🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

High Barrier Materials Market

High Barrier Materials Market Global Industry Analysis and Forecast (2024-2032) By Film Type (Metalized Films, Clear Films),By Material Type (Plastic, Aluminium),By Packaging Type (Pouches, Bags),By End User(Food, Beverages) and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1841

High Barrier Materials Market Synopsis

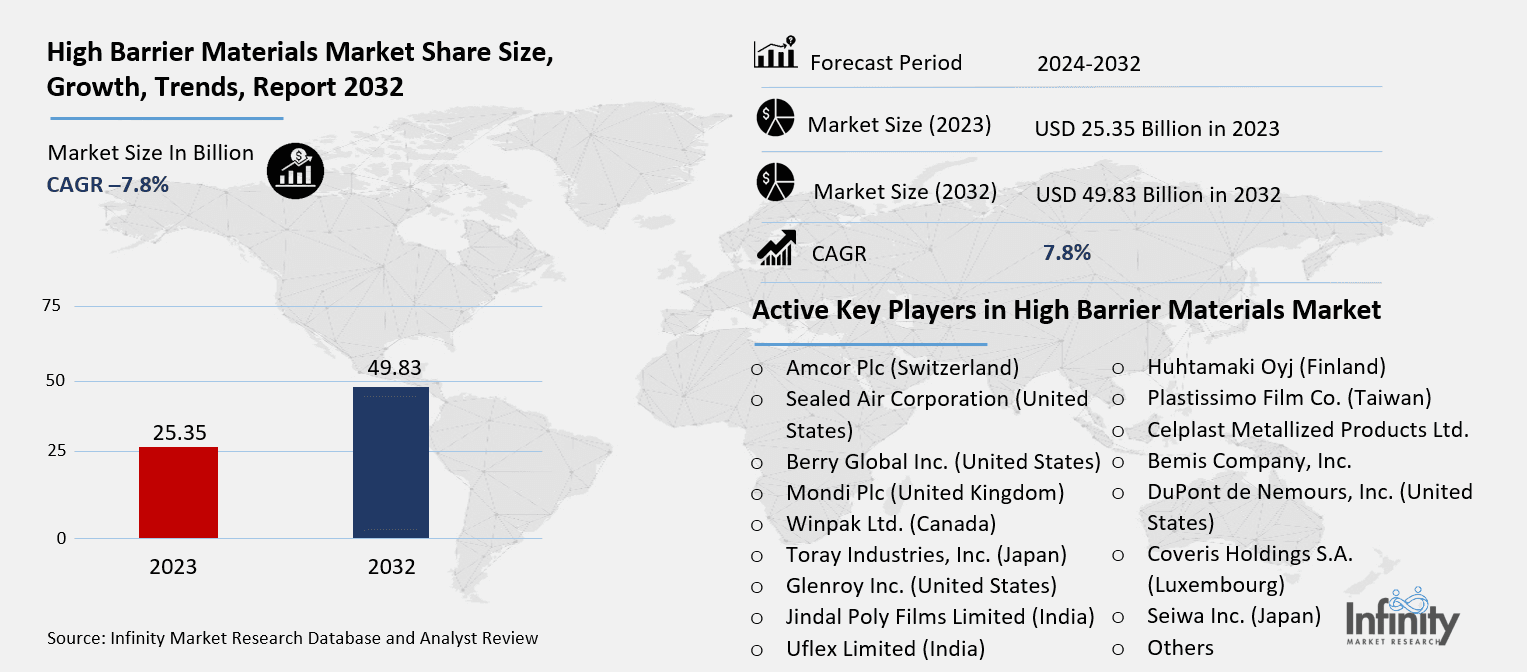

High Barrier Materials Market Size Was Valued at USD 25.35 Billion in 2023, and is Projected to Reach USD 49.83 Billion by 2032, Growing at a CAGR of 7.8% From 2024-2032.

Driven by growing demand for sophisticated packaging solutions across many sectors, including food and beverage, pharmaceuticals, and electronics, the High Barrier Materials Market is seeing consistent expansion. High barrier materials, such as ethylene vinyl alcohol (EVOH), polyvinylidene chloride (PVDC), and aluminum foil, keep things safe from oxygen, moisture, and other environmental factors that could damage their quality and shelf life. Adoption of high-barrier materials keeps widening as the world's worries about food waste and product safety grow.

The food and beverage sector is one of the main development engines since excellent shelf life and preservation of product freshness depend mostly on high barrier packaging. Manufacturers are including more multilayer films and coatings to improve packaging efficiency as convenience foods and ready-to-eat meals become more popular. Furthermore, the pharmaceutical industry mostly depends on high-barrier materials to guard delicate medications against moisture and contamination, therefore guaranteeing product stability and effectiveness.

