🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Green Building Market

Green Building Market (By Product Type (Exterior Products, Interior Products, Building Systems, Solar Products, Others), By End-User (Residential, Commercial, Industrial, Others), By Region and Companies)

Jul 2024

Building and Construction

Pages: 190

ID: IMR1172

Green Building Market Overview

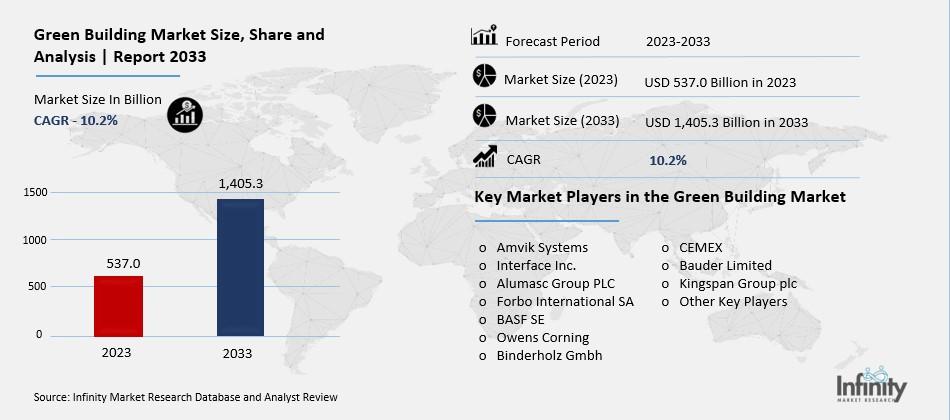

Global Green Building Market size is expected to be worth around USD 1,405.3 Billion by 2033 from USD 537.0 Billion in 2023, growing at a CAGR of 10.2% during the forecast period from 2023 to 2033.

The Green Building Market refers to the industry focused on constructing and renovating buildings in an environmentally friendly way. This includes using sustainable materials, reducing waste, conserving water, and ensuring energy efficiency. Green buildings are designed to have a lower impact on the environment and to provide healthier living and working spaces for people.

This market is growing because more people and companies are becoming aware of the importance of protecting the environment and saving resources. Governments are also encouraging green building practices through regulations and incentives. As a result, there is increasing demand for eco-friendly construction materials, energy-efficient appliances, and technologies that make buildings more sustainable. This shift not only helps the planet but also often leads to long-term cost savings for building owners through reduced energy and maintenance costs.

Drivers for the Green Building Market

Growing Environmental Awareness

One of the main drivers for the green building market is the increasing awareness of environmental issues. People are becoming more conscious of their impact on the planet, and this awareness translates into a demand for sustainable and eco-friendly buildings. Green buildings use materials and techniques that reduce the environmental footprint, making them a preferred choice for environmentally responsible individuals and organizations.

Government Regulations and Incentives

Governments around the world are implementing regulations and offering incentives to promote green building practices. These measures include tax benefits, subsidies, and stricter building codes aimed at reducing energy consumption and carbon emissions. Such regulatory frameworks encourage developers and property owners to adopt green building practices to comply with the law and take advantage of financial benefits.

Cost Savings and Energy Efficiency

Green buildings are designed to be energy-efficient, which leads to significant cost savings in the long run. Features such as solar panels, energy-efficient windows, and advanced insulation reduce the need for artificial heating and cooling, cutting down utility bills. This financial advantage makes green buildings attractive to both residential and commercial property owners looking to reduce operating costs.

Health and Well-being Benefits

Green buildings prioritize the health and well-being of their occupants. They incorporate design elements that improve indoor air quality, natural lighting, and ventilation. Using non-toxic materials also reduces exposure to harmful chemicals, creating a healthier living and working environment. This focus on well-being is a major draw for people seeking a healthier lifestyle and for businesses aiming to enhance employee productivity and satisfaction.

Technological Advancements

Technological advancements play a crucial role in driving the green building market. Innovations in building materials, such as recycled and sustainable options, and smart building technologies that optimize energy use, are continuously emerging. These advancements make it easier and more cost-effective to construct green buildings, encouraging more developers to adopt these practices.

Market Demand and Competitive Advantage

The demand for green buildings is steadily increasing, driven by the rising awareness of their benefits. Green buildings often command higher market values and are seen as a symbol of sustainability and innovation. Businesses adopting green building practices gain a competitive edge by attracting environmentally conscious customers and enhancing their corporate image. This market demand is a significant driver, pushing more companies to invest in green building projects to stay competitive and relevant.

