🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Generator Rental Market

Generator Rental Market (By Power Rating (Below 100 kVA, 100 kVA -500 kVA, 501 kVA -1000 kVA, Above 1000 kVA, Other Power Rating), By Fuel Type (Diesel, Natural Gas, Others Fuel Type), By Application (Continuous Load, Standby Load, Peak Load Shaving, Other Applications), By End-Use ( Utilities, Oil & Gas, Mining, Construction, Events, Other End-Use), By Region and Companies)

Jul 2024

Energy and Power

Pages: 140

ID: IMR1183

Generator Rental Market Overview

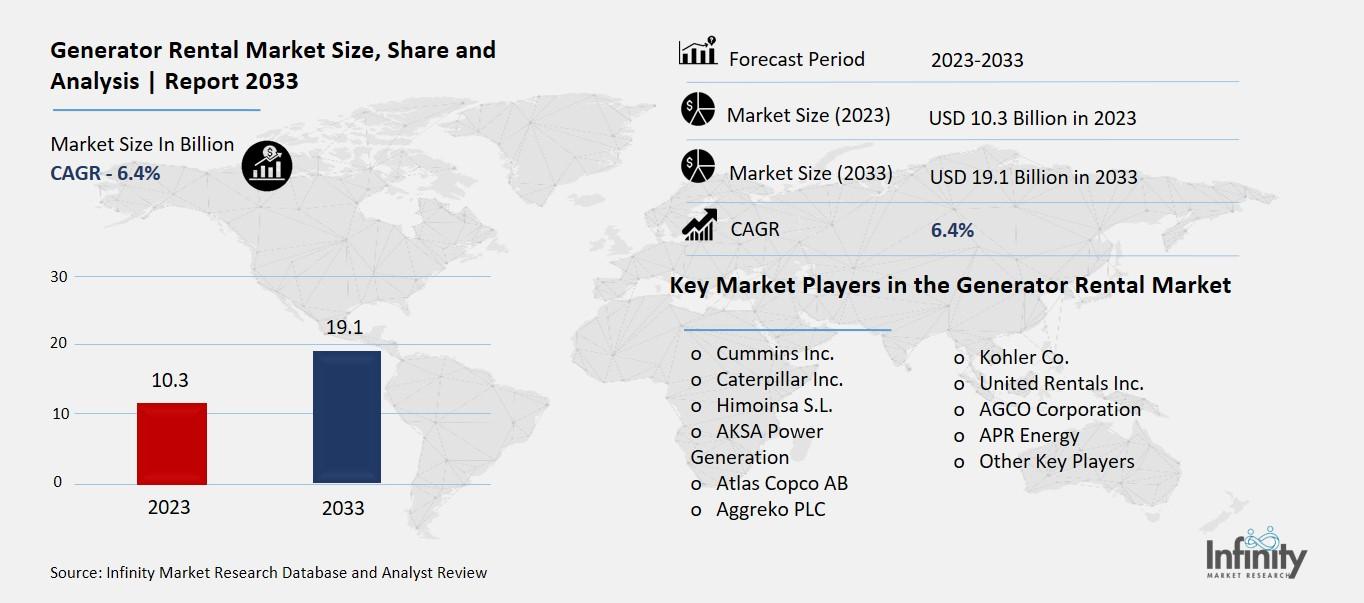

Global Generator Rental Market size is expected to be worth around USD 19.1 Billion by 2033 from USD 10.3 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The generator rental market is about companies and people renting generators instead of buying them. Generators make electricity when there’s no power, like during a power outage or at places without a power supply, such as construction sites or outdoor events. Renting a generator can be more cost-effective, especially for short-term use or special projects.

People and businesses rent generators for various reasons. For instance, event organizers might need temporary power for concerts or festivals. Construction companies often use rented generators to power tools and equipment on job sites. Additionally, rented generators can provide essential power to homes, hospitals, and other critical facilities during emergencies or natural disasters. The rental service typically includes delivery, setup, and maintenance, making it convenient for users who don't want to handle these tasks themselves.

Drivers for the Generator Rental Market

Growing Demand from Construction and Industrial Sectors

The construction and industrial sectors are key drivers for the generator rental market. Construction sites often need reliable power sources, especially in remote areas where the electricity grid might not be accessible. Similarly, industrial operations require backup power to ensure continuous production and avoid costly downtime. The expansion of these sectors, driven by urbanization and infrastructure development, boosts the demand for rental generators.

