🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hydrogen Generator Market

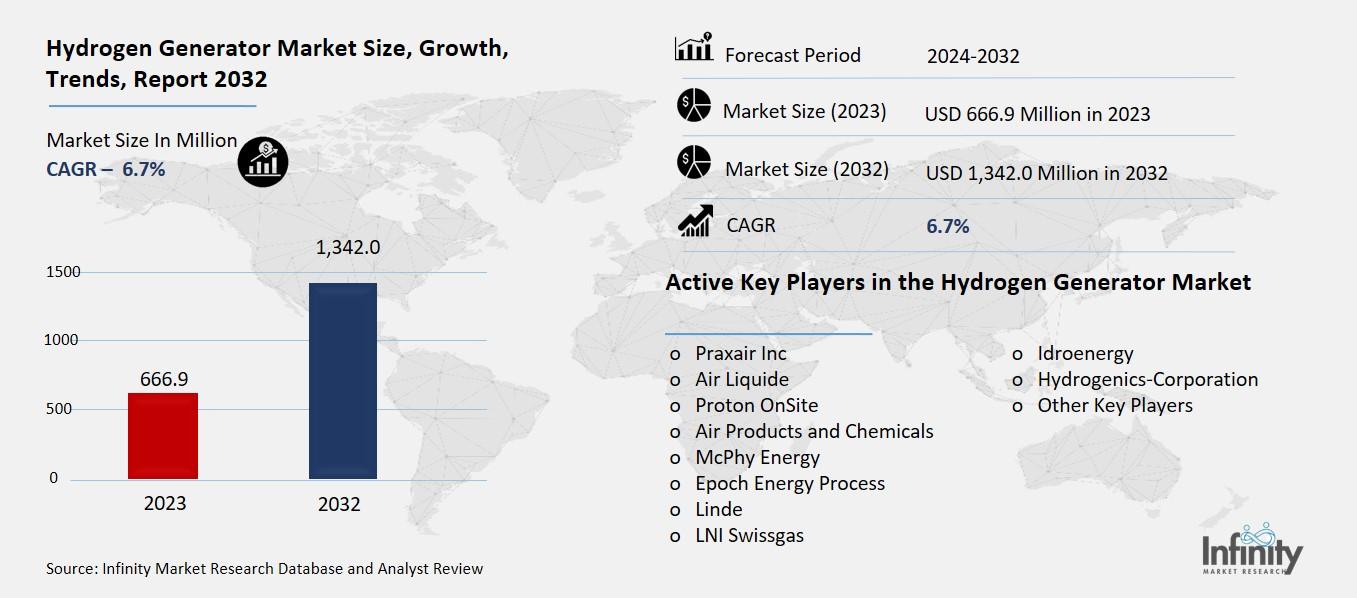

Hydrogen Generator Market Global Industry Analysis and Forecast (2024-2032) by Product (On-site and Portable), Process (Electrolysis, Steam Reforming, and Other Processes), Application (Petroleum Recovery, Chemical Processing, Refinery, Fuel Cells, and Other Applications) and Region

Mar 2025

Energy and Power

Pages: 138

ID: IMR1895

Hydrogen Generator Market Synopsis

Hydrogen Generator Market Size Was Valued at USD 666.9 Million in 2023, and is Projected to Reach USD 1,342.0 Million by 2032, Growing at a CAGR of 6.7% From 2024-2032.

Demand for hydrogen generators is growing strongly, spurred by the demand for clean energy solutions and government action to accelerate hydrogen as a core component of the energy transition. Hydrogen generators generate hydrogen using processes like electrolysis and steam methane reforming (SMR), the latter used for large-scale projects across all major industries, including transportation, power and chemical processing. Increasing investments in green hydrogen production, advancements in fuel cell technology, and stringent carbon emission reduction regulations are driving the hydrogen generation market. The industry players are increasingly concentrating on acquiring production facilities, building cost-effective technologies, and entering joint ventures in order to strengthen their market presence.

