🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Health Insurance Market

Global Health Insurance Market (By Provider, Public and Private; By Coverage, Point of Service (POS), Preferred Provider Organizations (PPOS), Health Maintenance Organization (HMOS), and Exclusive Provider Organizations (EPOS); By Age Group, Minor, Adults, and Senior Citizen; By Distribution Channel, Banks, Brokers/Agent, Direct Sales, and Other Distribution Channels; By Region and Companies), 2024-2033

Nov 2024

Financial Services & Insurance

Pages: 138

ID: IMR1308

Health Insurance Market Overview

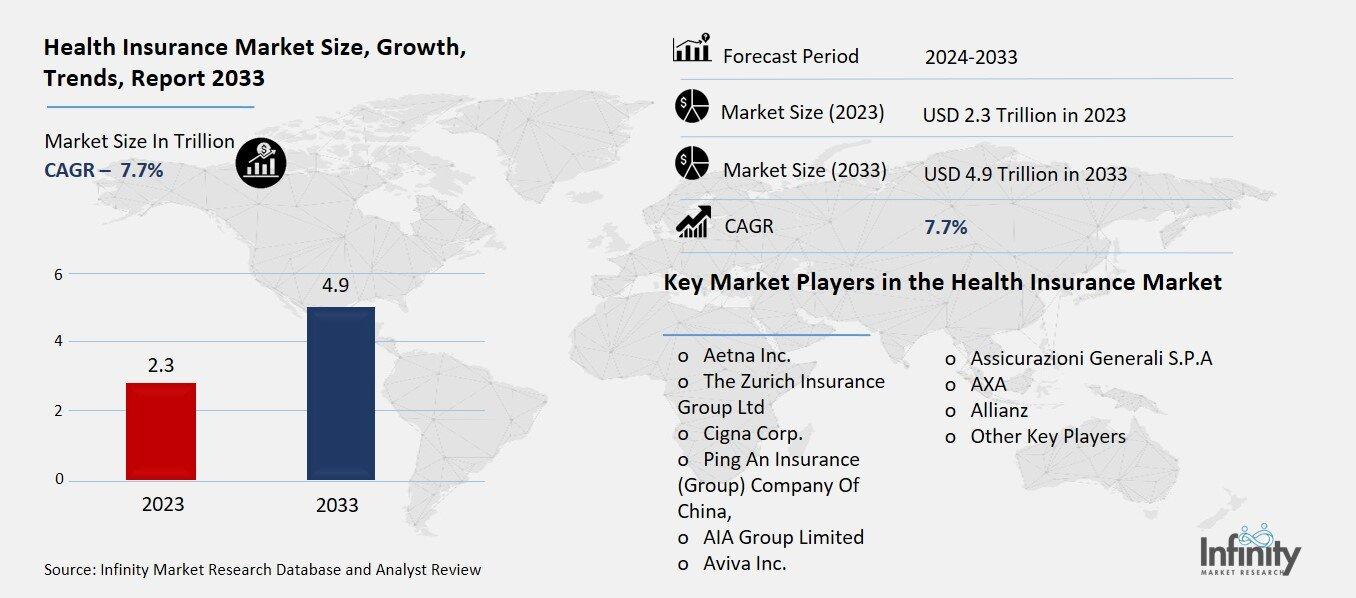

Global Health Insurance Market acquired the significant revenue of 2.3 Trillion in 2023 and expected to be worth around USD 4.9 Trillion by 2033 with the CAGR of 7.7% during the forecast period of 2024 to 2033. The health insurance market is considered a flexible and significant segment of the worldwide economy, oriented to offer citizens a safety net against the expensive healthcare services. It comprises of different types of plans which entail for a set of services such as physician, hospital care, surgeries, drugs, and preventative care.

The drivers of this market include; increase in global healthcare costs, prevalence of chronic diseases, and increased emphasis on improving healthcare access. There are strictly private insurance companies to which people can subscribe or there is state insurance through programs like Medicaid or Medicare in some countries. It also depends on changes in legislation, innovations, and shifts in the clients’ demand. Also, with the passing of the affordable healthcare bill, there has been an emphasis on avoiding diseases through health management services and wellness incentives consequently, there has been adoption of plans that incorporate these services.

Drivers for the Health Insurance Market

Rising Rates of Chronic Conditions

An improved acceptability of growth and development of diseases like diabetes, heart diseases, obesity have greatly contributed to the openness towards acceptance of health insurance. Such affections that are linked to lifestyle issues like poor diet, little or no exercise, stress, etc., are growing in prevalence around the world, and therefore placing more load on the global healthcare foundation. Chronic illnesses are conditions that cannot be cured, and therefore continue to need monitoring, frequent check-up, use of drugs and sometimes operations which are quite expensive. Therefore, people who are in some way or another are facing one or the other of these conditions are in a process of relying on health insurance with the aim of minimizing the financial risks resulting from repeated and constant need for health care services. This demand is further fueled by the fact that most of these diseases are either preventable or can be well controlled trough early diagnosis which makes it an incentive to look for a health plan that provides especially preventative care, early diagnosis, and disease management services.

