🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hydrogen Fuel Cells Market

Hydrogen Fuel Cells Market (By Type (Air-Cooled Type, Water-Cooled Type), By Product (Proton Exchange Membrane Fuel cells, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells), By Application (Stationary, Transportation, Portable), By End-User (Fuel Cell Vehicles, Utilities, Defense), By Region and Companies)

Jun 2024

Energy and Power

Pages: 138

ID: IMR1116

Hydrogen Fuel Cells Market Overview

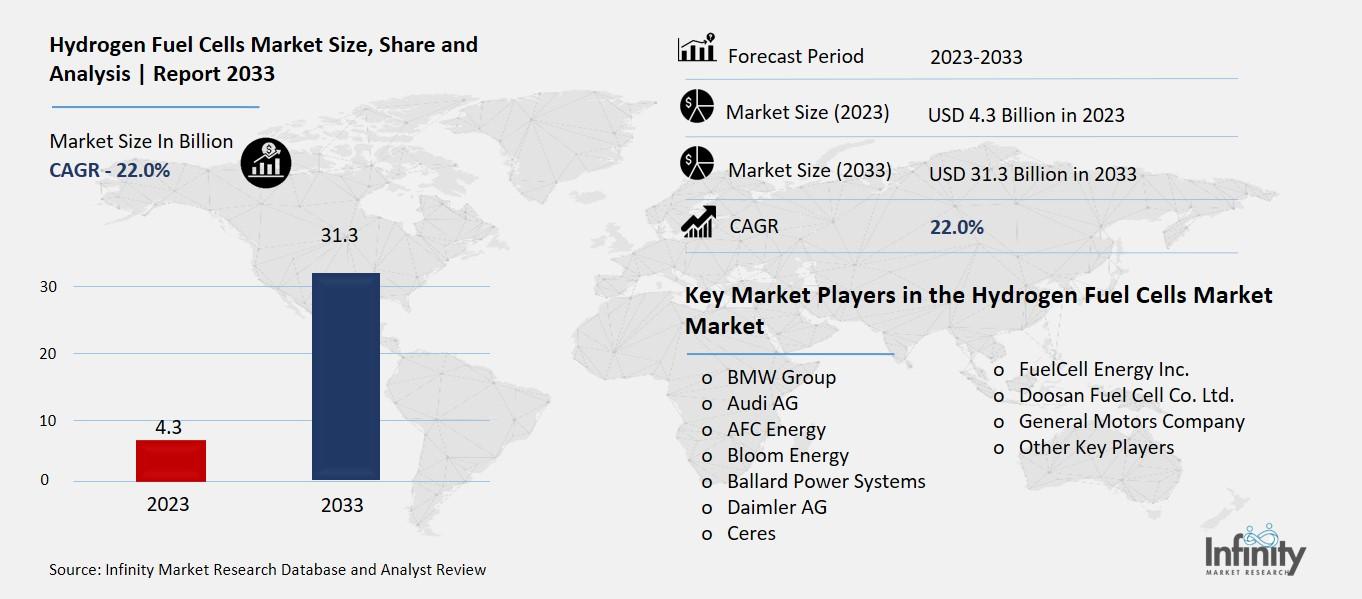

Global Hydrogen Fuel Cells Market size is expected to be worth around USD 31.3 Billion by 2033 from USD 4.3 Billion in 2023, growing at a CAGR of 22.0% during the forecast period from 2023 to 2033.

The Hydrogen Fuel Cells Market is all about the industry that makes and sells hydrogen fuel cells. These fuel cells use hydrogen gas to create electricity through a chemical reaction. They are an eco-friendly technology because their only byproduct is water, which means they don’t produce harmful emissions like traditional fossil fuels do. Hydrogen fuel cells can be used in various applications, such as powering cars, buses, and trucks, and even providing energy for buildings and portable devices.

