powder

- Lump

- Filter Cake

By Application

-

Aluminum Production

-

Steel Production

-

Hydrofluoric Acid

-

Concrete Additives

-

Lithium-Ion Battery

-

Other Applications

Segment Analysis

By Grade Analysis

There are five categories within the grade segment: optical, metallurgical, lapidary, ceramic, and acid grades. In 2023, the metallurgical grade segment held a dominant market share of around 37.8%. The calcium fluoride (CaF2) concentration of metallurgical grade fluorspar frequently exceeds 97%. This grade efficiently purges molten metal of contaminants, allowing for smoother casting and improved product quality.

Its ubiquitous availability and affordability add to its appeal and domination in industrial environments. Metallurgical-grade fluorspar is used in several metallurgical operations, such as the creation of welding rods and ferroalloys. Metallurgical grade fluorspar is the most widely used and dominant grade on the market due to its excellent purity, fluxing qualities, affordability, adaptability, and robust industry demand.

By Variety Analysis

Antozonite, blue john, chlorophane, yttrocerite, yttrofluorite, and other materials are separated apart in the variety sector. In 2023, the yttrofluorite category held a dominant market share of around 36.7%. A type of fluorspar that contains yttrium impurities is called yttrofluorite.

Its excellent purity guarantees increased productivity in a range of industrial environments. Yttrium is used in ceramics, electronics, and optics. The flexibility of yttrofluorite is demonstrated by its use in ceramics, enamels, and specialty glassware. Thus, yttrofluorite's broad range of applications helps explain why it dominates the market.

By Forms Analysis

The powder, lump, and filter cake categories are included in the Fluorspar market segmentation based on form. The powder category dominated the market in 2023, and this pattern is expected to continue for the duration of the forecast.

For compound assembly and metallurgical applications, dry powder is accessible in powder form in developed nations such as North America and Europe. Due to the extensive application of high-purity corrosive fight, this market is anticipated to rise steadily during the estimated time.

By Application Analysis

The application segment includes ceramics, metallurgy, chemistry, and other fields. In 2023, the metallurgical segment held a dominant market share of approximately 44.9%. Fluorspar is essential to the manufacturing of aluminum and steel.

Superior-quality metals with improved mechanical qualities and fewer flaws are produced when fluorspar is used. Its contribution to refining results in enhanced performance attributes that satisfy demanding industry standards. By increasing metal fluidity and lowering energy consumption, fluorspar improves process efficiency and results in lower costs and higher production.

Regional Analysis

The market for fluorspar in the Asia Pacific region held a 46.1% share in 2023, mostly because of China's substantial exports and production.

As the largest producer and exporter of fluorspar worldwide, China is expected to play a significant role in the growth of the Asia-Pacific market. It is expected that expanding downstream activities in China will propel regional market expansion. Furthermore, the Fluorspar market in China commanded the most market share, while the Fluorspar market in India grew at the fastest rate in the Asia-Pacific area.

From 2023 to 2033, the North American fluorspar market is anticipated to rise significantly. The growing demand for steel and aluminum from the building and construction industry will affect the fluorspar market in North America.

The region's growing need for cooling equipment and hydrofluoric acid, which are needed to produce HFC and HCFC, will further contribute to the continued high demand for fluorspar. Furthermore, the fluorspar market in the United States accounted for the greatest part of the industry, while the market in Canada grew at the quickest rate in the North American area.

Competitive Analysis

The report provides an appropriate analysis of the major players in the global fluorspar market, as well as a comparative assessment based on factors such as product offerings, business summaries, geographic reach, enterprise strategies, market share by segment, and SWOT analysis.

A detailed analysis of the firms' recent events and developments—including product development, inventions, partnerships, joint ventures, mergers and acquisitions, strategic alliances, and other activities—is also included in the report. This makes it possible to assess the level of total market competition.

Recent Developments

In December 2023: Orbia Advance Corporation's business group, Orbia Fluor & Energy Materials, changed its name to better align with its current and next-generation solutions.

April 2022: Gujarat Mineral Development Corporation plans to establish a 40,000 tonnes per annum fluorspar beneficiation plant in Kadipani, a joint venture with Gujarat Fluorochemicals and Navine Fluorine International.

Key Market Players in the Fluorspar Market

-

British Fluorspar Ltd.

-

Dehek Fluorspar Mining & Processing Co.

-

Gujarat Mineral Development Corporation Ltd.

-

Longkou Fenghai Fluorspar Co. Ltd.

-

Malakooti Mining Co.

-

Marwar Mining & Allied Industries Ltd.

-

New Fluorspar Corporation

-

Tertiary Minerals Plc

-

Yarnes Minerals Ltd.

-

Yunnan Yuxi Fluorspar Mining

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.4 Billion |

|

Market Size 2033 |

USD 3.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Grade, Variety, Forms, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

British Fluorspar Ltd., Dehek Fluorspar Mining & Processing Co., Gujarat Mineral Development Corporation Ltd., Longkou Fenghai Fluorspar Co. Ltd., Malakooti Mining Co., Marwar Mining & Allied Industries Ltd., New Fluorspar Corporation, Tertiary Minerals Plc, Yarnes Minerals Ltd., Yunnan Yuxi Fluorspar Mining, Other Key Players |

|

Key Market Opportunities |

Growing Demand in Steel and Aluminum Industries |

|

Key Market Dynamics |

Increasing Steel and Aluminum Production |

📘 Frequently Asked Questions

1. How much is the Fluorspar Market in 2023?

Answer: The Fluorspar Market size was valued at USD 2.4 Billion in 2023.

2. What would be the forecast period in the Fluorspar Market report?

Answer: The forecast period in the Fluorspar Market report is 2023-2033.

3. Who are the key players in the Fluorspar Market?

Answer: British Fluorspar Ltd., Dehek Fluorspar Mining & Processing Co., Gujarat Mineral Development Corporation Ltd., Longkou Fenghai Fluorspar Co. Ltd., Malakooti Mining Co., Marwar Mining & Allied Industries Ltd., New Fluorspar Corporation, Tertiary Minerals Plc, Yarnes Minerals Ltd., Yunnan Yuxi Fluorspar Mining, Other Key Players

4. What is the growth rate of the Fluorspar Market?

Answer: Fluorspar Market is growing at a CAGR of 4.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.