Increasing Frequency of Power Outages

Power outages are becoming more frequent due to aging infrastructure, severe weather conditions, and increased energy consumption. These outages can disrupt businesses, healthcare facilities, and homes, prompting the need for reliable backup power solutions. Rental generators provide a quick and flexible solution, ensuring that operations can continue smoothly during power disruptions. This trend is particularly noticeable in regions with unstable power grids.

Rising Popularity of Events and Outdoor Activities

Events, festivals, and outdoor activities are on the rise globally, requiring temporary power solutions. Rental generators are ideal for these purposes as they can be easily transported and set up. They provide the necessary power for lighting, sound systems, and other equipment, making them a preferred choice for event organizers. The growth of the events industry directly contributes to the increased demand for generator rentals.

Growing Adoption of Renewable Energy Sources

The integration of renewable energy sources like wind and solar into the energy mix has led to a need for backup power during periods when these sources are not generating electricity. Rental generators, particularly those running on natural gas or other cleaner fuels, are being used to complement renewable energy systems. This ensures a stable power supply and supports the transition to a more sustainable energy infrastructure.

Technological Advancements and Product Innovations

Advancements in generator technology and the development of more efficient, quieter, and environmentally friendly generators have positively impacted the rental market. Innovations such as hybrid generators, which combine diesel and battery power, offer enhanced efficiency and reduced emissions. These technological improvements make rental generators more attractive to a wider range of customers, further driving market growth.

Government Initiatives and Policies

Governments around the world are implementing policies and initiatives to improve energy infrastructure and ensure reliable power supply. These measures often include incentives for using rental generators in various applications, from disaster recovery to construction projects. Supportive regulations and funding for infrastructure projects create additional opportunities for the generator rental market, encouraging its expansion.

Increasing Awareness of the Benefits of Rental Generators

Businesses and individuals are becoming more aware of the benefits of renting generators rather than purchasing them. Renting offers flexibility, cost savings, and access to the latest technology without the need for significant upfront investment. This growing awareness, coupled with the economic advantages, is driving more customers to opt for rental solutions, thereby boosting the market.

Restraints for the Generator Rental Market

High Initial Costs

One of the primary restraints is the high initial cost associated with setting up and maintaining rental fleets. Companies need to invest significantly in acquiring and maintaining a range of generators to meet diverse customer needs. This substantial investment can be a barrier, especially for smaller firms or new entrants in the market. Additionally, the costs of storage, logistics, and servicing these generators add to the overall expenses, making it a capital-intensive business.

Regulatory Challenges

The generator rental industry is subject to stringent regulatory frameworks, especially concerning environmental standards and emissions controls. Compliance with these regulations requires continuous investment in newer, more environmentally friendly technologies. Meeting these regulatory requirements can be both costly and time-consuming, particularly in regions with strict environmental laws. Failure to comply can result in hefty fines and damage to the company's reputation, further hindering market growth.

Market Competition

The generator rental market is highly competitive, with numerous players vying for market share. This intense competition can lead to price wars, reducing profit margins for the companies involved. Larger, established companies with extensive resources can often undercut prices, making it difficult for smaller businesses to compete. This competitive pressure can limit the profitability and sustainability of operations within the market.

Economic Dependence

The demand for generator rentals is closely tied to the economic performance of key sectors such as construction, mining, and oil and gas. Economic downturns in these sectors can lead to reduced demand for rental generators. For instance, during economic recessions, construction projects may be delayed or canceled, directly impacting the demand for temporary power solutions. This economic sensitivity makes the generator rental market vulnerable to fluctuations in these industries.

Technological Advancements

While technological advancements can drive market growth, they can also pose challenges. Companies must continuously update their rental fleets to include the latest technologies to remain competitive. This constant need for technological upgrades requires significant capital expenditure. Moreover, customers are increasingly demanding advanced features such as remote monitoring and control, which necessitate additional investments in technology and training.

Opportunity in the Generator Rental Market

Expanding Construction Industry

One significant opportunity in the generator rental market is the booming construction industry. Construction projects often require temporary power solutions, making generator rentals an attractive option. This is particularly evident in regions like North America and Asia-Pacific, where construction investments are surging. For example, the construction sector in these areas is expected to see substantial growth, which will, in turn, boost the demand for rental generators. The flexibility and cost-effectiveness of renting generators instead of purchasing them allow construction companies to manage their budgets better while ensuring they have reliable power sources.

