🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

High Purity Alumina Market

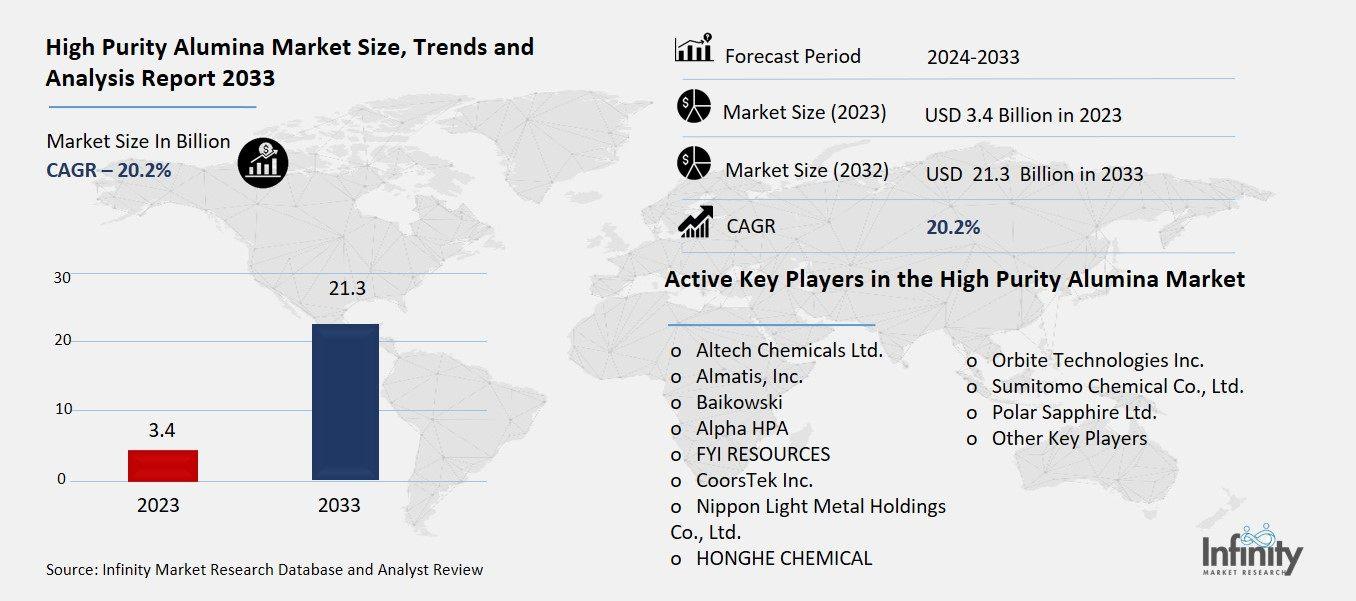

High Purity Alumina Market Global Industry Analysis and Forecast (2024-2033) by Product (4N, 5N, and 6N), Application (LED, Lithium-ion Batteries, Phosphor, Semiconductor, Sapphire, and Other Applications) and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR2003

High Purity Alumina Market Synopsis

The global high purity alumina market was valued at USD 3.4 billion in 2023 and is expected to grow from USD 4.0 billion in 2024 to USD 21.3 billion by 2033, reflecting a CAGR of 20.2% over the forecast period.

The High Purity Alumina (HPA) market is achieving high rates of growth because of increased demand in a number of high-tech and energy related industries. HPA, which is usually known as aluminum oxide (Al₂O₃) and has a purity of 99.99% or more, is one of the most significant materials involved in the production of LED lights, lithium-ion batteries’ separators, synthetic sapphire substrates, and semiconductors. The worldwide demand for energy efficiency and electric mobility has greatly accelerated HPA use especially in electric vehicle batteries and portable electronics as well. Also, there is a shift to sustainable lighting, which creates the demand for LEDs, which need a high-purity alumina as a phosphor covering. Asia Pacific is the leader of the market with China, Japan and South Korea, accounting for the high volume of electronics production.

High Purity Alumina Market Driver Analysis

Government Policies Supporting Clean Energy

Incentives and regulatory changes that support EVs and energy-efficient products increase HPA demand as High Purity Alumina is of extreme importance to the technologies for such efforts. Governments throughout the world are providing tax breaks, subsidy, and tighter regulations on emission to make the use of electric vehicles and energy-efficient lamps such as LEDs more prevalent in a short period. HPA is incorporated into the lithium-ion battery separators, which make them both safe and effective in the EV batteries, as well as coatings at phosphors of LEDs. With increasing regulatory pressure to decrease carbon emission and increase energy efficiency, industries using HPA are ramping up thus increasing direct demand for this special material.

