🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

High-Voltage Direct Current (Hvdc) Transmission Systems Market

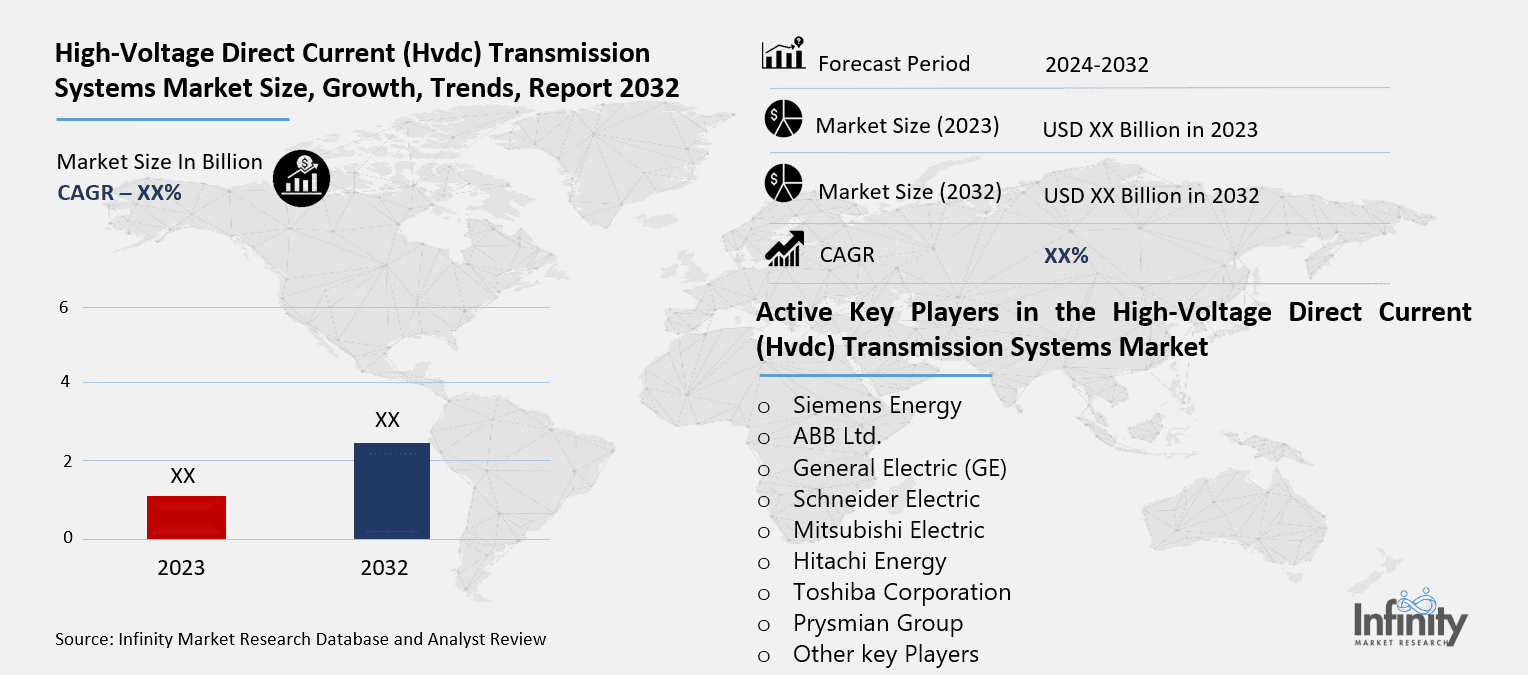

High-Voltage Direct Current (Hvdc) Transmission Systems Market Global Industry Analysis and Forecast (2024-2032) By Technology (Line Commutated Converters (LCC), Voltage Source Converters (VSC)) By Type (Point-to-Point (P2P), Multi-Terminal HVDC (MTDC)) By Application (Power Transmission, Offshore Wind Farms, Grid Interconnections, Urban Power Distribution) By Voltage Level (Extra High Voltage (EHV), High Voltage (HV), Ultra-High Voltage (UHV)) and Region

Mar 2025

Energy and Power

Pages: 138

ID: IMR1843

High-Voltage Direct Current (Hvdc) Transmission Systems Market Synopsis

High-Voltage Direct Current (Hvdc) Transmission Systems Market acquired the significant revenue of XX Billion in 2023 and expected to be worth around USD XX Billion by 2032 with the CAGR of XX% during the forecast period of 2024 to 2032.

