🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

GRP (Glass Reinforced Plastic) Piping Market

Global GRP (Glass Reinforced Plastic) Piping Market (By Type, Epoxy, Vinyl Ester, and Polyester; By Application, Oil and Gas, Wastewater Treatment, Chemicals, Irrigation, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Building and Construction

Pages: 138

ID: IMR1350

GRP (Glass Reinforced Plastic) Piping Market Overview

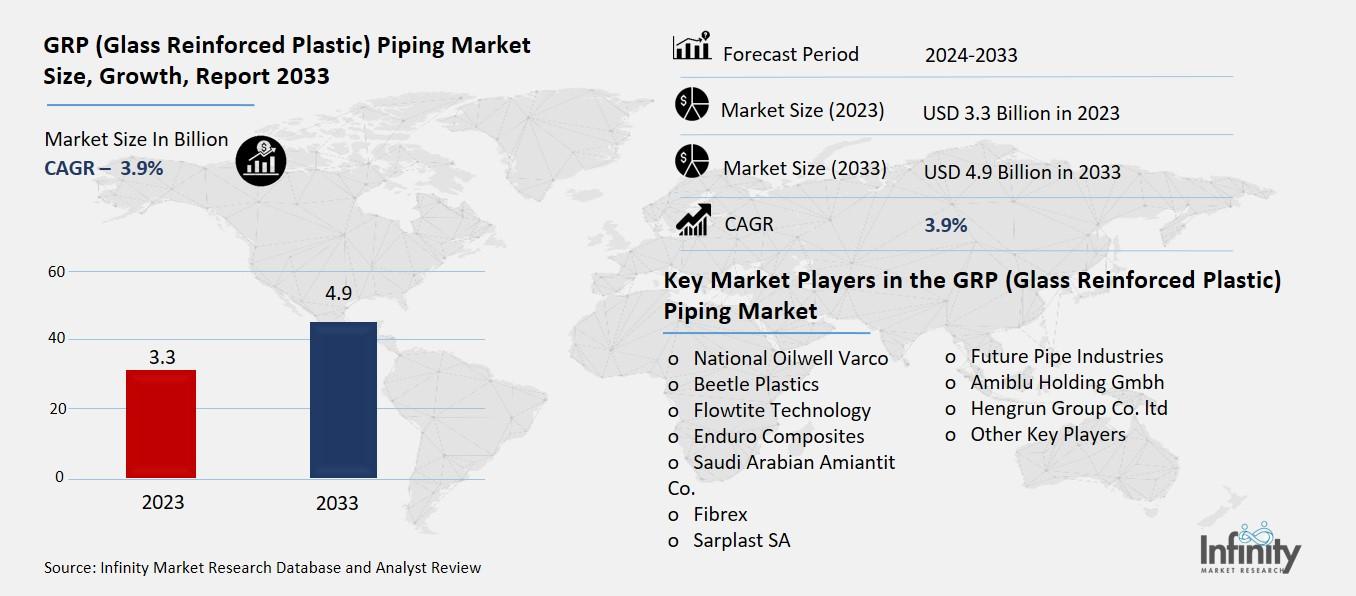

Global GRP (Glass Reinforced Plastic) Piping Market acquired the significant revenue of 3.3 Billion in 2023 and expected to be worth around USD 4.9 Billion by 2033 with the CAGR of 3.9% during the forecast period of 2024 to 2033. The GRP piping market is a relatively emerging market that forms a part of a vast construction and industrial piping industry. GRP pipes are manufactured from glass fibers reinforced with polyester or vinyl ester resin creating a light weight corrosion free product that is very strong. These pipes are being favored in markets like water treatment, chemical processing, and oil and gas because they have exceptional chemical, heat, and environmental resistance that make the pipes suitable for long-term usage. The market for GRP piping is constantly growing because building an environment-insensitive system is becoming increasingly necessary for countries with water shortages or pollution problems.

