🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Formic Acid Market

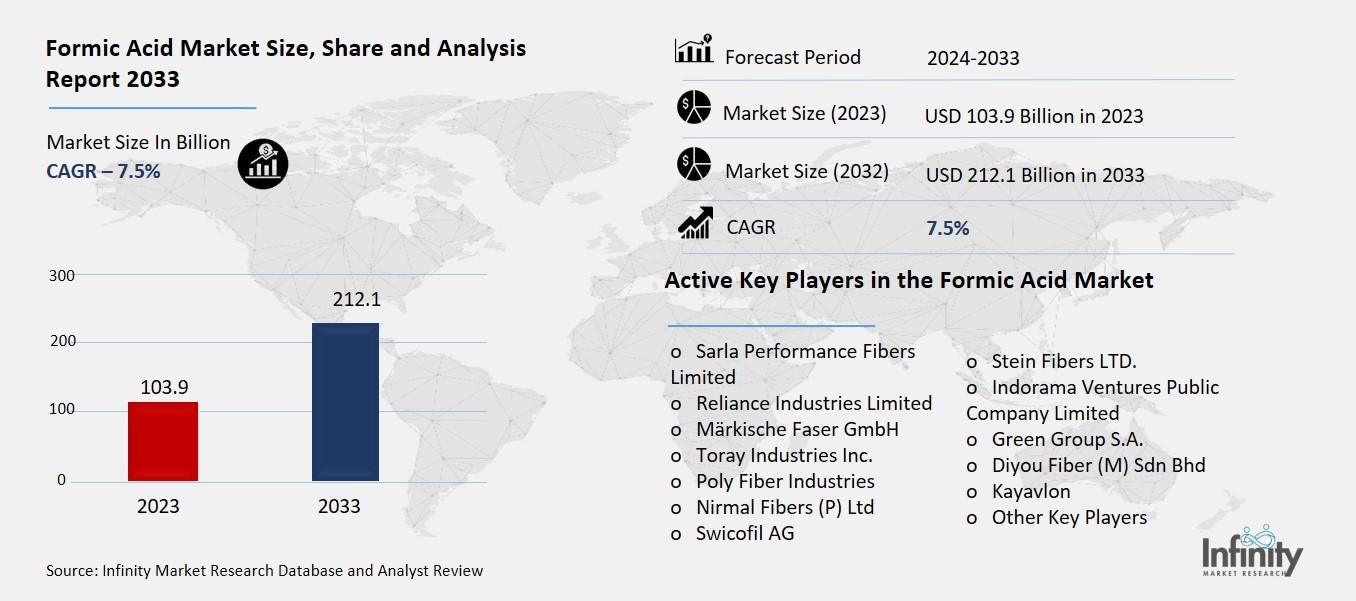

Formic Acid Market Global Industry Analysis and Forecast (2024-2033) by Product Type (Polyester Filament Yarn (PFY) and Polyester Staple Fiber (PSF)), Application (Automotive, Textile, Home Furnishing, Construction, Filtration, and Other Applications), Form (Solid and Hollow), Grade (Polyethylene terephthalate (PET) Polyester and PCDT Polyester), and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1925

Formic Acid Market Synopsis

The Global Formic Acid Market was valued at USD 103.9 billion in 2023 and is expected to grow from USD 110.8 billion in 2024 to USD 212.1 billion by 2033, reflecting a CAGR of 7.5% over the forecast period.

The Formic Acid Market stands as a major part of worldwide textile production as polyester fibers find extensive use in clothing items along with domestic accessories and industrial materials as well as non-woven fabric applications. The sustainable properties of polyester fiber surpass natural options like cotton or wool because they provide durability and wrinkle resistance and easy maintenance as well as affordable pricing. The market grew because of fast urbanization together with growing disposable consumer wealth and increasing needs for affordable synthetic materials which especially benefit developing nations. The global sustainability movement is supported by emerging technologies that expand the market for recycled polyester (rPET). The market operates while dealing with two major obstacles which include environmental issues from micro plastic contamination and the consumption of petroleum-derived raw materials.