Power transmission systems called High-Voltage Direct Current (HVDC) distribute electricity by direct current (DC) at high voltages across lengthy distances. HVDC technology enables efficient delivery of massive power flows over long distances at elevated voltages by minimizing the power loss compared to standard alternating current systems. The HVDC system incorporates converter units to transform AC power streams into DC electricity when sending then back to AC at its destination point. The HVDC technology serves multiple essential functions by ensuring power grid stability and enabling renewable energy integration while boosting power transmission efficiency throughout territories with diverse topographic characteristics or extensive power transfer needs.

The market for High-Voltage Direct Current transmission systems shows strong growth as users pursue superior power transmission methods which combine efficiency with reliability and cost-effectiveness. HVDC systems excel at transmitting large power volumes across extensive distances without significant power loss which enables them to function as an indispensable solution during market energy expansion. HVDC technology provides the necessary equipment to integrate renewable energy sources into the grid for offshore wind farms by transmitting power across extended distances to onshore grids. Increased renewable energy investments together with improved HVDC technology systems will sustain market expansion.

HVDC systems face growing demand because governments are now prioritizing sustainability together with energy security objectives. The combination of financial support for clean energy development through policy initiatives and tighter emission restrictions establishes HVDC technology as a fundamental driver for industry adoption. The integration potential of renewable energy serves as one of the main applications for HVDC systems in addition to their role in enhancing network stability and easing transmission bounds and power trade. Utility companies see HVDC's benefits as critical elements for their operations especially when serving extensive regions such as offshore wind facilities situated outside human access requirements reliable transmission systems.

HVDC systems have achieved enhanced system performance through recent technological developments like voltage-source converters (VSC-HVDC) and integrated hybrid solutions. Advanced HVDC technologies extend practical applications into grid interconnection zones as well as offshore wind power networks as well as extended power lines. HVDC systems demonstrate their role as a fundamental component of modern power transmission networks since they enhance grid performance and help achieve energy sector decarbonization during our ongoing energy transition to cleaner power sources. Market expansion for HVDC transmission systems will persist because of these supporting factors.

The market displays numerous benefits however it encounters crucial obstacles. The combination of expensive initial HVDC equipment costs and technical complexity hinders new companies from entering this market and resultingly reduces adoption speed among developing areas with restricted funding options. The maintenance challenges alongside reliability problems and prolonged payback duration persist as operational considerations for utilities which slows down implementation across the sector. With improvements in the technological maturity of HVDC systems and realizing economies of scale the total installation expenses will drop which will enhance market accessibility for utilities and promote rapid adoption.

High-Voltage Direct Current (Hvdc) Transmission Systems Market Trend Analysis

Trend

Growing Emphasis on Long-Distance Power Transmission

The High-Voltage Direct Current (HVDC) transmission systems market sees an increasing focus on delivering power over extensive distances as a primary marketplace trend. HVDC systems have surpassed AC transmission systems for electric power distribution due to their superior capacity at moving large amounts of power through long distances. HVDC technology retains considerably lower line losses than AC systems while offering suitable functionality for distant power transmission projects. Power plants continue to move further from city centers because of increasing offshore wind energy and solar power development so long-distance transmission excellence becomes an immediate requirement. This technology serves power transmission needs by allowing efficient movement of substantial energy volumes without degraded efficiency levels throughout electricity delivery networks.