Further, GRP pipes being lightweight and easy to install, and cost competitive helps to increase its application both in the new construction and retrofitting and replacement of traditional metallic pipe system. Market has also been boosted by various improvements in the technology and increased understanding of the superiority of GRP over metals such as steel and concrete.

Drivers for the GRP (Glass Reinforced Plastic) Piping Market

Durability and Long Service Life

HRP pipes are one of the most durable within the GRP pipes, having potential service life over 50 years where normal operating conditions apply. This has been so mainly because of the nature of the glass fiber reinforced polymer that is not affected easily by corrosion, scaling, and other processes of chemical degradation. The pipes are not subjected to rust, rusting leaks, erosion due to aggressive chemicals or harsh environmental RE110 conditions like steel or concrete piping systems.

Also they are less susceptible to cracking and wear, thus meaning that the physical properties of the GRP pipes will stay intact for decades. The result of this long term is less frequent maintenance and replacement, therefore the use of GRP pipes befits well the definition of low cost in the long run. This reliability reduces the frequency of breakdowns, controls expenses of utilizing the structures, and improves total system capacity for industries such as water treatment, sewage systems, and chemical processing, that is why the GRP pipes are used not just in new constructions, but also become the substitution for aged structures of pipe systems.

Restraints for the GRP (Glass Reinforced Plastic) Piping Market

Vulnerability to Physical Damage

Despite their many advantages, GRP pipes can be vulnerable to physical damage, particularly from impact or excessive force. In construction environments, where heavy machinery, such as excavators and cranes, are commonly used, there is a risk that GRP pipes may suffer from cracks, fractures, or even breakage if not handled properly. This is especially true during transportation, installation, or when exposed to sudden impacts, as the glass fibers in GRP, while strong, are also brittle under certain conditions. Additionally, GRP pipes can be more susceptible to damage from sharp objects or if subjected to bending beyond their tolerance limits. While the material is generally durable in standard operational conditions, such physical damage can compromise the structural integrity of the pipes, leading to potential leaks or failures. Therefore, proper handling, installation procedures, and protective measures are crucial to prevent damage during the construction and installation phases.

Opportunity in the GRP (Glass Reinforced Plastic) Piping Market

Adoption in Renewable Energy Infrastructure

GRP pipes are becoming an increasingly popular choice in the construction of renewable energy projects, particularly in wind turbine installations and solar power plants, thanks to their outstanding corrosion resistance, durability, and long service life. In wind energy projects, GRP pipes are used for a variety of applications, including the construction of offshore wind farms, where the pipes are exposed to harsh marine environments. Their resistance to saltwater corrosion ensures that they maintain their integrity over time, reducing the need for costly replacements or maintenance. Similarly, in solar power plants, GRP pipes are used for water and cooling systems, as well as for the transportation of fluids, where their durability ensures uninterrupted operations in potentially harsh climates, such as desert regions or areas with high humidity.

Trends for the GRP (Glass Reinforced Plastic) Piping Market

Technological Advancements in Manufacturing

The development of advanced manufacturing techniques, such as filament winding and resin infusion, has significantly improved the production of GRP pipes, making them more affordable and efficient. Filament winding is a process where continuous glass fibers are wound around a mandrel in specific patterns, and then impregnated with resin. This technique ensures that the GRP pipes have enhanced strength and uniformity, as the fibers are aligned to withstand the expected pressure and load conditions. It also reduces material waste and labor costs, making the process more cost-effective compared to traditional methods.

Resin infusion, on the other hand, involves drawing resin into a mold containing the dry glass fibers, allowing for a more controlled and efficient distribution of the resin. This technique results in high-quality GRP pipes with superior strength-to-weight ratios, as well as reduced excess resin use, which lowers production costs. The precise control over resin infusion ensures that the pipes are lightweight yet durable, and have the desired mechanical properties for various applications.

