🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Healthy Snack Market

Healthy Snack Market (By Product (Frozen & Refrigerated, Fruit, Nuts and Seeds, Bakery, Savory, Bars and Confectionery, Dairy, Others), By Claim (Gluten-Free, Low/No Sugar, Low/No Fat, Others), By Packaging (Bag & Pouches, Boxes, Cans, Jars, Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others), By Region and Companies)

Jun 2024

Consumer and Retails

Pages: 110

ID: IMR1083

Healthy Snack Market Overview

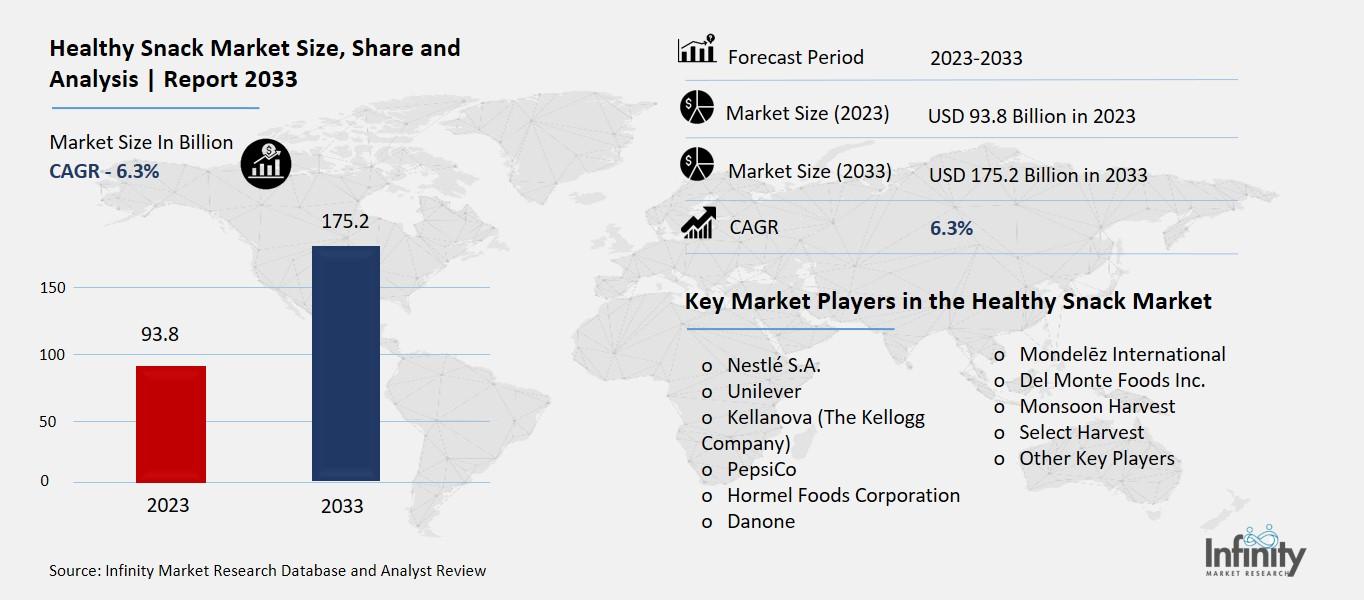

Global Healthy Snack Market size is expected to be worth around USD 175.2 Billion by 2033 from USD 93.8 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2033 to 2033.

The Healthy Snack Market refers to the industry that produces and sells snacks that are considered good for your health. These snacks are typically low in unhealthy fats, sugars, and calories, and often contain beneficial nutrients like vitamins, minerals, and fiber. Examples of healthy snacks include fruits, vegetables, nuts, yogurt, and whole-grain products like granola bars. The market for healthy snacks has been growing as more people are becoming health-conscious and looking for convenient, nutritious alternatives to traditional, less healthy snack options.

