🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Global High Power Transformers Market

Global High Power Transformers Market (By Cooling (Dry Type, Oil Immersed), By Voltage Rating (SPT (≤ 60 MVA), LPT (> 60 MVA)), By Application (Commercial, Industrial, Utility), By Region and Companies)

Aug 2024

Energy and Power

Pages: 136

ID: IMR1203

High Power Transformers Market Overview

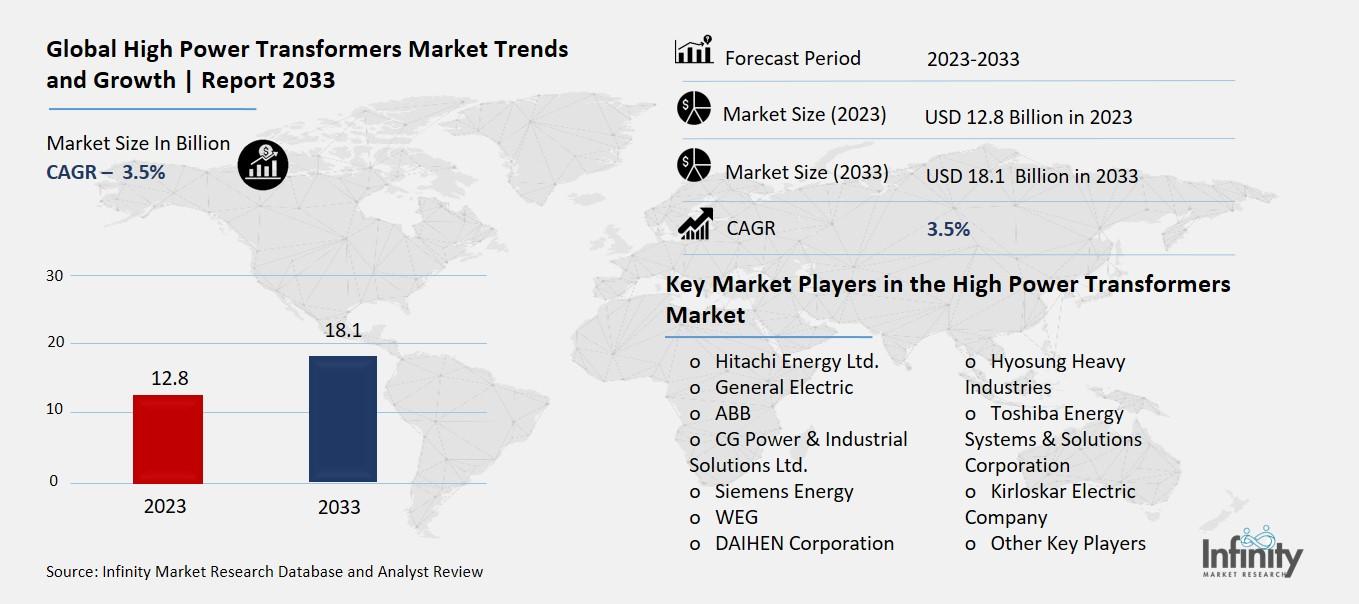

Global High Power Transformers Market size is expected to be worth around USD 18.1 Billion by 2033 from USD 12.8 Billion in 2023, growing at a CAGR of 3.5% during the forecast period from 2023 to 2033.

The High Power Transformers Market refers to the global industry focused on producing and selling high power transformers. These transformers are used to increase or decrease the voltage of electrical power in various settings, like power plants and industrial facilities. They are crucial for efficiently transmitting electricity over long distances and ensuring that it reaches homes, businesses, and factories safely and effectively.

In simpler terms, think of high power transformers as giant electrical adapters. Just like the small adapters you use to charge your phone, these big transformers adjust the voltage of electricity to the right level needed for different uses. The market for these transformers includes everything from designing and making them to selling and maintaining them. With the growing demand for electricity and the need to modernize old power grids, this market is becoming increasingly important.

Drivers for the High Power Transformers Market

Growing Demand for Electricity

One of the primary drivers for the high power transformers market is the increasing electricity demand. As populations grow and industrialization progresses, the need for a reliable and efficient power supply rises. High power transformers play a crucial role in transmitting electricity over long distances without significant losses. This growing demand is particularly evident in developing countries where rapid urbanization and infrastructure development are taking place. For instance, in 2022, global electricity generation saw a 2.3% increase, with significant contributions from countries like China. This surge in electricity generation fuels the need for high power transformers to manage and distribute power effectively.