Restraints for the Green Building Market

High Initial Costs

One of the biggest challenges for the green building market is the high initial costs associated with sustainable construction. Materials and technologies used in green buildings, such as energy-efficient windows, insulation, and renewable energy systems, are often more expensive than traditional building materials. This increased upfront cost can be a significant barrier for developers and builders, especially in regions where financial incentives or subsidies are not available. The higher initial investment can deter potential adopters, slowing the market growth despite the long-term cost savings on energy and maintenance.

Lack of Awareness and Expertise

Another major restraint is the lack of awareness and expertise among builders, architects, and consumers. Many stakeholders are not fully informed about the benefits and methods of green building practices. Additionally, there is a shortage of trained professionals who specialize in sustainable construction techniques. This gap in knowledge and skills can lead to suboptimal implementation of green building projects, reducing their effectiveness and appeal. Efforts to educate and train industry professionals and the public are crucial to overcoming this barrier and fostering more widespread adoption of green building practices.

Regulatory and Certification Challenges

Green building projects often face regulatory and certification challenges. Navigating the complex landscape of environmental regulations, building codes, and certification processes, such as LEED or BREEAM, can be daunting and time-consuming. These processes require thorough documentation and compliance with stringent standards, which can delay projects and increase administrative burdens. Moreover, inconsistencies in regulations across different regions can create confusion and hinder the progress of green building initiatives.

Market Fragmentation

The green building market is highly fragmented, with numerous small and medium-sized enterprises (SMEs) involved. This fragmentation can lead to inefficiencies and a lack of standardized practices across the industry. SMEs often struggle to compete with larger companies that have more resources and better access to advanced technologies and materials. The lack of collaboration and standardization can hinder the market's overall growth and the adoption of green building practices on a larger scale.

Economic Factors

Economic downturns and fluctuations can also impact the green building market. During periods of economic instability, investment in new construction projects typically decreases, affecting both conventional and green buildings. When budgets are tight, developers may prioritize cost-saving measures and delay or cancel green building projects, which are perceived as having higher initial costs. Economic factors, therefore, play a significant role in the adoption and proliferation of green building practices, influencing the market's growth trajectory.

Opportunity in the Green Building Market

Increasing Environmental Awareness

One of the primary drivers of opportunity in the green building market is the rising environmental consciousness among consumers and businesses. People are becoming more aware of the impact of buildings on the environment, leading to a higher demand for sustainable construction practices. This trend is supported by governmental policies and regulations that encourage or mandate green building standards, such as LEED certification in the United States.

Economic Benefits

Green buildings offer significant economic advantages, including lower operating costs due to energy efficiency and reduced water usage. These savings make green buildings attractive to investors and developers looking for long-term returns. Additionally, green buildings often have higher property values and occupancy rates, providing further financial incentives for adopting sustainable practices.

Technological Advancements

The integration of advanced technologies in construction and building management is another key opportunity. Innovations such as smart building systems, renewable energy integration, and energy-efficient materials are transforming the industry. These technologies not only enhance the performance of green buildings but also make them more cost-effective to construct and operate. Companies are investing in research and development to create new materials and methods that further reduce the environmental footprint of buildings.

Health and Well-being

Green buildings are designed to improve indoor environmental quality, which positively impacts the health and well-being of occupants. Features such as better air quality, natural lighting, and the use of non-toxic materials contribute to healthier living and working environments. This aspect is increasingly important to consumers, particularly in the wake of the COVID-19 pandemic, which has heightened awareness of indoor health issues.

Government Support and Incentives

Governments worldwide are offering various incentives to promote green building practices. These include tax credits, grants, and subsidies for adopting energy-efficient technologies and materials. Such support helps offset the initial costs of green building projects, making them more financially viable for developers and builders. The growing number of government initiatives aimed at reducing carbon emissions and promoting sustainable development is a significant boost for the market.

Market Expansion in Emerging Regions

Emerging markets, particularly in the Asia-Pacific region, are seeing rapid growth in the green building sector. Countries like China and India are investing heavily in sustainable infrastructure to address environmental challenges and meet international climate commitments. The adoption of green building practices in these regions presents a substantial growth opportunity, as they continue to urbanize and develop their construction industries.

Trends for the Green Building Market

Integration of Renewable Energy Systems

One of the major trends in the green building market is the growing integration of renewable energy systems. Solar panels, wind turbines, and geothermal energy systems are becoming standard features in green buildings. These systems not only help in reducing reliance on non-renewable energy sources but also significantly cut down on carbon emissions. By generating their energy, buildings are becoming more self-sufficient and environmentally friendly.