Companies in the Healthy Snack Market focus on creating snacks that are both tasty and good for your body. They often use natural ingredients and avoid artificial additives. The market includes a wide variety of products, from individually packaged snacks for on-the-go consumption to larger, family-sized portions for home consumption. Healthy snacks are popular among people of all ages, including children, adults, and seniors, who want to maintain a balanced diet without sacrificing taste or convenience.

Drivers for the Healthy Snack Market

Increasing Health Consciousness Among Consumers

One of the primary drivers for the Healthy Snack Market is the increasing awareness and consciousness about health among consumers. People are becoming more educated about the link between diet and health, leading them to seek out snacks that offer nutritional benefits rather than empty calories. This trend is bolstered by a growing concern over lifestyle diseases such as obesity, diabetes, and heart disease, prompting individuals to adopt healthier eating habits.

Rise in Demand for Convenient, On-the-Go Nutrition

Another significant driver is the rise in demand for convenient, on-the-go nutrition. Busy lifestyles and hectic schedules have led to an increased preference for snacks that are portable, easy to consume, and nutritious. Healthy snacks like protein bars, fruit packs, and yogurt cups cater to consumers looking for quick and easy alternatives to traditional junk food options.

Government Initiatives Promoting Healthy Eating

Government initiatives and policies promoting healthy eating habits are also driving growth in the Healthy Snack Market. Public health campaigns, nutritional guidelines, and regulations aimed at reducing the consumption of unhealthy snacks and promoting the consumption of nutritious foods are influencing consumer behavior. These initiatives encourage food manufacturers to innovate and produce healthier snack options that meet regulatory standards.

Innovation in Product Development

Innovation in product development is a key driver of growth in the Healthy Snack Market. Manufacturers are continuously introducing new and improved snack options that offer a balance between health and taste. This includes snacks that are low in sugar, salt, and unhealthy fats, as well as snacks that are rich in vitamins, minerals, and fiber. Product innovation also includes the use of natural and organic ingredients, catering to consumers' preferences for clean-label and sustainable food choices.

Expansion of Distribution Channels

The expansion of distribution channels is playing a crucial role in driving the Healthy Snack Market. Snack manufacturers are leveraging e-commerce platforms, convenience stores, supermarkets, and vending machines to make their products more accessible to consumers. This omnichannel approach allows consumers to purchase healthy snacks wherever and whenever they need them, further boosting market growth.

Influence of Social Media and Health Influencers

Social media and health influencers are influencing consumer choices and driving demand for healthy snacks. Platforms like Instagram, Facebook, and YouTube are used to promote healthy lifestyles and showcase nutritious snack options. Health influencers and bloggers share recipes, reviews, and recommendations, influencing their followers to adopt healthier eating habits and try new products in the Healthy Snack Market.

Restraints for the Healthy Snack Market

Higher Cost of Healthy Snacks Compared to Traditional Snacks

One of the main restraints for the Healthy Snack Market is the higher cost of healthy snacks compared to traditional snacks. Healthy snacks often contain natural and organic ingredients, which can be more expensive to produce. This higher production cost is passed on to consumers, making healthy snacks less affordable for some individuals, especially those on a tight budget. As a result, price sensitivity remains a significant barrier to broader consumer adoption of healthy snacks.

Limited Shelf Life and Perishability of Fresh Ingredients

Another restraint is the limited shelf life and perishability of fresh ingredients used in healthy snacks. Many healthy snacks, such as fresh fruits, vegetables, and dairy products, have shorter shelf lives compared to processed and preservative-laden snacks. This limits the distribution and availability of fresh and perishable healthy snacks, especially in regions with inadequate storage and transportation infrastructure. Manufacturers must carefully manage inventory and supply chain logistics to minimize waste and ensure product freshness.

Consumer Perception Challenges and Taste Preferences

Consumer perception challenges and taste preferences present barriers to the Healthy Snack Market. Despite increasing health consciousness, some consumers still perceive healthy snacks as less flavorful or less satisfying than traditional snacks. Taste preferences heavily influence snack choices, and convincing consumers that healthy snacks can be delicious and satisfying remains a challenge for manufacturers. Innovations in flavor profiles and texture are crucial to overcoming this barrier and broadening consumer acceptance of healthy snack options.