The market has difficulties, including high production costs and environmental issues about plastic-based barrier materials; nevertheless, there are great development possibilities. Many conventional high-barrier materials—especially multilayer plastics—cause problems for sustainability and recycling. Manufacturers are thus spending on research and development to provide recyclable, bio-based, high-barrier materials that fit rising consumer and legal needs for environmentally responsible packaging.

High Barrier Materials Market Outlook, 2023 and 2032: Future Outlook

High Barrier Materials Market Trend Analysis

Trend: Growing demand for sustainable and recyclable high-barrier packaging solutions

As businesses search for environmentally responsible substitutes for conventional plastic-based materials, the market for high barrier materials is seeing a notable turn toward recyclable packaging solution. Manufacturers are developing biodegradable, compostable, and recyclable high-barrier materials to satisfy consumer and regulatory needs with growing environmental consciousness and strict rules on single-use plastics. Bio-based films, advanced multilayer structures that are easier to recycle, and solvent-free coatings are all becoming more popular. This is especially true in the food and beverage and pharmaceutical industries, where long shelf life and product safety are very important.

Drivers: Growing consumer demand for extended shelf-life products

As businesses search for environmentally responsible substitutes for conventional plastic-based materials, the market for high barrier materials is seeing a notable turn toward recyclable packaging solution. Manufacturers are developing biodegradable, compostable, and recyclable high-barrier materials to satisfy consumer and regulatory needs with growing environmental consciousness and strict rules on single-use plastics. Bio-based films, advanced multilayer structures that are easier to recycle, and solvent-free coatings are all becoming more popular. This is especially true in the food and beverage and pharmaceutical industries, where long shelf life and product safety are very important.

Restraints: High production costs of advanced barrier materials

The high barrier materials market is much limited by the substantial manufacturing expenses of advanced barrier materials. These materials—multilayer films, metalized coatings, and high-performance polymers like EVOH and PVDC—demand advanced technology, exact material formulations, and specific manufacturing techniques. Raw material costs—including coatings and high-performance resins—add still another layer to the total cost. Furthermore, the demand for advanced machinery and strict quality control policies raises running expenses, so high-barrier materials are more costly than more traditional packaging solutions. This cost element limits their adoption, especially for small and medium-sized businesses (SMEs) with stretched budgets.

Opportunities: Innovation in biodegradable and compostable high-barrier materials

The market for high-barrier materials is seeing great prospects driven by the rising need for biodegradable and compostable packaging solutions. Companies are spending on research and development to provide environmentally friendly, high-barrier materials that preserve product protection while lowering environmental effects as consumers and regulatory authorities drive for sustainable alternatives. Bio-based polymers like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and cellulose-based coatings are becoming more popular because they are good barriers and can be composted or recycled. Circular economy projects and corporate sustainability goals are pushing these materials to be used in more areas, like food and drink packaging, medicine packaging, and personal care packaging.

High Barrier Materials Market Segment Analysis

High Barrier Materials Market Segmented on the basis of By Film Type, By Material Type, By Packaging Type and By End User.

By Type

o Metalized Films

o Clear Films

By Material Type

o Plastic

o Aluminium

By End User

o Food

o Beverages

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Film Type, Metalized Films segment is expected to dominate the market during the forecast period

As businesses search for environmentally responsible substitutes for conventional plastic-based materials, the market for high barrier materials is seeing a notable turn toward recyclable packaging solution. Manufacturers are developing biodegradable, compostable, and recyclable high-barrier materials to satisfy consumer and regulatory needs with growing environmental consciousness and strict rules on single-use plastics. Bio-based films, advanced multilayer structures that are easier to recycle, and solvent-free coatings are all becoming more popular. This is especially true in the food and beverage and pharmaceutical industries, where long shelf life and product safety are very important. Furthermore, switching to sustainable high-barrier materials calls for conquering issues with scalability and cost. Many environmentally friendly substitutes, including water-based coatings and biodegradable films, demand changes in current manufacturing techniques and have greater production costs. Furthermore, it is difficult to include these materials in current recycling systems since infrastructure for processing new barrier materials is still under development.

By End User, Food segment expected to held the largest share

Driven by the requirement for extended shelf life, product freshness, and protection against moisture, oxygen, and pathogens, the food sector is a key consumer of high barrier materials. High-barrier packaging options are widely used for perishable goods like meat, dairy, ready-to-eat meals, and snacks. These include multilayer films, metalized films, and EVOH-based laminates. Manufacturers are investing in sophisticated packaging methods that provide great protection while preserving sustainability as customer demand for quick and durable food goods rises.