Restraints for the Health Insurance Market

Complexity of Insurance Plans

The complexity and lack of transparency in health insurance policies pose significant barriers for consumers, often making it challenging for them to fully comprehend what is covered under their plan. Health insurance policies can be filled with technical jargon, complex terms, and intricate clauses that are difficult for the average person to interpret without specialized knowledge. For instance, terms like "deductibles," "co-payments," "out-of-pocket maximums," and "network restrictions" are commonly used but may not be clear to those without prior experience with insurance.

This lack of clarity can lead to confusion about what services are actually covered, how claims are processed, and what costs will ultimately be borne by the policyholder. As a result, potential customers may hesitate to purchase health insurance, fearing unexpected expenses or denial of claims due to a lack of understanding about their coverage.

Opportunity in the Health Insurance Market

Integration with Wellness Programs

Health insurers can tap into the growing consumer interest in wellness and fitness by offering plans that integrate features focused on overall health management. As more individuals become proactive about maintaining a healthy lifestyle, there is increasing demand for insurance products that go beyond traditional healthcare services and incorporate preventive care, fitness tracking, and mental health support.

Insurers can partner with fitness tracking companies or offer wearable devices that monitor physical activity, sleep patterns, and other health metrics, providing policyholders with real-time data that can help them make healthier choices. These tools not only encourage a more active lifestyle but can also lead to lower healthcare costs by preventing chronic diseases or managing existing conditions more effectively.

Trends for the Health Insurance Market

Shift Toward Value-Based Care

The growing trend toward value-based care is significantly reshaping the health insurance market, moving away from traditional fee-for-service models, which prioritize the volume of services provided, to a more efficient and patient-centered approach. In a value-based care model, insurers and healthcare providers are incentivized to focus on delivering high-quality care that improves patient outcomes, rather than simply increasing the number of treatments or services rendered. This shift encourages healthcare providers to invest in preventive care, disease management, and coordinated treatment plans that are designed to keep patients healthier in the long term, ultimately reducing the need for costly interventions.

Segments Covered in the Report

By Provider

o Public

o Private

By Coverage

o Point of Service (POS)

o Preferred Provider Organizations (PPOS)

o Health Maintenance Organization (HMOS)

o Exclusive Provider Organizations (EPOS)

By Age Group

o Minor

o Adults

o Senior Citizen

By Distribution Channel

o Banks

o Brokers/Agent

o Direct Sales

o Other Distribution Channels

Segment Analysis

By Provider Analysis

On the basis of provider, the market is divided into public and private. Among these, private segment acquired the significant share in the market owing to the widespread availability of employer-sponsored insurance plans and the variety of private insurance options available to individuals and families. While public programs like Medicare and Medicaid play crucial roles, especially for specific populations such as the elderly and low-income individuals, the private sector remains the primary source of health insurance coverage for the majority of the population.

