🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

HDPE Pipes Market

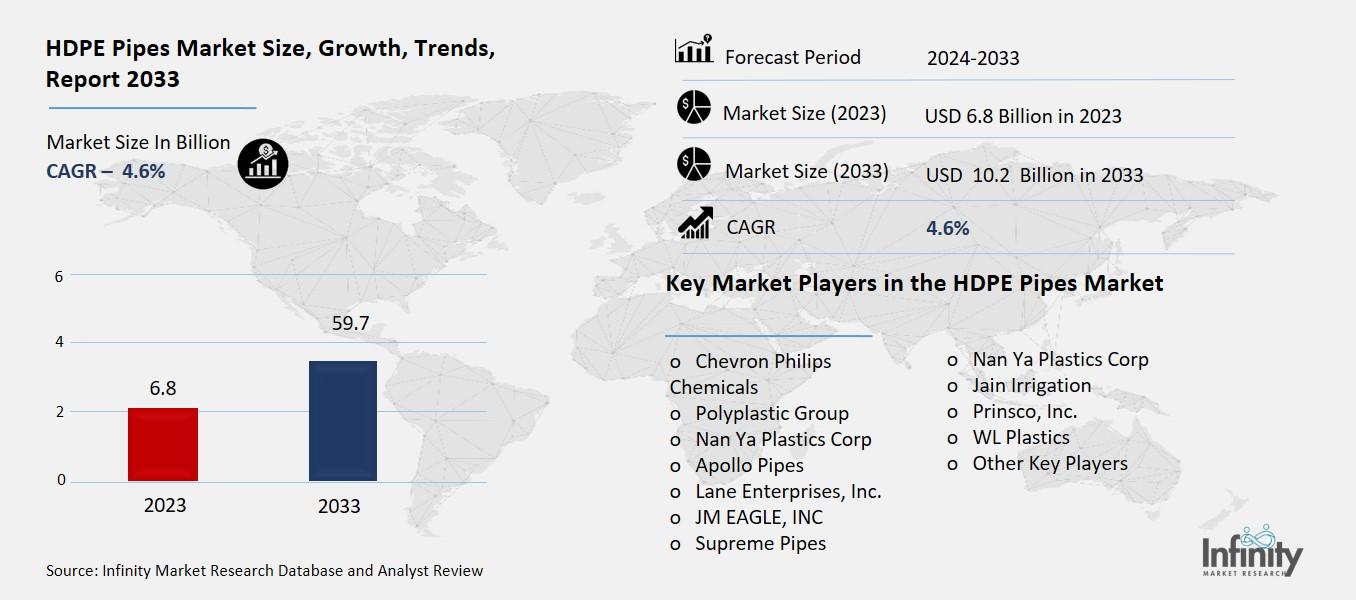

Global HDPE Pipes Market (By Type, PE 63, PE 80, and PE 100; By Application, Sewage System Pipe, Oil and Gas Pipe, Water Supply Pipe, Agricultural Irrigation Pipe, and Other Applications; By Region and Companies), 2024-2033

Nov 2024

Building and Construction

Pages: 138

ID: IMR1323

HDPE Pipes Market Overview

Global HDPE Pipes Market acquired the significant revenue of 20.0 Billion in 2023 and expected to be worth around USD 34.1 Billion by 2033 with the CAGR of 5.5% during the forecast period of 2024 to 2033. The market for the HDPE (High-Density Polyethylene) pipes is on the rise due to its valuable characteristics including high durability and corrosion resistance as well as flexibility of the material. HDPE has found wide application in several fields such as in water supply, sewerage systems, oil and natural gas transportation and in horticulture.

The use of HDPE pipes has also been favored with the demands for infrastructure development, especially in the developing countries and the emphasis on optimum and sustainable products at an affordable cost compared to the conventional pipes materials such as PVC and metal. It is also occasioned by the increasing need to access water that has undergone purification for human consumption as well as mobility that suggests that infrastructures in water and wastewater treatment is receiving more investment.