The integration of renewable energy resources into power networks requires special focus given current power grid expansion efforts. The distance between offshore wind farms and population centers requires reliable transmission through long-distance power lines because renewable energy generators are typically stocked in remote areas. The integration of HVDC systems establishes efficient connections between distant renewable power stations and urban electricity networks for clean power transfer to demand locations. Electrical nodes from different regions and nations can share electricity when HVDC systems function as connecting elements for national grids which enhances power security. Energy loss reduction together with improved grid stability and accelerated clean energy transition makes HVDC systems essential for long-distance power transmission applications.

Opportunity

Rising Demand for Renewable Energy Integration

Recent technological shifts toward renewable wind power and solar energy systems demand advanced transmission solutions that deliver power efficiently across expansive distances. Renewable energy facilities in distant locations facing transmission limitations because traditional AC power systems experience enhanced power losses as they operate across longer distances. HVDC (High-Voltage Direct Current) technology brings enhanced solutions to power distribution by delivering more efficient transmission while reducing substantial energy waste across extended distances. The stability capabilities of HVDC systems remain crucial for integrating renewable energy with intermittent characteristics into worldwide power systems.

The future years will see substantial investments in HVDC infrastructure thanks to renewed government and private sector interest in renewable energy systems. The rising percentage of renewable energy will require the building of novel HVDC transmission routes and the upgrading of current grid systems. HVDC technology will be essential for achieving global energy transition goals and building a sustainable future because it enables environmentally friendly long-distance power transmission.

High-Voltage Direct Current (Hvdc) Transmission Systems Market Segment Analysis

High-Voltage Direct Current (Hvdc) Transmission Systems Market Segmented on the basis of By Technology, By Type, By Application, By Voltage Level.

By Technology

o Line Commutated Converters (LCC)

o Voltage Source Converters (VSC)

By Type

o Point-to-Point (P2P)

o Multi-Terminal HVDC (MTDC)

By Application

o Power Transmission

o Offshore Wind Farms

o Grid Interconnections

o Urban Power Distribution

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Technology, Line Commutated Converters (LCC) segment is expected to dominate the market during the forecast period

Line Commutated Converters (LCC) technology is a cornerstone in traditional High Voltage Direct Current (HVDC) systems, specifically designed for long-distance and high-capacity power transmission. It operates using thyristor-based converters, which are highly efficient in transmitting large amounts of electricity over extended distances. The inherent robustness of LCC systems ensures stable operation, making them a preferred choice for large-scale applications such as connecting distant power generation plants to urban centers. LCC-based HVDC systems are recognized for their ability to handle the significant power requirements of industries and populations spread across vast distances, offering a reliable and cost-effective solution for high-capacity transmission.

However, the operation of LCC systems comes with certain limitations. These systems require strong grid synchronization, which means that the connected grids must operate in harmony to maintain stable power flow. This can present challenges when dealing with fluctuations in power supply or demand, as LCC systems are less flexible in managing such variations compared to more modern HVDC technologies. Despite these challenges, LCC technology continues to be favored in regions with well-established infrastructure, where the demand for reliable, high-capacity, long-distance transmission is paramount, and the initial cost of deployment can be offset by the efficiency and stability it offers over time.

By Voltage Level, Ultra-High Voltage (UHV) segment expected to held the largest share

Ultra-High Voltage (UHV) systems are designed to operate at voltages exceeding 800 kV, making them essential for ultra-long-distance power transmission. These systems are primarily used to connect distant power generation sources, such as remote hydroelectric plants or large-scale renewable energy projects, to major load centers. By utilizing higher voltage levels, UHV HVDC systems enable the transmission of large quantities of electricity with significantly reduced losses over vast distances. This is especially crucial in regions where energy generation is located far from consumption areas, ensuring efficient and reliable power delivery to meet growing energy demands.