Competition from Traditional Snack Categories

Competition from traditional snack categories poses a significant restraint to the Healthy Snack Market. Snacks high in sugar, salt, and unhealthy fats continue to dominate store shelves and consumer preferences. These snacks often have long-established brand loyalty and lower price points, making it difficult for healthy snacks to compete effectively. Manufacturers must differentiate their products through effective marketing, unique value propositions, and innovative product offerings to capture market share from traditional snack categories.

Regulatory and Labeling Requirements

Regulatory and labeling requirements present challenges to the Healthy Snack Market. Government regulations related to health claims, nutritional content, and ingredient labeling can be complex and vary across different regions and markets. Meeting these regulatory requirements adds additional costs and administrative burdens for manufacturers. Furthermore, inconsistencies in labeling standards can confuse consumers and impact their purchasing decisions. Clear and transparent labeling practices are essential to building trust and credibility in the healthy snack sector.

Opportunity in the Healthy Snack Market

Increasing Health Awareness and Conscious Eating

One of the primary opportunities for the Healthy Snack Market is the increasing awareness of health and conscious eating among consumers. People are becoming more aware of the impact of diet on their health and are actively seeking healthier snack options. This trend is driven by rising rates of lifestyle-related diseases such as obesity and diabetes, prompting individuals to adopt better dietary habits. As consumers prioritize health and wellness, there is a growing demand for snacks that are low in sugar, salt, and unhealthy fats, while being rich in nutrients like vitamins, minerals, and fiber.

Growing Demand for Functional and Nutrient-Dense Snacks

There is a significant opportunity in the market for functional and nutrient-dense snacks. Consumers are looking for snacks that not only satisfy hunger but also provide additional health benefits. Functional snacks, such as protein bars, energy balls, and probiotic yogurt, are gaining popularity due to their ability to support digestive health, boost immunity, and enhance energy levels. Manufacturers are innovating to incorporate functional ingredients like superfoods, plant-based proteins, and antioxidants into their snack offerings, catering to health-conscious consumers.

Expansion of Online Retail Channels

The expansion of online retail channels presents a promising opportunity for the Healthy Snack Market. E-commerce platforms allow snack manufacturers to reach a broader audience, including consumers who prioritize convenience and prefer to shop online. The COVID-19 pandemic has accelerated the shift towards online shopping, further boosting the demand for healthy snacks available for purchase through digital platforms. Manufacturers can capitalize on this trend by enhancing their online presence, optimizing digital marketing strategies, and leveraging e-commerce platforms to increase sales and brand visibility.

Innovation in Product Development and Packaging

Innovation in product development and packaging is key to unlocking opportunities in the Healthy Snack Market. Manufacturers are introducing new and innovative snack options that cater to specific dietary preferences and health goals. This includes snacks that are gluten-free, vegan, non-GMO, and allergen-free, appealing to a diverse consumer base. In addition to product innovation, packaging plays a crucial role in attracting consumers and conveying health benefits. Sustainable and eco-friendly packaging solutions are becoming increasingly important as consumers prioritize sustainability and environmental responsibility.

Expansion into Emerging Markets and Demographics

Expanding into emerging markets and demographics presents untapped opportunities for growth in the Healthy Snack Market. Rising disposable incomes, urbanization, and changing dietary preferences in emerging markets like Asia-Pacific and Latin America are driving demand for healthier snack alternatives. Additionally, targeting specific demographic groups such as children, seniors, and athletes with tailored snack solutions can help manufacturers capture new market segments and diversify their customer base.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations offer opportunities for market expansion and innovation in the Healthy Snack Market. Collaborations between snack manufacturers, retailers, health organizations, and fitness centers can enhance product distribution, promote brand awareness, and educate consumers about the benefits of healthy snacking. Partnerships with food service providers, schools, and workplaces can also create opportunities for integrating healthy snacks into institutional catering and vending programs, promoting healthier eating habits on a larger scale.