Renewable Energy Integration

The integration of renewable energy sources into the power grid is another significant driver for the high power transformers market. With a global push towards reducing carbon emissions and transitioning to sustainable energy, renewable sources like wind and solar power are becoming more prominent. High power transformers are essential for integrating these variable renewable energy sources into the existing power grid, ensuring stability and reliability. Governments worldwide are investing in renewable energy projects and grid modernization, further propelling the demand for high power transformers.

Technological Advancements

Technological advancements in transformer design and manufacturing are also driving market growth. Innovations such as smart transformers and digital substations are enhancing the efficiency and reliability of power transmission and distribution systems. These advanced transformers can monitor and respond to changes in power demand and supply, improving overall grid management. As the energy sector continues to evolve with these technological advancements, the demand for high power transformers that incorporate these new technologies is expected to rise.

Infrastructure Development

Substantial infrastructure development, particularly in emerging economies, is a key driver for the high power transformers market. Developing countries are investing heavily in building and upgrading their electrical infrastructure to support economic growth and improve the quality of life for their populations. High power transformers are integral to these infrastructure projects, enabling the efficient transmission and distribution of electricity across vast regions. As countries continue to develop their infrastructure, the demand for high power transformers will likely increase.

Electrification of Transportation

The electrification of transportation systems is another significant factor driving the high power transformers market. As electric vehicles (EVs) become more popular, there is a growing need for charging infrastructure and the integration of EVs into the power grid. High power transformers are necessary to handle the increased load and ensure a stable power supply for EV charging stations. This trend towards electrified transportation is expected to continue, boosting the demand for high power transformers.

Government Initiatives

Government initiatives aimed at enhancing energy access and reliability are also propelling the high power transformers market. Many governments are implementing policies and programs to improve electricity access in rural and underserved areas, requiring substantial investments in power infrastructure, including high power transformers. For example, the Indian government's efforts to increase electricity production and support renewable energy projects are driving the demand for high power transformers. Such initiatives are crucial in supporting the growth and expansion of the high power transformers market.

Restraints for the High Power Transformers Market

Volatile Raw Material Prices

One of the major challenges for the high power transformers market is the instability in raw material prices. High power transformers rely heavily on materials like steel, copper, and crude oil, all of which have seen significant price fluctuations. This volatility makes it difficult for manufacturers to predict costs and maintain stable product pricing. Additionally, the cost variations among manufacturers due to market conditions and production capabilities further complicate pricing strategies, making it hard for companies to sustain profitability.

Regulatory and Compliance Challenges

Stringent government regulations and compliance requirements also significantly restrain the high power transformers market. Environmental regulations to reduce emissions and enhance energy efficiency necessitate constant upgrades and innovations, which can be costly and time-consuming. Compliance with these regulations often requires significant investment in research and development, as well as in updating manufacturing processes to meet new standards. This can strain resources and affect the overall growth of the market.

Supply Chain Disruptions

The supply chain for high power transformers is complex and can be easily disrupted by various factors. Natural disasters, geopolitical tensions, and economic instability can all impact the availability and cost of raw materials and components. The COVID-19 pandemic, for instance, highlighted the vulnerabilities in global supply chains, causing delays and shortages that affected production timelines and costs. These disruptions make it challenging for manufacturers to ensure timely delivery and maintain the quality of their products.

Technological and Infrastructure Barriers

Technological advancements and infrastructure limitations can also hinder the growth of the high power transformers market. The integration of advanced technologies requires substantial capital investment and skilled labor, which may not be readily available in all regions. Additionally, existing infrastructure in many areas is outdated and not equipped to handle modern high power transformers, necessitating significant upgrades and investments. This can slow down the adoption of new technologies and impede market expansion.

Competition and Market Saturation

The high power transformers market is highly competitive, with numerous players vying for market share. This intense competition can lead to price wars and reduced profit margins. Moreover, in some regions, the market is reaching saturation, making it harder for companies to find new growth opportunities. Established players with strong market presence and brand loyalty pose a significant challenge to new entrants trying to establish themselves in the market.

Opportunity in the High Power Transformers Market

Growing Demand for Renewable Energy Integration

One of the significant opportunities in the high power transformers market lies in the integration of renewable energy sources. As countries strive to meet their renewable energy targets and reduce carbon emissions, the need for high power transformers to connect renewable energy plants to the grid is increasing. This trend is particularly strong in regions like Europe and North America, where governments are pushing for higher adoption of wind, solar, and hydroelectric power. The transition to cleaner energy sources requires advanced transformers capable of handling variable power loads and ensuring stable grid operation.