High Purity Alumina Market Restraint Analysis

Environmental Concerns

Chemical heavy means of production may result in environmental hazards if not controlled properly since the traditional manufacturing of High Purity Alumina (HPA) using Bayer process and hydrochloric acid leaching involves the application of strong acids or alkali, high temperature and hazardous waste production. If immature, waste streams, emissions, and chemical residues are not well managed, they can contaminate soil sources, air, and water supplies putting the risk ecosystems and the public’s wellbeing. Also, these processes are energy-intensive, hence contributing to the emission of greenhouse gases. With the world getting serious about environmental policies, manufacturers are coming under increasing pressure to implement cleaner and environmentally-friendly technologies for production, as well as invest in appropriate waste management systems.

High Purity Alumina Market Opportunity Analysis

New Applications in Medical and Aerospace

HPA properties are appropriate for high performance components in such industries due to its outstanding nature of being chemically stable, heat resistant, hard and an insulator of electricity. In the medical industry, HPA is applied in its bioceramics for the implants, dental materials, and medical imaging devices because of its biocompatibility and purity. In the aerospace industry, it is worthwhile for its high temperature and corrosion resistance, which makes it a perfect fit for the components of engines, sensors, and optics. These high-demanding applications necessitate the use of materials that ensure delivery even under harrowing conditions, and HPA’s purity and physical properties are well suited for such high-end uses.

High Purity Alumina Market Trend Analysis

R&D in Nano-HPA and Coated Separator Technologies

Innovation is focusing on the next gen batteries and precision electronics with the help of next-gen HPA materials, as the industrial stage requires attention to such performance, safety, and efficiency. In the technology of the battery, improvements in changing lithium ion battery separators with ultra-high purity and nano structured HPA is in focus which increases the thermodynamic stability and block short circuiting – a must for electric vehicles and energy storage systems. In precision electronics, novel HPA materials are being designed for use in substrates, coatings, and insulating layers with little pollution and excellent strength quality. These innovations enable devices to be more miniaturized, at a higher energy density, and longer lifespans; putting HPA at the forefront of future electronic and energy solutions as a vital enabler.

High Purity Alumina Market Segment Analysis

The High Purity Alumina Market is segmented on the basis of Product, Processing Method, and Application.

By Product

o 4N

o 5N

o 6N

By Application

o LED

o Lithium-ion Batteries

o Phosphor

o Semiconductor

o Sapphire

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product, 4N Segment is Expected to Dominate the Market During the Forecast Period

The products discussed in this research study, the 4N segment is expected to account for the largest market share of high purity alumina market in the forecast period. This dominance is reported to be owing to its wide applicability, cost effectiveness and suitability to industries, which require high demand such as LEDs, lithium-ion battery separators, and electronic display. Although more specific uses require higher purity grades such as 5N and 6N, 4N HPA provides with an excellent price/performance ratio for which it is the favored choice for mass-market production processes. Its purity level is adequate enough to comply with technical specifications of most of the most advanced techs without the vastly escalated cost of the ultra-high purity forms.