Segments Covered in the Report

By Type

o Epoxy

o Vinyl Ester

o Polyester

By Application

o Oil and Gas

o Wastewater Treatment

o Chemicals

o Irrigation

o Other Applications

Segment Analysis

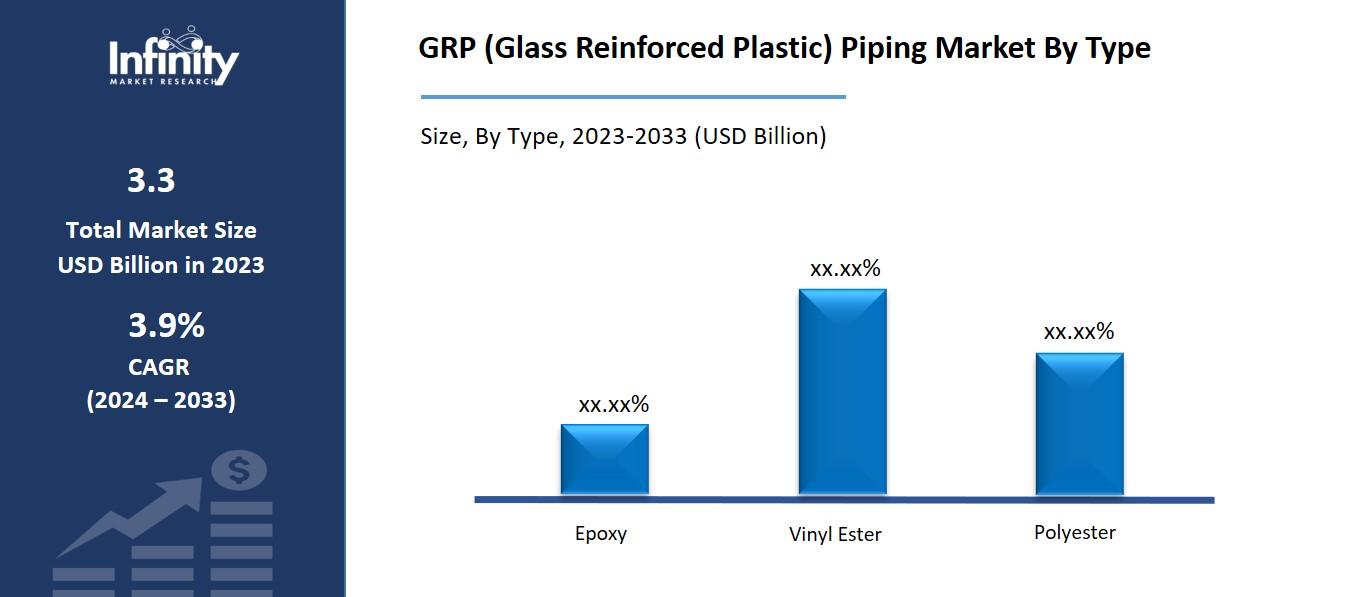

By Type Analysis

On the basis of type, the market is divided into epoxy, vinyl ester, and polyester. Among these, polyester segment acquired the significant share in the market owing to their cost-effectiveness, versatility, and adequate performance for a wide range of applications. Polyester resins are less expensive compared to epoxy and vinyl ester resins, making polyester GRP pipes an attractive option for industries where budget constraints are a concern, such as water distribution, sewage, and agricultural sectors.

Additionally, polyester GRP pipes offer good mechanical properties, such as resistance to corrosion, and perform well in environments with moderate temperatures and chemical exposure. Their ability to meet the demands of a wide array of industries, combined with their affordability, has led to their dominant position in the market.