Trends for the Healthy Snack Market

Rise in Plant-Based and Vegan Snacks

One of the prominent trends in the Healthy Snack Market is the rise in plant-based and vegan snacks. Consumers are increasingly opting for snacks that are free from animal products, driven by health, environmental, and ethical considerations. Plant-based snacks, such as nut and seed mixes, vegetable chips, and plant-based protein bars, are gaining popularity due to their perceived health benefits and sustainability. This trend is expected to continue as more consumers adopt plant-based diets and seek out snacks that align with their dietary preferences.

Demand for Clean-Label and Natural Ingredients

There is a growing demand for clean-label and natural ingredients in healthy snacks. Consumers are becoming more conscious of what goes into their food and are looking for snacks with simple, recognizable ingredients. Clean-label snacks are free from artificial colors, flavors, preservatives, and additives, appealing to consumers seeking wholesome and transparent food options. Manufacturers are responding by reformulating their products to include natural sweeteners, whole grains, and minimally processed ingredients to meet this demand.

Snacks with Functional Benefits

Snacks with functional benefits are gaining traction in the market. Functional snacks are designed to provide specific health benefits beyond basic nutrition. Examples include snacks fortified with vitamins, minerals, probiotics, and antioxidants to support digestive health, immunity, and overall well-being. Consumers are increasingly seeking snacks that offer functional benefits, such as energy-boosting, weight management, and stress-relieving properties, contributing to the growth of this segment.

Innovation in Snack Formats and Packaging

Innovation in snack formats and packaging is another trend shaping the Healthy Snack Market. Manufacturers are introducing new and convenient snack formats that cater to busy lifestyles and on-the-go consumption. This includes single-serve portions, resealable pouches, and snack bars that are easy to carry and consume. Sustainable and eco-friendly packaging solutions are also gaining traction, as consumers prioritize environmental sustainability and look for snacks packaged in recyclable and biodegradable materials.

Personalization and Customization in Snack Offerings

Personalization and customization are becoming increasingly important trends in the Healthy Snack Market. Consumers are seeking snacks that cater to their individual dietary needs, preferences, and health goals. This trend is driving the development of personalized snack options, such as build-your-own snack packs, subscription services, and snacks tailored to specific dietary requirements like gluten-free, keto-friendly, and low-sugar diets. By offering personalized choices, manufacturers can enhance consumer satisfaction and loyalty.

Expansion of Online and Direct-to-Consumer Channels

The expansion of online and direct-to-consumer channels is reshaping the distribution landscape for healthy snacks. E-commerce platforms, subscription services, and direct-to-consumer models allow snack manufacturers to reach a broader audience and bypass traditional retail channels. This trend has been accelerated by the COVID-19 pandemic, which increased online shopping and created new opportunities for digital marketing and consumer engagement.

