🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hospital Beds Market

Hospital Beds Market (By Type (Electric Beds, Semi-Electric Beds, Manual Beds), By Application (Acute Care, Psychiatric Care, Long-term Care, Other Applications), By End-User (Hospitals, Home Care Settings, Elderly Care Facilities, Ambulatory Surgical Centers, Other End-Users), By Region and Companies)

Jun 2024

Healthcare

Pages: 158

ID: IMR1095

Hospital Beds Market Overview

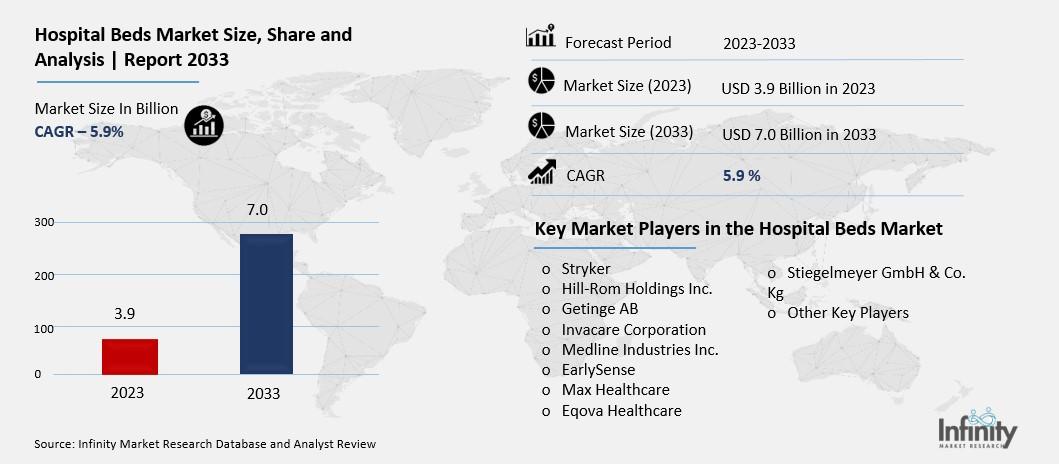

Global Hospital Beds Market size is expected to be worth around USD 7.0 Billion by 2033 from USD 3.9 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

The term "Hospital Beds Market" refers to the market segment that deals with the manufacturing, distribution, and sale of beds specifically designed for use in hospitals, clinics, and other healthcare facilities. These beds are crucial for patient care, providing comfort, support, and safety during treatment, recovery, and long-term stays. The market includes a variety of bed types, from standard manual beds to advanced electric beds equipped with features like adjustable height, backrests, and side rails. Specialized beds for Intensive Care Units (ICU), bariatric patients, and pediatric patients are also part of this market.

Several factors drive the hospital beds market. The aging global population is increasing the demand for healthcare services, leading to a higher requirement for hospital beds. Technological advancements in bed design and features, such as remote-controlled beds and beds with integrated patient monitoring systems, are also influencing market growth. Additionally, the rise in chronic diseases requiring hospitalization, coupled with improvements in healthcare infrastructure in emerging markets, is expanding the market further. Regulatory standards and guidelines that ensure patient safety and comfort are critical considerations for manufacturers and healthcare providers in this market.

Drivers for the Hospital Beds Market

Aging Population and Healthcare Needs

One of the primary drivers of the hospital beds market is the global aging population. As populations age, there is an increased prevalence of chronic diseases and a higher demand for healthcare services. Elderly individuals often require extended periods of hospitalization for various ailments, which drives the need for hospital beds. According to data from the United Nations, the global population aged 60 years and above is growing at a rapid pace. For instance, in 2020, there were 727 million people aged 65 years or over worldwide, a number projected to double to over 1.5 billion by 2050. This demographic shift is expected to significantly increase the demand for hospital beds, particularly those designed for long-term care and rehabilitation.

