🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ice Cream Packaging Equipment Market

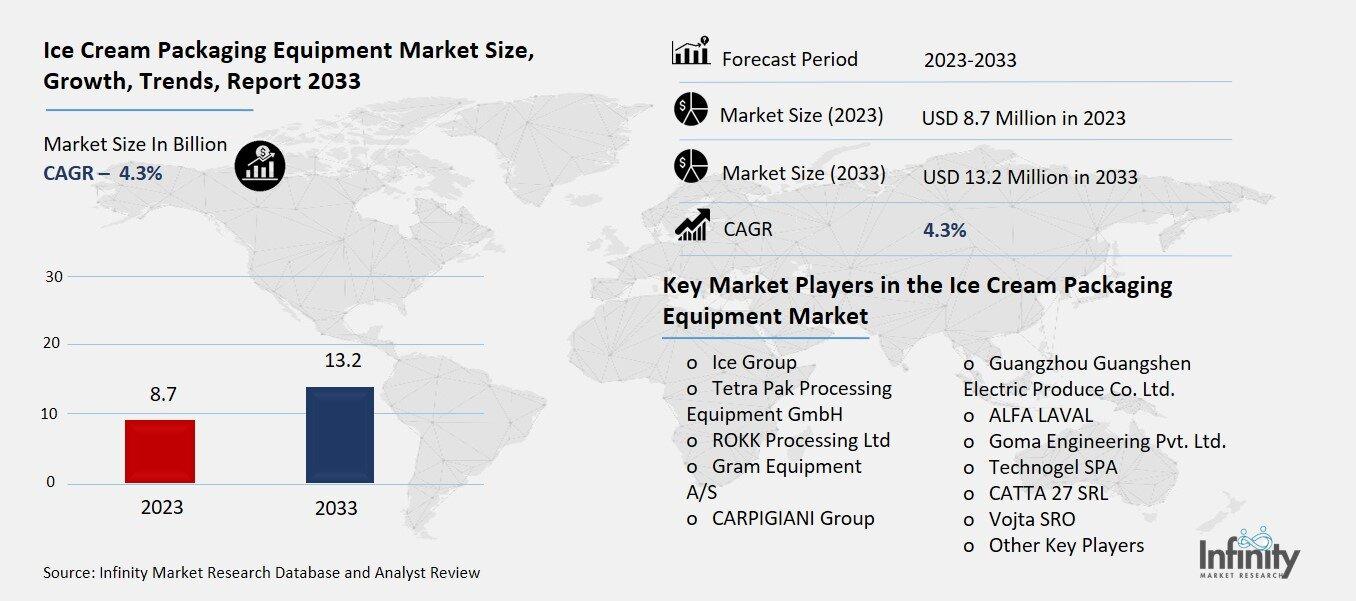

Global Ice Cream Packaging Equipment Market (By Packaging Type, Cup, Stick Pack, Tub, Folding Carton, and Other Packaging Types; By Equipment Type, Filling Freezers, Mixing Equipment, Moulding Equipment, Extrusion Equipment, and Other Equipment Types; By Region and Companies), 2024-2033

Oct 2024

Packaging And Transportation

Pages: 138

ID: IMR1249

Ice Cream Packaging Equipment Market Overview

Global Ice Cream Packaging Equipment Market acquired the significant revenue of 8.7 Billion in 2023 and expected to be worth around USD 13.2 Billion by 2033 with the CAGR of 4.3% during the forecast period of 2024 to 2033. The market is driven by the growing demand for diverse ice cream products which leads to an increasing need for efficient and automated packaging solutions. The market comprises various equipment types, including filling, wrapping, sealing, cartooning, and labeling machines. This machines cater to specific packaging formats like tubs, cones, sticks, and sandwiches.

The level of automation ranges from fully automatic systems for high-capacity production lines to semi-automatic and manual systems for smaller producers. Key end-users such as dairy processing plants, ice cream manufacturers, and small-scale artisanal producers requires distinct packaging. The market also sees a segmentation based on packaging materials, such as plastic, paper, and flexible films. This reflects the growing trend towards sustainability and material innovation.

Drivers for the Ice Cream Packaging Equipment Market

Increasing Ice Cream Consumption

Rising global demand for ice cream is driven by factors such as increasing disposable income, urbanization, and the influence of Western food culture. The availability of ice cream as a treat or dessert have grown considerably in the developed region. Also, consumers in the developed regions gain access to refrigeration and cold chain infrastructure. Additionally, shift of consumer preferences towards premium products increased the demand for a variety of flavors and types, such as vegan, low-calorie, and functional variants. This trend is further fueled by the preference of younger population for novel flavors. It encourages manufacturers to innovate and diversify their offerings to cater to changing tastes.