Segments Covered in the Report

By Product

-

- Frozen & Refrigerated

- Fruit, Nuts and Seeds

- Bakery

- Savory

- Bars and Confectionery

- Dairy

- Others

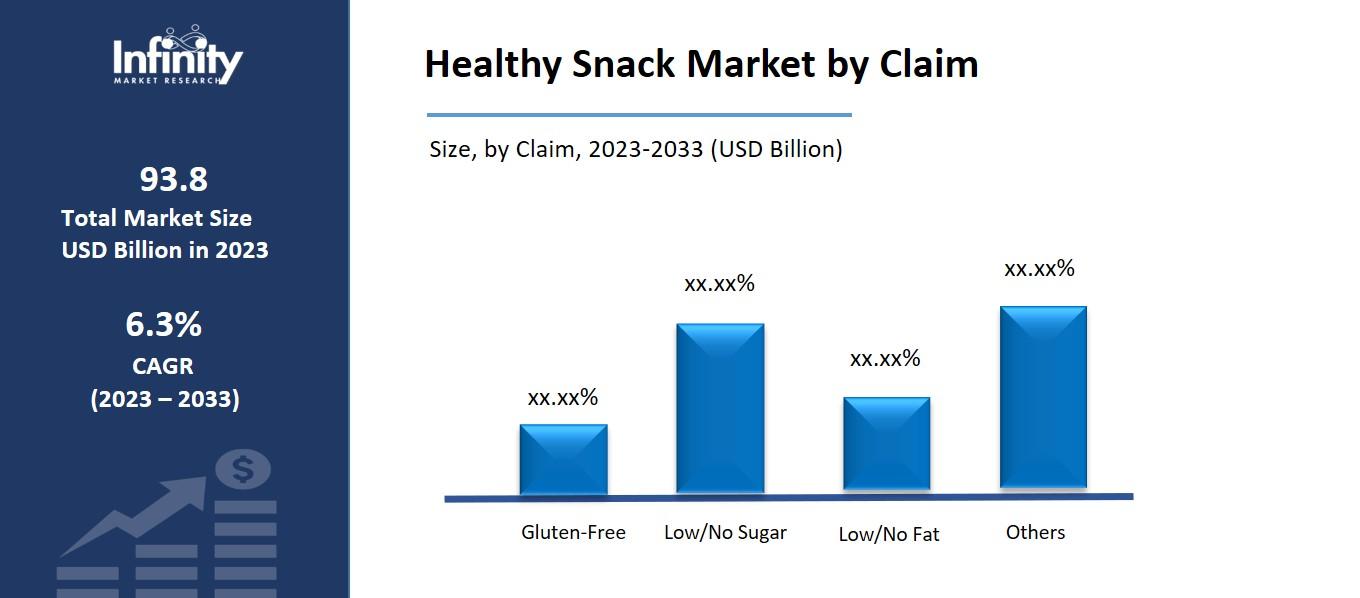

By Claim

-

- Gluten-Free

- Low/No Sugar

- Low/No Fat

- Others

By Packaging

-

- Bag & Pouches

- Boxes

- Cans

- Jars

- Others

By Distribution Channel

-

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Segment Analysis

By Product Analysis

In 2023, the fruit, nuts, and seeds category had a 38.1% market share. The rising demand from consumers for quick, tasty, and nutrient-dense snack options has led to a trend toward healthier snacks, such as fruits, nuts, and seeds. The market for healthy snack bars is driven by consumer preferences for whole nuts, seeds, fruits, and chocolate in addition to health and convenience considerations, per 2023 research released by FoodNavigator-USA. The market is also positively impacted by the increased demand for snacks with nutritional value and the growing awareness of leading a healthy lifestyle.

The growing popularity of dietary fads including plant-based diets, veganism, and paleo diets has an impact on the industry as well. Nuts, seeds, and fruits fit in nicely with these dietary choices, which supports the market segment's further expansion. Furthermore, the perception of these snacks as natural, healthy, and sustainable increases their appeal to consumers who care about the environment. According to the State of the Industry 2022 research, customers are looking for nuts and snack mixes that are healthier, which is driving more innovation in this market.

From 2023 to 2033, the market for healthy bakery snacks is projected to expand at a compound annual growth rate (CAGR) of 6.2%. The market reflects shifting consumer preferences, which have an impact on the choice of grains used in baked goods and snack items. These trends include a propensity for plant-based foods, gluten- and grain-free options, and lifestyle diets. Furthermore, the market for healthy bakery snacks is expanding due in large part to the growing demand for items derived from natural and organic ingredients as well as the appeal of artisanal and specialized bakery goods.

