🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hydrochloric Acid Market

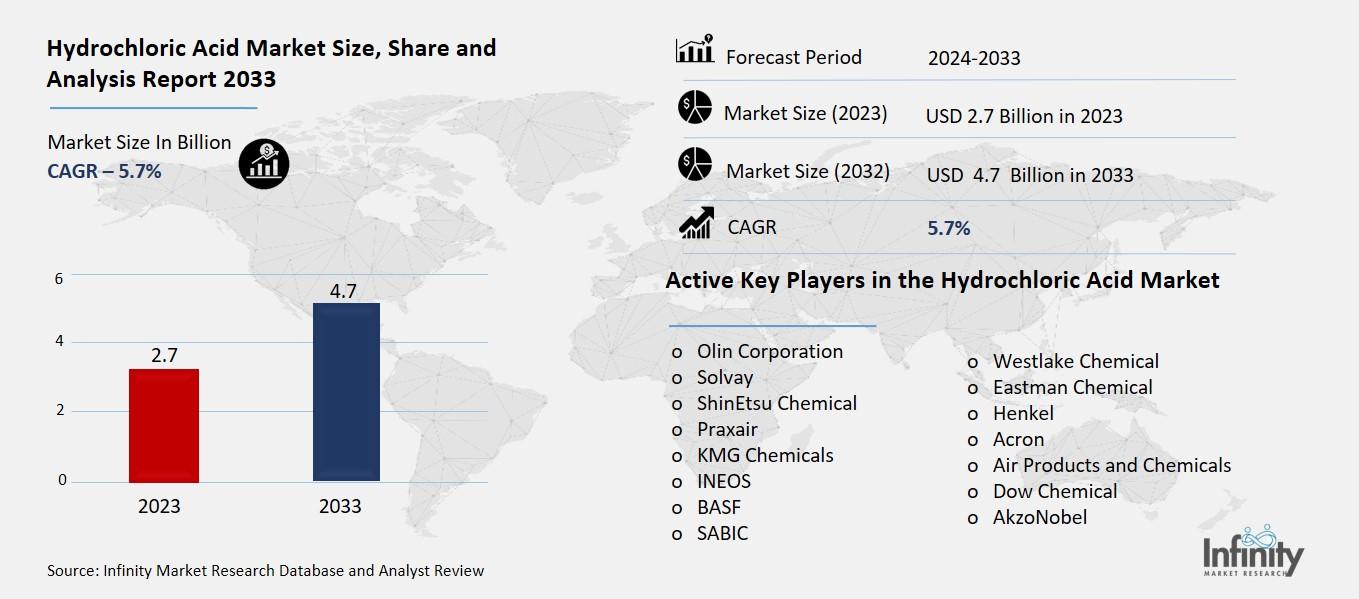

Hydrochloric Acid Market Global Industry Analysis and Forecast (2024-2033) by End-Use Industry (Food & Beverage, Pharmaceutical, Steel, Oil & Gas, Chemical Synthesis, and Other End-Use Industries), and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR1940

Hydrochloric Acid Market Synopsis

The Global Hydrochloric Acid Market was valued at USD 2.7 billion in 2023 and is expected to grow from USD 2.8 billion in 2024 to USD 4.7 billion by 2033, reflecting a CAGR of 5.7% over the forecast period.

The global chemicals industry includes hydrochloric acid as a major market segment because this acid finds numerous applications across chemical processing and steel pickling as well as water treatment and food production and oil well acidizing needs. The organic and inorganic compounds such as vinyl chloride and fertilizers require strong inorganic acid HCl for their successful production. The market demand has a direct relationship with industrial development mainly in three areas specifically construction and automotive and oil & gas industries. Asia Pacific leads the market since it experiences fast industrial expansion primarily within China and India. New recycling methods emerge due to environmental rules and safety issues regarding substance handling and transportation which creates new challenges in the market. The market evolves based on changes in raw material supply as well as worldwide economic status.

Hydrochloric Acid Market Driver Analysis

Increased Use in Oil & Gas Industry

Hydrochloric acid functions extensively to perform oil well acidizing and enhanced oil recovery (EOR) processes required for both production maintenance and increased hydrocarbon output. Hydrochloric acid serves as an injection solution in oil well acidizing due to its ability to dissolve limestone and dolomite formations and carbonate deposits to enlarge fractures and increase oil and gas delivery to wellbore channels. The method shows outstanding results when applied to carbonate reservoirs. The procedure of enhanced oil recovery (EOR) involves hydrochloric acid use both for scale clearing and for opening blockages and for increasing production rate in aged wells. HCl's ability to dissolve minerals and reduce formation damage gives it value as a solution for improving permeability and extending well life duration.