Hydrogen Generator Market Driver Analysis

Expansion of Hydrogen Fuel Cell Vehicles

Owing to increasing investment in (FCEVs), the demand for hydrogen production is expected to significantly increase. FCEVs [could] provide a zero-emission alternative to traditional internal combustion engine (ICE) vehicles by consuming hydrogen as a fuel source that generates electricity through a fuel cell. With stricter emissions regulations coming into force globally and an increasing push towards clean forms of mobility, automakers and energy companies are heavily investing in both FCEVs and the associated refueling infrastructure - namely hydrogen stations. Major countries such as Japan and South Korea, Germany, and the U.S. at the federal and state levels have already implemented policies and funding programs to accelerate FCEV adoption for both the passenger and commercial vehicle markets, including busses and trucks. This increasing shift to hydrogen-based transport is creating a growing demand for low-cost hydrogen, spurring development in electrolyzer technology and utility-scale hydrogen production projects.

Hydrogen Generator Market Restraint Analysis

Storage & Safety Concerns

Hydrogen has low energy density and is highly flammable, creating major technical and logistical hurdles to large-scale adoption. At ambient temperature, gaseous hydrogen has a significantly lower energy density compared to traditional fossil fuels so it needs to be compressed (over 350–700 bar) or liquefied (−253°C) to storage and transport safely. These creates additional complexity and cost for hydrogen infrastructure. Hydrogen also has a low ignition energy and a wide-range of flammability which pose serious safety hazards during storage, transportation, and handling of Hydrogen. This necessitates the use of special materials and containment systems to avoid leaks, as hydrogen molecules are tiny and can permeate traditional pipelines and containers.

Hydrogen Generator Market Opportunity Analysis

Hydrogen Blending in Natural Gas

Mixing hydrogen with natural gas to form a hydrogen-methane mixture is a very promising path toward carbon-free energy since this way green hydrogen can utilize already existing gas pipelines. Adding hydrogen to natural gas can reduce the carbon footprint of conventional gas-powered systems without the need for immediate, large-scale infrastructure changes by utilities. Hydrogen can be injected into natural-gas pipelines at concentrations of up to 20% (by volume) without major retrofitting of existing distribution networks. This means there is no gas system phase out, it is a transition that spans decades, as the world will need to keep using existing gas infrastructure as we transition to a hydrogen-based energy system. Countries such as Germany, the UK, and Australia are piloting projects to evaluate the practicality and efficiency of blending hydrogen with natural gas.

Hydrogen Generator Market Trend Analysis

Strategic Partnerships & Collaborations

Joint ventures and partnerships in the hydrogen industry continue to grow, with companies increasingly sparking collaboration with an eye toward enabling the infrastructure and supply chains that will support large-scale hydrogen adoption. The partnerships involve major organisations across energy suppliers, automotive, industrial gas suppliers and technology companies joining forces to streamline the production, transport, storage and use of hydrogen. Now major energy firms are joining forces with governments and technology providers to develop green hydrogen production plants, hydrogen refuelling networks, and hydrogen integration into power grids. Inspiration can be found in collaborative frameworks, such as the Hydrogen Council, a worldwide alliance of prominent energy and transport companies that work together to accelerate investment and technology development in hydrogen.