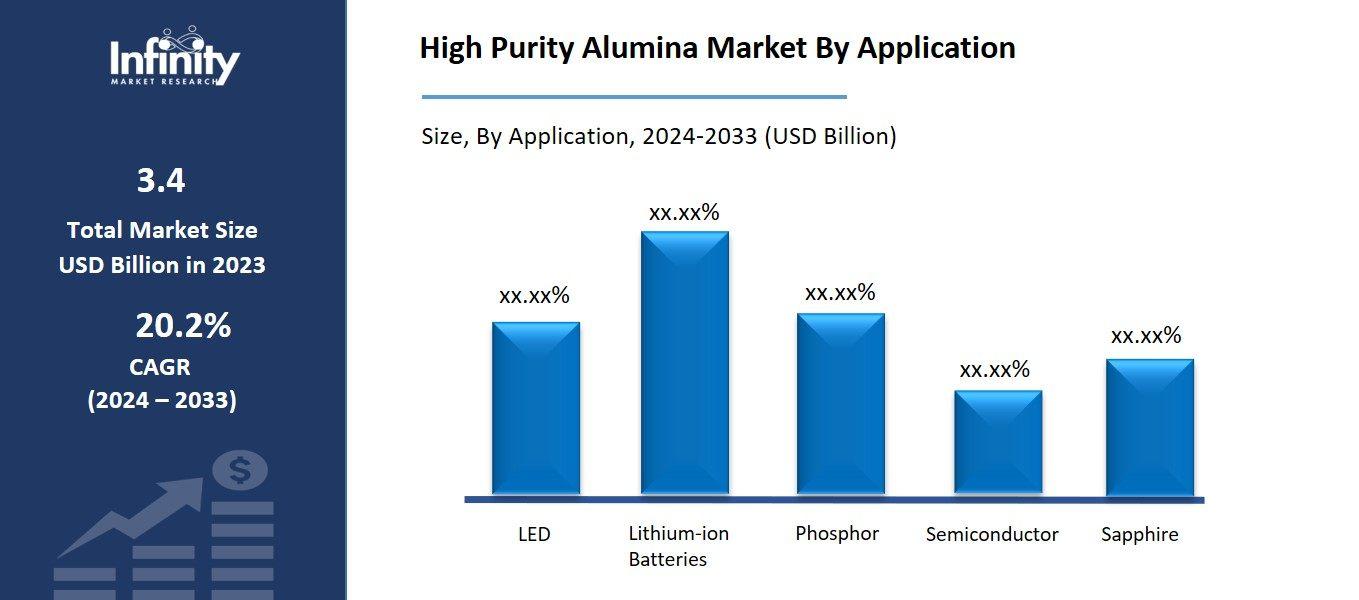

By Application, the LED Segment is Expected to Held the Largest Share

In terms of applications, LED segment is anticipated to have the largest share of the high purity alumina (HPA) market in the forecast period based on the fact that the usage of energy-efficient technologies of lighting has become common both in residential, commercial, and industrial spheres. HPA is an important material in manufacturing synthetic sapphire substrates and phosphor coatings in the LEDs which are all important for increasing light output and durability. As countries work towards limiting energy usage and carbon footprint globally, traditional lighting is downed by governments and industries with the use of LEDs. Such a transition, supported by increasing demand in the automotive lighting, consumer electronics, as well as street lighting, continues to fuel impressive HPA consumption in the LED area.

High Purity Alumina Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is expected to dominate the high purity alumina (HPA) market over the forecast period due to its strong industrial base, technological advancements, and growing demand for high-performance electronic components. China, Japan and South Korea are big players in LED manufacturing, consumer electronics and lithium-ion battery – areas of application for HPA. However, the especially voracious drive of China towards electric vehicles and renewable energy storage indicated a substantial rise of the regional demand for HPA in the structures of batteries. In addition, good government policies, massive development in infrastructure and decline in cost of manufacturing HPA enhances the position of Asia Pacific as the largest consumer and producer of HPA. The dominance of the region also lies in the fact that there are the major players present and the continuous investments in such areas as advanced materials and clean technologies.

Recent Development

In May 2024, Alpha HPA made its final investment decision to begin full-scale High Purity Alumina (HPA) production at its facility in Gladstone, Queensland. The project aimed to establish the world’s largest single-site HPA refinery.

In August 2023, Sumitomo Chemical announced plans to begin mass production of its innovative ultra-fine α-alumina products (NXA series) in September, with manufacturing taking place at its Ehime Works.

Active Key Players in the High Purity Alumina Market

o Altech Chemicals Ltd.

o Almatis, Inc.

o Baikowski

o Alpha HPA

o FYI RESOURCES

o CoorsTek Inc.

o Nippon Light Metal Holdings Co., Ltd.

o HONGHE CHEMICAL

o Orbite Technologies Inc.

o Sumitomo Chemical Co., Ltd.

o Polar Sapphire Ltd.

o Other Key Players

Global High Purity Alumina Market Scope

|

Global High Purity Alumina Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.4 Billion |

|

Market Size in 2024: |

USD 4.0 Billion | ||

|

Forecast Period 2024-33 CAGR: |

20.2% |

Market Size in 2033: |

USD 21.3 Billion |

|

Segments Covered: |

By Product |

· Cast · Extrusion · Sheet · Plate · Other Products | |

|

By Application |

· LED · Lithium-ion Batteries · Phosphor · Semiconductor · Sapphire · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Government Policies Supporting Clean Energy | ||

|

Key Market Restraints: |

· Environmental Concerns | ||

|

Key Opportunities: |

· New Applications in Medical and Aerospace | ||

|

Companies Covered in the report: |

· Altech Chemicals Ltd., Almatis, Inc., Baikowski, Alpha HPA, and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the High Purity Alumina Market Research report?

Answer: The forecast period in the High Purity Alumina Market Research report is 2024-2033.

2. Who are the key players in the High Purity Alumina Market?

Answer: Altech Chemicals Ltd., Almatis, Inc., Baikowski, Alpha HPA, and Other Key Players.

3. What are the segments of the High Purity Alumina Market?

Answer: The High Purity Alumina Market is segmented into Product, Application, and Regions. By Product, the market is categorized into 4N, 5N, and 6N. By Application, the market is categorized into LED, Lithium-ion Batteries, Phosphor, Semiconductor, Sapphire, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the High Purity Alumina Market?

Answer: The High Purity Alumina (HPA) market stands for the global community concerned about the manufacture, distribution, and usage of an alumina (Al₂O₃) product with 99.99% or more purity. HPA is a high value specialty type of aluminum oxide which predominately finds application in technology. It is important in the production of LED lights, lithium-ion battery separators, synthetic sapphire for smartphones’ screens, optical lenses, and semiconductor substrates. The demand arises as a result of the increased demand in the electronics, electric van, and renewable energy sector, especially with the increase in the adoption of LED and expansion of the battery technologies.

5. How big is the High Purity Alumina Market?

Answer: The global High Purity Alumina Market was valued at USD 3.4 billion in 2023 and is expected to grow from USD 4.0 billion in 2024 to USD 21.3 billion by 2033, reflecting a CAGR of 20.2% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.