🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Generative AI in Insurance Market

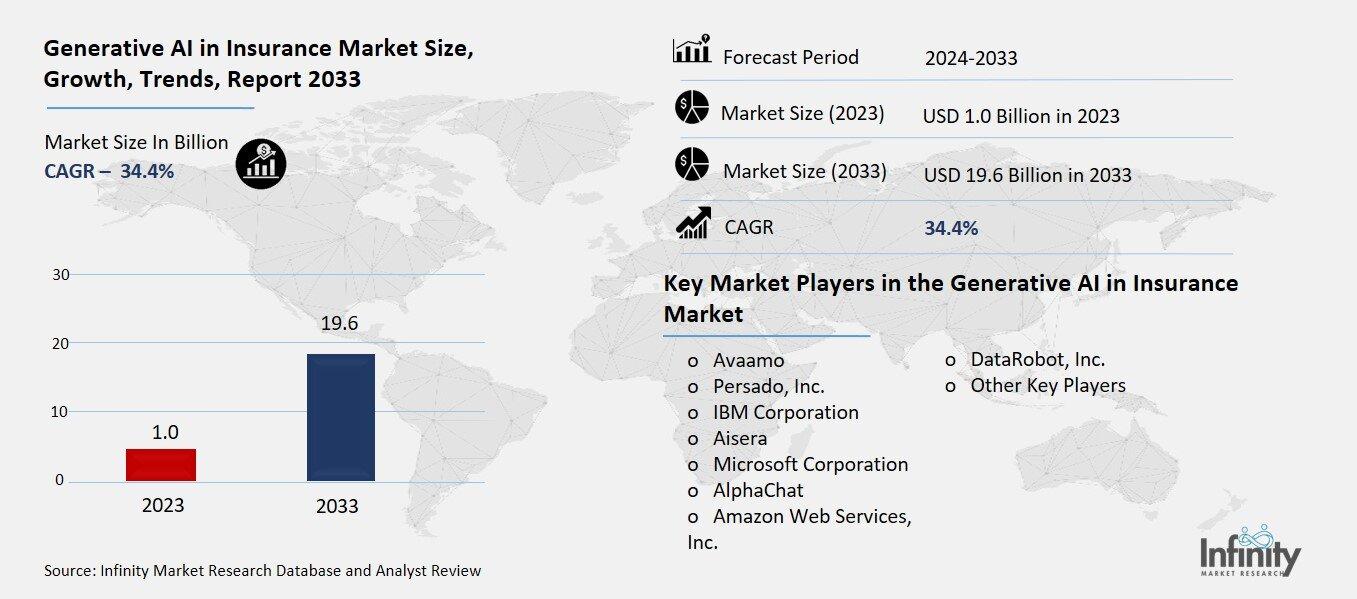

Global Generative AI in Insurance Market (By Component, Solution and Service; By Technology, Transformers, Variational Auto-encoders, Generative Adversarial Networks (GANs), Diffusion Networks, and Other Technologies; By Application, Automated Underwriting, Personalized Insurance Policies, Claims Processing Automation, Fraud Detection and Prevention, Virtual Assistants and Customer Support, and Other Applications, By Region and Companies), 2024-2033

Nov 2024

Financial Services & Insurance

Pages: 138

ID: IMR1285

Generative AI in Insurance Market Overview

Global Generative AI in Insurance Market acquired the significant revenue of 1.0 Billion in 2023 and expected to be worth around USD 19.7 Billion by 2033 with the CAGR of 34.4% during the forecast period of 2024 to 2033. Generative AI is revolutionizing the insurance market by enhancing risk assessment, claims processing, and customer engagement. That is why generative AI models are capable of extracting quantities of data, analyzing them, as well as using patterns and potential outcomes that, compared to conventional approaches, are significantly more efficient. In a way, this technology allows companies like insurers to develop policy offerings and specific pricing strategies according to a ‘person’s profile and usage history, making underwriting more effective.

Also, generative AI optimizes end-to-end claims handling by generating documentation and unlocking analytical insights, which thereby minimizes processing time and expenses. Besides, it also improves the organization’s customer service since it can be used to design unique communications and support models that increase customer loyalty.

Drivers for the Generative AI in Insurance Market

Enhanced Data Analysis

Generative AI greatly improves insurers’ capability of analyzing massive voluminous and heterogeneous data in a short span of time and thereby revolutionizes the conventional risk assessment and decision making paradigms. As a result of utilizing complex computations and AI learning models, generative AI can analyze huge sets of data in as short a time as possible for such as historical claims data, customer behavior, market trends and any external risks. With this capability, it becomes easy for insurers to build complex risk models that help one understand some of the risks related to certain policies or customers better. Moreover, due to the generation of different circumstances in which it works, it is possible to call it a useful tool for identifying the likelihood of claims, which helps insurers improve their criteria for underwriting and setting suitable prices.