Regulatory limits on some barrier materials, such as PVDC, and the move toward recyclable, biobased substitutes are changing the industry and forcing businesses to create creative, environmentally responsible, high-barrier packing solutions. High barrier materials are absolutely important for maintaining the taste, carbonation, and nutritional integrity of beverages, including juices, soft drinks, alcoholic beverages, and dairy-based drinks.

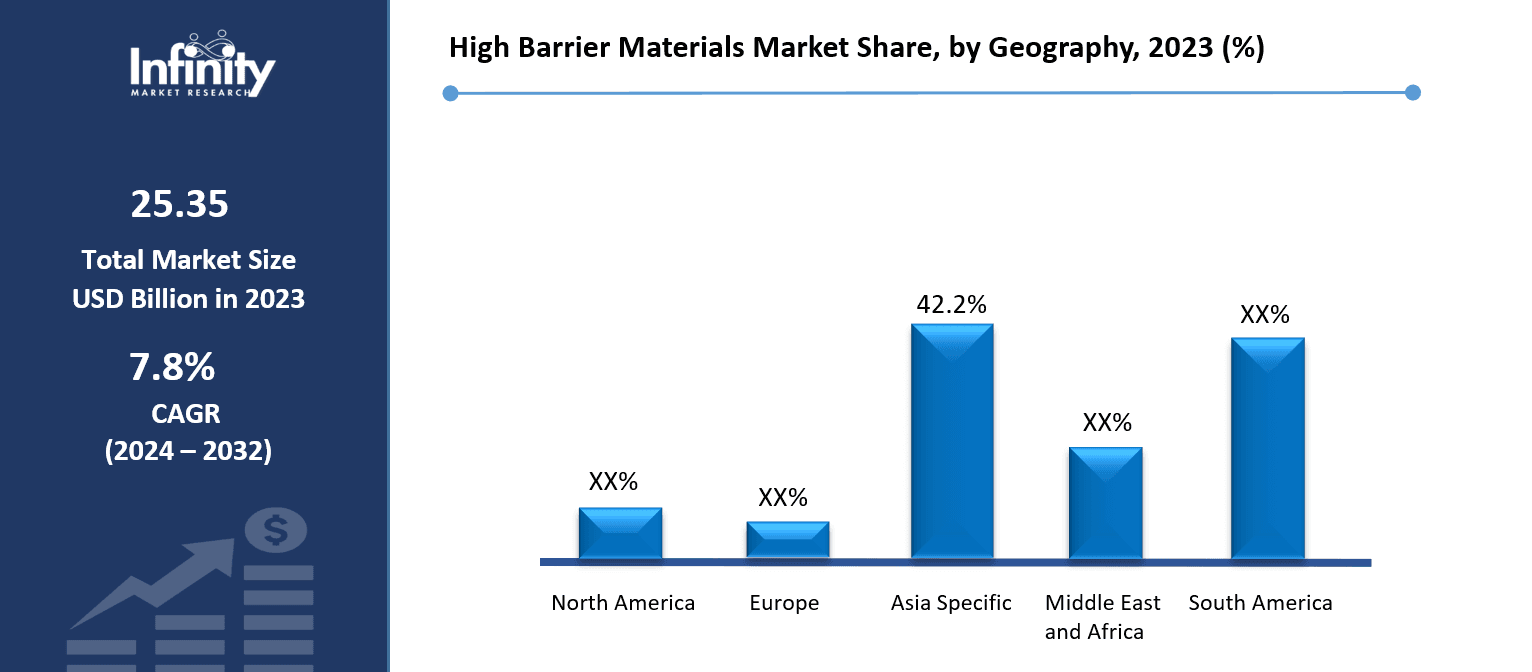

High Barrier Materials Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by fast industrialization, increasing packaged food consumption, and developing pharmaceutical sectors, the Asia-Pacific region is predicted to lead the high-barrier materials market over the forecast period. High-barrier packaging solutions are becoming more and more sought after in nations including China, India, and Japan to guarantee product safety, increase shelf life, and lower food waste. Particularly in the food, beverage, and personal care sectors, the region's fast-growing e-commerce market drives even more demand for robust and protective packaging. Government rules supporting sustainable packaging and food safety are also driving producers to make investments in creative barrier materials with better recyclability and less environmental effect.