Technological Advancements in Hospital Beds

Advancements in technology play a crucial role in driving the hospital beds market forward. Modern hospital beds are equipped with advanced features such as electric controls, adjustable heights, integrated patient monitoring systems, and pressure relief mattresses. These technological innovations enhance patient comfort, improve caregiving efficiency, and reduce the risk of complications such as bedsores. For example, smart hospital beds can monitor vital signs and adjust automatically to ensure patient safety and comfort. The global market for smart hospital beds is expected to grow rapidly, driven by the integration of IoT (Internet of Things) and AI (Artificial Intelligence) technologies in healthcare equipment.

Healthcare Infrastructure Development

The development and expansion of healthcare infrastructure in emerging markets are also significant drivers of the hospital beds market. Governments and private healthcare providers are investing in new hospitals, clinics, and nursing homes to meet the increasing demand for healthcare services. This expansion includes the purchase of new hospital beds to equip these facilities adequately. For example, in India, the government's initiative to build new hospitals and upgrade existing ones under the Ayushman Bharat scheme has increased the demand for hospital beds in the country. This trend is mirrored in other developing regions where healthcare infrastructure is rapidly evolving to cater to growing healthcare needs.

Restraints for the Hospital Beds Market

Cost Constraints and Budget Limitations

One of the primary restraints for the hospital bed market is the high cost associated with advanced hospital bed technologies. While modern hospital beds offer a range of advanced features such as electric controls, patient monitoring systems, and specialized mattresses, these features come at a premium price. For example, electric hospital beds can cost significantly more than manual beds, which makes it challenging for healthcare providers, particularly in developing countries or underfunded healthcare systems, to afford these beds in large quantities. Moreover, the maintenance and servicing costs of these advanced beds can also add to the financial burden on healthcare facilities.

Regulatory and Safety Compliance

Another significant restraint for the hospital beds market is the stringent regulatory standards and safety compliance requirements imposed by governments and healthcare regulatory bodies. Hospital beds must meet various safety and quality standards to ensure patient safety and comfort. Compliance with these standards often requires extensive testing, certification, and documentation, which can increase the time and cost of bringing new hospital beds to market. For example, beds used in intensive care units (ICUs) must meet specific safety and functionality criteria to ensure they can support critically ill patients effectively. Non-compliance with these regulations can lead to fines, product recalls, and damage to the reputation of manufacturers and healthcare providers.

Limited Healthcare Infrastructure in Developing Regions

The limited healthcare infrastructure in developing regions poses a significant restraint for the hospital beds market. Many developing countries lack adequate healthcare facilities, hospitals, and clinics, which limits the demand for hospital beds. Even where healthcare infrastructure exists, it may be outdated or insufficient to meet the growing healthcare needs of the population. For example, sub-Saharan Africa faces a severe shortage of hospital beds, with only 0.7 beds per 1,000 individuals compared to a global average of 2.9 beds per 1,000 individuals. This shortage is exacerbated by limited financial resources and competing healthcare priorities, such as immunization and maternal health.

Opportunity in the Hospital Beds Market

Increasing Healthcare Expenditure and Investments

One of the primary opportunities for the hospital beds market is the increasing healthcare expenditure and investments in healthcare infrastructure globally. Governments and private healthcare providers are expanding their healthcare facilities, and building new hospitals, clinics, and nursing homes to meet the growing healthcare needs of their populations. For instance, according to data from the World Health Organization (WHO), global healthcare expenditure is expected to reach over USD 10 trillion by 2022, reflecting a significant increase in healthcare spending. This investment is expected to drive the demand for hospital beds, particularly in emerging markets where healthcare infrastructure is still developing. For example, China has been rapidly expanding its healthcare infrastructure, with plans to build over 20,000 new primary healthcare facilities by 2030, which will significantly increase the demand for hospital beds.

Technological Advancements and Innovation

Technological advancements present a major opportunity for the hospital beds market. Innovations such as smart hospital beds equipped with IoT (Internet of Things) and AI (Artificial Intelligence) technologies are gaining traction. These beds can monitor patient vital signs, adjust positions automatically to prevent bedsores, and integrate with electronic health records (EHR) systems for real-time patient data management. The global market for smart hospital beds is projected to grow significantly, driven by the increasing adoption of digital health solutions and the need for improved patient outcomes.

