🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hot Dip Galvanized Pipe Market

Hot Dip Galvanized Pipe Market Global Industry Analysis and Forecast (2024-2032) By Application (Construction, Automotive), By Pipe Type (Seamless Pipes, Welded Pipes), By Coating Thickness (Standard Coating , Heavy Coating),By Pipe Size (Small Diameter Pipes, Medium Diameter Pipes),By End-User Industry(Construction Industry, Automotive Industry) and Region

Feb 2025

Manufacturing

Pages: 138

ID: IMR1807

Hot Dip Galvanized Pipe Market Synopsis

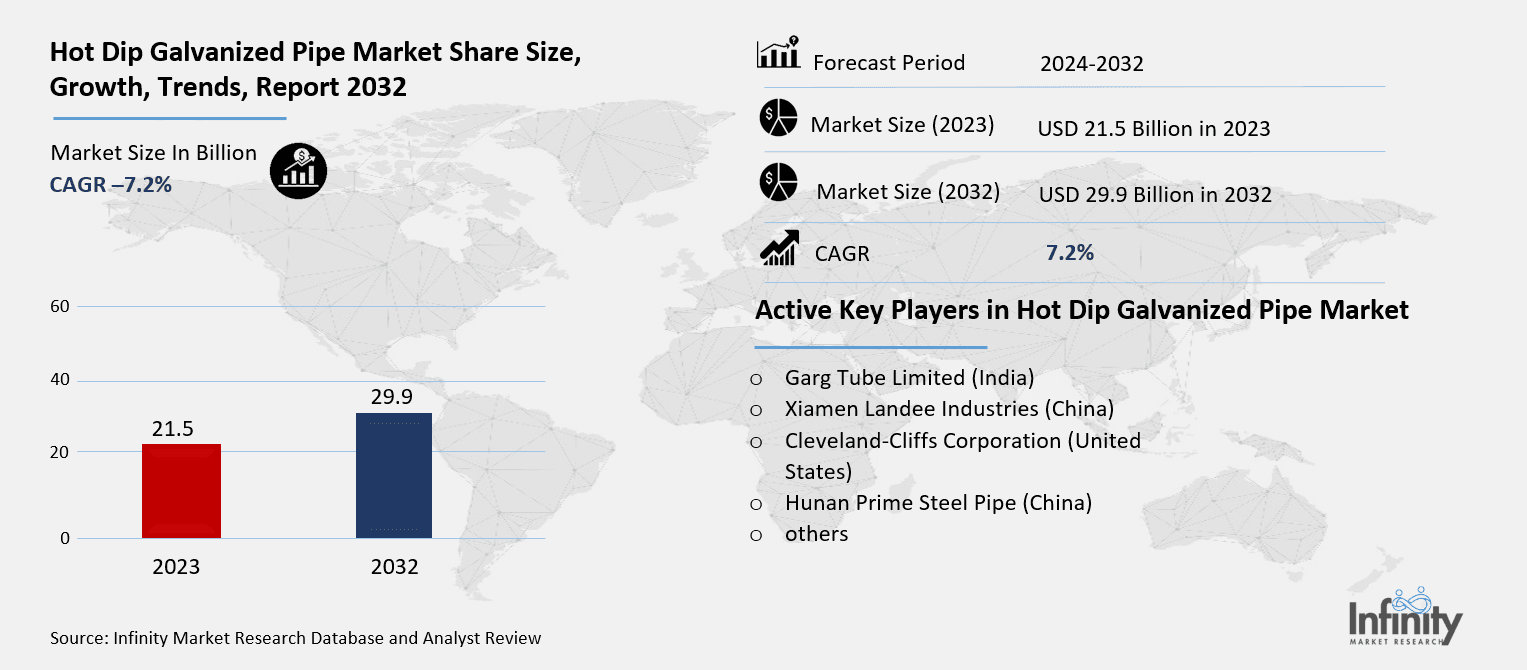

Hot Dip Galvanized Pipe Market Size Was Valued at USD 21.5 Billion in 2023, and is Projected to Reach USD 29.9 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

