🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Heparin Market

Global Heparin Market (By Product, Low Molecular Weight Heparin and Unfractionated Heparin; By Source, Porcine and Bovine; By Application, Venous Thromboembolism, Coronary Artery Disease, Atrial Fibrillation/Flutter, and Other Applications; By Distribution Channel, Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy; By Region and Companies), 2024-2033

Nov 2024

Healthcare

Pages: 138

ID: IMR1305

Heparin Market Overview

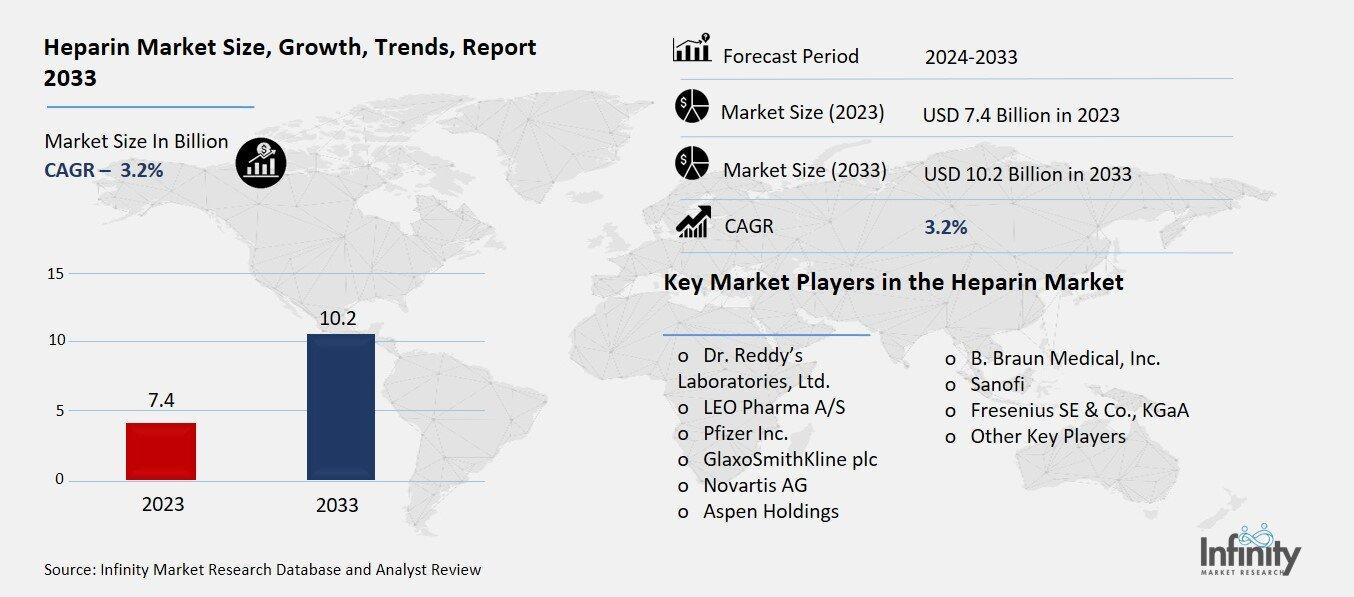

Global Heparin Market acquired the significant revenue of 7.4 Billion in 2023 and expected to be worth around USD 10.2 Billion by 2033 with the CAGR of 3.2% during the forecast period of 2024 to 2033. The market for heparin is gradually progressing due to high prevalence of cardiovascular diseases, deep vein thrombosis, pulmonary embolism and boosting number of surgical procedures that require the use of anticoagulants. Anticoagulant heparin has a significant role of reducing formation of blood clots, a factor that is very vital for the treatment of many ailments.

The increased need for heparin is also induced by the improvement in healthcare facilities during the past decades, especially in the developing nations and the increasing population of senior people most of whom are at high risk of thromboembolic diseases. The market is broadly split by type (unfractionated heparin, LMWH, and ULWH), and application and LMWH offers large potential since it is known to be well tolerated and simple to administer.

Drivers for the Heparin Market

Growing Prevalence of Cardiovascular Diseases and Blood Disorders

The increasing incidence of deep vein thrombosis, pulmonary embolism and other cardiovascular diseases where anticoagulants like heparin are used is a main driver to the global demand. DVT is defined as blood clots forming in the deep veins of the legs and its complications include; PE whereby a clot moves to the lungs and blocks the blood flow. These procedures combined with escalating lifestyle indicators like sedentary lifestyle, obesity and an ageing population consequently poses a challenge that healthcare providers are tapping efficient anticoagulation treatment to address risks caused by these disorders.

