🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Fraud Management in Banking Market

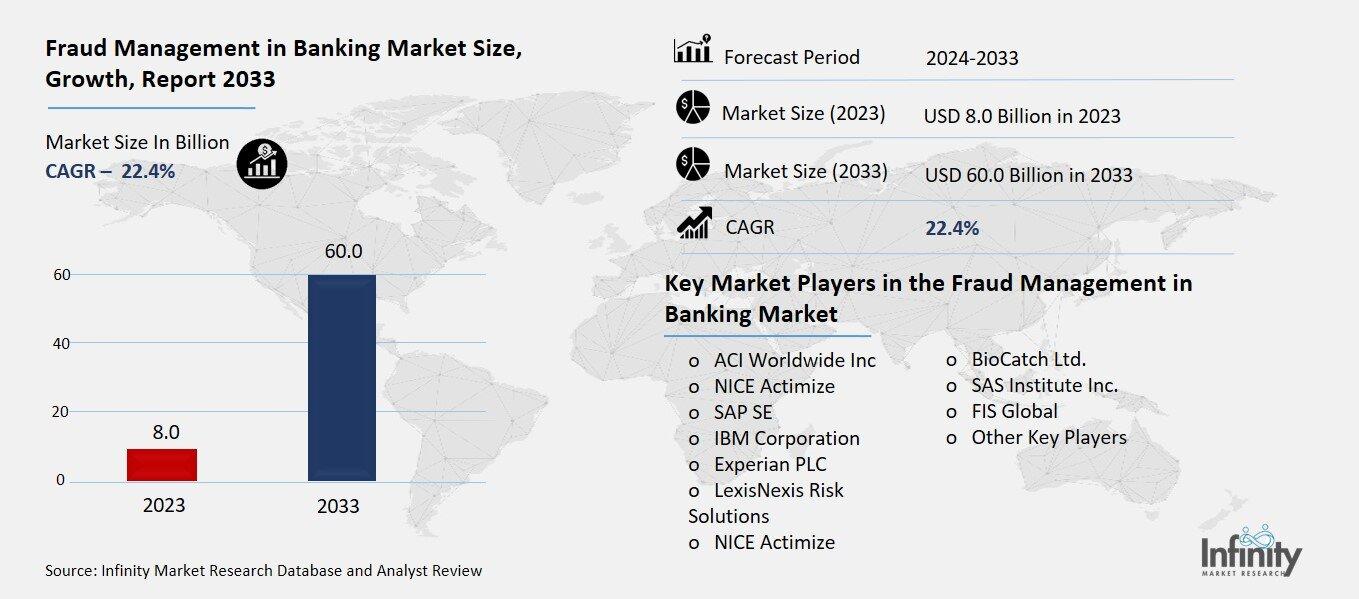

Global Fraud Management in Banking Market (By Component, Solution and Service; By Fraud Type, Payment Fraud, Money Laundering, Identity Theft, Loan Fraud, and Other Fraud Types; By Application, Fraud Detection and Prevention Systems, Customer Authentication, Identity and Access Management (IAM), Transaction Monitoring, and Other Applications, By Region and Companies), 2024-2033

Oct 2024

Financial Services & Insurance

Pages: 138

ID: IMR1282

Fraud Management in Banking Market Overview

Global Fraud Management in Banking Market acquired the significant revenue of 8.0 Billion in 2023 and expected to be worth around USD 60.0 Billion by 2033 with the CAGR of 22.4% during the forecast period of 2024 to 2033. The banking sector fraud management is evolving rapidly and expanding at an even faster rate because of the growing and ever complicated fraud incidents as well as growing concerns and customer data and security regulations among other reasons. Some prominent factors include the focused rise in the use of internet banking services since their application offers great convenience in their operations to the customers but at the same time, make the banking systems more susceptible to cyber criminals’ attacks.

Banks and other financial institutions are expanding their use of AI, machine learning, biometric, and other innovative solutions in their bid to improve their ability to detect and avoid fraud in realtime. At the same time, the concerns on the part of the regulators and the desire to improve customer trust are forcing banks to seek for comprehensive fraud management solutions, which are capable of addressing the immediate threats, as well as to fit into the organizational processes.