Rising demand across many sectors, including construction, infrastructure, water distribution, and industrial manufacturing, is driving a consistent increase in the hot-dip galvanized pipe market. By coating steel pipes with a protective layer of zinc, hot dip galvanizing—a generally utilized technique—increases their longevity and corrosion resistance. This approach increases pipe lifetime, which qualifies them for demanding conditions, including industrial environments and coastal areas. The key driver for market growth is the growing need for long-lasting and maintenance-free piping solutions.

With governments all over investing in smart cities, transportation networks, and water supply systems, construction and infrastructure development account significantly for market growth. Particularly in developing nations, the rise in urbanization has resulted in more galvanized pipe structural use as well as fencing and plumbing. Furthermore, driving demand for hot-dip galvanized pipes are strict government rules on the usage of corrosion-resistant materials in public infrastructure projects.

Driven by major infrastructure initiatives in China, India, and Southeast Asian nations, the geographical dynamics of the market reveal Asia-Pacific leads in production and consumption. With substantial demand in the industrial and building industries, North America and Europe also have sizable proportions. Furthermore, because galvanized pipes can resist severe climatic conditions, the Middle East is seeing growing use of them in water and gas as well as in oil and gas projects.

Hot Dip Galvanized Pipe Market Outlook, 2023 and 2032: Future Outlook

Hot Dip Galvanized Pipe Market Trend Analysis

Trend: Growing demand for corrosion-resistant pipes in infrastructure projects

The rising use of corrosion-resistant pipes in infrastructure projects all around is clearly visible in the hot-dip galvanized pipe market. Demand for robust and long-lasting materials has exploded as governments and businesses significantly fund urban development, smart cities, and transportation systems. Many things like bridges, highways, railroads, and water distribution systems use hot-dip galvanized pipes, which are known for being very long-lasting and resistant to corrosion. These pipes are also being used in infrastructure projects because they are a cheap alternative that lowers maintenance costs and ensures structural integrity in harsh environments like coastal and high-moisture areas. Strict government rules and building guidelines, which require the use of corrosion-resistant materials, accelerate this trend. Galvanized pipes are chosen in areas prone to severe weather, such as North America and the Middle East, since they resist humidity, salt exposure, and industrial pollution. The fast expansion of industrial zones and commercial buildings, particularly in emerging nations like China and India, is also driving market development. Adoption of hot-dip galvanized pipes is likely to increase as infrastructure development remains a worldwide focus, therefore influencing the direction of the building and utility industries.

Drivers: Rapid urbanization and expanding construction industry

The fast urbanization and the expanding building sector globally greatly influence the hot dip galvanized pipe market. Demand for robust and corrosion-resistant piping systems in infrastructure projects is growing as populations rise and cities grow. Applications include water supply, drainage systems, scaffolding, fencing, and structural frameworks see hot dip galvanized pipes extensively used in both residential and commercial building. Because of their extended lifetime and low maintenance needs, governments and corporate developers are extensively funding smart cities, highways, bridges, and public utilities, hence increasing the market for these pipes.With massive housing and industrial projects driving the demand for galvanized pipes, emerging nations in Asia-Pacific, the Middle East, and Africa lead in urban growth. Real estate and infrastructure development is driving demand of hot dip galvanized pipes in road, metro rail projects, and power plants in nations such China, India, and Indonesia. Government programs supporting greener building materials and tougher standards for corrosion-resistant pipes also help to boost industry expansion. The hot dip galvanized pipe market is likely to see continuous demand as urbanization proceeds, so it is an essential part of modern infrastructure building.

