🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Grid-forming Inverter Market

Grid-forming Inverter Market (By Type (Micro Inverter, String Inverter, Central Inverter, Other Types), By Voltage (100-300 V, 300-500 V, above 500 V, Other Voltage), By Power Rating (Below 50 KW, 50-100 KW, above 100 KW, Other Power Rating), By Application (Solar PV Plants, Wind Power Plants, Energy Storage System, Electric Vehicles, Other Applications), By Region and Companies)

Aug 2024

Energy and Power

Pages: 138

ID: IMR1200

Grid-forming Inverter Market Overview

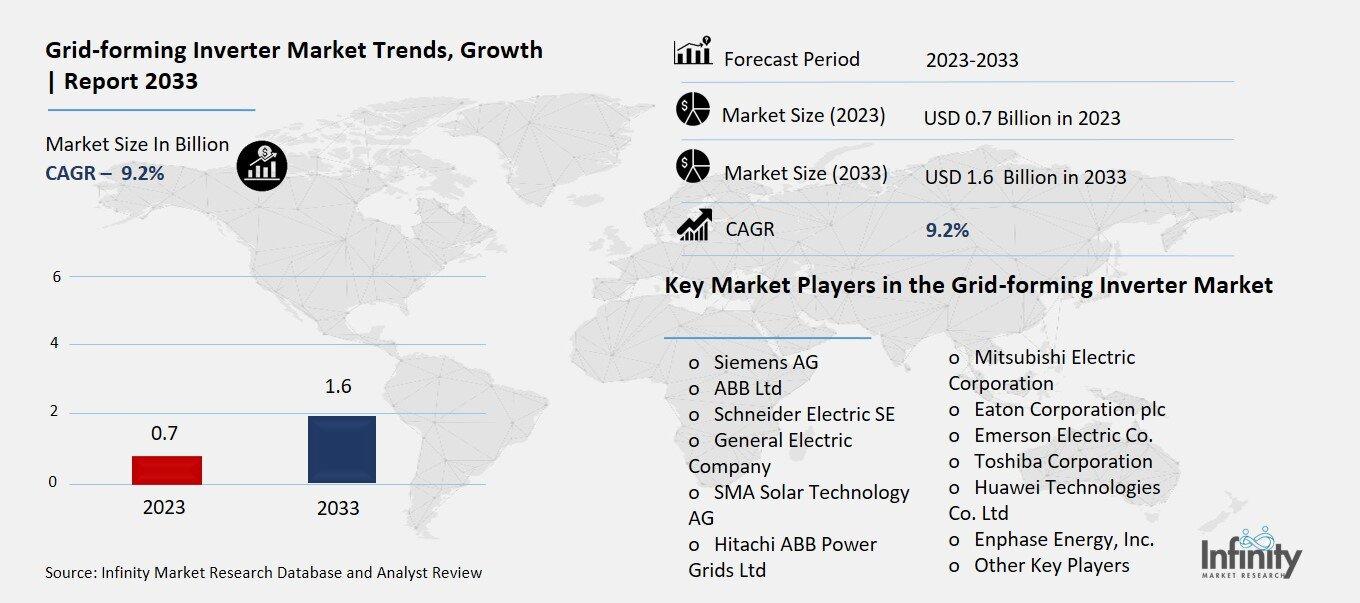

Global Grid-forming Inverter Market size is expected to be worth around USD 1.6 Billion by 2033 from USD 0.7 Billion in 2023, growing at a CAGR of 9.2% during the forecast period from 2023 to 2033.

The grid-forming inverter market revolves around the development and sale of inverters that can create a stable power grid. These inverters are crucial for integrating renewable energy sources like solar and wind into the power grid. Unlike traditional inverters, which rely on an existing grid to synchronize their output, grid-forming inverters can establish and maintain grid stability even in the absence of a traditional power grid. This makes them essential for modern energy systems, particularly in microgrids and remote areas where renewable energy sources are predominant.

These inverters help ensure a stable power supply by automatically adjusting to changes in power demand and generation. This ability to "form" a grid makes them a key technology for the future of energy, as the world moves towards more sustainable and decentralized power systems. The market for grid-forming inverters is growing rapidly due to the increasing adoption of renewable energy, the need for resilient power systems, and advancements in inverter technology.