Growing Energy Needs in Emerging Markets

Emerging markets, especially in Asia and Africa, present a significant opportunity for the generator rental market. As these regions experience rapid industrialization and urbanization, the demand for reliable power sources increases. However, infrastructure development in these areas can be slow, leading to frequent power outages. Rental generators provide a quick and efficient solution to bridge the gap between power demand and supply, ensuring continuous operations for industries and urban centers alike. This growing need for stable power in developing regions is a driving force behind the expansion of the generator rental market.

Data Center Expansion

The proliferation of data centers globally also offers a significant opportunity for the generator rental market. Data centers require a consistent and reliable power supply to ensure continuous operation and data integrity. Any power outage can lead to significant financial losses and operational disruptions. As more businesses shift towards cloud computing and data storage solutions, the construction of new data centers accelerates, increasing the demand for backup power solutions. Rental generators are ideal for this purpose, providing an immediate and reliable power source during outages or maintenance periods.

Oil and Gas Industry Growth

The oil and gas industry is another key sector driving the demand for rental generators. Operations in this industry often occur in remote locations where access to the grid is limited. Therefore, reliable power generation on-site is crucial for continuous drilling and extraction activities. Rental generators offer a flexible and cost-effective solution for these temporary power needs. Additionally, as the global energy demand continues to rise, the oil and gas industry is expanding, further driving the need for reliable and portable power solutions provided by rental generators.

Adoption of Sustainable Solutions

There is a growing trend towards sustainable and low-emission power solutions within the generator rental market. Companies are increasingly investing in eco-friendly generator technologies, such as those powered by hydrogen or hybrid systems. This shift is driven by stricter environmental regulations and the global push towards reducing carbon footprints. Rental companies that offer these greener options can tap into a market of environmentally conscious customers, opening new revenue streams and ensuring compliance with environmental standards.

Trends for the Generator Rental Market

Growing Demand in Construction

The construction industry is one of the primary drivers of the generator rental market. As urbanization and industrialization continue to rise globally, especially in regions like Asia-Pacific, the demand for construction projects is skyrocketing. Generators are crucial in construction sites to power heavy machinery like concrete mixers, air compressors, and welders, especially in areas with unstable power supplies. This increasing activity in the construction sector significantly boosts the demand for rental generators.

Increasing Use in the Oil and Gas Sector

The oil and gas industry is another major player in the generator rental market. Most oil and gas projects are located in remote areas with harsh environmental conditions, requiring high-capacity generators for drilling and excavation. These generators also serve as backup power sources in case of emergencies or power outages. With substantial investments expected in the oil and gas sector, the demand for rental generators is set to grow further.

Shift Towards Sustainable Power Sources

Environmental concerns and stricter regulations are pushing the generator rental market towards more sustainable options. There is a growing preference for natural gas generators over traditional diesel ones due to their lower emissions and higher efficiency. Natural gas generators are not only more environmentally friendly but also offer cost savings during operation, making them a popular choice in regions like North America where environmental policies are becoming more stringent.

Impact of Technological Advancements

Technological advancements are playing a significant role in shaping the generator rental market. Modern generators are more efficient, reliable, and capable of handling varying power loads, which makes them suitable for a wider range of applications. Innovations like hybrid generators, which combine renewable energy sources with traditional fuel-based systems, are gaining traction. These advancements are expected to drive market growth by offering more versatile and efficient power solutions.

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the generator rental market. The lack of stable grid infrastructure in these regions and frequent power outages drive the demand for reliable power solutions. Moreover, ongoing infrastructure projects in these regions further fuel the need for rental generators, providing a stable and consistent power supply for various applications.

Increasing Focus on Customer Service

Customer service and support are becoming critical factors in the generator rental market. Companies are focusing on offering comprehensive service packages that include installation, maintenance, and 24/7 support to enhance customer satisfaction and loyalty. This trend is particularly important as businesses seek reliable partners to ensure uninterrupted power supply, further driving the demand for rental generators .