Preference for Sustainable and Locally Sourced Materials

The use of sustainable materials is another key trend. Green buildings increasingly utilize materials like bamboo, recycled steel, and reclaimed wood, which have a lower environmental impact compared to traditional materials. Additionally, there is a strong preference for locally sourced materials as they reduce transportation emissions and support the local economy. This shift helps in minimizing the overall carbon footprint of construction projects.

Adoption of Smart Technology

Smart technology is playing a crucial role in enhancing the efficiency of green buildings. Automated systems for lighting, heating, and cooling can adjust based on occupancy and weather conditions, significantly reducing energy consumption. Smart meters and real-time energy monitoring allow building managers to identify inefficiencies and optimize energy use, leading to better sustainability and cost savings.

Focus on Water Conservation

Water conservation is a critical aspect of green building design. Buildings are now equipped with advanced plumbing systems, low-flow fixtures, and rainwater harvesting setups to reduce water usage. This trend is driven by the need to alleviate pressure on local water resources and to promote sustainable water management practices. Efficient water use not only helps the environment but also reduces operational costs.

Increase in Green Building Certifications

Certifications like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are becoming more popular. These certifications provide a recognized standard for assessing the environmental performance of buildings. They encourage builders to adopt sustainable practices and help in attracting eco-conscious tenants and investors. The pursuit of these certifications is driving the adoption of green building practices across the industry.

Modular Construction and Prefabrication

Modular construction and prefabrication are gaining traction in the green building sector. These methods involve constructing building components off-site in a controlled environment, which minimizes waste and improves efficiency. Once completed, these modules are transported to the site and assembled. This approach not only speeds up construction but also ensures higher quality control and less environmental impact during the building process.

Segments Covered in the Report

By Product Type

o Exterior Products

o Interior Products

o Building Systems

o Solar Products

o Others

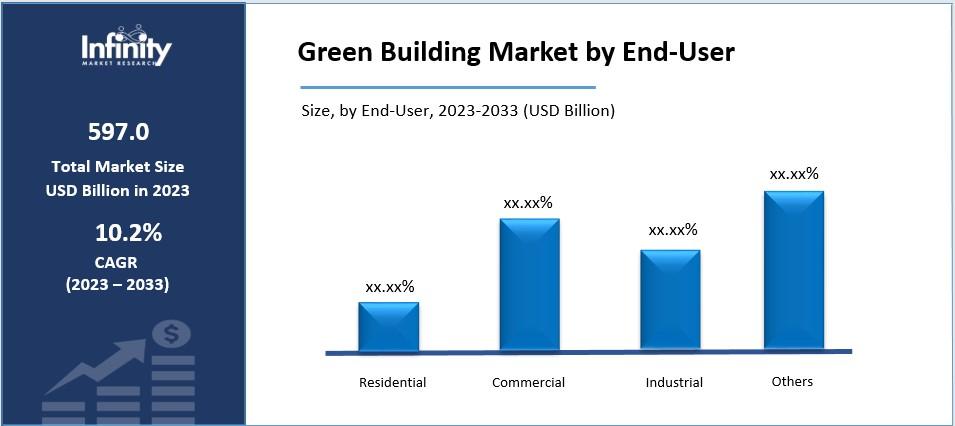

By End-User

o Residential

o Commercial

o Industrial

o Others

Segment Analysis

By Product Type Analysis

The external products market held a 46.8% revenue share in 2023, depending on the type of product. The market for green building products includes a vast array of external components that are intended to improve a structure's energy efficiency and sustainability. These consist of cool roofs, insulated siding, energy-efficient windows, and environmentally friendly landscaping. Enhancing natural illumination, using eco-friendly materials, and strengthening insulation and weatherproofing are the main trends in external products.

For example, cool roofs are becoming more and more popular because of their reflective surfaces, which cut heat absorption and therefore cooling expenses. Native plants used in sustainable landscaping improve aesthetics while preserving water and fostering biodiversity, supporting the larger trend of ecological responsibility in green building.

The solar products segment is expected to grow at a strong compound annual growth rate (CAGR) of 7.9%. Photovoltaic panels and solar water heaters are examples of solar products that are essential to the green construction industry. The use of photovoltaic technology is very popular, and solar panel integration into building designs is becoming more and more important. Emerging technologies that maximize space usage while permitting solar energy generation include solar windows and building-integrated photovoltaics (BIPV). Solar products are a crucial component of sustainable building techniques in the green construction industry since they lead to energy self-sufficiency, cheaper operating costs, and reduced carbon emissions.