Modernization of Electrical Grids

The modernization of electrical grids presents another substantial opportunity for the high power transformers market. Aging infrastructure in many developed countries is being upgraded to enhance reliability, efficiency, and resilience against outages. This involves replacing old transformers with new, technologically advanced ones that can support smart grid applications. Smart grids use digital technology to manage electricity demand and supply more effectively, necessitating the deployment of high power transformers with advanced monitoring and control capabilities.

Expansion in Emerging Economies

Emerging economies, particularly in Asia-Pacific and Africa, are experiencing rapid urbanization and industrialization, leading to increased electricity demand. Governments in these regions are investing heavily in expanding their power infrastructure to support economic growth. High power transformers are crucial for transmitting electricity over long distances from power plants to urban centers and industrial hubs. Countries like India and China are focusing on expanding their transmission networks, creating a robust demand for high power transformers.

Electrification of Transportation

The electrification of transportation, including electric vehicles (EVs) and electric public transit systems, is driving the demand for high power transformers. Charging infrastructure for EVs requires reliable and efficient transformers to handle high power loads. Additionally, electrified railways and other public transportation systems need robust transformers to ensure smooth and efficient operation. As the adoption of electric transportation grows, so does the need for supporting electrical infrastructure, presenting a significant opportunity for the high power transformers market.

Technological Advancements

Technological advancements in transformer design and materials offer opportunities for market growth. Innovations such as the development of smart transformers, which can provide real-time data on performance and health, and the use of advanced materials that improve efficiency and reduce losses, are driving the market forward. These advancements not only enhance the performance and lifespan of transformers but also make them more attractive to utilities and industries looking to optimize their operations.

Government Initiatives and Policies

Supportive government initiatives and policies aimed at improving energy infrastructure and increasing access to electricity are creating opportunities for the high power transformers market. Programs focused on rural electrification, energy efficiency, and the adoption of renewable energy sources often include funding and incentives for upgrading or expanding power transmission networks. These initiatives are particularly impactful in regions with underdeveloped power infrastructure, where the need for new high power transformers is critical to achieving energy access goals.

Trends for the High Power Transformers Market

Growth in Renewable Energy Integration

One of the major trends driving the high power transformers market is the increasing integration of renewable energy sources into the power grid. Countries around the world are investing heavily in renewable energy projects such as wind and solar farms. This surge is creating a demand for high power transformers that can handle the variable output from these renewable sources and integrate it efficiently into the existing power grids. The push towards a greener, more sustainable energy future is expected to sustain this trend over the coming years.

Modernization of Aging Infrastructure

A significant trend in the high power transformers market is the modernization of aging electrical infrastructure. Many regions, particularly in North America and Europe, have power grids that are decades old. The United States, for instance, has allocated substantial funds to upgrade its electric grid to improve reliability and efficiency. This modernization involves replacing old transformers with newer, more efficient models, driving demand in the market.

Technological Advancements

Technological advancements are also playing a crucial role in shaping the high power transformers market. Innovations such as smart transformers, which provide real-time data and enhanced control over the power distribution process, are gaining traction. These advanced transformers help reduce energy losses and improve the reliability of the power supply, making them highly desirable in modern power grids.

Increasing Industrialization and Urbanization

Rapid industrialization and urbanization, especially in emerging economies like China and India, are significantly impacting the high power transformers market. These regions are witnessing a surge in demand for electricity to support growing industrial activities and urban populations. This trend is leading to increased investments in power generation and distribution infrastructure, including high power transformers.

Focus on Energy Efficiency

There is a growing emphasis on energy efficiency across the globe. Governments and organizations are implementing policies and initiatives aimed at reducing energy consumption and minimizing losses in power transmission. High power transformers that offer improved efficiency and lower energy losses are in high demand as part of these efforts to create more sustainable and efficient power systems.

Regional Market Dynamics

Different regions are experiencing unique trends in the high power transformers market. For instance, the Asia-Pacific region is dominating due to rapid urbanization and infrastructure development. In contrast, North America focuses on upgrading its aging infrastructure, and Europe is investing heavily in integrating renewable energy sources. Understanding these regional dynamics is crucial for stakeholders looking to capitalize on market opportunities.