Segments Covered in the Report

By Power Rating

o Below 100 kVA

o 100 kVA -500 kVA

o 501 kVA -1000 kVA

o Above 1000 kVA

o Other Power Rating

By Fuel Type

o Diesel

o Natural Gas

o Other Fuel Type

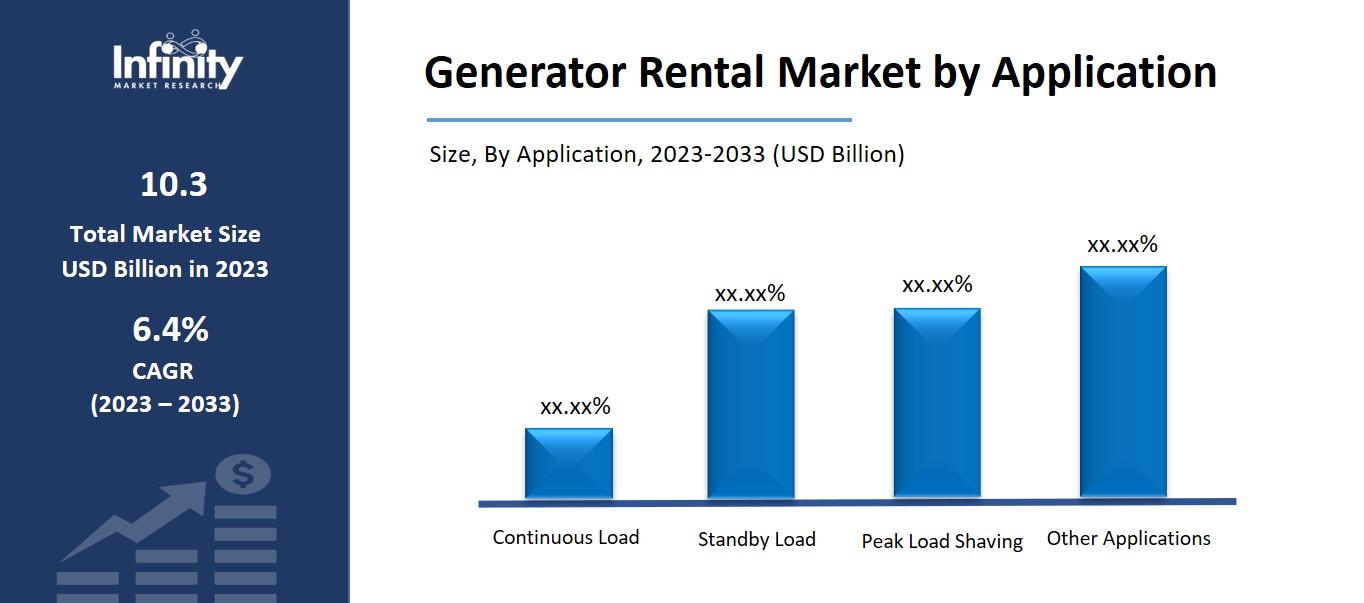

By Application

o Continuous Load

o Standby Load

o Peak Load Shaving

o Other Applications

By End-Use

o Utilities

o Oil & Gas

o Mining

o Construction

o Events

o Other End-Use

Segment Analysis

By Power Rating Analysis

The global Generator Rental Market is segmented into Up to 50 kW, 51-500 kW, 501-2500 kW, and Above 2500 kW. The 51-500 kW segment dominates, accounting for 59.8% of market revenue. The global generator rental market is anticipated to have the biggest revenue share in the 100-500 kW segment over the projected period, primarily due to increased demand from the construction and mining industries. These companies require a steady and continuous power supply for a range of operations, such as lighting, drilling, and excavation. Furthermore, throughout the projected period, the need for power backup during maintenance and repair work in factories and industrial plants is anticipated to propel the market revenue growth of this category.

Due to the utilities and energy sectors' rapid expansion, the 500 kW is anticipated to post the quickest revenue growth rate in the global generator rental market over the projection year. For these regions to continue supplying power to the grid continuously, substantial backup power is needed. The growing need for backup power in hospitals, data centers, and other important infrastructure locations is another reason propelling this segment's sales rise.

By Fuel Type Analysis

The diesel category held a 72.8% market share in 2023. The global generator rental market is divided into categories based on fuel type, such as natural gas, diesel, and others. With the biggest market share, the diesel category has become the dominating player in the generator rental industry. Diesel generators' popularity can be attributed to several factors, including their reputation for strength, longevity, and high power output, which makes them ideal for a variety of uses. They can supply steady electricity for long periods and are incredibly dependable. Compared to other fuel sources, diesel fuel is more generally accessible and available, guaranteeing a consistent supply for rental companies and end users.

Diesel generators are an affordable option for many companies and sectors due to their cost advantages in terms of fuel economy and maintenance needs. Additionally, because of their adaptability, diesel generators can be utilized in a variety of industries, such as manufacturing, events, emergency backup power, and construction. Although interest in alternative fuels like propane and natural gas is growing, the diesel category still holds a dominant market share because of its affordability, availability, and dependability.

By Application Analysis

In 2023, the continuous load segment accounted for the greatest proportion of the market, with about 34.8%. The global generator rental market is divided into three segments based on the application: peak load shaving, standby load, and continuous load. In the generator rental market, the continuous load category has the biggest market share.

