🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Gold Mining Market

Gold Mining Market (By Mining Method (Placer Mining, Hardrock Mining, Other Mining Methods), By End User (Investment, Jewelry, Other End Users), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 128

ID: IMR1151

Gold Mining Market Overview

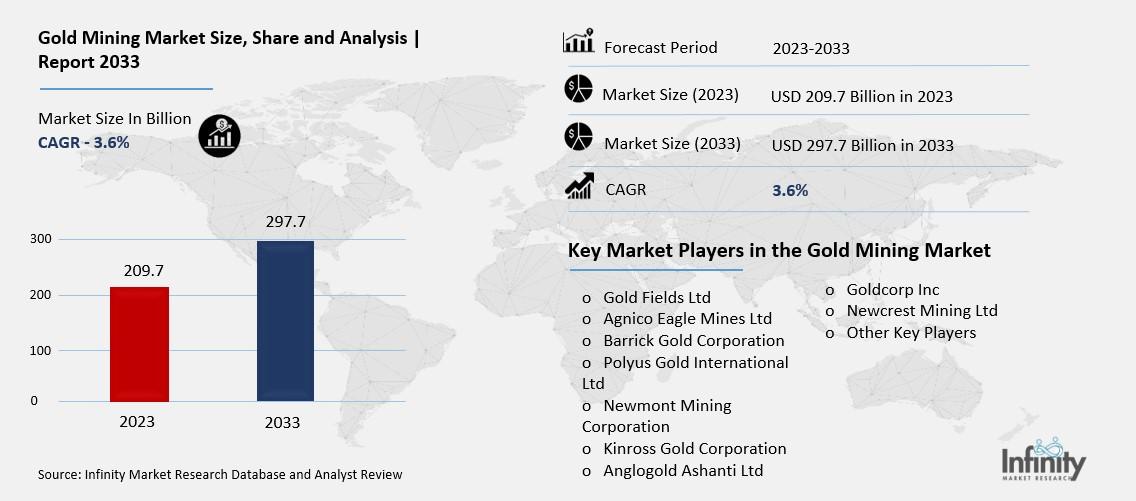

Global Gold Mining Market size is expected to be worth around USD 297.7 Billion by 2033 from USD 209.7 Billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2023 to 2033.

The gold mining market refers to the industry involved in the extraction and processing of gold from the earth. This market includes all activities related to the discovery, mining, and selling of gold. Companies in this market explore areas for gold deposits, mine the gold, and then refine it into a pure form before selling it to buyers. Gold mining can take place in large open-pit mines, underground mines, and even in rivers and streams where gold particles can be panned out.

The gold mining market is crucial because gold is a valuable commodity used in various applications, such as jewelry, electronics, and as an investment. The price of gold can be influenced by many factors, including economic conditions, currency values, and demand for gold in different industries. This market is also known for its impact on the environment and local communities, often leading to discussions about sustainable and responsible mining practices.

Drivers for the Gold Mining Market

Rising Gold Prices

One of the main drivers for the gold mining market is the rising price of gold. Gold prices have seen a significant increase over the past few years due to various factors, including economic uncertainty, geopolitical tensions, and inflation fears. As gold is considered a safe-haven asset, investors flock to it during times of economic instability, driving up demand and prices. Higher gold prices make gold mining more profitable, encouraging companies to increase production and explore new mining projects.

Economic Growth in Developing Countries

Economic growth in developing countries is contributing to the increased demand for gold. As disposable incomes rise, more people can afford to invest in gold, both as a luxury item and as a financial asset. Countries like India, China, and other emerging economies are seeing a growing middle class with higher purchasing power, which drives the demand for gold and supports the mining industry. Additionally, central banks in these countries are also increasing their gold reserves, further boosting the market.

Restraints for the Gold Mining Market

Environmental Regulations Impacting Operations

Gold mining operations face stringent environmental regulations globally. These regulations are designed to minimize the ecological footprint of mining activities, including water and air pollution, deforestation, and habitat destruction. Compliance with these regulations often requires substantial investments in technology and processes to mitigate environmental impacts. Companies must navigate complex permitting processes and adhere to strict guidelines, which can increase operational costs and timelines.

Challenges in Securing Investment

Securing investment for gold mining projects can be challenging due to various factors. Economic uncertainties, fluctuating gold prices, and geopolitical risks can deter investors from committing to long-term mining ventures. Additionally, the high capital intensity of mining operations requires significant upfront investment in exploration, infrastructure development, and equipment acquisition. Volatile market conditions and regulatory uncertainties further complicate the investment landscape, leading to cautious investor sentiment.