This market is growing because of the increasing need for clean and renewable energy sources. As concerns about climate change and pollution rise, more companies and governments are investing in hydrogen fuel cells to reduce carbon footprints and move towards a greener future. Advances in technology are making hydrogen fuel cells more efficient and affordable, which helps boost their adoption in different sectors around the world.

Drivers for the Hydrogen Fuel Cells Market

Growing Demand for Clean Energy Solutions

The Hydrogen Fuel Cells market is driven by the growing demand for clean energy solutions. As concerns about climate change and air pollution increase, there is a global push towards reducing greenhouse gas emissions. Hydrogen fuel cells offer a promising alternative to traditional fossil fuels because they produce electricity through a chemical reaction between hydrogen and oxygen, with water as the only byproduct. This makes them environmentally friendly and supports efforts to transition to a low-carbon economy.

Expansion in Automotive Applications

One of the key drivers for the Hydrogen Fuel Cells market is their expanding use in automotive applications. Hydrogen fuel cells are gaining traction as a viable alternative to internal combustion engines and battery-powered electric vehicles (EVs). They offer advantages such as longer driving ranges and shorter refueling times compared to traditional EV batteries. Major automakers are investing in hydrogen fuel cell technology to develop commercial fuel cell vehicles (FCVs) and heavy-duty trucks. For instance, Toyota has launched the Mirai FCV, and Hyundai has introduced the Nexo SUV. The automotive sector is expected to be a significant driver of growth in the hydrogen fuel cells market, with projections indicating substantial market expansion in the coming years.

Government Support and Policies

Government support and policies play a crucial role in driving the Hydrogen Fuel Cells market. Many governments worldwide are implementing policies and providing incentives to promote the adoption of hydrogen fuel cells as part of their climate change mitigation strategies. For example, countries like Japan, South Korea, Germany, and the United States have established hydrogen roadmaps and funding programs to support research, development, and deployment of hydrogen technologies. These initiatives include subsidies for hydrogen fuel cell vehicles, funding for hydrogen refueling infrastructure, and tax incentives for companies investing in hydrogen technologies.

Technological Advancements and Cost Reductions

Technological advancements and cost reductions are significant drivers for the Hydrogen Fuel Cells market. Advances in fuel cell technology, such as improvements in membrane electrode assemblies (MEAs), catalysts, and fuel processing, have increased the efficiency and durability of hydrogen fuel cells. These advancements have led to reductions in manufacturing costs, making hydrogen fuel cells more competitive with other energy technologies. Additionally, research and development efforts are focused on enhancing the performance and reliability of hydrogen fuel cells, further driving market growth.

Diverse Applications in Energy and Industrial Sectors

The versatility of hydrogen fuel cells in various energy and industrial sectors is driving their adoption. Beyond automotive applications, hydrogen fuel cells are used in stationary power generation, including backup power for data centers and telecommunications infrastructure. They also play a role in providing clean power for residential and commercial buildings, where grid reliability and energy independence are critical. Industrial applications include powering material handling equipment in warehouses and manufacturing plants, where hydrogen fuel cells offer benefits such as zero emissions and quiet operation.

International Collaborations and Partnerships

International collaborations and partnerships are fostering the growth of the Hydrogen Fuel Cells market. Governments, research institutions, and private companies are collaborating to accelerate the development and deployment of hydrogen technologies globally. For example, the Hydrogen Council, a global initiative of leading energy, transport, and industry companies, is working to promote hydrogen as a key component of the future energy system. These collaborations aim to overcome technological and market barriers, facilitate knowledge sharing, and drive investment in hydrogen fuel cell infrastructure.