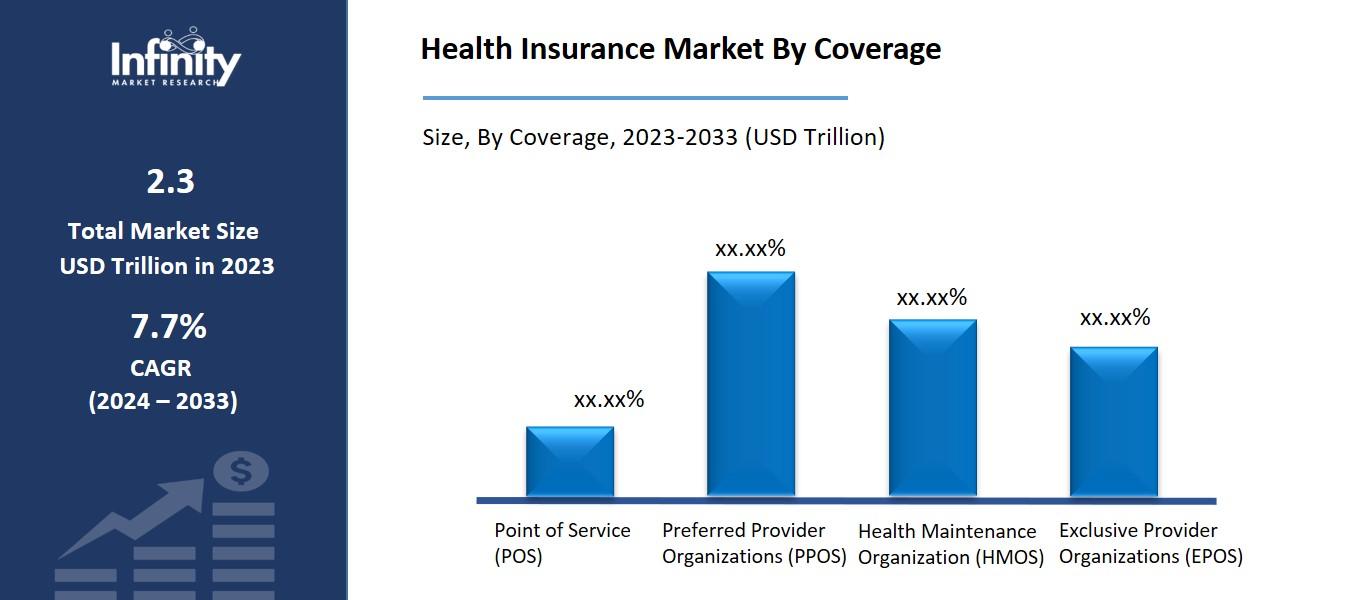

By Coverage Analysis

On the basis of coverage, the market is divided into preferred provider organizations (PPOS), health maintenance organization (HMOS), and exclusive provider organizations (EPOS). Among these, preferred provider organizations (PPOS) segment held the prominent share of the market. PPOs are popular due to their flexibility, allowing members to receive care from both in-network and out-of-network providers, albeit at higher out-of-pocket costs for out-of-network services. This flexibility appeals to individuals who value a broader choice of healthcare providers and are willing to pay higher premiums for that convenience.

By Age Group Analysis

On the basis of age group, the market is divided into minor, adults, and senior citizen. Among these, adult segment held the significant share of the market due to the prevalence of employer-sponsored insurance plans, which are predominantly available to working-age adults. According to data from the U.S. Census Bureau, in 2023, 53.7% of Americans had employment-based coverage, a significant portion of which is utilized by adults aged 19 to 64. Additionally, adults are more likely to purchase individual health insurance plans compared to minors or senior citizens, further contributing to their dominant share in the market.

By Distribution Channel Analysis

On the basis of distribution channel, the market is divided into banks, brokers/agent, direct sales, and other distribution channels. Among these, brokers/agent segment held the most of the share of the market. This dominance is attributed to brokers and agents' ability to provide personalized guidance, assess individual needs, and offer tailored insurance solutions, thereby enhancing customer satisfaction and trust. Their expertise in navigating complex insurance products and regulations makes them a preferred choice for many consumers seeking comprehensive coverage options.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 30.5% of the market. The region benefits from a well-established healthcare infrastructure, a high level of insurance penetration, and strong government programs such as Medicare and Medicaid in the United States. The presence of major private health insurance providers and employer-sponsored insurance plans further bolsters the market. In addition, North American consumers have greater awareness and access to various insurance options, ranging from private health plans to government-backed programs, leading to widespread coverage adoption.

The region's high healthcare expenditure, combined with an aging population and increasing prevalence of chronic conditions, has also driven demand for comprehensive health insurance solutions. Additionally, technological advancements in digital health, telemedicine, and health management tools are contributing to the market's growth in the region, as consumers seek more efficient and flexible healthcare options.

Competitive Analysis

The health insurance market is highly competitive, with numerous players ranging from established multinational insurers to emerging digital-first companies. Major traditional providers such as UnitedHealth Group, Anthem, Aetna, and Cigna dominate the market, leveraging their extensive networks, broad customer base, and diversified product offerings. These large insurers often compete on price, coverage options, and the ability to offer additional services such as wellness programs, telemedicine, and mental health support. However, in recent years, newer players, particularly digital health insurers and insurtech startups, have been disrupting the industry by offering more flexible, tech-enabled solutions that cater to younger, more digitally-savvy consumers.

Recent Developments

In April 2024, AIA announced the launch of new health plans in the Great Bay region, designed to include compensation, home visit services, and outpatient coverage.

Key Market Players in the Health Insurance Market

o Aetna Inc.

o The Zurich Insurance Group Ltd

o Cigna Corp.

o Ping An Insurance (Group) Company Of China,

o AIA Group Limited

o Aviva Inc.

o Assicurazioni Generali S.P.A

o AXA

o Allianz

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.3 Trillion |

|

Market Size 2033 |

USD 4.9 Trillion |

|

Compound Annual Growth Rate (CAGR) |

7.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Trillion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Provider, Coverage, Age Group, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Aetna Inc., The Zurich Insurance Group Ltd, Cigna Corp., Ping An Insurance (Group) Company Of China, AIA Group Limited, Aviva Inc., Assicurazioni Generali S.P.A, AXA, and Other Key Players. |

|

Key Market Opportunities |

Integration with Wellness Programs |

|

Key Market Dynamics |

Rising Rates of Chronic Conditions |

📘 Frequently Asked Questions

1. Who are the key players in the Health Insurance Market?

Answer: Aetna Inc., The Zurich Insurance Group Ltd, Cigna Corp., Ping An Insurance (Group) Company Of China, AIA Group Limited, Aviva Inc., Assicurazioni Generali S.P.A, AXA, and Other Key Players.

2. How much is the Health Insurance Market in 2023?

Answer: The Health Insurance Market size was valued at USD 2.3 Trillion in 2023.

3. What would be the forecast period in the Health Insurance Market?

Answer: The forecast period in the Health Insurance Market report is 2024-2033.

4. What is the growth rate of the Health Insurance Market?

Answer: Health Insurance Market is growing at a CAGR of 7.7% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.