By Claim Analysis

In 2023, the low- or no-sugar snack category had a 38.8% market share. Health-related problems including obesity and cardiovascular disease are becoming increasingly common, which has prompted consumers to read nutritional labels more carefully. Low- or no-fat products are more popular on the market because they are seen to be better options for managing weight and cardiovascular health. In response to this market trend, food makers restructure snacks to lower or eliminate fat content while preserving flavor, satisfying consumers' need for healthier options.

Customers emphasize getting enough protein in their diets; they naturally go for high-protein snacks. Producers frequently accommodate this inclination by adding high-protein components to their snack mixes. A Whisps survey from 2023 indicates that 79% of Americans are attempting to consume healthier snacks and that there is a rising trend for snacks high in protein.

Between 2023 and 2033, the market for gluten-free snacks is projected to expand at a CAGR of 7.8%. The market for gluten-free claims in the healthy snack industry is mostly driven by consumers' growing need for dietary alternatives and their growing knowledge of gluten sensitivity. Wheat, barley, and rye contain the protein gluten, which can cause negative reactions in certain people, including non-celiac gluten sensitivity and celiac disease. An increasing number of people are looking for gluten-free choices to suit their dietary demands and tastes as knowledge of these disorders rises.

By Packaging Analysis

In 2023, the bags and pouches segment held a 42.8% share. Because they are convenient, easy to handle, and retain flavor and freshness, healthy snacks are typically packaged in bags or pouches. These packaging alternatives are ideal for snack consumption on the go because they are lightweight, frequently resealable, and effectively protect the snacks inside. Additionally, windowed or transparent bags and pouches improve product visibility and attractiveness and let customers make well-informed decisions. Their popularity in the snack business is also largely due to their affordability, sustainability attributes, and adaptability in serving different kinds of snacks.

Snack goods must have visually appealing packaging that communicates the high quality and health advantages of their contents to succeed in the highly competitive industry. Customers are searching for plant-based, low- or no-sugar, gluten-free products that fit with alternative diets like vegan, paleo, and keto. Additionally, snack producers can meet their specific needs by utilizing custom packaging solutions, which come in a variety of sizes, shapes, and types, such as roll stock packaging, pillow-shaped bags, and straight bags. This will ensure that their products stand out on the shelves and satisfy consumer preferences for convenient, healthy snack options.

CAGR for the canned segment is anticipated to be 6.1% between 2023 and 2033. Canning nutritious food is growing in popularity because it satisfies consumer desires and producer requirements. Because they are airtight and lightproof, can help manufacturers increase the shelf life of foods by preserving freshness and nutritional value without the need for additional preservatives. Cans' strength and resilience reduce spoilage and damage during transit, guaranteeing the product's integrity when it gets to customers.

By Distribution Channel Analysis

44.2% of the market was made up of healthy snack distribution via supermarkets and hypermarkets in 2023. When buying healthful snacks, customers tend to go toward supermarkets and hypermarkets, which is explained by several factors. These retail locations successfully address the rising need for quick and healthful snack options by offering a wide variety of nutrient-dense snack options, such as roasted nuts, seeds, and fruits.

Furthermore, supermarkets and hypermarkets can control the majority of the market in terms of distribution channels due to their sheer size on a global scale. One of the biggest grocery chains in the world, 7-Eleven, for example, has more than 80,000 locations across 16 countries. The swift advancement of retail infrastructure in developing nations is anticipated to propel the segment's rise even more.

Online distribution of healthful snacks is becoming more and more common. Customers find it appealing to shop from home, have easy access to a wide selection of goods, and compare prices and reviews. From the standpoint of healthy snack producers and brands, the Internet offers access to a larger consumer base that includes those living in rural or underserved areas. Geographical restrictions are removed, enabling brands to access a larger audience and grow their clientele internationally.

A survey by Dynata, commissioned by mobile app developer Bryj, indicates that 39% of consumers in 2024 would rather purchase groceries via an app. In a similar vein, a Bank of America survey revealed that 61% of participants intended to shop online for groceries by 2024. These results imply that a sizeable fraction of consumers would rather purchase groceries and snacks online.