Hydrochloric Acid Market Restraint Analysis

Corrosive Properties and Transport Challenges

The requirements of specialized containers and logistics systems for hydrochloric acid management stem from its intense corrosivity as well as reactivity and lead to elevated operational expenses. Safety regulations mandate tight adherence for HCl transportation and storage because any leaks or spills or exposures result in severe injury to people along with environmental damage and equipment destruction. To safely handle hydrochloric acid containers, need to be made of corrosion-proof materials including rubber-lined steel alongside HDPE or glass-lined tanks. Companies need special certified personnel along with custom vehicles and compulsory insurance coverage to abide by hazardous materials regulations during transport. The combined elements increase management expenses and difficulties when handling hydrochloric acid throughout the supply chain.

Hydrochloric Acid Market Opportunity Analysis

Rising Demand for Water Treatment Chemicals

The world-wide expansion of municipal and industrial water treatment facilities generates increased need for hydrochloric acid because this substance serves critical functions in water quality management. Water treatment facilities use hydrochloric acid to achieve pH management and impurity clearing as well as equipment and membrane maintenance. Water treatment facilities across the world receive government and industrial funding to upgrade their infrastructure because of mounting water availability issues alongside pollution risks and public health threats. The expansion of new infrastructure happens in developing countries which serves to accommodate rising population numbers together with industrial requirements and developed nations upgrade their systems to comply with tighter environmental regulations. Water treatment emerges as a vital growth segment for hydrochloric acid because the market expansion requires increased consumption of treatment chemicals such as HCl.

Hydrochloric Acid Market Trend Analysis

Shift Toward Sustainable and Eco-Friendly Processes

The hydrochloric acid industry now prioritizes emission reduction along with chemical recycling because environmental challenges meet stricter government regulations. The improper handling of hydrochloric acid production and utilization leads to dangerous air emissions together with waste generation. The rising environmental concerns have led companies to allocate funds toward developing new production methods which enable HCl recycling from industrial processes especially within steel and chemical industries. Recovery systems for HCl reduce environmental stress and cut production expenses by eliminating needs for new acid inputs for the market. Growth in the market through innovation and ecological regulations becomes achievable when companies embrace greener practices which follow worldwide patterns of environmental accountability.

Hydrochloric Acid Market Segment Analysis

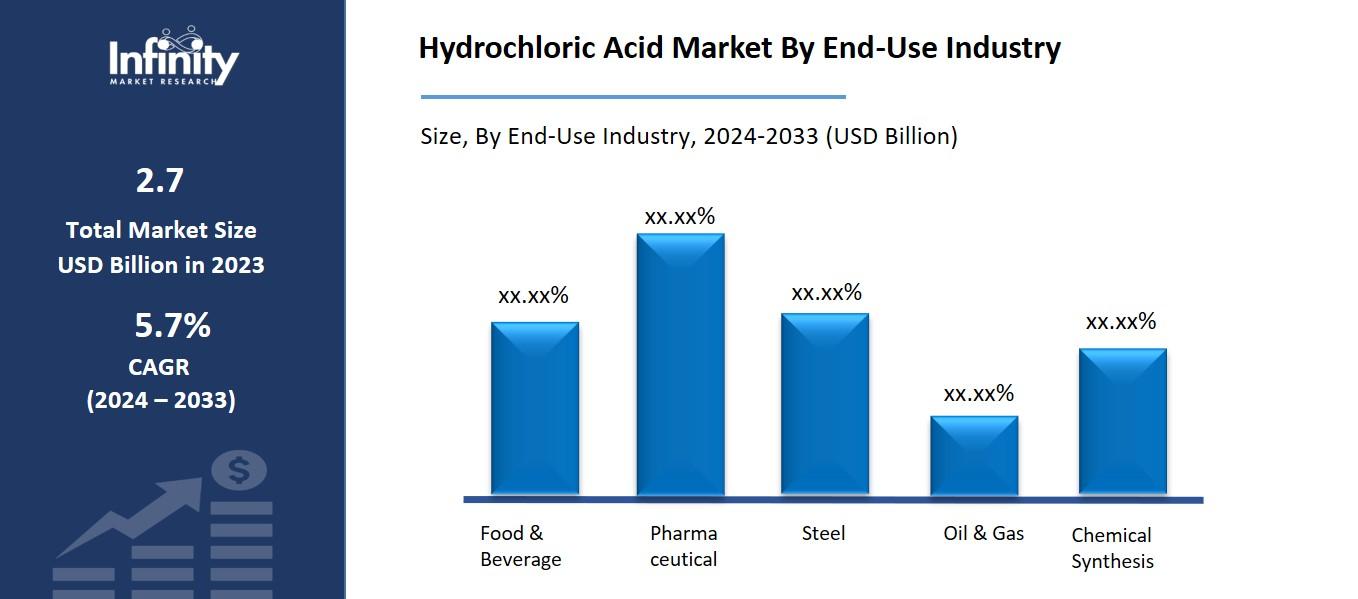

The Hydrochloric Acid Market is segmented on the basis of End-Use Industry, Processing Method, and Application.