Restraints for the Hydrogen Fuel Cells Market

High Cost of Production and Infrastructure

One significant restraint for the Hydrogen Fuel Cells market is the high cost associated with production and infrastructure development. Hydrogen fuel cell technologies require expensive materials such as platinum and other rare metals for their catalysts, which can drive up manufacturing costs. Additionally, the infrastructure required to produce, store, transport, and distribute hydrogen fuel, including refueling stations, pipelines, and storage facilities, requires substantial investment. According to a report by the International Renewable Energy Agency (IRENA), the cost of hydrogen production needs to decrease significantly to achieve widespread commercialization. High initial costs and the need for infrastructure development are major barriers hindering the market growth of hydrogen fuel cells.

Limited Hydrogen Refueling Infrastructure

The limited availability of hydrogen refueling infrastructure is another restraint for the Hydrogen Fuel Cells market. Unlike gasoline stations, hydrogen refueling stations are less common and are concentrated in specific regions, primarily in developed countries such as the United States, Japan, Germany, and South Korea. The lack of a comprehensive refueling network makes it inconvenient for consumers to adopt hydrogen fuel cell vehicles (FCVs) and limits their widespread commercialization. According to the Hydrogen Council, as of 2022, there are around 650 hydrogen refueling stations worldwide, compared to over 178,000 gasoline stations in the U.S. alone. The expansion of refueling infrastructure is essential to support the growth of the hydrogen fuel cell market.

Technological Challenges and Performance Issues

Technological challenges and performance issues pose significant restraints for the Hydrogen Fuel Cells market. Despite advancements, hydrogen fuel cells still face durability issues, such as the degradation of fuel cell membranes and catalysts over time. Cold start capabilities, efficiency losses at high temperatures, and water management are also technical challenges that need to be addressed. Improving the reliability, durability, and efficiency of hydrogen fuel cells is crucial to gaining consumer confidence and increasing market adoption. Research and development efforts are ongoing to overcome these technological barriers and enhance the performance of hydrogen fuel cell systems.

Competition from Battery Electric Vehicles

Competition from battery electric vehicles (EVs) presents a restraint for the Hydrogen Fuel Cells market. Battery EVs have gained popularity due to advancements in battery technology, lower costs, and a more established charging infrastructure. They are seen as a direct competitor to hydrogen fuel cell vehicles, particularly in the passenger vehicle segment. Battery EVs offer advantages such as shorter refueling times and a broader refueling infrastructure network, making them more appealing to consumers. As a result, some automakers have shifted their focus and investments towards battery EVs, posing a challenge to the growth of hydrogen fuel cell vehicles.

Regulatory and Policy Uncertainties

Regulatory and policy uncertainties are additional restraints for the Hydrogen Fuel Cells market. Regulations related to safety standards, hydrogen transportation, and storage can vary significantly between countries and regions, creating barriers to market expansion. Moreover, inconsistent policies and a lack of long-term incentives for hydrogen infrastructure development can deter investments from governments and private sector players. Clear and supportive regulatory frameworks are essential to provide a stable environment for the growth of the hydrogen fuel cell market.

Opportunity in the Hydrogen Fuel Cells Market

Rising Demand for Clean Energy Solutions

The Hydrogen Fuel Cells market presents significant opportunities driven by the rising demand for clean energy solutions. As countries worldwide commit to reducing greenhouse gas emissions and combating climate change, hydrogen fuel cells offer a sustainable alternative to traditional fossil fuels. According to the International Energy Agency (IEA), hydrogen could meet 18% of global energy demand by 2050, with fuel cells playing a crucial role in sectors such as transportation, industry, and residential applications. The shift towards renewable energy sources and the decarbonization of economies presents a vast opportunity for hydrogen fuel cells to become a key component of the future energy landscape.

Growing Investments in Hydrogen Infrastructure

There is an opportunity for growth in the Hydrogen Fuel Cells market due to increasing investments in hydrogen infrastructure. Governments and private sector players are allocating substantial funds to develop hydrogen production, storage, and distribution infrastructure. For example, the European Union's Hydrogen Strategy aims to install at least 40 gigawatts (GW) of electrolyzers for hydrogen production by 2030. Similarly, Japan's Strategic Roadmap for Hydrogen and Fuel Cells sets ambitious targets for hydrogen infrastructure expansion. These investments are expected to create a robust hydrogen ecosystem, including refueling stations and industrial applications, which will drive market growth.

