🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hydrocarbon Market

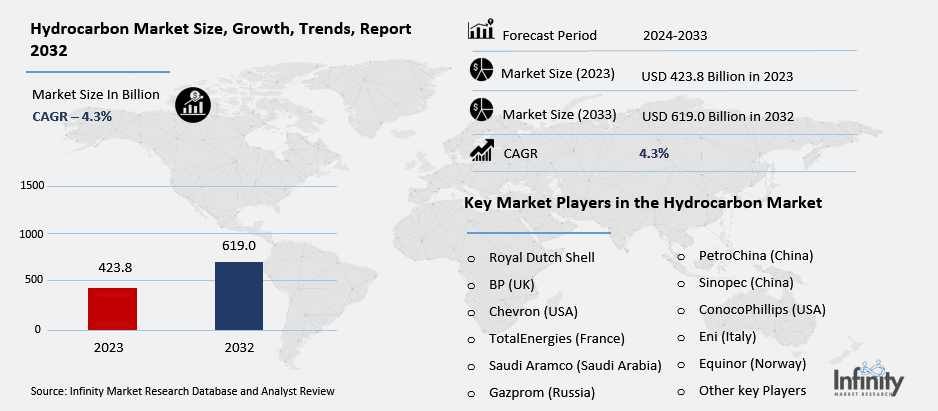

Hydrocarbon Market Global Industry Analysis and Forecast (2024-2032) By Type( Natural Gas, Crude Oil, Coal, Liquefied Natural Gas (LNG), Naphtha, Others),By Application( Energy Generation, Industrial Feedstock, Transportation Fuel, Residential Heating, Petrochemicals, Others),By End-User(Power Generation, Automotive, Industrial, Residential, Commercial, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1561

Hydrocarbon Market Synopsis

Hydrocarbon Market Size Was Valued at USD 423.8 Billion in 2023, and is Projected to Reach USD 619.0 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.

The hydrocarbon market refers to the business of the search, manufacture, refining and selling of hydrocarbons which are natural gas, oil, coal, LNG, Naphtha among others. These hydrocarbons are sought after commodities in electricity production, manufacturing industries, for mobility and domestic use in heating. The market operates on the demand for energy, fuel, and petrochemical products and is affected by world economic development, changes on technology, and geopolitics.

Hydrocarbon Market is one of the global market interests and involves the exploration and processing of hydrocarbon including the crude oil, natural gas, coal, LNG and naphtha. A hydrocarbon is mainly a source of energy, a transportation fuel, and a material for other industries. Crude oil is the largest source of energy in the world, while natural gas, and specifically LNG, is becoming increasingly popular largely because of its properties in terms of its lesser emissions. The growing needs for energy caused by the global industrialization process and the constantly growing population is one of the primary driving forces of the hydrocarbon. Further, it is noted that hydrocarbons are a key component for petrochemical industries as feed stocks for many chemicals.

In the energy sector, hydrocarbons are applied for the generation of electric power as well as in industries and oil and natural gas are indispensable in power stations, oilfields, and factories. Transportation fuel segment that is dependent on crude oil and Refined Petroleum Products still remains among one of the biggest markets. The emerging market in cleaner energy, including renewable energy and electric cars is threatening the conventional hydrocarbon business, but hydrocarbons cannot be ignored as they ‘‘deliver the energy density and cost at scale to meet global demand’’.

Briefly, pollution and regulation deploying carbon emission as a measure is influencing the energy sector to introduce cleaner technologies impacting the hydrocarbon demand and prices. The shift to cleaner energy sources around the world is also partly causing development of carbon capture, storage practices / other related technologies. At the same time it is recognised that the short- to medium-term outlook for the hydrocarbon market is strong with continued demand for fossil fuels.

Hydrocarbon Market Outlook, 2023 and 2032: Future Outlook

Hydrocarbon Market Trend Analysis

Trend: Shift Towards Liquefied Natural Gas (LNG)

Out of the available sources of energy the trend observed in the last several years is a preference of liquefied natural gas (LNG). The main factors that contributed to this trend are the increasing interest towards the reduction of carbon emissions and a volume of natural gas reserves. LNG is generally regarded as cleaner source of energy than coal and oil and is therefore regards as a better option in power generation as well as in the transport sector. This transition is most conspicuous in the European and Asian countries where countries are exiting coal and searching for cleaner sources of power. The development of LNG throughout the years for both liquefaction plants and LNG terminals has aided this transition giving countries variety on their energies.

Further, LNG is viewed as an important factor to improve the position of energy sources since it is import and can be easily stored. There has been increased demand in the international market in LNG since more countries with reserves of natural gas such as the US and Qatar have developed LNG export facilities. Consequently, the ratio of LNG in the overall global hydrocarbon market is only set to rise further particularly as global environment standards rise and global demand for cleaner fuels rises.