Restraints for the Generative AI in Insurance Market

Data Privacy Concerns

The increasing reliance on generative AI in the insurance sector raises significant privacy concerns regarding the use of sensitive customer data. Insurers often collect and analyze vast amounts of personal information, including health records, financial data, and demographic details, to inform their underwriting and claims processes. However, the use of such sensitive data heightens the risk of data breaches and unauthorized access, which can compromise customer privacy.

Furthermore, stringent regulations like the General Data Protection Regulation (GDPR) in Europe and various privacy laws across different jurisdictions impose strict requirements on how personal data is collected, stored, and utilized. Non-compliance with these regulations can result in substantial fines and reputational damage for insurers.

Opportunity in the Generative AI in Insurance Market

New Product Development

Generative AI plays a pivotal role in the creation of innovative insurance products specifically designed to address emerging risks, particularly in rapidly evolving areas such as cyber insurance. As organizations increasingly rely on digital infrastructures and face the threat of cyberattacks, traditional insurance offerings often fall short in adequately covering the complexities of these risks. Generative AI can analyze extensive datasets, including threat intelligence, industry-specific vulnerabilities, and historical claims related to cyber incidents, to identify unique patterns and potential risk factors that traditional models might overlook.

Trends for the Generative AI in Insurance Market

Increased Investment in AI

There is a notable trend among insurers to invest in AI technologies as a strategic imperative to remain competitive and enhance operational efficiency. As the insurance landscape becomes increasingly digital, traditional methods of underwriting, claims processing, and customer engagement are proving inadequate to meet the demands of modern consumers and the complexities of new risks. By adopting AI technologies, insurers can streamline operations, reduce costs, and improve service delivery. For instance, AI-powered automation can expedite claims processing by analyzing data and generating insights that facilitate quicker decision-making, significantly reducing turnaround times and improving customer satisfaction.

Moreover, investments in AI enable insurers to leverage predictive analytics, which enhances risk assessment by identifying trends and patterns that inform better underwriting practices. This proactive approach not only minimizes losses but also allows for the development of personalized insurance products tailored to individual customer needs, thereby fostering deeper customer relationships.

Segments Covered in the Report

By Component

o Solution

o Service

By Technology

o Transformers

o Variational Auto-encoders

o Generative Adversarial Networks (GANs)

o Diffusion Networks

o Other Technologies

By Application

o Automated Underwriting

o Personalized Insurance Policies

o Claims Processing Automation

o Fraud Detection and Prevention

o Virtual Assistants and Customer Support

o Other Applications

Segment Analysis

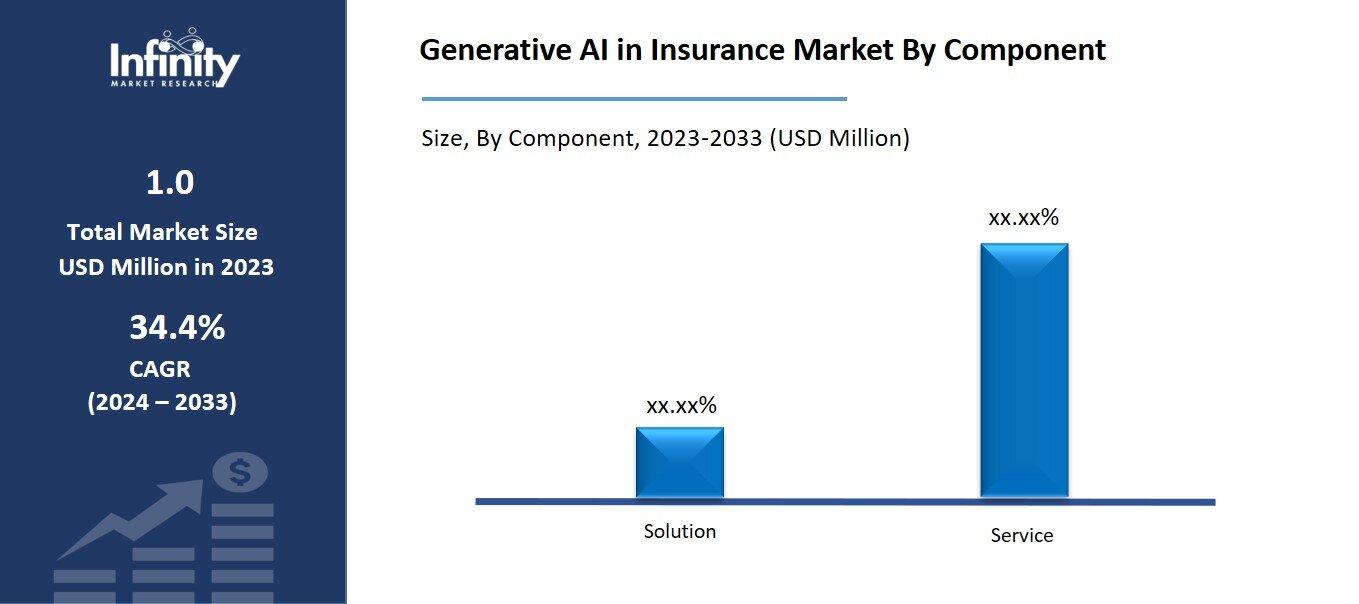

By Component Analysis

On the basis of component, the market is divided into solution and service. Among these, solution segment acquired the significant share in the market owing to the increasing demand for advanced technology that enhances operational efficiency and customer engagement. Solutions such as AI-powered underwriting tools, automated claims processing systems, and risk assessment algorithms enable insurers to streamline their operations and make data-driven decisions.