Expansion in Automotive Applications

The automotive sector presents a significant opportunity for the Hydrogen Fuel Cells market, particularly in heavy-duty and commercial vehicles. Hydrogen fuel cell vehicles (FCVs) offer advantages such as longer driving ranges and shorter refueling times compared to battery electric vehicles (EVs), making them suitable for applications requiring high energy density and quick refueling. Major automakers like Toyota, Hyundai, and Honda are investing in hydrogen fuel cell technology and launching commercial FCVs. The global market for hydrogen-powered vehicles is expected to grow significantly, driven by advancements in fuel cell technology and supportive government policies.

Integration with Renewable Energy Sources

Hydrogen fuel cells offer an opportunity to integrate with renewable energy sources such as wind and solar power. Renewable energy can be used to produce hydrogen through electrolysis, a process that splits water into hydrogen and oxygen. This green hydrogen can then be used in fuel cells to generate electricity without producing greenhouse gas emissions. The scalability of renewable energy and the ability to store hydrogen for long periods make hydrogen fuel cells a versatile solution for grid stabilization and energy storage. Countries with abundant renewable energy resources, such as Australia and Chile, are exploring hydrogen production as a means to store and export clean energy.

Emerging Markets and Global Expansion

There are opportunities for the Hydrogen Fuel Cells market in emerging markets and global expansion. Countries in Asia-Pacific, particularly Japan and South Korea, have been early adopters of hydrogen fuel cell technology and are investing heavily in its deployment. China has also set ambitious targets for hydrogen production and fuel cell adoption as part of its energy transition strategy. Additionally, North America, Europe, and other regions are ramping up efforts to support the hydrogen economy. The global expansion of hydrogen infrastructure and fuel cell applications presents opportunities for manufacturers, suppliers, and service providers in the hydrogen value chain.

Technological Advancements and Cost Reductions

Technological advancements and cost reductions offer opportunities for the Hydrogen Fuel Cells market. Ongoing research and development efforts are focused on improving the efficiency, durability, and performance of hydrogen fuel cells while reducing manufacturing costs. Innovations in materials, catalysts, and system design are expected to enhance the competitiveness of hydrogen fuel cells compared to other energy technologies. Cost reductions will make hydrogen fuel cells more accessible and attractive to a wider range of applications, accelerating market adoption.

Trends for the Hydrogen Fuel Cells Market

Rapid Advancements in Fuel Cell Technology

One of the significant trends in the Hydrogen Fuel Cells market is rapid advancements in fuel cell technology. Researchers and manufacturers are continuously innovating to improve the efficiency, durability, and cost-effectiveness of hydrogen fuel cells. Advancements include the development of new materials for catalysts and membranes, enhanced system designs for better performance, and innovations in hydrogen production methods. For instance, proton exchange membrane fuel cells (PEMFCs) are gaining popularity due to their high efficiency and suitability for various applications, including transportation and stationary power generation. These technological advancements are crucial for increasing the competitiveness of hydrogen fuel cells in the global energy market.

Expansion of Hydrogen Refueling Infrastructure

There is a growing trend towards the expansion of hydrogen refueling infrastructure worldwide. Governments, automakers, and energy companies are collaborating to build a network of hydrogen refueling stations to support the adoption of fuel cell vehicles (FCVs). In regions such as Europe, North America, and Asia-Pacific, significant investments are being made to increase the number of refueling stations and improve their accessibility. For example, the California Fuel Cell Partnership aims to expand the hydrogen refueling network across the state to support the commercialization of FCVs. This expansion is essential for addressing consumer concerns about refueling convenience and promoting the widespread adoption of hydrogen fuel cell technology.