Drivers for the Grid-forming Inverter Market

Increasing Renewable Energy Integration

One of the main drivers of the grid-forming inverter (GFI) market is the global push towards renewable energy. As the world moves away from fossil fuels and embraces cleaner energy sources like solar and wind, the demand for GFIs has surged. These inverters are crucial because they help maintain grid stability even with the intermittent nature of renewable energy sources. By ensuring that energy from solar panels or wind turbines can be smoothly integrated into the power grid, GFIs play a pivotal role in supporting the renewable energy transition.

Enhancing Grid Stability and Resilience

The power grid is becoming more decentralized with the advent of various renewable energy sources. This decentralization demands robust solutions to maintain stability and resilience. Grid-forming inverters provide essential services such as voltage and frequency regulation, which are critical for the smooth operation of modern power grids. Their ability to enhance grid stability makes them indispensable as more renewable energy sources are added to the grid.

Technological Advancements

Continuous technological advancements are making GFIs more efficient and cost-effective. Improvements in power electronics, semiconductor materials, and control algorithms are enhancing the performance of these inverters. Additionally, integrating energy storage systems with GFIs allows for better management of energy supply and demand, further supporting grid stability. These advancements not only improve performance but also reduce costs, making GFIs a more attractive option for utilities and consumers alike.

Policy and Regulatory Support

Government policies and regulatory frameworks are also driving the growth of the GFI market. Many governments are introducing incentives, subsidies, and mandates to promote renewable energy integration. These supportive policies create a favorable environment for the adoption of GFIs. By providing financial and regulatory support, governments are accelerating the deployment of renewable energy technologies, including grid-forming inverters.

Growing Demand for Microgrids and Distributed Generation

The rise of microgrids and distributed generation systems is another significant driver for the GFI market. Microgrids require advanced inverters to manage local generation and consumption while maintaining grid stability. GFIs are well-suited for this purpose as they can operate independently of the main grid, ensuring continuous power supply even during outages. This capability makes them an essential component of modern energy infrastructure.

Focus on Decarbonization

Global efforts to reduce carbon emissions and achieve carbon neutrality are boosting the GFI market. As companies and governments commit to reducing their carbon footprint, the demand for technologies that support renewable energy integration grows. Grid-forming inverters are a key part of this effort, enabling the efficient use of renewable energy and contributing to overall decarbonization goals. The increasing focus on sustainability and clean energy is expected to drive significant growth in the GFI market in the coming years.

Restraints for the Grid-forming Inverter Market

Technical Challenges

Grid-forming inverters face several technical challenges that can hinder their market growth. These inverters must operate independently and maintain grid stability, which requires sophisticated control algorithms and precise engineering. The complexity of these systems means that they are more prone to technical issues and require specialized knowledge for troubleshooting and maintenance. This need for expert handling can limit their use to areas with access to skilled technicians, reducing their appeal in less developed regions.

Integration Issues

Integrating grid-forming inverters into existing power grids can be problematic. These inverters need to synchronize with other grid components and manage power fluctuations effectively. Compatibility issues with older grid infrastructure can lead to inefficiencies and operational challenges. Ensuring seamless integration often requires additional investments in upgrading grid infrastructure, which can be costly and time-consuming. This requirement can slow down the adoption rate of grid-forming inverters as utilities and other stakeholders weigh the benefits against the financial and logistical challenges.

Regulatory and Policy Barriers

Regulatory and policy barriers also pose significant restraints to the grid-forming inverter market. Different regions have varying standards and regulations for power generation and distribution, which can complicate the deployment of these inverters. Navigating through the regulatory landscape requires time and resources, potentially delaying projects and increasing costs. Inconsistent policies can also lead to uncertainty in the market, deterring investments from both manufacturers and consumers who are wary of future regulatory changes that might affect their operations.

Limited Awareness and Acceptance

Another restraint is the limited awareness and acceptance of grid-forming inverters among potential users. Many stakeholders, including utility companies and end-users, are more familiar with traditional grid-following inverters and might be hesitant to switch to a newer technology. This lack of awareness can be attributed to insufficient education and outreach efforts from manufacturers and industry advocates. Overcoming this barrier requires concerted efforts to educate the market about the benefits and capabilities of grid-forming inverters, which can be a gradual and resource-intensive process.