The growing reliance on digital platforms and the need for personalized insurance products have driven insurers to adopt comprehensive AI solutions that can process vast amounts of data quickly and accurately. These solutions not only improve the speed and accuracy of decision-making but also enhance the overall customer experience by providing tailored products and services.

By Technology Analysis

On the basis of technology, the market is divided into variational auto-encoders, generative adversarial networks (GANs), diffusion networks, and other technologies. Among these, generative adversarial networks (GANs) segment held the prominent share of the market due to their powerful capabilities in generating realistic synthetic data and enhancing data diversity for training machine learning models. GANs consist of two neural networks—the generator and the discriminator that work in opposition to produce high-quality outputs, making them particularly effective for applications requiring complex data synthesis.

By Application Analysis

On the basis of application, the market is divided into automated underwriting, personalized insurance policies, claims processing automation, fraud detection and prevention, virtual assistants and customer support, and other applications. Among these, food industry segment held the prominent share of the market. Claims processing is a critical function in the insurance industry, often characterized by complex workflows and extensive documentation. The integration of generative AI technologies allows insurers to automate routine tasks, such as data entry, document verification, and initial claims assessments. This not only reduces the time taken to process claims but also minimizes human error, leading to improved accuracy and reliability in decision making.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market. The region is home to some of the largest and most technologically advanced insurance companies, which are increasingly adopting AI solutions to enhance their operational efficiencies, risk assessment capabilities, and customer service offerings. The strong presence of established insurers in the United States and Canada provides a solid foundation for investment in innovative technologies, enabling companies to remain competitive in a rapidly evolving market.

Moreover, the regulatory environment in North America, while complex, is also supportive of technological advancements, allowing insurers to experiment with and deploy generative AI applications more freely than in other regions. This flexibility encourages innovation and facilitates the integration of AI solutions into existing processes, ultimately driving revenue growth.

Competitive Analysis

The competitive landscape of the generative AI market in insurance is characterized by a dynamic mix of established players and innovative startups, all vying for market share in a rapidly evolving technological landscape. Major insurance companies are increasingly investing in AI capabilities to enhance operational efficiency, improve risk assessment, and provide personalized customer experiences. This has led to a wave of partnerships between traditional insurers and technology firms specializing in AI, data analytics, and machine learning, facilitating the integration of advanced solutions into existing processes.

Recent Developments

In June 2023, Simplifai, an AI automation solutions provider, launched Simplifai InsuranceGPT, a groundbreaking custom-built GPT tool powered by its no-code AI platform. This innovative tool enhances the company's end-to-end business process automation, enabling seamless communication between insurers and their customers.

In May 2023, Roots Automation, known for its AI-powered Digital Coworkers, introduced InsurGPT, the world's most advanced generative AI model tailored specifically for the insurance market. InsurGPT enhances the natural language capabilities of Digital Coworkers by employing proprietary, fine-tuned Large Language Models (LLMs) to effectively read and extract data from both structured and unstructured documents.

Key Market Players in the Generative AI in Insurance Market

o Avaamo

o Persado, Inc.

o IBM Corporation

o Aisera

o Microsoft Corporation

o AlphaChat

o Amazon Web Services, Inc.

o DataRobot, Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.0 Billion |

|

Market Size 2033 |

USD 19.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

34.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Technology, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Avaamo, Persado, Inc., IBM Corporation, Aisera, Microsoft Corporation, AlphaChat, Amazon Web Services, Inc., DataRobot, Inc., and Other Key Players. |

|

Key Market Opportunities |

New Product Development |

|

Key Market Dynamics |

Enhanced Data Analysis |

📘 Frequently Asked Questions

1. Who are the key players in the Generative AI in Insurance Market?

Answer: Avaamo, Persado, Inc., IBM Corporation, Aisera, Microsoft Corporation, AlphaChat, Amazon Web Services, Inc., DataRobot, Inc., and Other Key Players.

2. How much is the Generative AI in Insurance Market in 2023?

Answer: The Generative AI in Insurance Market size was valued at USD 1.0 Billion in 2023.

3. What would be the forecast period in the Generative AI in Insurance Market?

Answer: The forecast period in the Generative AI in Insurance Market report is 2024-2033.

4. What is the growth rate of the Generative AI in Insurance Market?

Answer: Generative AI in Insurance Market is growing at a CAGR of 34.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.