Increasing Adoption in the Transportation Sector

The transportation sector is witnessing increasing adoption of hydrogen fuel cell technology, particularly in commercial vehicles and public transportation. Hydrogen fuel cell vehicles (FCVs) offer advantages such as longer driving ranges and shorter refueling times compared to battery electric vehicles (EVs), making them suitable for heavy-duty applications. Major automakers like Toyota, Hyundai, and Nikola Corporation are investing in hydrogen-powered trucks and buses to reduce emissions and operating costs. Governments are also incentivizing the adoption of zero-emission vehicles, including FCVs, through subsidies and tax incentives, further driving market growth.

Integration with Renewable Energy Sources

There is a growing trend towards integrating hydrogen fuel cells with renewable energy sources such as wind and solar power. Green hydrogen, produced through electrolysis using renewable electricity, is considered a sustainable energy carrier that can be stored and transported for various applications. The scalability of renewable energy and the ability to produce green hydrogen at scale are driving interest in hydrogen fuel cells as a key component of the future energy system. Countries like Germany and Japan are leading initiatives to develop hydrogen production facilities powered by renewable energy, demonstrating the potential for synergies between hydrogen and renewables.

Emerging Applications in Energy Storage

Hydrogen fuel cells are increasingly being explored for energy storage applications, particularly in grid stabilization and renewable energy integration. Fuel cell systems can store excess renewable energy in the form of hydrogen, which can be converted back to electricity during periods of high demand or when renewable generation is low. This capability supports the stability and reliability of electricity grids, especially in regions with high renewable energy penetration. Energy companies and utilities are investing in pilot projects to demonstrate the feasibility and benefits of hydrogen energy storage, paving the way for commercial deployment.

Global Partnerships and Collaborations

Global partnerships and collaborations are driving innovation and market growth in the Hydrogen Fuel Cells market. Governments, research institutions, and private sector companies are forming alliances to accelerate the development and deployment of hydrogen technologies. For example, the Hydrogen Council, a global initiative of leading energy, transport, and industry companies, promotes collaboration to advance hydrogen as a clean energy solution. These partnerships facilitate knowledge sharing, technology transfer, and investment in hydrogen infrastructure, supporting the commercialization of fuel cell technologies worldwide.

Segments Covered in the Report

By Type

o Air-Cooled Type

o Water-Cooled Type

By Product

o Proton Exchange Membrane Fuel cells

o Phosphoric Acid Fuel Cells

o Solid Oxide Fuel Cells (SOFC)

o Molten Carbonate Fuel Cells

By Application

o Stationary

o Transportation

o Portable

By End-User

o Fuel Cell Vehicles

o Utilities

o Defense

Segment Analysis

By Type Analysis

With more than 56.0% of the market, the Air-Cooled Type led the Hydrogen Fuel Cells Market in 2023. Because of its ease of use and minimal maintenance needs, air-cooled fuel cells are preferred in situations where weight and space limitations are important considerations. These fuel cells, which provide affordable solutions for a variety of industries, including transportation and stationary power generation, use air as the oxidizer and are cooled by ambient air.

On the other hand, the market for hydrogen fuel cells also includes a sizable section for the water-cooled kind. Water-cooled fuel cells are renowned for their increased efficiency and superior performance in challenging operating conditions, even though they will have a smaller market share in 2023. These fuel cells are the best options for applications needing a consistent and dependable power source, such as backup power systems and grid-scale energy storage, because they use water as a coolant, allowing for higher power densities and longer operational lifespans.

All things considered, both water- and air-cooled fuel cells are crucial to the hydrogen fuel cell market since they meet a range of consumer demands and application specifications. Water-cooled fuel cells are becoming more and more popular in critical applications where dependability and performance are crucial, despite Air-Cooled fuel cells' dominance in the market due to their ease of use and affordability.