Opportunity: Rising Demand for Petrochemical Products

One next trend which can be observed and identified today in the field of hydrocarbon market is the demand for petrochemicals which are produced from hydrocarbon resources such as crude oil and natural gas. A few industries where employing Petrochemicals are as follows: Plastics, Chemicals, Pharmaceuticals, Automobile and Agriculture. Emerging global economies especially in Asia have a progressive industrialization which is increasing the consumption of petrochemical products given that they are core input in production of various manufactures like packaging material, textiles and electronics among others. The increase in the use of consumer goods, infrastructure development and other technological changes has boosted the demand of raw material produced from hydrocarbons.

This opportunity is further supported by innovation in petrochemical processing technologies to improve on the conversion of hydrocarbons. The employment of cleaner technologies in petrochemical products production impacts reductions on its emission levels, such that a greater emphasis on energy efficiency consistent with standards is gradually assuming added significance to firms in an effort to respond to demands of regulations as well as alleviating the negative effects of their activities on the natural environment. The growing usage of petrochemical products in various sectors reveals numerous opportunities for hydrocarbon in terms of growth for companies involved in refining and petrochemical business.

Driver: Global Economic Growth

The major influence which is related directly with hydrocarbon market is economic growth resulting in higher energy demands and manufacturing processes. Through economic development, energy demands increases and hence use of hydrocarbon like crude oil and natural gases. The manufacturing process, transportation services and construction activities rely greatly on energy provided by hydrocarbon products. Growing economies mainly in the Asian and African continent are demanding energy and thus has led to increased consumption of hydrocarbons.

In addition, the transportation sector, which largely depends on petroleum products as fuel, remains a major consumer of hydrocarbon. This coupled with an increasing global population and continually increasing rates of urbanization means that transportation fuel and energy for residential and commercial use is needed. This demand for energy is expected to continue in the future since development and industrialization does not show signs of fades in the future. Therefore, the interactiveness of the hydrocarbon market with other sectors and the world economy keeps the hydrocarbon market highly sensitive to changes in global economic rates of growth.

Restraints: Environmental Regulations and Climate Change Policies

The current market for hydrocarbons is coupled with strong threats flowing from increasing the number of environmental legislations and climate change initiatives meant at checking carbon emission. National and global authorities continue to set and enforce high standards of emission restrictions within industries, towards the use of environmentally friendly energies. Nearly every country today has joined international accords like the Paris Accord or similar policies and is planning to shift to cleaner energy from the fickle hydrocarbon resources. Such policies are expected to open up a can of worms in the hydrocarbon market mostly in the regions where the use of coal, oil and natural gases still reign supreme.

Other factors which are also coming up as restraints of hydrocarbon market growth are restrictions emanating from pressures from the public as well as environmental conscious organizations. Consumers and business are also experiencing heightened awareness and they are very sensitive to issues to do with the effects of fossils to the environment hence, transformation of consumer preferences. As the global political climate grows increasingly hostile to the hydrocarbon industry through measures such as carbon capture and storage as well as expansion into cleaner energy sources. However, all these changes that would assist in combating climate change, may have the effect of reducing the future market for hydrocarbons.

Hydrocarbon Market Segment Analysis

Hydrocarbon Market Segmented on the basis of type, application and end user.

By Type

o Natural Gas

o Crude Oil

o Coal

o Liquefied Natural Gas (LNG)

o Naphtha

o Others

By Application

o Energy Generation

o Industrial Feedstock

o Transportation Fuel

o Residential Heating

o Petrochemicals

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Natural Gas segment is expected to dominate the market during the forecast period

The hydrocarbon market is segmented into several types: namely, natural gas, crude oil, coal, LNG, naphtha and so on. Of these resources, crude oil is still the most prevalent source of energy to date. Petroleum is the world’s main source of transport fuels like petrol, diesel and also plays an important role in production of chemical feedstock. But increased use of natural gas is occurring in today’s market place because the combustion of natural gas is a cleaner occurrence which has gained a preference in electric power generation and in industries. LNG is also on the rise owing to the fact that natural gas is easy to transport and store as compared to petroleum, forming a major basis of global energy export.

coal is a major source of energy generation and recently it has emerged some challenges mainly the environmental issues and the environmental organizations that are pressing the government to shutdown coal power plants due to high emission effects to the atmosphere. As a result, the role of coal, which supplies energy with high emissions, in meeting global power demands is anticipated to decrease. Naphtha, as a petroleum product is used popularly as feed stock in the petrochemical industry with special emphasis in the manufacturing of plastics and chemical products. They have always been an essential survival pillar in the hydrocarbon market especially when the industrial demand of these products increases. Various other minor hydrocarbon products contained within this category include bitumen and fuel oil, which find application in specialized industrial applications only.