Opportunity in the Gold Mining Market

Increasing Demand for Safe Haven Assets

The gold mining market presents significant opportunities driven by the increasing global demand for safe-haven assets. Gold has long been valued as a hedge against economic uncertainties, inflationary pressures, and geopolitical risks. In times of market volatility or economic downturns, investors turn to gold as a stable store of value, driving up demand. This sustained demand provides a stable revenue stream for gold mining companies, particularly during periods of market turbulence.

Technological Advancements in Mining Operations

Advancements in mining technology offer opportunities to enhance operational efficiency, reduce costs, and improve resource recovery rates in the gold mining sector. Innovations such as autonomous mining equipment, real-time data analytics, and advanced processing techniques enable more precise exploration and extraction of gold deposits. These technologies not only increase productivity but also contribute to sustainable mining practices by minimizing environmental impacts and optimizing resource utilization.

Trends for the Gold Mining Market

Shift Towards Sustainable Mining Practices

There is a noticeable trend towards sustainable mining practices in the gold mining industry. Companies are increasingly focusing on reducing their environmental footprint through initiatives such as energy-efficient operations, water conservation, and reclamation of mined lands. Stakeholders, including investors and regulatory bodies, are placing greater emphasis on environmental and social governance (ESG) criteria, influencing corporate strategies. Adopting sustainable practices not only enhances operational efficiency but also improves stakeholder relations and mitigates regulatory risks.

Integration of Advanced Technologies

The integration of advanced technologies is transforming the gold mining sector, enhancing efficiency, safety, and resource recovery rates. Automation and robotics are revolutionizing mining operations by enabling remote operation of equipment and real-time monitoring of processes. Furthermore, artificial intelligence (AI) and machine learning algorithms are being leveraged to analyze geological data, optimize drilling patterns, and predict equipment maintenance needs. These technologies improve decision-making, reduce operational costs, and increase the accuracy of resource estimation.

Segments Covered in the Report

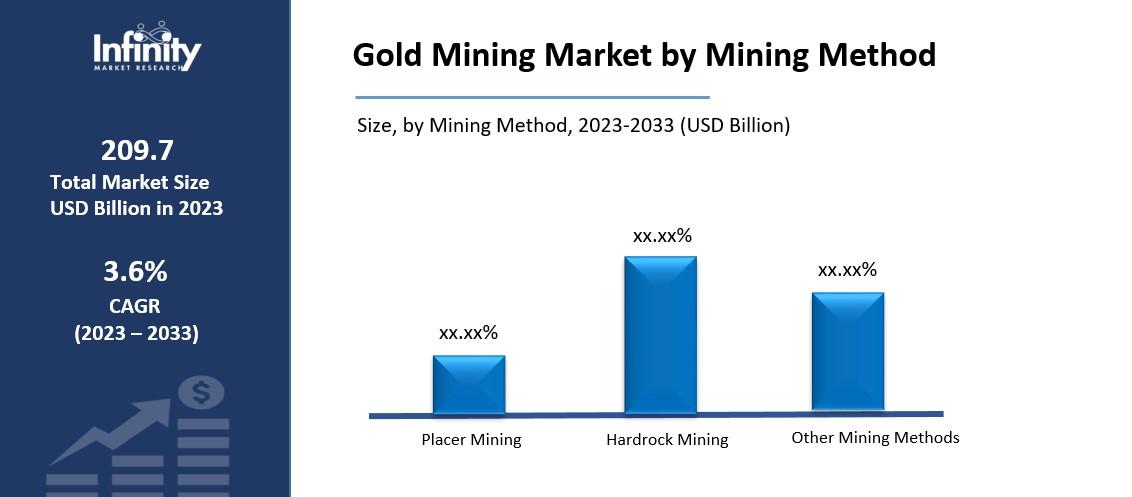

By Mining Method

o Placer Mining

o Hardrock Mining

o Other Mining Methods

By End User

o Investment

o Jewelry

o Other End Users

Segment Analysis

By Mining Method

Placer mining and hard rock mining are the two segments of the global market that differ in terms of the mining technique. Throughout the projected period, the placer mining segment is anticipated to lead the market. One of the traditional methods of mining gold is to remove it from alluvial deposits of sand, gravel, and silt that are located in or near waterways like rivers and streams.