Regional Analysis

In 2023, the market for healthy snacks in North America held a 38.8% share. Throughout North America, there has been a noticeable change in eating habits in recent years toward healthier ones. Even when it comes to snacking, people are choosing healthier options as they become more aware of what they put into their bodies. Healthy snacking is becoming more and more popular throughout the region as a result of this trend.

In addition, the rising consciousness in North America regarding the significance of a well-rounded diet and the influence of food has propelled the consumption of healthful snacks. People are seeking ways to make healthier food choices and improve their diets in response to the rise in chronic diseases including diabetes, heart disease, and obesity. As a result, people are choosing healthier snacks in place of traditional ones, which are frequently heavy in calories, sugar, and bad fats.

From 2023 to 2033, the healthy snack market in Asia Pacific is projected to expand at a compound annual growth rate (CAGR) of 7.1%. Asia is becoming more and more aware of the benefits of eating foods high in probiotics and prebiotics, which support immunity and intestinal health. Adding functional elements to snacks, such as antioxidants and macronutrients, has become a common tactic used by many manufacturers to create healthier snack options.

Additionally, to draw in customers, a lot of businesses are putting more of a focus on attractive product flavors and clean labels. Shortly, these trends are projected to support the growth of the Asia Pacific market for healthy snacks. Leaders in the food sector are placing a higher priority on repurposing food waste and launching delicious snacks that are bursting with macro and micronutrients. These businesses concentrate on using their industrial methods to turn byproducts into wholesome chips.

Competitive Analysis

Prominent companies have been making significant R&D investments to offer novel and nutritious snack options. These businesses rely on their well-known brands and broad distribution networks to hold a substantial market share.

Recent Developments

September 2023: A limited edition RXBAR ManifX bar with customized wrappers was introduced by Kellanova's RXBAR brand in collaboration with podcaster Maria Menounos. There is a Chocolate Sea Salt flavor option for the RXBAR ManifX bars, which have 12g of protein.

September 2023: Under the GetPRO brand, Danone UK&I unveiled a new range of high-protein dairy snacks made especially for people who want to get the most out of their exercise routines. The eleven products in the GetPRO line, which include high-protein yogurts, mousses, puddings, and beverages, provide 15–25g of protein per serving. Notably, these products are low-fat or fat-free and don't include any added sugars, appealing to health-conscious customers.

Key Market Players in the Healthy Snack Market

-

- Nestlé S.A.

- Unilever

- Kellanova (The Kellogg Company)

- PepsiCo

- Hormel Foods Corporation

- Danone

- Mondelēz International

- Del Monte Foods Inc.

- Monsoon Harvest

- Select Harvest

- Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 93.8 Billion |

|

Market Size 2033 |

USD 175.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Product, Claim, Packaging, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Nestlé S.A., Unilever, Kellanova (The Kellogg Company), PepsiCo, Hormel Foods Corporation, Danone, Mondelēz International, Del Monte Foods Inc., Monsoon Harvest, Select Harvest, Other Key Players |

|

Key Market Opportunities |

Increasing Health Awareness and Conscious Eating |

|

Key Market Dynamics |

Increasing Health Consciousness Among Consumers |

📘 Frequently Asked Questions

1. How much is the Healthy Snack Market in 2023?

Answer: The Healthy Snack Market size was valued at USD 175.2 Billion in 2023.

2. What would be the forecast period in the Healthy Snack Market report?

Answer: The forecast period in the Healthy Snack Market report is 2023-2033.

3. Who are the key players in the Healthy Snack Market?

Answer: Nestlé S.A., Unilever, Kellanova (The Kellogg Company), PepsiCo, Hormel Foods Corporation, Danone, Mondelēz International, Del Monte Foods Inc., Monsoon Harvest, Select Harvest, Other Key Players

4. What is the growth rate of the Healthy Snack Market?

Answer: Healthy Snack Market is growing at a CAGR of 6.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.