Formic Acid Market Driver Analysis

Growing Demand for Affordable Textiles

The mass production of Polyester fiber serves clothing industry and home furnishings and upholstery market due to affordable costs alongside flexible applications. The reduced manufacturing costs of polyester support manufacturers to deliver affordable goods which maintain their durability level. The apparel market consistently chooses polyester for making shirts dress items and sportswear and outerwear because it provides resistance to wrinkles and fast drying time together with shape retention abilities. The home furnishings field utilizes polyester in various products starting from curtains and extending to bed linens and cushions follows with carpets because of its strong properties and resistance towards stains and simple upkeep abilities.

Formic Acid Market Restraint Analysis

Dependence on Petrochemicals

The crude oil price volatility together with rising sustainability pressure dramatically affects the availability of raw materials required to produce polyester fiber. The manufacturing expenses for polyester products depend strongly on fluctuations in crude oil market values as both purified terephthalic acid (PTA) and monoethylene glycol (MEG) originate from petroleum products. Changes in oil supply stability and price movements cause manufacturing operation costs to rise and create profit challenges throughout the supply chain systems. Rising global environmental consciousness leads to escalated manufacturer pressures to use fewer fossil fuels while implementing sustainable industrial methods.

Formic Acid Market Opportunity Analysis

Sustainable Fiber Innovation

The textile industry spends more on bio-based and recyclable polyester materials because it wants to lessen environmental effects and satisfy public demand for eco-friendly products. Production of bio-based polyester through renewable materials such as corn and sugarcane gives it a diminished carbon footprint than traditional petroleum-based polyester materials do. New technologies of recyclable polyester now aim to create zero-waste systems by efficiently turning worn materials into new fibers that maintain high product quality. These innovative methods draw manufacturers of all scales to increase their financing and establish partnerships throughout the supply chain which begins with material suppliers and ends with fashion companies.

Formic Acid Market Trend Analysis

Shift Toward Circular Economy

The polyester fiber production process now incorporates recycling techniques because businesses recognize both environmental issues and growing demand for sustainable materials. Manufacturing companies collect bottles made from PET plastic waste from consumers to turn them into recycled polyester which manufacturers call rPET. The manufacturing process enables companies to cut their usage of virgin petrochemical materials and decrease the amount of plastic waste both in landfills and marine environments. The production process decreases energy consumption in addition to producing fewer carbon emissions than standard polyester production. Major retail brands now incorporate rPET into their products which serve as materials for clothing apparel footwear and home textile products to fulfill their sustainability milestones.

Formic Acid Market Segment Analysis

The Formic Acid Market is segmented on the basis of Product Type, Form, and Form.

By Product Type

o Polyester Filament Yarn (PFY)

o Polyester Staple Fiber (PSF)