Restraints: Fluctuating raw material prices, especially steel and zinc

The fluctuations in raw material prices—especially steel and zinc—cause one of the main challenges in the hot-dip galvanized pipe market. Galvanized pipes are produced mostly of steel, which is the main material utilized; trade policies, geopolitics, and global supply-demand imbalances all affect their pricing. Likewise, mining restrictions, environmental laws, and changes in world metal markets affect zinc, which is necessary for the galvanizing process, and cause price volatility. The erratic cost of these raw materials influences manufacturing costs and profit margins for producers, thus influencing pricing in the market. For manufacturers and end users in long-term project planning and budgeting, the fluctuation in raw material prices also presents difficulties. Regular price swings could compel businesses to change their pricing policies, therefore influencing demand from sectors like construction and agriculture that are price sensitive. High raw material costs can also cause galvanized pipe prices to rise; hence, other materials such as PVC or stainless steel appeal to consumers more. Manufacturers are concentrating more and more on maximizing production efficiency, guaranteeing long-term supply contracts, and investigating low-cost galvanizing methods to cut reliance on costly raw materials in order to lower these risks.

Opportunities: Expansion of renewable energy projects requiring galvanized pipes

With renewable energy projects presenting a major potential, the hot-dip galvanized pipe market is set for expansion. Demand for robust and corrosion-resistant materials is growing as nations move toward solar, wind, and hydroelectric power sources. Particularly in structural supports for solar panel mounting systems, wind turbine foundations, and geothermal energy facilities, galvanized pipes are absolutely vital for many projects. Long-term sustainability in renewable energy infrastructure would benefit from its capacity to resist demanding environmental conditions such as severe temperatures, wetness, and chemical exposure. Apart from their robustness, galvanized pipes help to lower maintenance costs over time by supporting the cost-effectiveness and lifetime of renewable energy plants. Particularly in Asia-Pacific, Europe, and North America, governments are all funding massive renewable energy projects, thereby increasing demand. To fit with environmental objectives, galvanized pipe industry manufacturers are creating cutting-edge coatings and environmentally friendly galvanizing methods. The integration of hot-dip galvanized pipes in renewable infrastructure is predicted to accelerate as the worldwide drive for green energy gets more intense, therefore generating profitable possibilities for market players.

Hot Dip Galvanized Pipe Market Segment Analysis

Hot Dip Galvanized Pipe Market Segmented on the basis of By Application, By Pipe Type, By Coating Thickness, By Pipe Size and By End-User Industry.

By Application

o Construction

o Automotive

By Pipe Size

o Seamless Pipes

o Welded Pipes

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Application, Construction segment is expected to dominate the market during the forecast period

With these pipes utilized extensively for structural purposes, plumbing, fencing, and scaffolding, the hot-dip galvanized pipe market is quite important in the building sector. Their outstanding durability and corrosion resistance make them perfect for projects involving underground and outdoor infrastructure since they guarantee long-term performance in demanding surroundings. Demand for galvanized pipes keeps growing as investments in smart cities, transit systems, and commercial structures expand together with rapid urbanization. Government rules encouraging the use of corrosion-resistant materials in public infrastructure projects also help to fuel market expansion, particularly in developing nations where massive building projects are flourishing. The automotive sector uses hot-dip galvanized pipes in structural components, exhaust systems, and vehicle frames to enhance their resistance against corrosion and strength. Automakers have included galvanized steel in their designs as the growing focus on lightweight yet strong materials for better fuel economy and vehicle lifetime drives demand. Furthermore, the demand for high-performance materials—including galvanized pipes for battery enclosures and protective structures—is growing as electric vehicles (EVs) develop. Supported by developments in galvanizing technology and environmentally friendly coating options, the use of galvanized pipes is likely to increase as vehicle producers concentrate on sustainability and durability.