Hydrogen Generator Market Segment Analysis

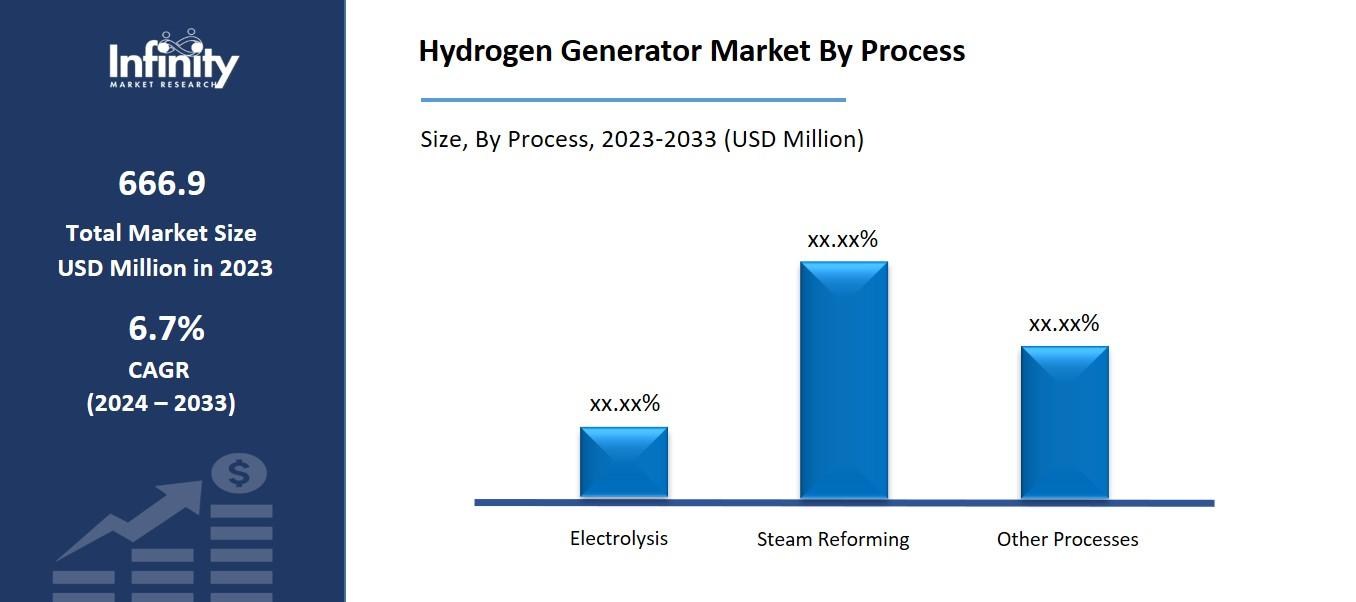

The Hydrogen Generator Market is segmented on the basis of Product, Process, and Application.

By Product

o On-site

o Portable

By Process

o Electrolysis

o Steam Reforming

o Other Processes

By Application

o Petroleum Recovery

o Chemical Processing

o Refinery

o Fuel Cells

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product, On-site segment is expected to dominate the market during the forecast period

The product discussed in this research study, the on-site segment is expected to account for the largest market share of hydrogen generator market in the forecast period. Hydrogen generation on-site means less complex transportation and storage infrastructure and lower supply chain costs, which will also offer operational reliability. Industries such as chemical production, petroleum refining, and metal processing are increasingly favoring on-site generation via electrolysis or thewidely practiced steam methane reforming (SMR) of natural gas to provide a consistent, high-purity hydrogen supply. Moreover, the transportation sector is also gaining propulsion as hydrogen production uses FCEVs are driven by the emergence of on-site hydrogen refilling stations.

By Process, the Steam Reforming segment is expected to held the largest share

The steam reforming segment is likely to dominate the market on account of its cost-effectiveness, efficiency, and widespread industrial adoption. Steam methane reforming (SMR) is the most widely used hydrogen production process, providing more than 95% of global hydrogen supply; its advantage is that it uses a relatively abundant and inexpensive feedstock in the form of natural gas to produce hydrogen through a reaction with steam. The method is used extensively in refineries, ammonia production, and chemical processes, establishing this method as the prevailing industrial hydrogen route. While demand is increasing for green hydrogen made from electrolysis, SMR has been the dominant process due to lower production costs and existing SMR infrastructure.

By Application, the Chemical Processing segment is expected to held the largest share

By application, the chemical processing segment is projected to hold the largest share of the hydrogen generator market owing to the wide applications of hydrogen in industrial chemistry. Hydrogen is an essential component for ammonia production, a key ingredient for fertilizers, and methanol synthesis is key for plastics, resins and fuels. Hydrogen is also used massively in petrochemical refining such as hydrocracking and desulfurization processes for producing cleaner fuels. This demand is also boosting investments into green ammonia and sustainable chemical production based on hydrogen.