By Application

o Automotive

o Textile

o Home Furnishing

o Construction

o Filtration

o Other Applications

By Form

o Solid

o Hollow

By Grade

o Polyethylene terephthalate (PET) Polyester

o PCDT Polyester

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

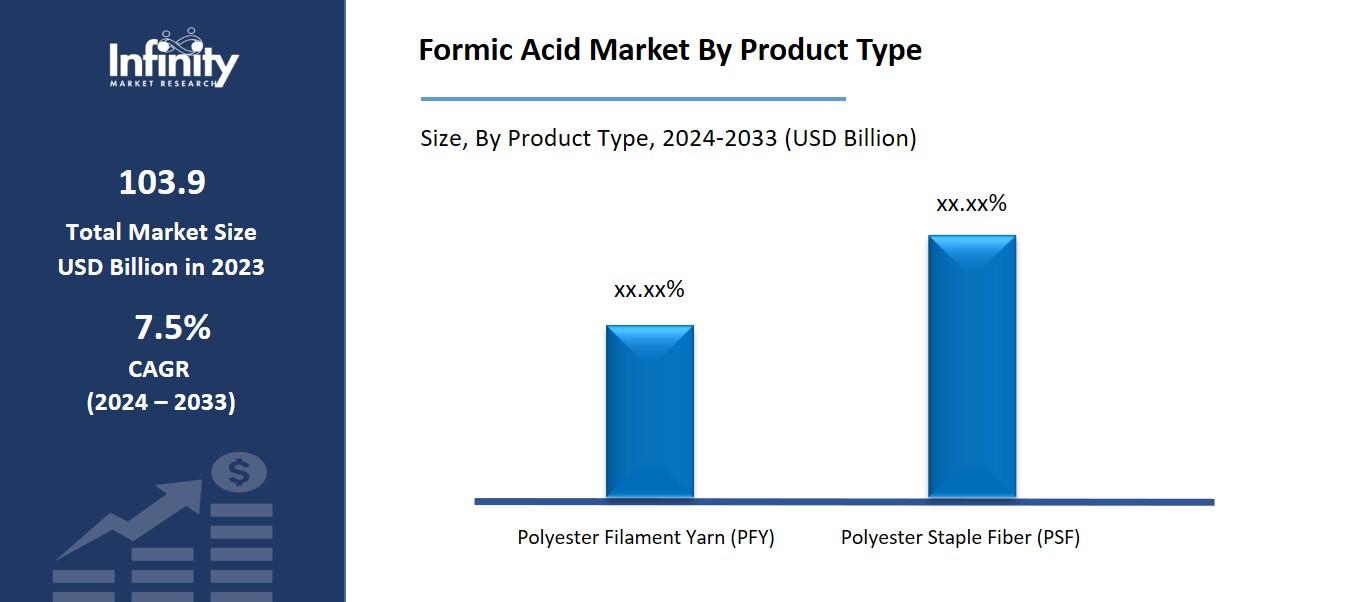

By Product Type, Polyester Staple Fiber (PSF) Segment is Expected to Dominate the Market During the Forecast Period

The product types discussed in this research study, the polyester staple fiber (PSF) segment is expected to account for the largest market share of Formic Acid Market in the forecast period. Industry manufacturers extensively use polyester fibers to make garments and activewear products in addition to linings and blended fabrics because of their durability and wrinkle resistance with great color stability and budget-friendly characteristics. Polyester fibers maintain their leading market position because of three major factors including the fast fashion boom together with growing disposable incomes and Asian-Pacific textile markets' rapid growth. Textile applications benefit from environmental sustainability through their increasing adoption of recycled polyester (rPET) which meets consumer demands for sustainable clothing. The textile segment remains the top segment in the Formic Acid Market because of its massive market share alongside continuous technological advancements.

By Application, the Textile Segment is Expected to Held the Largest Share

By application, the textile segment is expected to hold the largest share of the Formic Acid Market due to its extensive and long-standing use across various types of clothing and apparel. The manufacturing industry relies on polyester because of these features that allow high-volume production for fashion items along with sportswear apparel and uniforms together with blended fabric materials. The marriage between fast fashion trends and rising consumer needs for inexpensive easy-care clothing items created immense demand for polyester which drove up its usage levels. The textile sector supports sustainability goals through the adoption of recycled polyester which enhances the segment’s leading position. Continued growth within Asian-Pacific textile manufacturing facilities preserves the textile segment as the biggest contributor to the total Formic Acid Market.

By Form, the Solid Segment is Expected to Held the Largest Share

By form, the solid segment is expected to hold the largest share of the Formic Acid Market during the forecast period. The strength along with durability and consistent quality of solid polyester fibers makes them suitable for multiple industrial applications which include textiles and home furnishings and the automotive sector. The combination of better structural properties makes these fibers an optimal selection for textiles that need spinning or weaving or knitting techniques before producing clothing goods as well as bedding materials and upholstery pieces. The solid structure delivers enhanced resilience properties and maintains shape better than other forms thus making it ideal for long-term performance needs. The availability and processing convenience of solid fibers leads to their extensive usage since they are available more frequently than hollow fibers.

By Grade, the Polyethylene terephthalate (PET) Polyester Segment is Expected to Held the Largest Share

The polyethylene terephthalate (PET) polyester segment is expected to maintain its position as the largest grade category in the Formic Acid Market. The widespread use of PET polyester material for fiber production occurs because it maintains excellent properties including durability and strength along with chemical resistance and cost-effectiveness. PET polyester continues to be a leading raw material which serves the creation of apparel and home textiles and industrial fabrics and packaging materials. The growing adoption of PET polyester occurs because of its ability to be recycled thus attracting manufacturers who want to minimize their environmental footprint. Different industries now embrace recycled PET (rPET) materials in textile development as well as fashion production because of global sustainability principles. PET polyester delivers versatile performance alongside available benefits which maintain its market dominance in different industries by grade.