By End-User Industry, Construction Industry segment expected to held the largest share

The building sector, which extensively employs these pipes in structural applications, plumbing, fencing, and scaffolding, primarily drives the hot-dip-dip galvanized pipe market. The demand for long-lasting and corrosion-resistant materials has surged due to the increase in infrastructure development projects worldwide, particularly in developing nations, driven by urbanization. Further driving market expansion are governments and commercial developers actively investing in smart cities, highways, bridges, and water distribution systems. Furthermore, driving the use of hot-dip galvanized pipes are strict building rules requiring the use of durable, rust-resistant materials in building projects. Because of their outstanding strength and corrosion resistance, hot-dip galvanized pipes are absolutely vital in the automotive sector for constructing vehicle frames, exhaust systems, and safety components. High-performance galvanized pipes are in more demand as the automobile industry develops with an eye toward lightweight, durable, and fuel-efficient vehicles. Furthermore, driving manufacturers to use galvanized steel components for maximum durability are the growing production of electric vehicles (EVs) and strict safety rules in North America and Europe. As investments in automotive manufacturing hubs in Asia-Pacific rise, the demand for hot-dip galvanized pipes in this industry is likely to develop steadily.

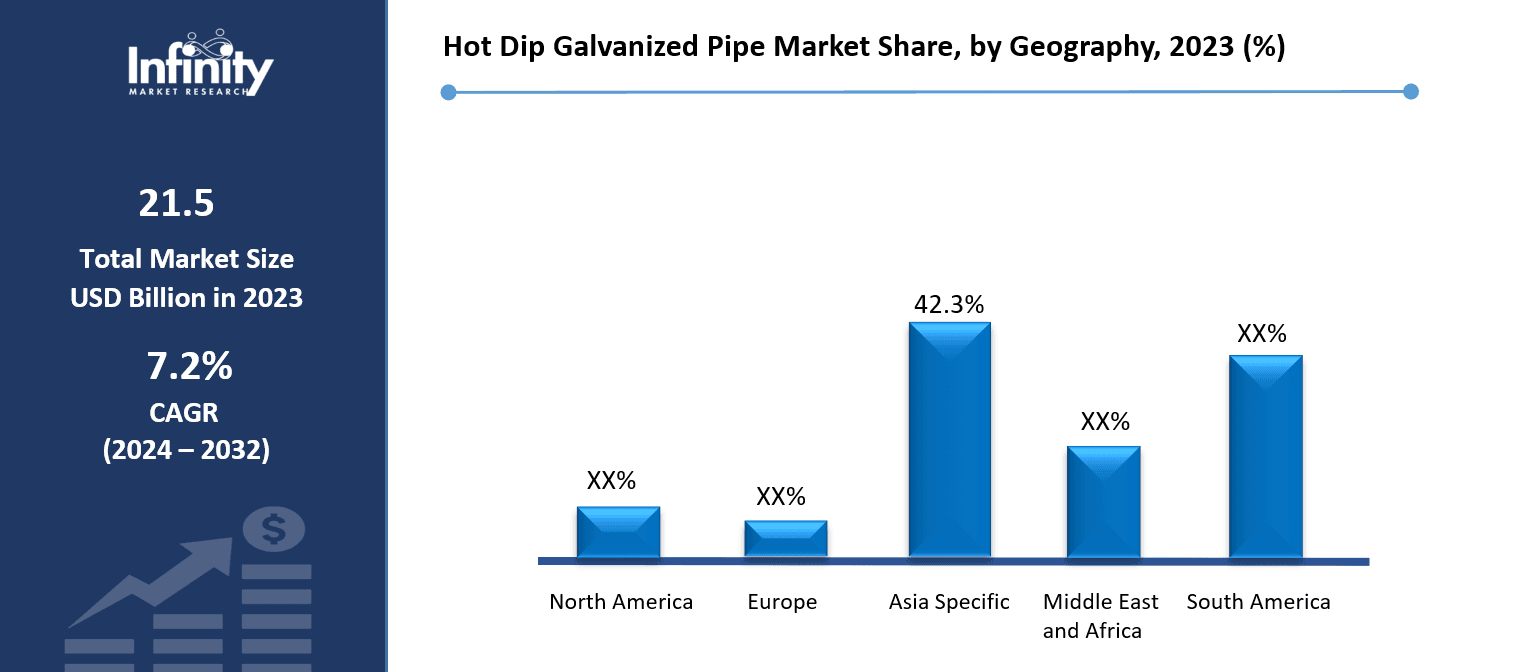

Hot Dip Galvanized Pipe Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by fast urbanization, large-scale infrastructure projects, and growing industrial sectors, the Asia Pacific region is predicted to rule the hot-dip galvanized pipe market over the forecast period. Countries including China, India, and Southeast Asia are extensively funding smart cities, transportation systems, and water distribution systems, thereby increasing the demand for galvanized pipes with outstanding corrosion resistance. Furthermore, driving market expansion are government projects supporting better public utilities and sustainable infrastructure. The area gains from a robust manufacturing base as well; important industry companies are increasing their capacity to satisfy growing domestic and export needs.

Hot Dip Galvanized Pipe Market Share, by Geography, 2023 (%)

Active Key Players in the Hot Dip Galvanized Pipe Market

o Garg Tube Limited (India)

o Xiamen Landee Industries (China)

o Cleveland-Cliffs Corporation (United States)

o Hunan Prime Steel Pipe (China)

o others

Global Hot Dip Galvanized Pipe Market Scope

|

Global Hot Dip Galvanized Pipe Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.5 Billion |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 29.9 Billion |