By Application, Energy Generation segment expected to held the largest share

Customers needs emanate from processing of raw materials and or commercial use as energy source, transportation, home heating and petrochemicals and among others. The largest application segment is energy generation as coal, natural gas, and oil hydrocarbons are utilized in power stations to create electricity. The transport fuel is another massive market for crude oil since transportation needs motor fuel, which is gasoline, diesel, and aviation fuels for cars, aeroplanes and vessels. With the increasing world population and their need to move from one place to another, transportation fuel continues to be an important market force.

Hydrocarbons play crucial roles in energy production, a source of transport fuel; and in the manufacture of industrial feedstock and petrochemicals. There is therefore a close relationship between the petrochemicals used in the manufacture of plastics, chemicals and other products and hydrocarbon like crude oil and natural gas. They also cite the use of natural gases and oil in the residential heating, especially in the cold climates. The petrochemicals and industrial feedstock as well as the energy and transportation fuel segments are pivotal to the continuous growth of the hydrocarbon due to the growing requirement of petrochemicals and fuels.

Hydrocarbon Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is one of the strongest markets concerning hydrocarbons, especially owing to – pipelines and transports for the hydrocarbons. The region also equally enjoys a good legal environment that keep the market stable and sustainable environmentally. Due to the increased demand for energy and petrochemical products in the world market, North America’s position in the hydrocarbon market will remain important for the further investments in the energy sector and infrastructure, innovations, and exports.

Hydrocarbon Market Share, by Geography, 2023 (%)

Active Key Players in the Hydrocarbon Market

o Royal Dutch Shell (Netherlands/UK)

o BP (UK)

o Chevron (USA)

o TotalEnergies (France)

o Saudi Aramco (Saudi Arabia)

o Gazprom (Russia)

o PetroChina (China)

o Sinopec (China)

o ConocoPhillips (USA)

o Eni (Italy)

o Equinor (Norway)

o Other key Players

Key Industry Developments in the Hydrocarbon Market

· June 2024: Chevron Corporation and Sonatrach signed a Memorandum of Understanding (MOU) to collaborate on developing hydrocarbon resources in Algeria's Ahnet and Berkine basins. Sonatrach is Algeria's national oil company. This strategic agreement marks a significant step in boosting exploration and production efforts in these gas-rich areas.

Global Hydrocarbon Market Scope

|

Global Hydrocarbon Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 423.8 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 619.0 Billion |

|

Segments Covered: |

By Type |

· Natural Gas · Crude Oil · Coal · Liquefied Natural Gas (LNG) · Naphtha · Others | |

|

By Application |

· Energy Generation · Industrial Feedstock · Transportation Fuel · Residential Heating · Petrochemicals · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Global Economic Growth | ||

|

Key Market Restraints: |

· Environmental Regulations and Climate Change Policies | ||

|

Key Opportunities: |

· Rising Demand for Petrochemical Products | ||

|

Companies Covered in the report: |

· ExxonMobil (USA), Royal Dutch Shell (Netherlands/UK), BP (UK), Chevron (USA), TotalEnergies (France), Saudi Aramco (Saudi Arabia), Gazprom (Russia), PetroChina (China), Sinopec (China), ConocoPhillips (USA), Eni (Italy) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Hydrocarbon Market research report?

Answer: The forecast period in the Hydrocarbon Market research report is 2024-2032.

2. Who are the key players in the Hydrocarbon Market?

Answer: ExxonMobil (USA), Royal Dutch Shell (Netherlands/UK), BP (UK), Chevron (USA), TotalEnergies (France), Saudi Aramco (Saudi Arabia), Gazprom (Russia), PetroChina (China), Sinopec (China), ConocoPhillips (USA), Eni (Italy) and Other Major Players.

3. What are the segments of the Hydrocarbon Market?

Answer: The Hydrocarbon Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Natural Gas, Crude Oil, Coal, Liquefied Natural Gas (LNG), Naphtha, Others. By Application, the market is categorized into Energy Generation, Industrial Feedstock, Transportation Fuel, Residential Heating, Petrochemicals, Others. By End-User, the market is categorized into Power Generation, Automotive, Industrial, Residential, Commercial, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Hydrocarbon Market?

Answer: The hydrocarbon market refers to the business of the search, manufacture, refining and selling of hydrocarbons which are natural gas, oil, coal, LNG, Naphtha among others. These hydrocarbons are sought after commodities in electricity production, manufacturing industries, for mobility and domestic use in heating. The market operates on the demand for energy, fuel, and petrochemical products and is affected by world economic development, changes on technology, and geopolitics.

5. How big is the Hydrocarbon Market?

Answer: Hydrocarbon Market Size Was Valued at USD 423.8 Billion in 2023, and is Projected to Reach USD 619.0 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.