Drivers for the HDPE Pipes Market

Corrosion and Chemical Resistance

HDPE pipes are popular for their feature of high resistance to corrosive environment and a host of chemicals that are likely to come across in systems like sewage systems and in the uptake of chemicals. Unlike metals, such as pipelines made of steel where the transport medium corrodes the pipes leading to weak structures or liners that corrode when exposed to water, chemicals or aggressive environment, HDPE pipes do not lose their physical and chemical properties for decades. It reveals that since they are not prone to attacks by water soluble chemicals, acids, alkalis and other similar sewage solutions, they are more appropriate to use in sewage treatment processes for industries and movement of chemicals in pharmaceuticals, mining and manufacturing industries.

HDPE pipes not only do not deteriorate when subjected to the chemical attack by the effluent found in sewage systems but they also do not support biofilm formation which is otherwise likely to deposit on the pipe wall to block or add to the overall deterioration of other pipe materials.

Restraints for the HDPE Pipes Market

Availability of Raw Materials

The production of HDPE (High-Density Polyethylene) relies heavily on petroleum-based raw materials, specifically naphtha, a byproduct of crude oil refining. As a result, the HDPE market is susceptible to supply chain challenges that arise from fluctuations in oil prices. When global oil prices experience significant increases or volatility, the cost of raw materials used in HDPE production also rises, leading to higher production costs. This can impact the overall pricing of HDPE pipes, making them less competitive compared to alternative materials. Additionally, disruptions in the oil supply chain, such as geopolitical tensions, natural disasters, or production constraints, can lead to shortages of the raw materials required for HDPE manufacturing.

Opportunity in the HDPE Pipes Market

Advancements in Manufacturing Technology

Technological improvements in HDPE pipe production have the potential to significantly reduce costs and enhance performance, making HDPE pipes an even more attractive option for a broader range of applications. Advancements in manufacturing processes, such as improved extrusion techniques, better control of resin quality, and the development of more efficient production methods, can lower energy consumption and streamline production, leading to reduced costs for manufacturers. These cost savings can then be passed on to end-users, making HDPE pipes a more affordable alternative to other materials like PVC, steel, or concrete, especially in large-scale infrastructure projects.

In addition to cost reductions, technological innovations can also improve the performance of HDPE pipes. For instance, enhanced polymer blends or advanced additives can increase the strength, flexibility, and resistance of HDPE pipes, allowing them to withstand more extreme environmental conditions, higher pressures, or more aggressive chemicals.

Trends for the HDPE Pipes Market

Integration with Smart Water Management

The integration of HDPE pipes into smart water management systems is a significant trend that is driving innovation in the market. With increasing concerns about water scarcity, infrastructure aging, and the need for efficient resource management, the use of sensors and monitoring technologies within HDPE pipe systems is becoming more prevalent. These "smart" pipes are equipped with embedded sensors that can monitor various parameters such as water flow, pressure, temperature, and even detect leaks or blockages in real-time. This data is transmitted to central management systems, allowing for early detection of issues, reducing the risk of costly repairs, and enabling more proactive maintenance.

Segments Covered in the Report

By Type

o PE 63

o PE 80

o PE 100

By Application

o Sewage System Pipe

o Oil and Gas Pipe

o Water Supply Pipe

o Agricultural Irrigation Pipe

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into PE 63, PE 80, and PE 100. Among these, PE 100 segment acquired the significant share in the market owing to its superior performance characteristics and suitability for high-demand applications. PE 100 is a grade of HDPE that offers enhanced mechanical properties, including high tensile strength, impact resistance, and excellent stress crack resistance, making it ideal for applications where durability and reliability are critical. It is widely used in high-pressure systems, such as water and gas pipelines, due to its ability to withstand higher operating pressures without compromising safety or integrity. The increased use of PE 100 is also driven by its ability to perform well in a variety of harsh environments, including those with aggressive chemicals or extreme temperatures.

By Application Analysis

On the basis of application, the market is divided into sewage system pipe, oil and gas pipe, water supply pipe, agricultural irrigation pipe, and other applications. Among these, sewage system pipe segment held the prominent share of the market due to the material’s excellent resistance to corrosion, chemical exposure, and wear, which makes it highly suitable for wastewater and sewage systems.