Drivers for the Fraud Management in Banking Market

Increase in Digital Transactions

The advancement in the use of internet banking and other types of electronic banking has brought about changes in the abilities of consumers to access the services of financial institutions in an efficient manner. While such a move has provided an opportunity to deliver enhanced experiences to customers, it has also opened the floodgates for more formidable fraud attempts. Similarly, as more transactions are conducted online, fraudsters continue to attack the weaknesses of such systems, which include but are not limited to phishing, identity theft, or even malware. This shifting threat environment makes it necessary for banks and other financial institutions to seek and implement sophisticated solutions in combating and identifying and possibly preventing frauds on real time basis. Such remedies employ various sophisticated innovations including artificial intelligent and machine learning, which makes it possible for them to scan through numerous transactions and efficiently analyze and determine abnormalactivities and correlate to fears in a short span of time.

Restraints for the Fraud Management in Banking Market

Complexity of Integration

Integrating new fraud management technologies with existing legacy systems poses significant challenges for financial institutions, primarily due to the inherent complexities and limitations of older technology infrastructures. Legacy systems, often characterized by outdated programming languages and rigid architectures, may not support modern applications, making it difficult to seamlessly integrate advanced fraud detection tools. This incompatibility can lead to prolonged implementation timelines, requiring extensive customization and testing to ensure compatibility. Moreover, financial institutions may face resource constraints, as their IT teams are often stretched thin managing existing systems while also attempting to adopt new technologies.

Opportunity in the Fraud Management in Banking Market

Focus on Customer-Centric Solutions

Developing user-friendly fraud detection solutions is essential for enhancing customer experience while ensuring robust security measures. As consumers increasingly engage with digital banking platforms, their expectations for seamless and intuitive interactions grow. Solutions that prioritize usability, such as simplified interfaces, clear notifications, and streamlined authentication processes, help reduce friction in the customer journey. By providing customers with easy-to-use tools for monitoring their accounts and reporting suspicious activity, banks can foster a sense of empowerment and trust.

Additionally, integrating features like real-time alerts and personalized fraud detection options allows customers to feel more in control of their financial security. This user-centric approach not only improves satisfaction but also encourages proactive engagement, as customers are more likely to report potential fraud when they feel their concerns are taken seriously.

Trends for the Fraud Management in Banking Market

AI and Machine Learning Integration

The growing reliance on artificial intelligence (AI) and machine learning (ML) in fraud detection is transforming how financial institutions approach predictive analytics. By leveraging vast amounts of transaction data, AI and ML algorithms can analyze patterns and identify anomalies that may indicate fraudulent behavior. These advanced technologies enable banks to move beyond traditional rule-based systems, which often struggle to adapt to the evolving tactics used by cybercriminals. Instead, AI-driven solutions can continuously learn from new data, improving their predictive capabilities over time.

Segments Covered in the Report

By Component

o Solution

o Service

By Fraud Type

o Payment Fraud

o Money Laundering

o Identity Theft

o Loan Fraud

o Other Fraud Types

By Application

o Fraud Detection and Prevention Systems

o Customer Authentication

o Identity and Access Management (IAM)

o Transaction Monitoring

o Other Applications

Segment Analysis

By Component Analysis

On the basis of component, the market is divided into solution and service. Among these, solution segment acquired the significant share in the market owing to the increasing demand for advanced technological tools that enhance fraud detection and prevention capabilities. As financial institutions seek to combat the rising threat of fraud, they are increasingly investing in comprehensive fraud management solutions that leverage artificial intelligence, machine learning, and analytics.

By Fraud Type Analysis

On the basis of fraud type, the market is divided into payment fraud, money laundering, identity theft, loan fraud, and other fraud types. Among these, payment fraud segment held the prominent share of the market due to the exponential growth in digital payment transactions and the increasing sophistication of cyber threats targeting these channels.