Formic Acid Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the Formic Acid Market over the forecast period due to its well-established textile and automotive industries, high consumer demand for synthetic fibers, and strong focus on technological innovation. Strong manufacturing capabilities in combination with a developed infrastructure have positioned this area for growth while recycling programs for polyester (rPET) have become important to sustainable practices. Market expansion of home furnishings and non-woven fabrics and industrial textiles drives the growth rate of both U.S. and Canadian polyester fiber industries. The regional market advantages are supported by major industrial participants along with continual research activities and governmental backing for sustainable materials. The global Formic Acid Market will stay led by North America because of increased concerns about sustainability coupled with rising demand for functional fabric materials during the upcoming years.

Recent Development

In March 2023, Reliance Industries completed the acquisition of Sintex Industries, following approval from the banks a year earlier and receiving the green light from the National Company Law Tribunal (NCLT) just a month ago.

In January 2022, Fiber Industries LLC, a producer of polyester staple fiber, announced plans to invest $30 million to enhance its operations in Darlington, South Carolina. The investment will focus on increasing production capacity through equipment upgrades and modernizing production lines with advanced control systems, as well as expanding the company’s warehouse facilities.

Active Key Players in the Formic Acid Market

o Sarla Performance Fibers Limited

o Reliance Industries Limited

o Märkische Faser GmbH

o Toray Industries Inc.

o Poly Fiber Industries

o Nirmal Fibers (P) Ltd

o Swicofil AG

o Stein Fibers LTD.

o Indorama Ventures Public Company Limited

o Green Group S.A.

o Diyou Fiber (M) Sdn Bhd

o Kayavlon

o Other Key Players

Global Formic Acid Market Scope

|

Global Formic Acid Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 103.9 Billion |

|

Market Size in 2024: |

USD 110.8 Billion | ||

|

Forecast Period 2024-33 CAGR: |

7.5% |

Market Size in 2033: |

USD 212.1 Billion |

|

Segments Covered: |

By Product Type |

· Polyester Filament Yarn (PFY) · Polyester Staple Fiber (PSF) | |

|

By Application |

· Automotive · Textile · Home Furnishing · Construction · Filtration · Other Applications | ||

|

By Form |

· Solid · Hollow | ||

|

By Grade |

· Polyethylene terephthalate (PET) Polyester · PCDT Polyester | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing Demand for Affordable Textiles | ||

|

Key Market Restraints: |

· Dependence on Petrochemicals | ||

|

Key Opportunities: |

· Sustainable Fiber Innovation | ||

|

Companies Covered in the report: |

· Sarla Performance Fibers Limited, Reliance Industries Limited, Märkische Faser GmbH, Toray Industries Inc. and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Formic Acid Market Research report?

Answer: The forecast period in the Formic Acid Market Research report is 2024-2033.

2. Who are the key players in the Formic Acid Market?

Answer: Sarla Performance Fibers Limited, Reliance Industries Limited, Märkische Faser GmbH, Toray Industries Inc. and Other Key Players.

3. What are the segments of the Formic Acid Market?

Answer: The Formic Acid Market is segmented into Product Type, Application, Form, and Regions. By Product Type, the market is categorized into Polyester Filament Yarn (PFY) and Polyester Staple Fiber (PSF). By Application, the market is categorized into Automotive, Textile, Home Furnishing, Construction, Filtration, and Other Applications. By Form, the market is categorized into Solid and Hollow. By Grade, the market is categorized into Polyethylene terephthalate (PET) Polyester and PCDT Polyester. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Formic Acid Market?

Answer: The Formic Acid Market encompasses worldwide activity touching polyester fiber production and distribution and consumer usage of synthetic material primarily made from petroleum. The global preference for polyester exceeds all other synthetic fibers because of its strength and durability together with its affordable manufacturing costs and its capability to adapt to various product categories from textiles to industrial items and consumer goods.

5. How big is the Formic Acid Market?

Answer: The global Formic Acid Market was valued at USD 103.9 billion in 2023 and is expected to grow from USD 110.8 billion in 2024 to USD 212.1 billion by 2033, reflecting a CAGR of 7.5% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.