Segments Covered in the Report

By Cooling

o Dry Type

o Oil Immersed

By Voltage Rating

o SPT (≤ 60 MVA)

o LPT (> 60 MVA)

By Application

o Commercial

o Industrial

o Utility

Segment Analysis

By Cooling Analysis

The worldwide high-power transformers market is segmented by cooling method, which comprises dry type and oil immersion. The dry-type segment dominated the market. Dust and moisture are two frequent external contaminants that dry-type transformers are often more resistant to. As a result, they can be put in areas with extreme weather or unfriendly conditions. In general, dry-type transformers require less maintenance than oil-immersed transformers. When there is no liquid coolant, maintenance is easier and requires fewer routine tests.

During the forecast period, the oil-immersed sector is predicted to develop at the quickest rate in the high-power transformers market. Oil-immersed cooling is best suited for high-power applications that require extensive heat dissipation. High-power transformers can benefit from oil's effective heat-absorbing and heat-transfer properties.

By Voltage Rating Analysis

The High Power Transformers Market is divided into two segments depending on voltage rating: SPT (≤60 MVA) and LPT (>60 MVA). The LPT (> 60 MVA) category has the highest market share. Transformers designed for high-voltage applications are likely to have a voltage rating of more than 60 MVA. The voltage rating shows the highest voltage that the transformer can safely handle. High-voltage transmission networks rely largely on transformers.

Over the projected period, the high power transformers market's SPT (≤ 60 MVA) segment is expected to develop the fastest. Industrial locations requiring moderate power and voltage levels to support manufacturing activities may benefit from high-power transformers with SPT and a voltage rating of 60 MVA or less.

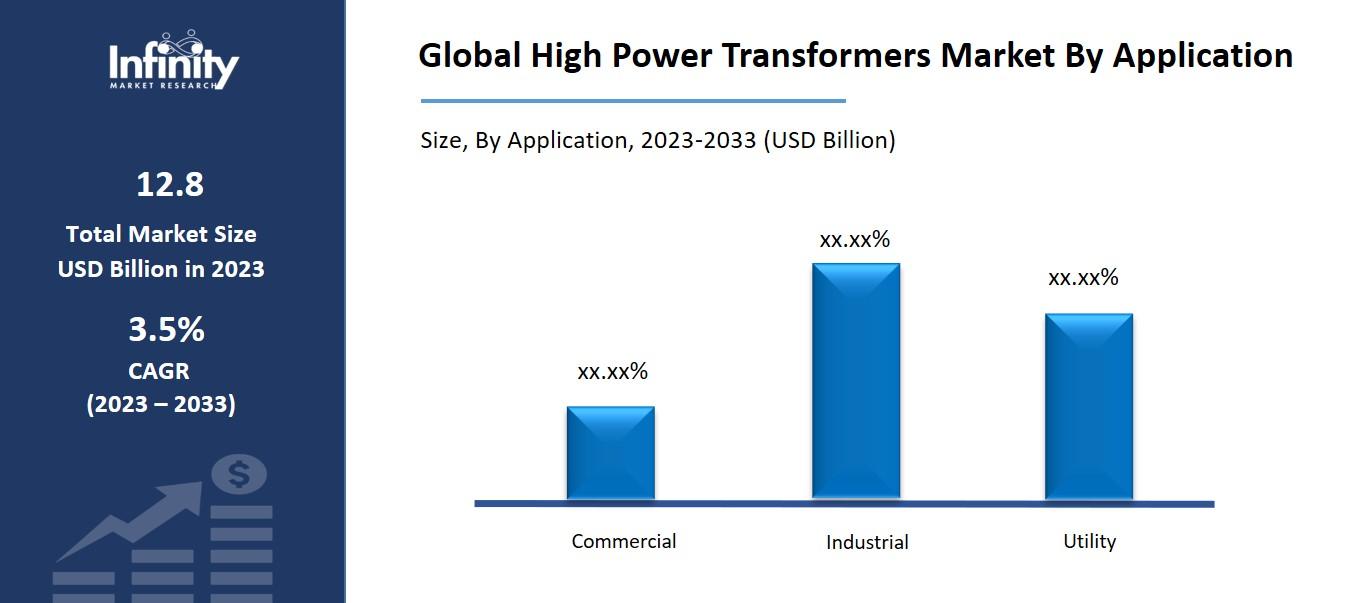

By Application Analysis

The High Power Transformers Market is divided into three segments: commercial, industrial, and utility. The utility segment dominates the market. High-power transformers can be added to or replaced by older transformers, allowing utilities to better handle rising electrical demand while improving the grid's total capacity. High-power transformers contribute to grid stability by providing a steady power supply and managing voltage levels. Their dependability is critical to ensuring the power grid's stability.