Restraints for the Ice Cream Packaging Equipment Market

High Initial Investment Cost

The high cost associated with purchasing and maintaining advanced packaging machinery poses a significant challenge for many players in the ice cream industry, particularly small-scale producers. Modern packaging equipment, which includes automation and smart technology, often requires substantial initial capital investment, making it difficult for smaller manufacturers to afford these solutions. Beyond the upfront costs, ongoing maintenance and the need for specialized technical skills to operate and service the machinery further contributes to the overall expense. As a result, many small-scale producers, who operate on tighter budgets and focus on niche or local markets, are unable to adopt advanced packaging technologies. This limits their ability to compete with larger manufacturers in terms of production efficiency, product consistency, and packaging innovation, potentially hindering their growth and competitiveness in the market.

Opportunity in the Ice Cream Packaging Equipment Market

Sustainable Packaging Solutions

The development of eco-friendly packaging solutions is becoming increasingly important as companies aim to comply with stringent environmental regulations and meet consumer expectations for sustainability. Governments around the world are implementing stricter policies on plastic use and waste management, prompting manufacturers to explore alternatives like biodegradable, recyclable, or compostable materials. This push for sustainable packaging is not only driven by regulatory compliance but also by the growing consumer demand for environmentally responsible brands. More consumers, particularly younger demographics, are prioritizing products that align with their values, including a reduced environmental footprint. As a result, companies in the ice cream industry are investing in innovative, eco-friendly packaging solutions to appeal to these environmentally conscious consumers, enhance their brand image, and gain a competitive edge in the market.

Trends for the Ice Cream Packaging Equipment Market

Increasing Focus on Shelf Life Extension

Innovations in packaging techniques to enhance product shelf life are becoming crucial in the ice cream industry, where maintaining product quality and preventing spoilage are major concerns. Advanced packaging methods, such as vacuum and modified atmosphere packaging (MAP), are increasingly being used to extend the freshness and quality of ice cream products during storage and distribution. Vacuum packaging removes air from the package, reducing the risk of ice crystal formation and maintaining the creamy texture of ice cream. Modified atmosphere packaging, on the other hand, involves altering the gaseous composition within the package to inhibit microbial growth and oxidation, thereby extending shelf life without the need for additional preservatives. These innovations not only help in ensuring that the ice cream retains its quality from production to consumption but also support manufacturers in reaching broader markets by enabling longer storage and transport times.

Segments Covered in the Report

By Packaging Type

o Cup

o Stick Pack

o Tub

o Folding Carton

o Other Packaging Types

By Equipment Type

o Filling Freezers

o Mixing Equipment

o Moulding Equipment

o Extrusion Equipment

o Other Equipment Types

Segment Analysis

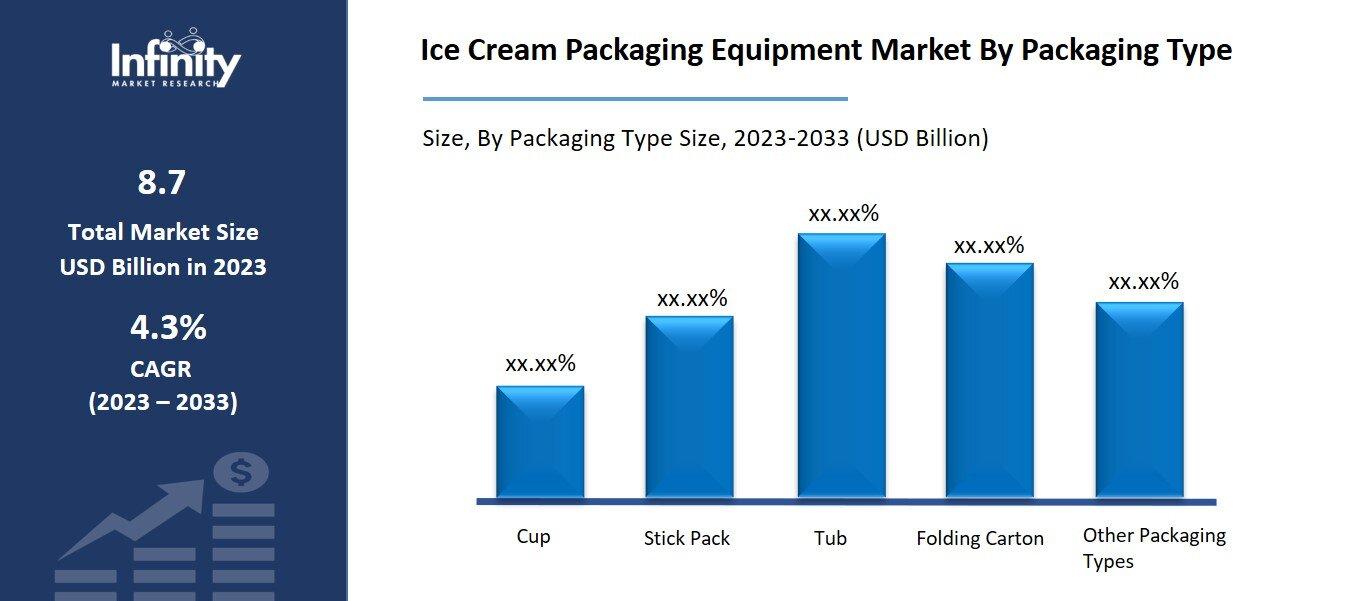

By Packaging Type Analysis

On the basis of packaging type, the market is divided into cup, stick pack, tub, folding carton, and other packaging types. Among these, cup segment acquired the significant share around 32.6% in the market owing to its convenience and widespread consumer preference. Cups are popular due to their portability, ease of use, and ability to cater to individual servings, making them ideal for on-the-go consumption and portion control. Additionally, the versatility in cup sizes and designs allows manufacturers to differentiate their products through unique branding, appealing to a wide range of consumer demographics. This packaging type is also commonly used for premium and specialty ice cream products, further contributing to its strong market presence.