There are multiple reasons for this. Applications with continuous loads, such as data centers, essential infrastructure, and medical institutions, need a steady supply of electricity. Their power demands may be reliably met by renting generators during both scheduled and unforeseen outages. Because these applications usually need to be used for extended periods and have large power requirements, continuous load rentals are crucial.

Furthermore, companies in this market place a high priority on the dependability and effectiveness of power solutions, and generator rentals provide tailored solutions to satisfy their unique needs. The continuous load segment's supremacy is due to its long-term usage, crucial power requirements, and the dependability that generator rentals offer.

By End-Use Analysis

The utilities sector held a dominant market share of around 32.2% in 2023. The global generator rental market is divided into utilities, oil & gas, mining, construction, events, and other categories according to the kind of end-use. With the biggest market share, the utilities sector has solidified its position as the industry leader in the generator rental business. This is mostly because of a few important factors: to guarantee their customers' constant access to electricity, utilities, such as power plants, and electric companies, need a dependable backup power source. A versatile and effective option is provided by generator rentals for scheduled maintenance, blackouts, or periods of high demand.

In areas with inadequate access to a reliable power grid, the utilities frequently operate in isolated or off-grid sites. In these situations, renting generators becomes essential to supplying these institutions with the electricity they require. In addition, the utility industry places a high priority on adhering to environmental rules, and rental businesses offer a selection of generators that satisfy emission limits and complement sustainability objectives. The utility sector, which places a high priority on environmental awareness and a steady supply of electricity, is still in charge of the generator rental business and is what propels its development.

Regional Analysis

Through a share of revenue of more than 54.5% in 2022, Asia-Pacific dominated the market. According to region, the generator rental industry's highest market share is found in Asia-Pacific. This dominance is the result of several factors, including the fast industrialization and urbanization of nations like China, India, and Southeast Asia, which have increased construction projects and raised demand for temporary power solutions.

Furthermore, the area is vulnerable to earthquakes, typhoons, and floods, which cause frequent power outages and necessitate the use of dependable backup power. Furthermore, Asia-Pacific is home to a thriving entertainment and events sector that primarily depends on transient power sources, such as athletic events, concerts, and festivals. The Asia-Pacific market is expanding due in part to rising awareness of and use of generator rental services as well as a strong emphasis on infrastructure development.

Competitive Analysis

The report provides an appropriate analysis of the major players in the global generator rental market, as well as a comparative assessment based on the companies' product offerings, business summaries, geographic reach, enterprise strategies, market share in specific segments, and SWOT analyses. A detailed analysis of the firms' recent events and developments—including product development, inventions, partnerships, joint ventures, mergers and acquisitions, strategic alliances, and other activities—is also included in the report. This makes it possible to assess the level of total market competition.

Recent Developments

In February 2023: The Cat XQ330 portable diesel generator set was introduced by Caterpillar and meets Tier 4 Final pollution criteria imposed by the US EPA. Both prime power and standby applications are intended for this new power solution. Caterpillar's latest product line demonstrates their commitment to providing sustainable solutions and satisfying client demands for consistent power generation across a range of applications.

Key Market Players in the Generator Rental Market

o Himoinsa S.L.

o Aggreko PLC

o AGCO Corporation

o APR Energy

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 10.3 Billion |

|

Market Size 2033 |

USD 19.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Power Rating, Fuel Type, Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Cummins Inc., Caterpillar Inc., Himoinsa S.L., AKSA Power Generation, Atlas Copco AB, Aggreko PLC, Kohler Co., United Rentals, Inc., AGCO Corporation, APR Energy, Other Key Players |

|

Key Market Opportunities |

Growing Energy Needs in Emerging Markets |

|

Key Market Dynamics |

Growing Adoption of Renewable Energy Sources |

📘 Frequently Asked Questions

1. What would be the forecast period in the Generator Rental Market?

Answer: The forecast period in the Generator Rental Market report is 2024-2033.

2. How much is the Generator Rental Market in 2023?

Answer: The Generator Rental Market size was valued at USD 10.3 Billion in 2023.

3. Who are the key players in the Generator Rental Market?

Answer: Cummins Inc., Caterpillar Inc., Himoinsa S.L., AKSA Power Generation, Atlas Copco AB, Aggreko PLC, Kohler Co., United Rentals, Inc., AGCO Corporation, APR Energy, Other Key Players

4. What is the growth rate of the Generator Rental Market?

Answer: Generator Rental Market is growing at a CAGR of 6.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.