Competitive Market Dynamics

The competitive market dynamics also act as a restraint for the grid-forming inverter market. Established manufacturers of traditional inverters have significant market share and customer loyalty, making it difficult for grid-forming inverter providers to penetrate the market. Additionally, ongoing innovations in traditional inverter technology can provide alternative solutions that might be more appealing to certain segments of the market due to lower costs or easier integration. This competitive pressure can limit the growth potential for grid-forming inverters as they strive to prove their superior value proposition in a crowded market.

Opportunity in the Grid-forming Inverter Market

Increasing Demand for Renewable Energy Integration

One of the most significant opportunities for the grid-forming inverter market lies in the growing demand for integrating renewable energy sources. As more countries and companies shift towards cleaner energy options like solar and wind, the need for effective systems to manage and stabilize these intermittent energy sources becomes crucial. Grid-forming inverters play a vital role in this process by creating a stable and reliable grid that can accommodate varying levels of renewable energy generation. This demand for renewable energy integration is driving the adoption of grid-forming inverters and expanding their market potential.

Advancements in Inverter Technology

Technological advancements are creating new opportunities in the grid-forming inverter market. Innovations in inverter technology are enhancing the performance and capabilities of these systems. Modern grid-forming inverters offer improved efficiency, better power quality, and enhanced grid support features. For example, advancements in digital control and communication technologies allow inverters to better manage energy flow and respond more quickly to grid disturbances. These technological improvements are making grid-forming inverters more attractive to utilities and energy developers, driving market growth.

Government Policies and Incentives

Government policies and incentives are significantly impacting the grid-forming inverter market. Many governments are implementing regulations and offering financial incentives to promote the use of renewable energy and advanced grid technologies. These policies can include subsidies, tax credits, and grants aimed at reducing the costs associated with installing and upgrading grid-forming inverters. By creating favorable conditions for investment and development, governments are supporting the growth of the market and encouraging the adoption of grid-forming inverter technologies.

Growth of Smart Grid Infrastructure

The expansion of smart grid infrastructure presents a substantial opportunity for the grid-forming inverter market. Smart grids use advanced technologies to improve the efficiency and reliability of electricity distribution. Grid-forming inverters are a key component of smart grids, as they help to stabilize and balance the grid while integrating renewable energy sources. The increasing deployment of smart grid technologies worldwide is driving the demand for grid-forming inverters, creating new opportunities for market growth.

Rising Investment in Energy Storage Systems

The rise in investment in energy storage systems is also benefiting the grid-forming inverter market. Energy storage systems, such as batteries, work closely with grid-forming inverters to provide stability and reliability to the grid. As investments in energy storage technologies increase, there is a corresponding need for advanced inverters that can effectively manage and integrate these storage systems. This synergy between energy storage and grid-forming inverters is driving market opportunities and encouraging further innovation.

Expanding Applications in Emerging Markets

Emerging markets are presenting new opportunities for the grid-forming inverter market. As developing countries invest in modernizing their energy infrastructure, there is a growing need for advanced grid technologies to support renewable energy integration and enhance grid reliability. Grid-forming inverters are becoming increasingly important in these regions as they work to build more resilient and efficient energy systems. The expansion of grid-forming inverter applications in emerging markets is driving growth and creating new business opportunities.

Trends for the Grid-forming Inverter Market

Rising Integration with Renewable Energy Sources

A major trend in the grid-forming inverter market is the growing integration with renewable energy sources. As the world shifts towards cleaner energy, there is an increased need for systems that can effectively manage the variability and intermittency of renewable power sources like solar and wind. Grid-forming inverters play a crucial role in this integration by creating stable and reliable grids that can accommodate these fluctuating energy sources. This trend is driving demand for advanced inverters that can seamlessly connect renewable energy systems to the grid while maintaining stability and efficiency.

Advancements in Inverter Technology

Technological advancements are transforming the grid-forming inverter market. Innovations such as enhanced digital controls, improved power electronics, and advanced software algorithms are making inverters more efficient and capable. Modern grid-forming inverters now feature better power quality management, faster response times to grid disturbances, and greater flexibility in operation. These technological improvements are making grid-forming inverters more attractive to utilities and energy developers, contributing to their growing adoption and market expansion.