By Equipment Type Analysis

On the basis of equipment type, the market is divided into filling freezers, mixing equipment, moulding equipment, extrusion equipment, and other equipment types. Among these, filling freezers held the prominent share of the market due to their critical role in the production process of ice cream. Filling freezers are essential for maintaining the ideal consistency and texture of ice cream by controlling the freezing process while incorporating air, which gives the product its smooth and creamy quality. These machines are designed to handle high volumes efficiently, making them indispensable for large-scale manufacturers seeking consistent quality and high production rates. Additionally, the versatility of filling freezers in handling different types of ice cream, including premium, low-fat, and specialty varieties, further boosts their demand in the market. Their importance in ensuring product quality and optimizing production output has positioned them as a key piece of equipment in the ice cream manufacturing process.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% the market. The region's well-established ice cream industry, supported by high consumer demand for a wide variety of ice cream products, has led to increased investments in advanced packaging solutions. Moreover, manufacturers in North America have embraced automation and innovative packaging technologies to enhance production efficiency and cater to evolving consumer preferences for convenience and product quality. Stringent food safety standards in the region also encourage the adoption of state-of-the-art packaging machinery to ensure product safety and compliance. Additionally, the presence of major ice cream brands and the growing trend towards premium and health-conscious ice cream varieties have further fueled the demand for sophisticated packaging equipment, contributing to North America's leading position in the market.

Competitive Analysis

The competitive landscape of the ice cream packaging equipment market is characterized by a blend of established industry leaders and emerging players, each vying for market share through innovation and differentiation. Major companies such as Tetra Pak are renowned for their comprehensive and sustainable packaging solutions, providing advanced machinery tailored for liquid products, including ice cream. Similarly, Meyer Burger Technology AG focuses on high-quality filling and sealing equipment targeted at the premium segment, while GEA Group offers a diverse range of innovative processing technologies, including filling freezers and mixing machines specifically designed for the ice cream sector.

Recent Developments

In March 2022, Revolution Desserts, LLC, an Atlanta-based ice cream manufacturer known for its trademarks Gelato Fiasco, Sweet Scoops, Art Cream, and SoCo Creamery, has been acquired by Yuengling's Corporation, an American ice cream manufacturer.

Key Market Players in the Ice Cream Packaging Equipment Market

o Ice Group

o Tetra Pak Processing Equipment GmbH

o ROKK Processing Ltd

o Gram Equipment A/S

o CARPIGIANI Group

o Guangzhou Guangshen Electric Produce Co. Ltd.

o ALFA LAVAL

o Goma Engineering Pvt. Ltd.

o Technogel SPA

o CATTA 27 SRL

o Vojta SRO

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 8.7 Billion |

|

Market Size 2033 |

USD 13.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Packaging Type, Equipment Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ice Group, Tetra Pak Processing Equipment GmbH, ROKK Processing Ltd, Gram Equipment A/S, CARPIGIANI Group, Guangzhou Guangshen Electric Produce Co. Ltd., ALFA LAVAL, Goma Engineering Pvt. Ltd., Technogel SPA, CATTA 27 SRL, Vojta SRO, and Other Key Players. |

|

Key Market Opportunities |

Sustainable Packaging Solutions |

|

Key Market Dynamics |

Increasing Ice Cream Consumption |

📘 Frequently Asked Questions

1. How much is the Ice Cream Packaging Equipment Market in 2023?

Answer: The Ice Cream Packaging Equipment Market size was valued at USD 8.7 Billion in 2023.

2. What would be the forecast period in the Ice Cream Packaging Equipment Market?

Answer: The forecast period in the Ice Cream Packaging Equipment Market report is 2024-2033.

3. Who are the key players in the Ice Cream Packaging Equipment Market?

Answer: Ice Group, Tetra Pak Processing Equipment GmbH, ROKK Processing Ltd, Gram Equipment A/S, CARPIGIANI Group, Guangzhou Guangshen Electric Produce Co. Ltd., ALFA LAVAL, Goma Engineering Pvt. Ltd., Technogel SPA, CATTA 27 SRL, Vojta SRO, and Other Key Players.

4. What is the growth rate of the Ice Cream Packaging Equipment Market?

Answer: Ice Cream Packaging Equipment Market is growing at a CAGR of 4.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.