The industrial segment of the high-power transformers market is expected to develop at the quickest rate during the forecast period. High-power transformers enable dependable and efficient power supply for large manufacturing and industrial sites. High power levels are frequently required in industries with heavy machinery and equipment. Transformers can alter the voltage to meet the demands of industrial equipment.

Regional Analysis

The North American high-power transformer market will dominate this industry. Significant investments have been made in North America to upgrade and extend energy infrastructure, particularly in the United States and Canada. High-power transformer installation meets rising energy demands while modernizing power infrastructure.

Europe has the second-largest market share for high-power transformers due to its leadership in the transition to renewable energy sources. When more wind, solar, and other renewable energy sources are integrated into the power grid, high-power transformers are required to control energy production swings. Furthermore, the German high-power transformers market had the highest market share, while the UK high-power transformers market was the fastest-growing in the European region.

The Asia-Pacific High Power Transformers Market is estimated to expand at the quickest CAGR between 2023 and 2033. This is because the Asia Pacific region is seeing a major rise in investment in power generation capacity. High-power transformers are critical for ensuring reliable power transmission and connecting new power plants to the grid. Furthermore, China's high-power transformers market had the highest market share, while India's high-power transformers market was the fastest-growing in the Asia-Pacific region.

Competitive Analysis

The High Power Transformers market continues to increase as leading companies invest extensively in R&D to broaden their product offerings. Market companies are also involved in several strategic initiatives aimed at strengthening their worldwide reach. Manufacturing locally to cut operational costs is one of the most common business strategies used by manufacturers in the global High Power Transformers industry to assist customers and expand the market sector.

Recent Developments

March 2023: General Electric said that it will invest more than USD 450 million in its existing US manufacturing facilities. In addition to improving the company and its American employees, the investment will include the acquisition of cutting-edge machinery and the implementation of adjustments. This will aid the company's efforts to establish two distinct, market-leading enterprises in the energy and aerospace sectors. It will also broaden the company's energy offerings, which now include generators, turbines, and transformers.

October 2022: Hitachi Energy has signed a contract with NTPC REL to deliver power transformers for their upcoming 4.75 GW renewable energy project in Gujarat, India. This vast 72,600-hectare solar park in Kutch, India, is part of the country's largest solar park project and would significantly improve its renewable energy potential while also helping its goal of becoming carbon neutral by 2020. The agreement between Hitachi Energy and NTPC REL will help India meet its objective of adopting renewable energy by 2030.

Key Market Players in the High Power Transformers Market

o Hitachi Energy Ltd.

o General Electric

o ABB

o CG Power & Industrial Solutions Ltd.

o WEG

o DAIHEN Corporation

o Toshiba Energy Systems & Solutions Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 12.8 Billion |

|

Market Size 2033 |

USD 18.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Cooling, Voltage Rating, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Hitachi Energy Ltd., General Electric, ABB, CG Power & Industrial Solutions Ltd., Siemens Energy, WEG, DAIHEN Corporation, Hyosung Heavy Industries, Toshiba Energy Systems & Solutions Corporation, Kirloskar Electric Company, Other Key Players |

|

Key Market Opportunities |

Modernization of Electrical Grids |

|

Key Market Dynamics |

Growing Demand for Electricity |

📘 Frequently Asked Questions

1. How much is the High Power Transformers Market in 2023?

Answer: The High Power Transformers Market size was valued at USD 12.8 Billion in 2023.

2. What would be the forecast period in the High Power Transformers Market?

Answer: The forecast period in the High Power Transformers Market report is 2023-2033.

3. Who are the key players in the High Power Transformers Market?

Answer: Hitachi Energy Ltd., General Electric, ABB, CG Power & Industrial Solutions Ltd., Siemens Energy, WEG, DAIHEN Corporation, Hyosung Heavy Industries, Toshiba Energy Systems & Solutions Corporation, Kirloskar Electric Company, Other Key Players

4. What is the growth rate of the High Power Transformers Market?

Answer: High Power Transformers Market is growing at a CAGR of 3.5% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.