Expansion of Smart Grid Technologies

The expansion of smart grid technologies is another significant trend impacting the grid-forming inverter market. Smart grids use advanced technology to monitor and manage electricity distribution more effectively. Grid-forming inverters are integral to smart grids, as they help stabilize and balance the grid while integrating renewable energy sources. The growth of smart grid infrastructure worldwide is driving demand for grid-forming inverters that can support these advanced systems, creating new opportunities for market growth.

Increased Focus on Energy Storage Solutions

Energy storage solutions are becoming increasingly important in the grid-forming inverter market. With the rise in energy storage technologies like batteries, there is a greater need for inverters that can effectively manage and integrate these systems into the grid. Grid-forming inverters work in tandem with energy storage systems to provide grid stability, improve reliability, and enhance overall system efficiency. The growing focus on energy storage is driving innovation in inverter technology and expanding market opportunities.

Growing Demand in Emerging Markets

Emerging markets are showing a growing demand for grid-forming inverters as they modernize their energy infrastructure. Developing countries are investing in renewable energy projects and advanced grid technologies to improve their power systems. Grid-forming inverters are essential in these regions for integrating renewable energy, enhancing grid stability, and supporting economic growth. The increasing adoption of grid-forming inverters in emerging markets is driving market growth and creating new business opportunities.

Enhanced Regulatory and Policy Support

Enhanced regulatory and policy support is shaping the grid-forming inverter market. Governments around the world are implementing regulations and offering incentives to promote the use of renewable energy and advanced grid technologies. These policies include subsidies, tax credits, and grants aimed at reducing the cost of implementing grid-forming inverters and encouraging their adoption. The supportive regulatory environment is contributing to the growth of the market and fostering innovation in inverter technology.