High Barrier Materials Market Share, by Geography, 2023 (%)

Active Key Players in the High Barrier Materials Market

o Amcor Plc (Switzerland)

o Sealed Air Corporation (United States)

o Berry Global Inc. (United States)

o Mondi Plc (United Kingdom)

o Winpak Ltd. (Canada)

o Toray Industries, Inc. (Japan)

o Glenroy Inc. (United States)

o Jindal Poly Films Limited (India)

o Uflex Limited (India)

o Cosmo Films Limited (India)

o Innovia Films Ltd. (United Kingdom)

o Schur Flexibles Holding GesmbH (Austria)

o Flexopack SA (Greece)

o Huhtamaki Oyj (Finland)

o Plastissimo Film Co. (Taiwan)

o Celplast Metallized Products Ltd. (Canada)

o Bemis Company, Inc. (United States)

o DuPont de Nemours, Inc. (United States)

o Coveris Holdings S.A. (Luxembourg)

o Seiwa Inc. (Japan)

o Others

Global High Barrier Materials Market Scope

|

Global High Barrier Materials Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.35 Billion |

|

Forecast Period 2024-32 CAGR: |

7.8% |

Market Size in 2032: |

USD 49.83 Billion |

|

Segments Covered: |

By Film Type |

· Metalized Films · Clear Films | |

|

By Material Type |

· Plastic · Aluminium | ||

|

By Packaging Type |

· Pouches · Bags | ||

|

By End User |

· Food · Beverages | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing consumer demand for extended shelf-life products | ||

|

Key Market Restraints: |

· High production costs of advanced barrier materials | ||

|

Key Opportunities: |

· Innovation in biodegradable and compostable high-barrier materials | ||

|

Companies Covered in the report: |

· Amcor Plc (Switzerland), Sealed Air Corporation (United States), Berry Global Inc. (United States), Mondi Plc (United Kingdom), Winpak Ltd. (Canada), Toray Industries, Inc. (Japan), Glenroy Inc. (United States), Jindal Poly Films Limited (India), Uflex Limited (India), Cosmo Films Limited (India), Innovia Films Ltd. (United Kingdom), Schur Flexibles Holding GesmbH (Austria), Flexopack SA (Greece), Huhtamaki Oyj (Finland), Plastissimo Film Co. (Taiwan), Celplast Metallized Products Ltd. (Canada), Bemis Company, Inc. (United States), DuPont de Nemours, Inc. (United States), Coveris Holdings S.A. (Luxembourg), Seiwa Inc. (Japan), Others.

| ||

📘 Frequently Asked Questions

1. What would be the forecast period in the High Barrier Materials Market research report?

Answer: The forecast period in the High Barrier Materials Market research report is 2024-2032.

2. Who are the key players in the High Barrier Materials Market?

Answer: Amcor Plc (Switzerland), Sealed Air Corporation (United States), Berry Global Inc. (United States), Mondi Plc (United Kingdom), Winpak Ltd. (Canada), Toray Industries, Inc. (Japan), Glenroy Inc. (United States), Jindal Poly Films Limited (India), Uflex Limited (India), Cosmo Films Limited (India), Innovia Films Ltd. (United Kingdom), Schur Flexibles Holding GesmbH (Austria), Flexopack SA (Greece), Huhtamaki Oyj (Finland), Plastissimo Film Co. (Taiwan), Celplast Metallized Products Ltd. (Canada), Bemis Company, Inc. (United States), DuPont de Nemours, Inc. (United States), Coveris Holdings S.A. (Luxembourg), Seiwa Inc. (Japan), Others.

3. What are the segments of the High Barrier Materials Market?

Answer: The High Barrier Materials Market is segmented into By Film Type, By Material Type, By Packaging Type, End User and region. By Film Type (Metalized Films, Clear Films),By Material Type (Plastic, Aluminium),By Packaging Type (Pouches, Bags),By End User(Food, Beverages). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the High Barrier Materials Market?

Answer: High Barrier Materials refer to specialized packaging materials designed to provide superior protection against external factors such as oxygen, moisture, light, and contaminants. These materials, including multilayer films, metalized films, and coated polymers, are widely used in industries like food, beverages, pharmaceuticals, and electronics to extend product shelf life and maintain quality. High barrier materials help prevent spoilage, preserve flavors, and enhance packaging durability while meeting sustainability and regulatory requirements. With advancements in biodegradable and recyclable barrier materials, the market is evolving to align with eco-friendly packaging trends.

5. How big is the High Barrier Materials Market?

Answer: High Barrier Materials Market Size Was Valued at USD 25.35 Billion in 2023, and is Projected to Reach USD 49.83 Billion by 2032, Growing at a CAGR of 7.8% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.