As consumers shift towards online and mobile payment methods, the volume of transactions has surged, creating a larger attack surface for fraudsters. Payment fraud encompasses various schemes, including credit card fraud, account takeover, and transaction fraud, which have become more prevalent in the digital landscape. Financial institutions are prioritizing the implementation of advanced fraud detection solutions specifically designed to address these threats, leading to increased investment in this segment.

By Application Analysis

On the basis of application, the market is divided into fraud detection and prevention systems, customer authentication, identity and access management (IAM), transaction monitoring, and other applications. Among these, fraud detection and prevention systems segment held the prominent share of the market. As cyber threats continue to evolve in complexity and frequency, banks and financial organizations are prioritizing robust fraud detection and prevention systems that can provide real-time insights and responses to potential threats. These systems utilize advanced technologies such as artificial intelligence and machine learning to analyze transaction patterns, detect anomalies, and respond quickly to suspicious activities, ensuring that fraudulent transactions can be intercepted before they cause significant financial loss.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 29.1% of the market. The region is home to some of the world's largest financial institutions, which are at the forefront of adopting advanced fraud detection and prevention technologies to safeguard their operations against increasing cyber threats. High levels of digital banking adoption, coupled with a rapidly expanding e-commerce landscape, have contributed to a greater need for effective fraud management solutions. Furthermore, regulatory frameworks in North America, such as the Gramm-Leach-Bliley Act (GLBA) and the Dodd-Frank Act, impose stringent compliance requirements, prompting financial institutions to invest heavily in sophisticated fraud management systems.

The presence of leading technology providers and a robust ecosystem for innovation also accelerates the development and deployment of cutting-edge solutions in the region. Additionally, heightened consumer awareness regarding fraud risks and growing expectations for security in digital transactions drive banks to prioritize investments in fraud prevention strategies.

Competitive Analysis

The competitive landscape of the fraud management market in banking is characterized by a diverse array of players, ranging from established financial institutions to specialized technology providers. Key players, including multinational corporations like FIS, FICO, and NICE Actimize, dominate the market by offering comprehensive fraud detection and prevention solutions that leverage advanced technologies such as artificial intelligence, machine learning, and big data analytics. These companies invest significantly in research and development to continuously enhance their offerings and maintain a competitive edge.

Recent Developments

In October 2023, Jack Henry introduced the Jack Henry Financial Crimes Defender™, a cloud-native solution for fraud detection and anti-money laundering (AML) that prioritizes real-time capabilities. This innovative solution empowers community and regional financial institutions to take a proactive approach in tackling financial crimes across various channels.

Key Market Players in the Fraud Management in Banking Market

o ACI Worldwide Inc

o NICE Actimize

o SAP SE

o IBM Corporation

o Experian PLC

o LexisNexis Risk Solutions

o NICE Actimize

o BioCatch Ltd.

o SAS Institute Inc.

o FIS Global

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 8.0 Billion |

|

Market Size 2033 |

USD 60.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

22.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Fraud Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

ACI Worldwide Inc., NICE Actimize, SAP SE, IBM Corporation, Experian PLC, LexisNexis Risk Solutions, NICE Actimize, BioCatch Ltd. SAS Institute Inc., FIS Global, and Other Key Players. |

|

Key Market Opportunities |

Focus on Customer-Centric Solutions |

|

Key Market Dynamics |

Increase in Digital Transactions |

📘 Frequently Asked Questions

1. Who are the key players in the Fraud Management in Banking Market?

Answer: ACI Worldwide Inc., NICE Actimize, SAP SE, IBM Corporation, Experian PLC, LexisNexis Risk Solutions, NICE Actimize, BioCatch Ltd. SAS Institute Inc., FIS Global, and Other Key Players.

2. How much is the Fraud Management in Banking Market in 2023?

Answer: The Fraud Management in Banking Market size was valued at USD 8.0 Billion in 2023.

3. What would be the forecast period in the Fraud Management in Banking Market?

Answer: The forecast period in the Fraud Management in Banking Market report is 2024-2033.

4. What is the growth rate of the Fraud Management in Banking Market ?

Answer: Fraud Management in Banking Market is growing at a CAGR of 22.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.