HDPE pipes offer superior durability in the challenging environments typically encountered in sewage and wastewater systems, where the presence of chemicals, high moisture, and fluctuating temperatures can quickly degrade traditional materials like metal or concrete. The non-corrosive nature of HDPE prevents rust and scaling, which helps to maintain the integrity of the pipes over time and reduces maintenance costs, making it a cost-effective solution for municipalities and other entities managing sewage infrastructure.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 29.1% of the market due to rapid urbanization, growing infrastructure development, and increasing industrial activities in the region. Countries like China, India, and Japan have witnessed significant investments in water supply, sewage systems, and irrigation projects, driving the demand for durable, cost-effective piping solutions. The region's expanding population, combined with a rising need for efficient water management and sustainable infrastructure, has further fueled the adoption of HDPE pipes.

Additionally, the growing oil and gas sector in Asia Pacific, particularly in countries such as India, China, and Southeast Asia, has contributed to the increased demand for HDPE pipes for oil and gas transportation. The lower installation and maintenance costs, along with the corrosion-resistant properties of HDPE, make it an attractive option for both public and private infrastructure projects across various sectors, including agriculture, construction, and utilities.

Competitive Analysis

The HDPE pipe market is highly competitive, with several key players dominating the landscape. Leading companies such as Lane Enterprises, JM Eagle, Blue Diamond Industries, Mexichem, WL Plastics, and Radius Systems leverage strategies like product innovation, geographic expansion, and strategic partnerships to maintain their market positions. Product innovation is a primary focus, with firms continually enhancing HDPE pipe durability, flexibility, and resistance to chemicals and corrosion to meet the evolving needs of industries such as water supply, sewage, oil and gas, and agricultural irrigation.

Recent Developments

In May 2022, WL Plastics acquired Charter Plastics' HDPE extrusion pipe business, a strategic move that broadens its product range and extends its geographic presence. This acquisition is expected to strengthen Charter Plastics' HDPE pipe portfolio and enhance its market position.

In February 2021, United Poly Systems introduced a new line of HDPE pipes designed to match the sizes of traditional copper and iron pipes, specifically for water supply applications. This strategic product launch is expected to enhance the company's market share in the HDPE pipe industry.

Key Market Players in the HDPE Pipes Market

o Chevron Philips Chemicals

o Polyplastic Group

o Nan Ya Plastics Corp

o Apollo Pipes

o Lane Enterprises, Inc.

o JM EAGLE, INC

o Supreme Pipes

o Nan Ya Plastics Corp

o Jain Irrigation

o Prinsco, Inc.

o WL Plastics

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 6.8 Billion |

|

Market Size 2033 |

USD 10.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Chevron Philips Chemicals, Polyplastic Group, Nan Ya Plastics Corp, Apollo Pipes, Lane Enterprises, Inc., JM EAGLE, INC, Supreme Pipes, Nan Ya Plastics Corp, Jain Irrigation, Prinsco, Inc., WL Plastics, and Other Key Players. |

|

Key Market Opportunities |

Advancements in Manufacturing Technology |

|

Key Market Dynamics |

Corrosion and Chemical Resistance |

📘 Frequently Asked Questions

1. Who are the key players in the HDPE Pipes Market?

Answer: Chevron Philips Chemicals, Polyplastic Group, Nan Ya Plastics Corp, Apollo Pipes, Lane Enterprises, Inc., JM EAGLE, INC, Supreme Pipes, Nan Ya Plastics Corp, Jain Irrigation, Prinsco, Inc., WL Plastics, and Other Key Players.

2. How much is the HDPE Pipes Market in 2023?

Answer: The HDPE Pipes Market size was valued at USD 6.8 Billion in 2023.

3. What would be the forecast period in the HDPE Pipes Market?

Answer: The forecast period in the HDPE Pipes Market report is 2024-2033.

4. What is the growth rate of the HDPE Pipes Market?

Answer: HDPE Pipes Market is growing at a CAGR of 4.6% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.