In addition to their ability to transport electricity over long distances, UHV systems play a vital role in enhancing the capacity and stability of the power grid. These systems are particularly beneficial in regions facing rapidly increasing power demands, as they improve grid reliability and enable better integration of renewable energy sources. UHV HVDC technology is increasingly being used for cross-border interconnections, enabling countries to share power efficiently and balance their energy resources. The adoption of UHV systems is also key in modernizing grids and supporting the global transition to cleaner, sustainable energy by facilitating the integration of large-scale renewable energy projects into the existing power infrastructure.

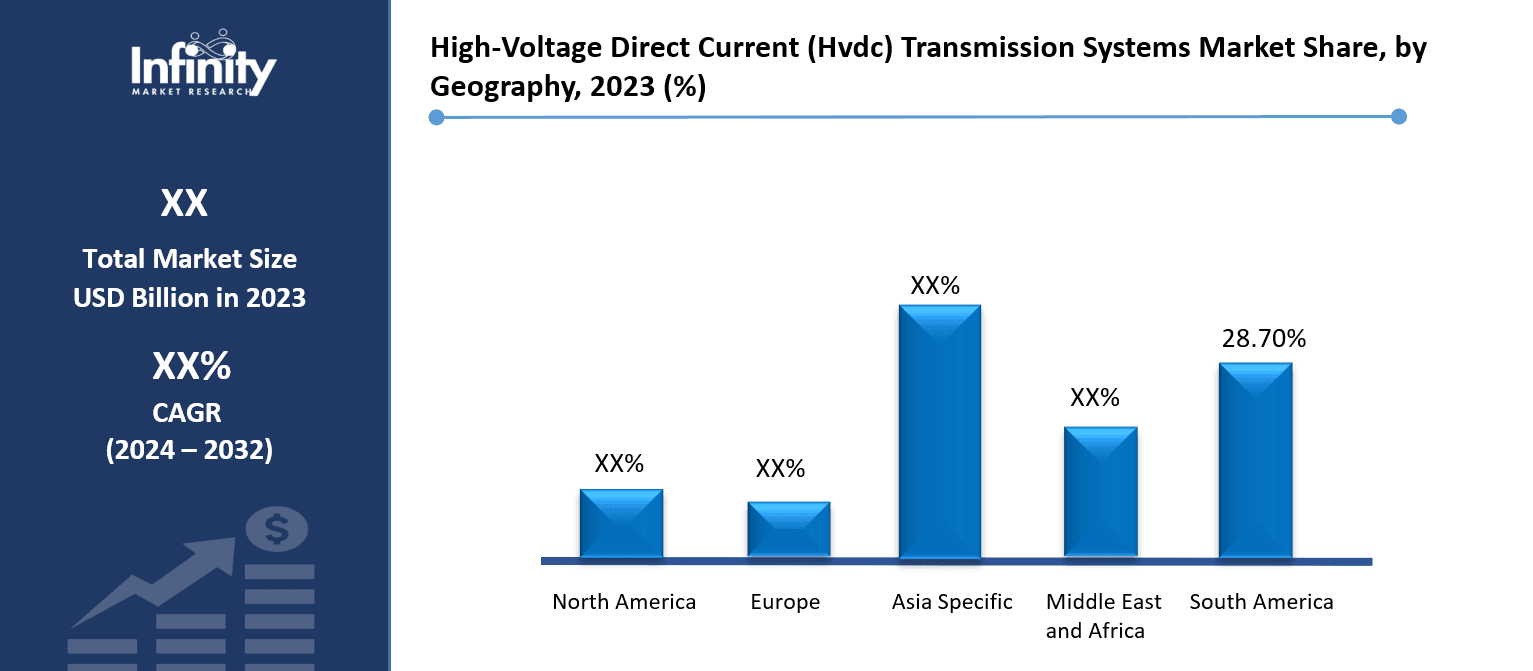

High-Voltage Direct Current (Hvdc) Transmission Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Constructors implement HVDC transmission systems at increasing rates throughout North America because nations increase their investments to upgrade essential electricity infrastructure systems as they integrate growing amounts of renewable energy sources particularly wind and solar capabilities into their networks. The growing energy requirements of urban areas find a solution in HVDC technology which allows efficient power transmission across long distances while minimizing losses. HVDC systems adoption increases as the U.S. and Canadian nations pursue power grid modernization to boost both reliability and energy efficiency.