This method of gold mining has been around for centuries and is well known for its simplicity and little environmental impact, especially when compared to some other methods. Hardrock mining, on the other hand, is anticipated to expand dramatically over the projection period. Another well-liked technique for extracting gold is hard rock mining, sometimes referred to as lode mining or underground mining. Hard rock mining is the process of extracting gold from solid rock formations as opposed to placer mining, which concentrates on alluvial deposits.

Although more complicated and capital-intensive processes are needed for this method, better grades of gold can be produced. Usually, hard rock mining operations have a longer mine life than placer mining, which focuses on deposits that are close or on the surface. For a considerable amount of time, this longevity can offer communities a reliable source of income and employment. therefore, propelling the expansion of the segment.

By End User

The global gold mining sector is divided into investment, jewelry, and other categories based on the end user. Throughout the projection period, the jewelry category is anticipated to hold a sizable market share. The increasing global use of gold is the reason for the segment's growth. Gold is a popular choice for jewelry due to its natural beauty, durability, and malleability. It is common practice to alloy gold with other metals, such as silver, copper, or palladium, to make several types of gold, such as rose, white, and yellow gold. As a result, during the projected period, this is anticipated to propel market expansion.

Regional Analysis

The market is anticipated to be dominated by Asia Pacific over the forecast period. Throughout the forecast period, the Asia Pacific region is anticipated to lead the worldwide gold mining market. The region's market is expanding as a result of the growing demand for gold from developing nations like China, India, and Japan. Furthermore, it is anticipated that greater investments from multinational companies would promote regional development. The top producers of gold in the region include China, Australia, Russia, and a few more nations.

Competitive Analysis

Prominent industry participants are making significant R&D investments to broaden their product offerings, hence contributing to the further expansion of the Gold Mining market. In order to increase their market share, market players are also engaging in a range of calculated strategic actions. Notable developments in this regard include the introduction of new products, contracts, mergers and acquisitions, increased investment, and cooperation with other businesses. In order to grow and thrive in an increasingly competitive and developing market, the gold mining sector needs to provide affordable products.

Recent Developments

In May 2023: In the biggest transaction in the history of the industry, Newmont Mining Corporation, the largest gold miner in the world, paid USD 19.2 billion to acquire Australian rival Newcrest Mining Ltd. In line with the same, Newcrest paid the deal through an Australian arrangement, giving its shareholders 0.4 Newmont shares for every Newcrest share as well as a special dividend of USD 1.10 per share.

In January 2022: For a cash payment of USD 470 million on a fully diluted, in-the-money basis, Golden Star Resources Ltd. was purchased by Chifeng Jilong Gold Mining Co., Ltd., its subsidiary Chijin International (Hong Kong) Limited, and Chijin's assignee Kefei Investment (BVI) Limited.

Key Market Players in the Gold Mining Market

o Barrick Gold Corporation

o Polyus Gold International Ltd

o Kinross Gold Corporation

o Anglogold Ashanti Ltd

o Goldcorp Inc

o Newcrest Mining Ltd

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 209.7 Billion |

|

Market Size 2033 |

USD 297.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Mining Method, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Gold Fields Ltd, Agnico Eagle Mines Ltd, Barrick Gold Corporation, Polyus Gold International Ltd, Newmont Mining Corporation, Kinross Gold Corporation, AngloGold Ashanti Ltd, Goldcorp Inc, Newcrest Mining Ltd, Other Key Players |

|

Key Market Opportunities |

Increasing Demand for Safe Haven Assets |

|

Key Market Dynamics |

Growing Demand for Gold Jewelry |

📘 Frequently Asked Questions

1. Who are the key players in the Gold Mining Market?

Answer: Gold Fields Ltd, Agnico Eagle Mines Ltd, Barrick Gold Corporation, Polyus Gold International Ltd, Newmont Mining Corporation, Kinross Gold Corporation, AngloGold Ashanti Ltd, Goldcorp Inc, Newcrest Mining Ltd, Other Key Players

2. How much is the Gold Mining Market in 2023?

Answer: The Gold Mining Market size was valued at USD 209.7 Billion in 2023.

3. What would be the forecast period in the Gold Mining Market?

Answer: The forecast period in the Gold Mining Market report is 2023-2033.

4. What is the growth rate of the Gold Mining Market?

Answer: Gold Mining Market is growing at a CAGR of 3.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.