Segments Covered in the Report

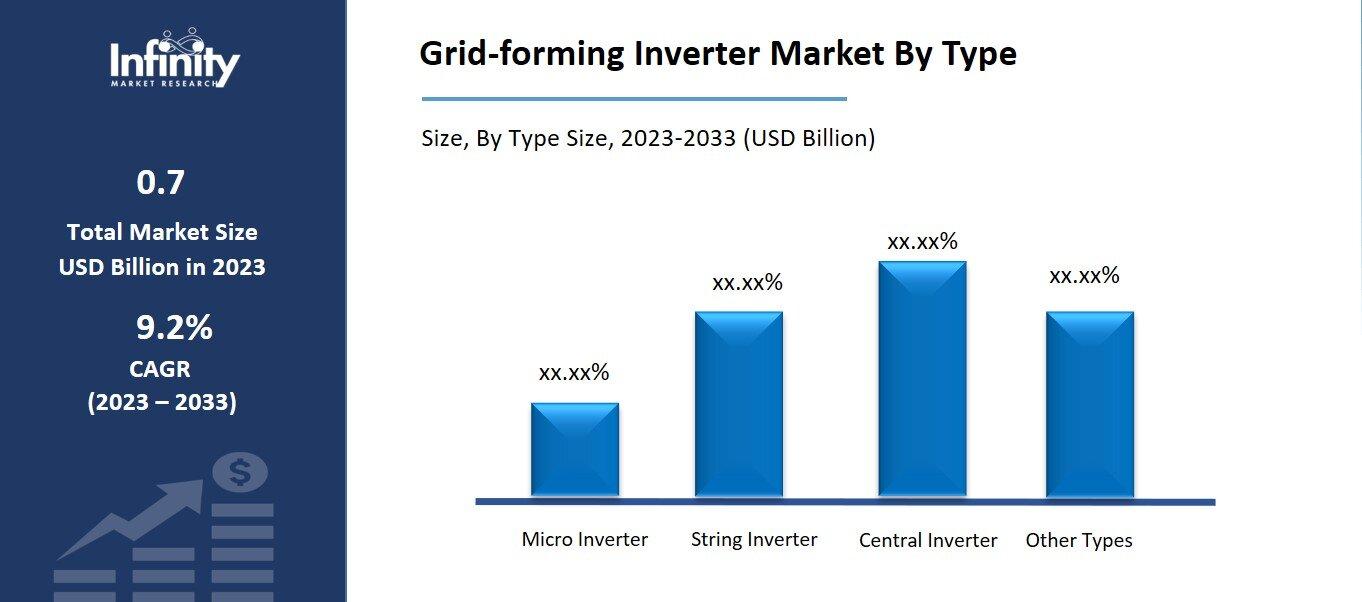

By Type

o Micro Inverter

o String Inverter

o Central Inverter

o Other Types

By Voltage

o 100-300 V

o 300-500 V

o Above 500 V

o Other Voltage

By Power Rating

o Below 50 KW

o 50-100 KW

o Above 100 KW

o Other Power Rating

By Application

o Solar PV Plants

o Wind Power Plants

o Energy Storage System

o Electric Vehicles

o Other Applications

Segment Analysis

By Type Analysis

String-inverters dominate the market. Since it is the most advanced and most efficient technology. The market is divided into three types: microinverters, string inverters, and central inverters. String inverters dominate the market since they are among the most advanced inverter kinds and highly efficient technologies. String inverters are popular due to their scalability, cost-effectiveness, and simplicity of installation. They are often used in photovoltaic (PV) solar systems, which connect several solar panels in series (or strings), providing flexibility in system design and installation. Furthermore, string inverters are very efficient and reliable, making them ideal for a wide range of grid-forming applications, including residential, commercial, and utility-scale solar arrays.

Furthermore, developments in string inverter technology have resulted in enhanced performance, grid integration capabilities, and compliance with emerging grid standards, reinforcing their market dominance. Central inverters are more typically linked with utility-scale solar photovoltaic (PV) installations, where they convert DC power from many solar panels into AC power for grid connection. Central inverters, on the other hand, often work in grid-following mode, synchronizing their output with the grid's voltage and frequency rather than creating grid parameters autonomously, as grid-forming inverters do.

By Voltage Analysis

Based on voltage, the central inverters segment will dominate the worldwide Grid-forming Inverter market in 2023. This category is noteworthy because of its widespread application in utility-scale renewable energy projects. These inverters are specifically intended to manage and convert massive solar and wind farm power outputs into grid-usable electricity. Their enormous power capacity and excellent control capabilities make them critical for ensuring grid stability by synchronizing renewable sources' variable output with system demands. Central inverters' supremacy is due in large part to their cost, installation, and maintenance efficiency.

Central inverters provide economies of scale due to their bigger capacity, resulting in a cheaper cost per watt and lower balance-of-system expenses as compared to other types. This cost-effectiveness is especially beneficial for utility-scale projects requiring significant power output, where central inverters provide a competitive alternative.

By Power Rating Analysis

The market is divided into four segments based on power rating: less than 10 KW, 10 - 50 KW, 50 - 100 KW, and more than 100 KW. Less than 10 KW accounts for the majority of the market. Inverters with an output power of less than 10 kW are appropriate for usage in home and commercial applications. The installation of solar systems in the residential sector is rapidly increasing around the world. In addition to residential inverters, string inverters, microinverters, and vehicle inverters all have output voltages of less than 10 KW. Below 10 KW, 10 - 50 KW accounts for the second largest proportion of the global market.

With a wide range of applications, including residential, commercial, and small-scale industrial projects, where energy demand falls within this power range, these installations are frequently mid-sized solar PV systems or microgrids, which are becoming increasingly popular for decentralized energy generation and grid resilience.

By Application Analysis

solar PV plants, wind power plants, and energy storage systems. Solar PV plants dominate the market, owing to environmental concerns and the need to shift to greener energy sources. Solar PV technology has emerged as a forerunner in this shift because of its widespread availability, scalability, and low cost. Continuous breakthroughs in solar PV technology, including increases in efficiency and durability, have made solar PV plants more competitive than conventional energy sources.

The wind power plant category is the second most prominent after solar PV plants, owing to favorable government regulations, incentives, and subsidies that have fostered the development of renewable projects, hence increasing their market share. Solar and wind energy also have advantages such as quick deployment, cheap running costs, and minimum environmental effect, making them a popular alternative for energy generation.