Both U.S. and Canadian electricity trade along borders supports market development through HVDC system capabilities for effortless long-distance power transfers. The growing installation of offshore wind initiatives on the U.S. East Coast drives an increase in HVDC technology demand because it allows dependable power transmission between offshore facilities and on-land power networks. HVDC-based developments showcase North America's dedication to creating an energy framework that is both sustainable and resistant to disruptions.

High-Voltage Direct Current (Hvdc) Transmission Systems Market Share, by Geography, 2023 (%)

Active Key Players in the High-Voltage Direct Current (Hvdc) Transmission Systems Market

o Siemens Energy

o ABB Ltd.

o General Electric (GE)

o Schneider Electric

o Mitsubishi Electric

o Hitachi Energy

o Toshiba Corporation

o Prysmian Group

o Other key Players

Global High-Voltage Direct Current (Hvdc) Transmission Systems Market Scope

|

Global High-Voltage Direct Current (Hvdc) Transmission Systems Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

|

By Technology |

· Line Commutated Converters (LCC) · Voltage Source Converters (VSC) | |

|

By Type |

· Point-to-Point (P2P) · Multi-Terminal HVDC (MTDC) | ||

|

By Application |

· Power Transmission · Offshore Wind Farms · Grid Interconnections · Urban Power Distribution | ||

|

By Voltage Level |

· Extra High Voltage (EHV) · High Voltage (HV) · Ultra-High Voltage (UHV) | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Efficiency of HVDC Technology in Long-Distance Power Transmission | ||

|

Key Market Restraints: |

· High Initial Capital Investment in HVDC Systems | ||

|

Key Opportunities: |

· Rising Demand for Renewable Energy Integration | ||

|

Companies Covered in the report: |

· Siemens Energy, ABB Ltd., General Electric (GE), Schneider Electric, Mitsubishi Electric, Hitachi Energy, Toshiba Corporation, Prysmian Group and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the High-Voltage Direct Current (Hvdc) Transmission Systems Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the High-Voltage Direct Current (Hvdc) Transmission Systems Market?

Answer: Siemens Energy, ABB Ltd., General Electric (GE), Schneider Electric, Mitsubishi Electric, Hitachi Energy, Toshiba Corporation, Prysmian Group and Other Major Players.

3. What are the segments of the High-Voltage Direct Current (Hvdc) Transmission Systems Market?

Answer: The High-Voltage Direct Current (Hvdc) Transmission Systems Market is segmented into By Technology, By Type, By Application, By Voltage Level and region. By Technology, the market is categorized into Line Commutated Converters (LCC), Voltage Source Converters (VSC). By Type, the market is categorized into Point-to-Point (P2P), Multi-Terminal HVDC (MTDC). By Application, the market is categorized into Power Transmission, Offshore Wind Farms, Grid Interconnections, Urban Power Distribution. By Voltage Level, the market is categorized into Extra High Voltage (EHV), High Voltage (HV), Ultra-High Voltage (UHV). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the High-Voltage Direct Current (Hvdc) Transmission Systems Market?

Answer: Power transmission systems called High-Voltage Direct Current (HVDC) distribute electricity by direct current (DC) at high voltages across lengthy distances. HVDC technology enables efficient delivery of massive power flows over long distances at elevated voltages by minimizing the power loss compared to standard alternating current systems. The HVDC system incorporates converter units to transform AC power streams into DC electricity when sending then back to AC at its destination point. The HVDC technology serves multiple essential functions by ensuring power grid stability and enabling renewable energy integration while boosting power transmission efficiency throughout territories with diverse topographic characteristics or extensive power transfer needs.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.