Despite existing anticoagulant agents, heparin with a swift effect profile and a long-established safety and effectiveness profile remains the mainstay of treatment in thromboembolic disorders. In addition, developments in the knowledge of the fundamental nature of cardiovascular diseases may have enhanced the perception of providers and clients concerning the imperative of early management.

Restraints for the Heparin Market

Risk of Contamination and Adverse Effects

The heparin supply chain has encountered significant challenges due to contamination issues, raising serious safety concerns that have directly impacted market growth. In recent years, several high-profile cases of contaminated heparin have been reported, leading to adverse patient outcomes and, in some cases, fatalities. These incidents highlighted the vulnerabilities associated with heparin production, particularly regarding its sourcing from animal tissues, which can introduce pathogens or impurities if not rigorously controlled. Regulatory agencies like the U.S. Food and Drug Administration (FDA) have increased scrutiny over heparin production processes, prompting manufacturers to invest in more stringent quality control measures and oversight.

Opportunity in the Heparin Market

Development of Synthetic Heparin Alternatives

Innovations in synthetic heparin formulations represent a promising advancement in the quest to reduce dependence on animal sources and mitigate contamination risks associated with traditional heparin production. Synthetic alternatives, developed through advanced biotechnological processes, offer the potential to create heparin-like compounds that retain the therapeutic efficacy of their natural counterparts while eliminating the variability and contamination issues linked to animal-derived heparin. These synthetic formulations can be produced in controlled environments, allowing for precise regulation of their chemical structure and ensuring a consistent quality that is less prone to contamination.

Trends for the Heparin Market

Shift Towards Low Molecular Weight Heparin

Low Molecular Weight Heparin (LMWH) has emerged as the preferred choice over unfractionated heparin (UFH) in many clinical settings, particularly for outpatient management, due to its distinct advantages in safety, efficacy, and patient compliance. One of the primary reasons for this preference is LMWH's improved safety profile; it is associated with a lower risk of heparin-induced thrombocytopenia (HIT), a serious immune-mediated complication that can occur with UFH.

Additionally, LMWH offers more predictable pharmacokinetics, allowing for fixed dosing regimens without the need for routine monitoring of activated partial thromboplastin time (aPTT), which is required for UFH. This simplification is particularly beneficial in outpatient settings, where patients can self-administer LMWH via subcutaneous injection, promoting adherence to treatment protocols.

Segments Covered in the Report

By Product

o Low Molecular Weight Heparin

o Unfractionated Heparin

By Source

o Porcine

o Bovine

By Application

o Venous Thromboembolism

o Coronary Artery Disease

o Atrial Fibrillation/Flutter

o Other Applications

By Distribution Channel

o Hospital Pharmacy

o Retail Pharmacy

o Online Pharmacy

Segment Analysis

By Product Analysis

On the basis of product, the market is divided into low molecular weight heparin and unfractionated heparin. Among these, low molecular weight heparin segment acquired the significant share in the market. LMWH offers a more predictable anticoagulant response, allowing for standardized dosing that simplifies treatment protocols and reduces the need for frequent laboratory monitoring. This predictability not only enhances patient safety but also promotes greater adherence to therapy.

Additionally, LMWH is associated with a lower incidence of complications such as heparin-induced thrombocytopenia, making it a safer option for many patients. The ease of administration through subcutaneous injections further contributes to its popularity, particularly in outpatient settings where patients can manage their treatment with minimal healthcare provider intervention. Moreover, LMWH has shown comparable efficacy in preventing thromboembolic events, establishing itself as a reliable choice in various clinical scenarios.

By Source Analysis

On the basis of source, the market is divided into porcine and bovine. Among these, porcine segment held the prominent share of the market. Porcine heparin is derived from the intestinal mucosa of pigs, which has been the traditional source of heparin for many years. This segment is favored primarily because porcine-derived heparin has a well-established safety and efficacy profile, backed by extensive clinical data that supports its use in a variety of therapeutic applications, including the prevention and treatment of thromboembolic disorders.

Additionally, the biochemical properties of porcine heparin closely resemble those of human heparin, making it highly effective for clinical use. Its availability and the efficiency of extraction methods have historically made porcine heparin a cost-effective option, further enhancing its attractiveness for manufacturers and healthcare providers.