By Product Analysis

With a market share of more than 45.1% in 2023, Proton Exchange Membrane (PEM) Fuel Cells dominated the hydrogen fuel cell market. PEM fuel cells are well known for their exceptional efficiency, quick startup times, and adaptability, which makes them perfect for a wide range of uses, such as stationary power generation, portable devices, and automobiles. Their broad acceptance and market supremacy are partly due to their capacity to function at low temperatures and provide clean energy with low emissions.

In the Hydrogen Fuel Cells Market, Phosphoric Acid Fuel Cells (PAFCs) constituted a noteworthy category, trailing closely behind. Particularly in stationary power production applications like cogeneration systems and distributed energy networks, PAFCs offer exceptional efficiency and dependability. They have a significant market presence because of their established technology and track record of success, which makes them the go-to option for major power generation projects.

Furthermore, the market for hydrogen fuel cells saw the emergence of Solid Oxide Fuel Cells (SOFCs) as a significant category. High temperatures are required for SOFC operation, and they have a high efficiency of directly converting a variety of fuels into energy. Their adaptability and potential for sustainable energy solutions are demonstrated by their use in combined heat and power systems, stationary power generation, and auxiliary power units for automobiles.

Furthermore, the market for hydrogen fuel cells continued to feature a significant presence of Molten Carbonate Fuel Cells (MCFCs). To effectively generate power, MCFCs run at high temperatures and can run on a range of fuels, such as biogas and natural gas. Their overall energy efficiency is improved by their capacity to capture waste heat for combined heat and power applications, which qualifies them for industrial and grid-scale power generation.

By Application Analysis

With a market share of more than 44.9% in 2023, stationary applications led the hydrogen fuel cell market. Stationary fuel cells are widely utilized to supply dependable and clean power for stationary power generation, backup power systems, and distributed energy generation in a variety of contexts, including the commercial, industrial, and residential domains. They are perfect for powering buildings, telecommunications towers, and vital infrastructure because of their low emissions profile, continuous operation, and efficiency.

Transportation became a prominent segment in the hydrogen fuel cell market, trailing closely behind. Compared to battery electric cars (BEVs), fuel cell vehicles (FCVs) fueled by hydrogen fuel cells provide zero-emission transportation options with longer driving ranges and quicker refueling periods. Worldwide markets are seeing a rise in the use of FCVs, particularly for heavy-duty vehicles like buses, trucks, and trains where electrification is difficult owing to payload and range requirements.

Furthermore, the market for hydrogen fuel cells continued to have a considerable presence from portable applications. Compact and lightweight, portable fuel cells offer on-demand electricity for a range of uses, such as off-grid power options, military gear, and consumer electronics. They are useful in situations where traditional power sources are either unavailable or unfeasible, such as isolated areas, outdoor activities, and crises, because of their portability and quick refilling capabilities.

All things considered, a variety of applications that each deal with particular energy requirements and environmental issues are driving the market for hydrogen fuel cells. Although stationary fuel cells dominate the market due to their extensive use in stationary power production, fuel cell technology has tremendous potential to transform sustainable energy solutions in the off-grid power and mobility sectors through portable and transportation applications.

By End-User Analysis

With a market share of more than 42.8% in 2023, Fuel Cell Vehicles (FCVs) became the market leader in the hydrogen fuel cell end-use segment. Compared to conventional internal combustion engine vehicles, hydrogen fuel cell-powered vehicles (FCVs) provide zero-emission transportation options with greater driving ranges and quicker refueling periods. The adoption of FCVs has been fueled by the growing emphasis on lowering greenhouse gas emissions and minimizing air pollution, especially in areas where clean transportation solutions are given priority.

Utility companies accounted for a large portion of the hydrogen fuel cell market, trailing closely behind. Fuel cells are used by utilities to generate stationary power, which supplies industrial, commercial, and residential customers with dependable and efficient electricity. Grid stability, energy security, and low emissions are features that make fuel cell power plants appealing to utilities looking to incorporate renewable energy sources and lessen their reliance on fossil fuels.