Hydrogen Generator Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

The hydrogen generator market in North America is anticipated to have a major share during the forecast period owing to strong government support, increasing investment in clean energy and established industrial and transportation sectors in the region. Large-scale hydrogen projects, policy incentives and funding programs to advance hydrogen infrastructure have helped the United States and Canada lead the deployment of hydrogen technologies. The U.S. Department of Energy (DOE) has initiated the Hydrogen Energy Earthshot and Regional Clean Hydrogen Hubs (H2Hubs) programs to reorient hydrogen production and use in multiple industrial sectors.

Moreover, the increasing deployment of hydrogen refueling stations and the growing adoption of fuel cell electric vehicles (FCEVs) are also positively influencing the market for hydrogen generators in the transportation segment. The presence of leading hydrogen technology companies, as well as ongoing advances in carbon capture, utilization, and storage (CCUS) that can make blue hydrogen generation cost-competitive, and growing interest in sourcing green hydrogen from renewable suppliers, also bolster North America’s top position.

Recent Development

In June 2024, Caterpillar Inc. introduced the Cat® CG260 gas generator sets to its portfolio of commercially available power solutions, designed to operate on hydrogen fuel.

In April 2024, Panasonic's Electric Works Company launched a pioneering pure hydrogen fuel cell generator in Europe, Australia, and China. This advanced technology produces electricity through a chemical reaction that combines high-purity hydrogen with oxygen from the air.

Active Key Players in the Hydrogen Generator Market

o Praxair Inc

o Air Liquide

o Proton OnSite

o Air Products and Chemicals

o McPhy Energy

o Epoch Energy Process

o Linde

o LNI Swissgas

o Idroenergy

o Hydrogenics-Corporation

o Other Key Players

Global Hydrogen Generator Market Scope

|

Global Hydrogen Generator Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 666.9 Million |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 1,342.0 Million |

|

Segments Covered: |

By Product |

· On-site · Portable | |

|

By Process |

· Electrolysis · Steam Reforming · Other Processes | ||

|

By Application |

· Petroleum Recovery · Chemical Processing · Refinery · Fuel Cells · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Expansion of Hydrogen Fuel Cell Vehicles | ||

|

Key Market Restraints: |

· Storage & Safety Concerns | ||

|

Key Opportunities: |

· Hydrogen Blending in Natural Gas | ||

|

Companies Covered in the report: |

· Praxair Inc, Air Liquide, Proton OnSite, and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Hydrogen Generator Market Research report?

Answer: The forecast period in the Hydrogen Generator Market Research report is 2024-2032.

2. Who are the key players in the Hydrogen Generator Market?

Answer: Praxair Inc, Air Liquide, Proton OnSite, and Other Major Players.

3. What are the segments of the Hydrogen Generator Market?

Answer: The Hydrogen Generator Market is segmented into Product, Process, Application, and Regions. By Product, the market is categorized into On-site and Portable. By Process, the market is categorized into Electrolysis, Steam Reforming, and Other Processes. By Application, the market is categorized into Petroleum Recovery, Chemical Processing, Refinery, Fuel Cells, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Hydrogen Generator Market?

Answer: Hydrogen Generator market is simply the market of systems, generating hydrogen gas (from, Electrolysis and Steam Methane Reforming (SMR)). Hydrogen generators find extensive applications in industries, including transportation, energy, chemicals and manufacturing, where hydrogen can function as a clean fuel alternative and a crucial industrial feedstock. DHP market is driven by the increasing demand for sustainable energy solutions, the implementation of government policies to promote hydrogen adoption, and the advancements in hydrogen production technologies. Players in this market are investing in research & development to make processes more efficient, lower the production costs, and achieve a wide application range in fuel cells and industrial processes.

5. How big is the Hydrogen Generator Market?

Answer: Hydrogen Generator Market Size Was Valued at USD 666.9 Million in 2023, and is Projected to Reach USD 1,342.0 Million by 2032, Growing at a CAGR of 6.7% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.