By Application Analysis

On the basis of application, the market is divided into venous thromboembolism, coronary artery disease, atrial fibrillation/flutter, and other applications. Among these, venous thromboembolism segment held the significant share of the market. The increasing awareness of the serious complications associated with VTE, coupled with the growing number of surgical procedures and hospitalizations, has driven healthcare providers to adopt effective prophylactic and therapeutic strategies. Heparin, especially low molecular weight heparin (LMWH), is the treatment of choice for VTE due to its rapid action and proven efficacy in preventing clot formation and managing existing clots.

By Distribution Channel Analysis

On the basis of distribution channel, the market is divided into hospital pharmacy, retail pharmacy, and online pharmacy. Among these, hospital pharmacy segment held the most of the share of the market. Hospitals are often the primary setting for the management of acute thromboembolic events, where rapid access to anticoagulants like heparin is essential for effective treatment.

In acute care settings, healthcare providers require immediate access to heparin for various applications, including venous thromboembolism (VTE) management and preoperative prophylaxis. Hospital pharmacies are equipped to handle the specific storage, preparation, and dispensing requirements associated with heparin, ensuring that patients receive timely and appropriate doses.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 31.8% of the market. The increasing prevalence of cardiovascular diseases, obesity, and other conditions that predispose individuals to venous thromboembolism has led to a rising need for effective anticoagulants. The high awareness among healthcare providers and patients regarding the importance of preventive measures in managing thromboembolic risks further propels the demand for heparin. Moreover, extensive clinical research and development efforts in North America have resulted in innovations in heparin formulations and delivery methods, contributing to the market's growth.

The regulatory environment in North America also plays a crucial role; stringent regulations ensure the quality and safety of heparin products, fostering trust among healthcare providers and patients. Furthermore, a strong presence of key pharmaceutical companies and manufacturers in the region facilitates a stable supply chain, allowing for timely availability of heparin products.

Competitive Analysis

The competitive landscape of the heparin market is characterized by a mix of established pharmaceutical companies and emerging players, all striving to capture market share through innovation and strategic partnerships. Key players, such as Sanofi, Baxter International Inc., and Pfizer, hold significant positions due to their extensive portfolios of heparin products, including low molecular weight heparin (LMWH) and unfractionated heparin (UFH). These companies benefit from strong brand recognition, well-developed distribution networks, and substantial resources for research and development.

Recent Developments

In June 2023, Techdow USA Inc., a subsidiary of the Hepalink Group, introduced Enoxaparin Sodium (Enoxaparin), a vital product available in seven widely used pre-filled syringe formats. This offering meets the essential demand for outpatient treatment and prevention of harmful blood clots.

In August 2023, the FDA granted approval to Delcath Systems, Inc. for its HEPZATO KIT, designed for the treatment of adult patients with metastatic uveal melanoma and unresectable hepatic metastases.

Key Market Players in the Heparin Market

o Dr. Reddy’s Laboratories, Ltd.

o LEO Pharma A/S

o Pfizer Inc.

o GlaxoSmithKline plc

o Novartis AG

o Aspen Holdings

o B. Braun Medical, Inc.

o Sanofi

o Fresenius SE & Co., KGaA

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 7.4 Billion |

|

Market Size 2033 |

USD 10.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Source, Application, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Dr. Reddy’s Laboratories, Ltd., LEO Pharma A/S, Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Aspen Holdings, B. Braun Medical, Inc., Sanofi, Fresenius SE & Co., KGaA, and Other Key Players. |

|

Key Market Opportunities |

Development of Synthetic Heparin Alternatives |

|

Key Market Dynamics |

Growing Prevalence of Cardiovascular Diseases and Blood Disorders |

📘 Frequently Asked Questions

1. Who are the key players in the Heparin Market?

Answer: Dr. Reddy’s Laboratories, Ltd., LEO Pharma A/S, Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Aspen Holdings, B. Braun Medical, Inc., Sanofi, Fresenius SE & Co., KGaA, and Other Key Players.

2. How much is the Heparin Market in 2023?

Answer: The Heparin Market size was valued at USD 7.4 Billion in 2023.

3. What would be the forecast period in the Heparin Market?

Answer: The forecast period in the Heparin Market report is 2024-2033.

4. What is the growth rate of the Heparin Market?

Answer: Heparin Market is growing at a CAGR of 3.2% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.