Regional Analysis

The Asia-Pacific region is expected to lead the Grid-forming Inverter Market throughout the forecast period. The target region is expected to generate a total incremental potential of USD 470.19 million by the end of 2030.

The Asia-Pacific Grid-forming Inverter Market is experiencing considerable growth as energy storage systems, particularly battery storage options, become more widely deployed. The use of energy storage technology, especially battery storage, is gaining traction throughout Asia. These systems are critical for making the best use of renewable energy resources.

Energy storage promotes grid stability and the smooth integration of renewable energy into the electricity system by storing excess renewable energy during periods of high production and releasing it when demand increases. This capacity is especially useful for controlling the intermittent nature of sources like solar and wind. Governments in Asia-Pacific are actively revising and introducing policies to enable the integration of renewable energy into the grid. These policy frameworks address a variety of aspects of renewable energy integration, such as grid connection procedures, grid access for renewable energy projects, and market-based renewable energy trading systems.

These regulations are intended to promote an enabling environment for renewable energy development and to ease the process of connecting renewable energy projects to the grid, thus speeding up the transition to cleaner energy sources.

Competitive Analysis

Major market companies are investing heavily in R&D to expand their product lines, which will fuel further growth in the Grid-forming Inverter Market. Market participants are also pursuing a variety of strategic measures to expand their global footprint, such as new product launches, contractual agreements, mergers and acquisitions, increased investment, and collaboration with other companies. Competitors in the Grid-forming Inverter Market must provide cost-effective products to flourish and survive in a more competitive and growing market.

Recent Developments

In July 2024: The Pacific Northwest National Laboratory (PNNL) and its collaborators created new models to help power system specialists analyze how a new technology, the grid-forming inverter, would work on the grid to improve grid stability. The study was conducted as part of the Universal Interoperability for Grid-Forming Inverters Consortium (UNIFI), a $25 million program launched in 2021 by the DOE's Solar Energy Technologies Office (SETO) and Wind Energy Technologies Office (WETO).

In July 2023: Gamesa has designed a new central inverter with grid-forming capabilities. According to Gamesa, the most recent hybrid version of the Proteus inverter is compatible with large-scale battery systems and can work in both grid-following and grid-forming modes. This product is scalable and capable of producing up to 5.6 MVA of battery discharge power at 40°C and 1,300 V, with an impressive 99% efficiency.

Key Market Players in the Grid-forming Inverter Market

o Siemens AG

o ABB Ltd

o Schneider Electric SE

o General Electric Company

o Mitsubishi Electric Corporation

o Eaton Corporation plc

o Emerson Electric Co.

o Toshiba Corporation

o Huawei Technologies Co. Ltd

o Enphase Energy, Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 0.7 Billion |

|

Market Size 2033 |

USD 1.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

9.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Voltage, Power Rating, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Siemens AG, ABB Ltd, Schneider Electric SE, General Electric Company, SMA Solar Technology AG, Hitachi ABB Power Grids Ltd, Mitsubishi Electric Corporation, Eaton Corporation plc, Emerson Electric Co., Toshiba Corporation, Huawei Technologies Co., Ltd, Enphase Energy, Inc. |

|

Key Market Opportunities |

Advancements in Inverter Technology |

|

Key Market Dynamics |

Growing Demand for Microgrids and Distributed Generation |

📘 Frequently Asked Questions

1. How much is the Grid-forming Inverter Market in 2023?

Answer: The Grid-forming Inverter Market size was valued at USD 0.7 Billion in 2023.

2. What would be the forecast period in the Grid-forming Inverter Market?

Answer: The forecast period in the Grid-forming Inverter Market report is 2023-2033.

3. Who are the key players in the Grid-forming Inverter Market?

Answer: Siemens AG, ABB Ltd, Schneider Electric SE, General Electric Company, SMA Solar Technology AG, Hitachi ABB Power Grids Ltd, Mitsubishi Electric Corporation, Eaton Corporation plc, Emerson Electric Co., Toshiba Corporation, Huawei Technologies Co., Ltd, Enphase Energy, Inc.

4. What is the growth rate of the Grid-forming Inverter Market?

Answer: Grid-forming Inverter Market is growing at a CAGR of 9.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.