By Application Analysis

On the basis of application, the market is divided into oil and gas, wastewater treatment, chemicals, irrigation, and other applications. Among these, irrigation segment held the prominent share of the market due to the increasing demand for efficient and sustainable water management solutions, particularly in agriculture. GRP pipes offer several advantages that make them ideal for irrigation systems, including their corrosion resistance, lightweight nature, and ability to withstand varying weather conditions. These properties ensure that GRP pipes can handle the challenges of water transportation over long distances without degrading or requiring frequent maintenance.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 34.1% of the market driven by rapid industrialization, urbanization, and significant infrastructure development in countries like China, India, and Japan. This region's growing demand for efficient and durable piping solutions in sectors such as water treatment, wastewater management, and chemical processing has led to a surge in the adoption of GRP pipes. China, in particular, stands as the largest consumer, owing to its extensive chemical manufacturing industry and large-scale infrastructure projects. The region’s focus on enhancing water distribution and improving sustainable irrigation systems further supports the market growth.

Additionally, favorable government policies and the presence of skilled labor have encouraged GRP pipe manufacturers to set up production facilities in Asia Pacific, further cementing the region's dominant position in the global market. The combination of cost-effective production, infrastructure expansion, and the rising demand for eco-friendly and corrosion-resistant materials has positioned Asia Pacific as a key driver of the GRP piping industry.

Competitive Analysis

The competitive landscape of the GRP pipes market is characterized by a mix of established industry players and emerging companies, all vying for market share through innovation, product differentiation, and geographic expansion. Major players in the market, such as Flowtite Technology, Amiantit, HOBAS, and National Oilwell Varco, leverage their global presence, strong distribution networks, and technical expertise to maintain a competitive edge. These companies focus on enhancing their product portfolios by offering a range of GRP pipes for various applications, from water treatment to oil and gas. Additionally, leading players are increasingly investing in advanced manufacturing techniques, such as filament winding and resin infusion, to improve production efficiency, reduce costs, and meet the growing demand for sustainable piping solutions.

Recent Developments

In April 2023, Perma-Pipe International Holdings secured two contracts worth over USD 8 million. The first involves installing insulated pipe infrastructure for a thermal distribution system at Fanshawe College in London, while the second supplies thermally insulated pipes to China Petroleum & Chemical Corporation for a project in Uganda. These contracts highlight the growing demand for GRP pipes in the oil and gas sectors of the Middle East and Africa.

Key Market Players in the GRP (Glass Reinforced Plastic) Piping Market

o National Oilwell Varco

o Beetle Plastics

o Flowtite Technology

o Enduro Composites

o Saudi Arabian Amiantit Co.

o Fibrex

o Sarplast SA

o Future Pipe Industries

o Amiblu Holding Gmbh

o Hengrun Group Co. ltd

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 3.3 Billion |

|

Market Size 2033 |

USD 4.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

National Oilwell Varco, Beetle Plastics, Flowtite Technology, Enduro Composites, Saudi Arabian Amiantit Co., Fibrex, Sarplast SA, Future pipe industries, Amiblu Holding Gmbh, Hengrun Group co. ltd, and Other Key Players. |

|

Key Market Opportunities |

Adoption in Renewable Energy Infrastructure |

|

Key Market Dynamics |

Durability and Long Service Life |

📘 Frequently Asked Questions

1. Who are the key players in the GRP (Glass Reinforced Plastic) Piping Market?

Answer: National Oilwell Varco, Beetle Plastics, Flowtite Technology, Enduro Composites, Saudi Arabian Amiantit Co., Fibrex, Sarplast SA, Future pipe industries, Amiblu Holding Gmbh, Hengrun Group co. ltd, and Other Key Players.

2. How much is the GRP (Glass Reinforced Plastic) Piping Market in 2023?

Answer: The GRP (Glass Reinforced Plastic) Piping Market size was valued at USD 3.3 Million in 2023.

3. What would be the forecast period in the GRP (Glass Reinforced Plastic) Piping Market?

Answer: The forecast period in the GRP (Glass Reinforced Plastic) Piping Market report is 2024-2033.

4. What is the growth rate of the GRP (Glass Reinforced Plastic) Piping Market?

Answer: GRP (Glass Reinforced Plastic) Piping Market is growing at a CAGR of 3.9% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.