By End-Use Industry

o Food & Beverage

o Pharmaceutical

o Steel

o Oil & Gas

o Chemical Synthesis

o Other End-Use Industries

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By End-Use Industry, Food & Beverages Segment is Expected to Dominate the Market During the Forecast Period

Food and beverages represents the largest segment within hydrochloric acid applications due to its fundamental role in food processing and preservation operations throughout the forecast period. The production of food additives through aspartame and fructose requires hydrochloric acid together with its use as a pH control agent and its application in processing corn syrup and gelatin and dairy products. The cleaning and sanitizing procedures for food processing equipment depend essential on the usage of hydrochloric acid to meet hygiene standards. Budgetary demands for packaged and processed food products are expanding globally since urbanization and population growth and changes in dietary patterns push manufacturers to use hydrochloric acid for maintaining product safety and quality standards. The food and beverage industry serves as a main market segment because food safety regulations reinforce the necessity of hydrochloric acid in manufacturing processes.

Hydrochloric Acid Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the hydrochloric acid market over the forecast period, driven by its well-established industrial base and strong demand from key sectors such as oil & gas, chemicals, and food processing. Petroleum companies in the United States rely extensively on hydrochloric acid for both oil well acidizing and enhanced oil recovery functions. The region maintains a stable demand since its advanced facilities for chemical production and water treatment operate consistently. Environmental regulations that promote efficient together with environmentally-safe practices have driven markets to invest in recycling methods and closed-loop systems which increases their strength. Moreover, the presence of major chemical producers and a high level of technological advancement support North America's leading position in the global hydrochloric acid market.

Recent Development

In January 2025, Jones-Hamilton Co. strengthened its hydrochloric acid portfolio and reinforced its position as a leading supplier in North America through the acquisition of Nexchlor LLC.

In March 2022, Wynnchurch Capital, L.P. announced its acquisition of Reagent Chemical & Research, LLC, a prominent specialty distributor of hydrochloric acid in North America.

Active Key Players in the Hydrochloric Acid Market

o Olin Corporation

o Solvay

o ShinEtsu Chemical

o Praxair

o KMG Chemicals

o INEOS

o BASF

o SABIC

o Westlake Chemical

o Eastman Chemical

o Henkel

o Acron

o Air Products and Chemicals

o Dow Chemical

o AkzoNobel

o Other Key Players

Global Hydrochloric Acid Market Scope

|

Global Hydrochloric Acid Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.7 Billion |

|

Market Size in 2024: |

USD 2.8 Billion | ||

|

Forecast Period 2024-33 CAGR: |

5.7% |

Market Size in 2033: |

USD 4.7 Billion |

|

Segments Covered: |

By End-Use Industry |

· Food & Beverage · Pharmaceutical · Steel · Oil & Gas · Chemical Synthesis · Other End-Use Industries | |

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increased Use in Oil & Gas Industry | ||

|

Key Market Restraints: |

· Corrosive Properties and Transport Challenges | ||

|

Key Opportunities: |

· Rising Demand for Water Treatment Chemicals | ||

|

Companies Covered in the report: |

· Olin Corporation, Solvay, ShinEtsu Chemical, Praxairand Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Hydrochloric Acid Market Research report?

Answer: The forecast period in the Hydrochloric Acid Market Research report is 2024-2033.

2. Who are the key players in the Hydrochloric Acid Market?

Answer: Olin Corporation, Solvay, ShinEtsu Chemical, Praxairand Other Key Players.

3. What are the segments of the Hydrochloric Acid Market?

Answer: The Hydrochloric Acid Market is segmented into End-Use Industry, and Regions. By End-Use Industry, the market is categorized into Food & Beverage, Pharmaceutical, Steel, Oil & Gas, Chemical Synthesis, and Other End-Use Industries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Hydrochloric Acid Market?

Answer: The hydrochloric acid market represents the world-wide activities of manufacturing and distributing hydrochloric acid (HCl) which functions as a strong corrosive inorganic acid utilized by multiple industries. The chemical industry depends heavily on hydrochloric acid for its manufacturing processes while the steel industry picks metals with this acid along with water treatment facilities and food production plants that require hydrochloric acid and oil wells employ it for acidizing operations and it also facilitates calcium chloride and vinyl chloride production.

5. How big is the Hydrochloric Acid Market?

Answer: The global Hydrochloric Acid Market was valued at USD 2.7 billion in 2023 and is expected to grow from USD 2.8 billion in 2024 to USD 4.7 billion by 2033, reflecting a CAGR of 5.7% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.