|

Segments Covered: |

By Application |

· Construction · Automotive | |

|

By Pipe Type |

· Seamless Pipes · Welded Pipes | ||

|

By Coating Thickness |

· Standard Coating · Heavy Coating | ||

|

By Pipe Size |

· Small Diameter Pipes · Medium Diameter Pipes | ||

|

By End-User Industry |

· Construction Industry · Automotive Industry | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rapid urbanization and expanding construction industry | ||

|

Key Market Restraints: |

· Fluctuating raw material prices, especially steel and zinc | ||

|

Key Opportunities: |

· Expansion of renewable energy projects requiring galvanized pipes | ||

|

Companies Covered in the report: |

· Garg Tube Limited (India), Xiamen Landee Industries (China), Cleveland-Cliffs Corporation (United States), Hunan Prime Steel Pipe (China), others. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Hot Dip Galvanized Pipe Market research report?

Answer: The forecast period in the Hot Dip Galvanized Pipe Market research report is 2024-2032.

2. Who are the key players in the Hot Dip Galvanized Pipe Market?

Answer: Garg Tube Limited (India), Xiamen Landee Industries (China), Cleveland-Cliffs Corporation (United States), Hunan Prime Steel Pipe (China), others.

3. What are the segments of the Hot Dip Galvanized Pipe Market?

Answer: The Hot Dip Galvanized Pipe Market is segmented into By Application, By Pipe Type, By Coating Thickness, By Pipe Size, By End-User Industry and region. By Application (Construction, Automotive), By Pipe Type (Seamless Pipes, Welded Pipes), By Coating Thickness (Standard Coating , Heavy Coating),By Pipe Size (Small Diameter Pipes, Medium Diameter Pipes),By End-User Industry(Construction Industry, Automotive Industry). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Hot Dip Galvanized Pipe Market?

Answer: Hot Dip Galvanized Pipe is a steel pipe that has been coated with a protective layer of zinc through the hot dip galvanization process, where the pipe is submerged in molten zinc to create a corrosion-resistant coating. This process enhances the pipe’s durability, preventing rust and oxidation, making it ideal for applications in construction, water supply, fencing, agriculture, and industrial infrastructure. Hot dip galvanized pipes are widely used due to their long lifespan, low maintenance requirements, and ability to withstand harsh environmental conditions, including moisture, chemicals, and extreme temperatures.

5. How big is the Hot Dip Galvanized Pipe Market?

Answer: Hot Dip Galvanized Pipe Market Size Was Valued at USD 21.5 Billion in 2023, and is Projected to Reach USD 29.9 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.