By End-User Analysis

Based on the end user, the residential category held the largest market share in 2023 with 42.9%. Individuals and families who live in environmentally and energy-efficiently constructed homes are referred to as residential end users in the green building industry. Energy-efficient appliances, eco-friendly design, and sustainable materials are all in style when it comes to residential green buildings. This covers elements like indoor air quality systems, solar panels, better insulation, and energy-efficient lighting. Green buildings are becoming more and more appealing to homeowners who want to live in healthier homes, lessen their impact on the environment, and save money on utilities.

The commercial segment is expected to grow at the fastest rate. Businesses and organizations occupying ecologically conscious office spaces, retail stores, and industrial facilities are considered commercial end users in the green building sector. Energy-efficient lighting, HVAC systems, green roofs, and sustainable building materials are all in style for commercial green buildings. Businesses choose green buildings to satisfy sustainability objectives, improve corporate social responsibility, and save operating expenses. These kinds of buildings also frequently include open, adaptable floor plans that support contemporary workplaces and enhance worker well-being.

Regional Analysis

In 2023, Europe accounted for the greatest revenue share with 37.9%. Owing to the region's strong emphasis on sustainability and environmental responsibility, the European green building sector is booming. Green building approaches are becoming more popular due to strict requirements, such as the EU's goal of becoming carbon neutral. Using smart building technologies in conjunction with a rise in the usage of sustainable materials are examples of innovative trends. Europe's dedication to environmentally friendly building is further reinforced by the increasing attention being paid to green certifications such as BREEAM (Building Research Establishment Environmental Assessment Method).

Asia Pacific is predicted to experience the fastest rate of growth. The market for green buildings is expanding rapidly in this region as a result of growing urbanization and increased sustainability consciousness. Even while coal still dominates the energy landscape, integration of renewable energy is becoming more and more popular, particularly in nations like China and India. Energy efficiency and environmental concerns are in line with this focus. To satisfy the rising demand for environmentally friendly and energy-efficient development, the area is also investing in smart building technologies and green certifications.

A move toward greener and more sustainable building techniques is causing a major upheaval in the North American green building business. The area is adopting environmentally friendly building practices and laws that encourage environmental responsibility and energy efficiency. The increasing use of sustainable energy alternatives, such as wind turbines and solar panels, is in line with the continent's objective to curtail carbon emissions and promote a more environmentally friendly and sustainable future.

Competitive Analysis

The market for green buildings has grown more competitive as more nations and businesses realize how important sustainability and energy efficiency are. To address the growing demand for green buildings, several significant players have developed in this industry, each providing distinctive solutions and services.

The building sector is one of the main competitors in the market. A large number of construction firms have adopted sustainable design ideas and green building practices into their projects. To guarantee that their structures fulfill the strictest sustainability requirements, these businesses frequently collaborate closely with engineers, architects, and other experts.

Recent Developments

June 2023: Accenture has purchased Green Domus, a prominent Brazilian sustainability consultancy that offers clients the know-how to create and implement a range of sustainability projects with a particular emphasis on measurable decarbonization.

March 2023: A green building technology business called BlocPower has raised approximately USD 25 million in equity and USD 130 million in debt financing to retrofit energy-efficient appliances into hundreds of thousands of homes and other structures.

Key Market Players in the Green Building Market

o Alumasc Group PLC

o Forbo International SA

o BASF SE

o Binderholz Gmbh

o CEMEX

o Bauder Limited

o Kingspan Group plc

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 537.0 Billion |

|

Market Size 2033 |

USD 1,405.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Amvik Systems, Interface Inc., Alumasc Group PLC, Forbo International SA, BASF SE, Owens Corning, Binderholz Gmbh, CEMEX, Bauder Limited, Kingspan Group plc, Other Key Players |

|

Key Market Opportunities |

Technological Advancements |

|

Key Market Dynamics |

Growing Environmental Awareness |

📘 Frequently Asked Questions

1. Who are the key players in the Calcium Carbonate Market?

Answer: Amvik Systems, Interface Inc., Alumasc Group PLC, Forbo International SA, BASF SE, Owens Corning, Binderholz Gmbh, CEMEX, Bauder Limited, Kingspan Group plc, Other Key Players

2. How much is the Calcium Carbonate Market in 2023?

Answer: The Calcium Carbonate Market size was valued at USD 537.0 Billion in 2023.

3. What would be the forecast period in the Calcium Carbonate Market?

Answer: The forecast period in the Calcium Carbonate Market report is 2023-2033.

4. What is the growth rate of the Calcium Carbonate Market?

Answer: Calcium Carbonate Market is growing at a CAGR of 10.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.