Furthermore, the Defense sector remained a significant player in the hydrogen fuel cell market. Fuel cells are used in military vehicles, remote power systems, and portable energy solutions because they operate quietly, produce fewer heat signatures, and have a longer endurance than conventional power sources. Defense forces can improve their operational capabilities in mission-critical activities by utilizing fuel cell technology, which also minimizes logistical obstacles and environmental impact.

Furthermore, other end-uses include a range of applications for hydrogen fuel cells in a variety of industries, such as off-grid electricity, maritime, aviation, and telecommunications. These uses of fuel cells for alternative energy, remote monitoring systems, and backup power highlight the adaptability and promise of fuel cell technology in meeting energy demands in a variety of sectors.

Regional Analysis

North America had a commanding 45.9% of the global market for hydrogen fuel cells in 2023, making it the market leader. The region's strong industrial infrastructure, technological developments, strict regulations, and the rising need for clean energy solutions across a range of industries are all contributing causes to this dominance.

North America, led by the United States, has a varied industrial environment with many industries that rely largely on hydrogen fuel cell technology. The need for hydrogen fuel cells is being driven by the automotive, energy, and stationary power generation industries to comply with environmental regulations and reduce emissions.

To solve environmental issues and meet sustainability goals, the region's growing population and increasing industrial activity are driving the need for novel clean energy solutions. As a result, the Asia-Pacific market is expanding more quickly, which is indicative of the region's growing importance in the worldwide Hydrogen Fuel Cells Market.

Competitive Analysis

There are few competitors in the highly disrupted worldwide hydrogen fuel cell market. Nonetheless, a growing number of new businesses are anticipated to enter the hydrogen fuel cell market during the projected period due to the sector's appeal.

Recent Developments

March 2022: Ceres and HORIBA MIRA collaborated to establish a Ceres fuel cell test facility and conduct fuel cell testing at the HORIBA MIRA West Midlands location in the UK.

November 2021: Ballard Power Systems collaborated with Caterpillar Inc. and Microsoft. This collaboration aimed to develop a megawatt-scale hydrogen fuel cell backup generator system for data centers. Through this collaboration, Ballard is expected to provide a state-of-the-art 1.5 MW ClearGenTM-II hydrogen fuel cell power generator.

Key Market Players in the Hydrogen Fuel Cells Market Market

o BMW Group

o Audi AG

o AFC Energy

o Bloom Energy

o Ballard Power Systems

o Daimler AG

o Ceres

o FuelCell Energy Inc.

o Doosan Fuel Cell Co. Ltd.

o General Motors Company

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 4.3 Billion |

|

Market Size 2033 |

USD 31.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

22.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Product, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

BMW Group, Audi AG, AFC Energy, Bloom Energy, Ballard Power Systems, Daimler AG, Ceres, FuelCell Energy Inc., Doosan Fuel Cell Co. Ltd., General Motors Company, Other Key Players |

|

Key Market Opportunities |

Growing Investments in Hydrogen Infrastructure |

|

Key Market Dynamics |

Growing Demand for Clean Energy Solutions |

📘 Frequently Asked Questions

1. How much is the Hydrogen Fuel Cells Market in 2023?

Answer: The Water and Hydrogen Fuel Cells Market size was valued at USD 4.3 Billion in 2023.

2. What would be the forecast period in the Hydrogen Fuel Cells Market report?

Answer: The forecast period in the Hydrogen Fuel Cells Market report is 2023-2033.

3. Who are the key players in the Hydrogen Fuel Cells Market?

Answer: BMW Group, Audi AG, AFC Energy, Bloom Energy, Ballard Power Systems, Daimler AG, Ceres, FuelCell Energy Inc., Doosan Fuel Cell Co. Ltd., General Motors Company, Other Key Players

4. What is the growth rate of the Hydrogen Fuel Cells Market?

Answer: Hydrogen Fuel Cells Market is growing at a CAGR of 22.0% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.