Rising Geriatric Population and Chronic Diseases

The rising geriatric population and increasing prevalence of chronic diseases are also creating opportunities for the hospital beds market. Elderly individuals and patients with chronic conditions often require long-term hospitalization and specialized care, driving the demand for hospital beds. According to the United Nations, the global population aged 60 years and older is growing at a rate of about 3% per year, with the number of older persons projected to double by 2050. This demographic trend is expected to significantly increase the demand for hospital beds designed for long-term care, rehabilitation, and palliative care. Additionally, the growing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer necessitates hospitalization and ongoing medical care, further boosting the demand for hospital beds equipped with advanced features.

Trends for the Hospital Beds Market

Increasing Demand for Specialty and Bariatric Beds

One significant trend in the hospital beds market is the increasing demand for specialty and bariatric beds. Specialty beds are designed for specific medical conditions and patient needs, such as ICU beds, pediatric beds, and maternity beds. These beds are equipped with features that cater to the unique requirements of patients in different healthcare settings. For example, ICU beds are designed to support critically ill patients with features like advanced monitoring systems and adjustable positioning. Pediatric beds are designed with safety features and colorful designs to create a child-friendly environment. Bariatric beds, on the other hand, are designed for obese and overweight patients, providing wider mattresses and higher weight capacities to ensure patient comfort and safety.

Integration of IoT and AI Technologies

Another prominent trend in the hospital beds market is the integration of IoT (Internet of Things) and AI (Artificial Intelligence) technologies in hospital beds. Smart hospital beds equipped with IoT sensors and AI algorithms can monitor patient vital signs, adjust bed positions automatically to prevent pressure ulcers, and alert healthcare providers about potential patient risks. These beds also integrate with electronic health record (EHR) systems to provide real-time patient data and improve clinical decision-making. The global smart hospital beds market is expected to witness substantial growth, with advancements in digital health solutions and the adoption of AI-driven technologies.

Focus on Patient Comfort and Safety

There is a growing emphasis on enhancing patient comfort and safety in the design and functionality of hospital beds. Manufacturers are developing beds with features like ergonomic designs, memory foam mattresses, side rails with easy access controls, and advanced fall prevention mechanisms. These features not only improve patient comfort but also reduce the risk of injuries and complications during hospitalization. For example, some hospital beds are equipped with advanced pressure relief systems that redistribute patient weight to prevent pressure ulcers. This trend is driven by healthcare providers' focus on improving patient outcomes and satisfaction.

Segments Covered in the Report

By Type

o Electric Beds

o Semi-Electric Beds

o Manual Beds

By Application

o Acute Care

o Psychiatric Care

o Long-term Care

o Other Applications

By End-User

o Hospitals

o Home Care Settings

o Elderly Care Facilities

o Ambulatory Surgical Centers

o Other End-Users

Segment Analysis

By Type Analysis

Electric beds, semi-electric beds, and manual beds are all included in the type segment. A subsegment of the market termed manual beds is expected to hold 44.1% of the market share in 2023 since they are more affordable and convenient than semi-electric and electric beds. Simple mechanical systems like springs, levers, and cranks can be used to simply modify manual beds, which do not require electricity to function. This makes them a hassle-free choice for medical facilities, especially those in underdeveloped nations with unstable electrical supplies. Manual beds are less expensive initially than beds with integrated motors or electronics because of their straightforward construction. Their affordability makes them more accessible to a wider range of consumers, particularly in public healthcare facilities with tight budgets. These beds guarantee uninterrupted operation during power outages, which is a necessity in medical situations because manual adjustment eliminates reliance on external power sources. Their continued usefulness in the absence of electricity greatly adds to their appeal in areas vulnerable to natural calamities that could interrupt power supplies.

By Application Analysis

Acute care, mental health care, long-term care, and other services are included in the application segment. The acute care subsegment is expected to account for 33.1% of the market share in 2023 due to the necessity of hospital beds for patients undergoing surgery or recuperating from trauma. Emergency hospital admissions, post-operative care requirements, and follow-up therapies account for a significant fraction of acute cases. Acute care beds allow for positional adjustments to provide comfort and aid in the healing process for patients in the early stages of recovery following surgery. Elements such as slanted sections and height-adjustable bars help with nursing and make vital sign monitoring easier for patients under observation. Because most acute conditions are temporary, short-term hospital admissions account for a larger portion of demand than hospitals that provide long-term or mental care.

By End-User Analysis

Hospitals, home care settings, senior care facilities, ambulatory surgical centers, and other establishments (nursing homes, etc.) are included in the end-user segment. The hospitals subsegment is predicted to account for 50.8% of the market in 2023, primarily because they are the primary front-line providers of acute and long-term care. To provide their 24-hour services, they must keep enough beds available for both long-term and short-term patients. Although senior living and home care facilities also use beds, their pool is smaller due to their decentralized structure. Furthermore, there is a greater average bed usage per admission in hospital settings due to the complexity of the treatments carried out there. The majority of market demand is concentrated in tertiary and multispecialty institutions, which consistently provide larger patient inflows.

Regional Analysis

Owing to the large number of hospitals and healthcare facilities in nations like the United States, North America continues to be the dominating region in the global market for hospital beds. In 2023, it is predicted to hold 42.7% of the market share. The U.S. healthcare system, which spends the most on healthcare worldwide, is mostly dependent on cutting-edge medical devices and technology. This means that there is an enormous need for hospital beds to accommodate the numerous patient beds needed in different types of healthcare facilities. Leading international producers of hospital beds are present, which further enhances North America's dominance in this industry.

The hospital bed market in Asia Pacific is the one that is expanding the fastest among the regions. The primary drivers of the market in the Asia Pacific area are the quick expansion of healthcare infrastructure to satisfy the demands of growing populations, rising income levels, and expanding medical tourism. Hospital construction and facility upgrades are receiving enormous investments from nations like China, India, and Japan. Because of this, the purchase of hospital beds has increased in recent years. Asian manufacturers are also able to expand internationally and boost exports due to reduced production costs.

Competitive Analysis

Large market players are heavily funding R&D to diversify their product offerings, which will encourage additional market expansion for the hospital beds sector. Market participants are engaging in a range of strategic initiatives to broaden their worldwide reach in response to notable shifts in the sector, such as the introduction of new products, contracts, mergers and acquisitions, higher investments, and partnerships. In order to thrive and endure in an increasingly cutthroat market, rivals in the hospital beds sector need to offer reasonably priced goods.

Key Market Players in the Hospital Beds Market

o Stryker

o Hill-Rom Holdings Inc.

o Getinge AB

o Medline Industries Inc.

o EarlySense

o Max Healthcare

o Eqova Healthcare

o Stiegelmeyer GmbH & Co. Kg

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 3.9 Billion |

|

Market Size 2033 |

USD 7.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Type, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Stryker, Hill-Rom Holdings Inc., Getinge AB, Invacare Corporation, Medline Industries Inc., EarlySense, Max Healthcare, Eqova Healthcare, Stiegelmeyer GmbH & Co. Kg, Other Key Players |

|

Key Market Opportunities |

Increasing Healthcare Expenditure and Investments |

|

Key Market Dynamics |

Aging Population and Healthcare Needs |

📘 Frequently Asked Questions

1. How much is the Hospital Beds Market in 2023?

Answer: The Hospital Beds Market size was valued at USD 3.9 Billion in 2023.

2. What would be the forecast period in the Hospital Beds Market report?

Answer: The forecast period in the Hospital Beds Market report is 2023-2033.

3. Who are the key players in the Hospital Beds Market?

Answer: Stryker, Hill-Rom Holdings Inc., Getinge AB, Invacare Corporation, Medline Industries Inc., EarlySense, Max Healthcare, Eqova Healthcare, Stiegelmeyer GmbH & Co. Kg, Other Key Players

4. What is the growth rate of the Hospital Beds Market?

Answer: Hospital Beds Market is growing at a CAGR of 5.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.