🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Industrial Nonwovens Market

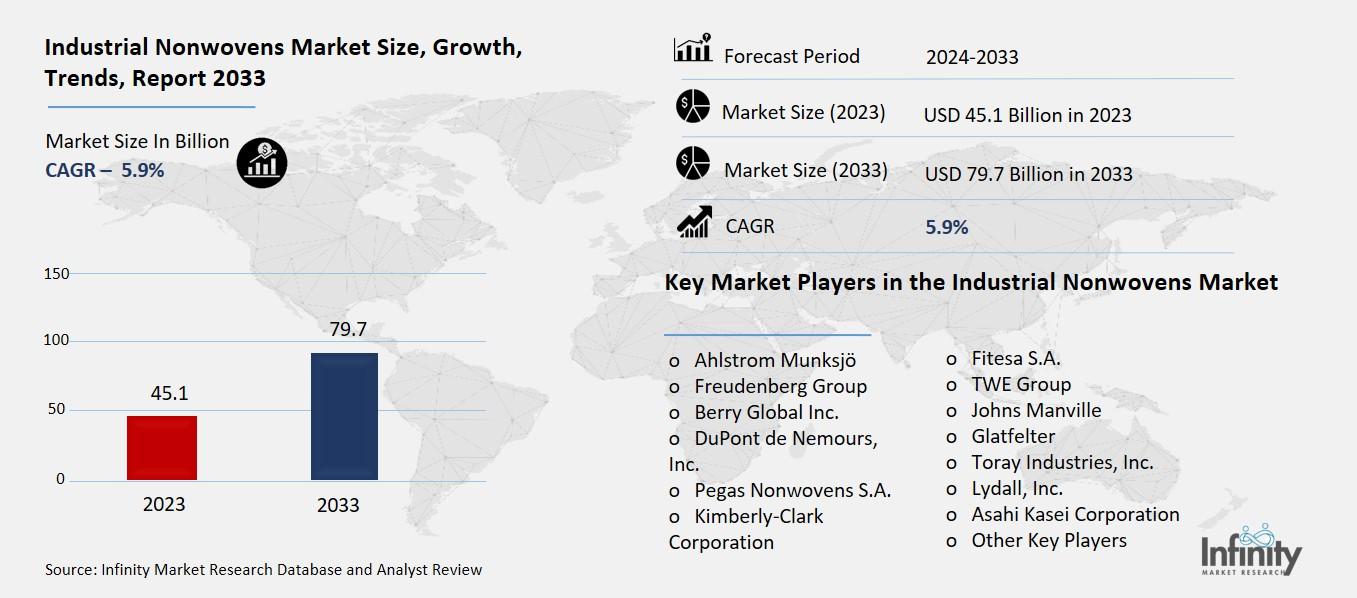

Global Industrial Nonwovens Market (By Type, Fibers and Polymers; By Application, Filtration, Electric/Electronic, Geotextiles, Industrial Sorbents/Mats, Insulation, Graphic Arts, Industrial Wipes, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1359

Industrial Nonwovens Market Overview

Global Industrial Nonwovens Market acquired the significant revenue of 45.1 Billion in 2023 and expected to be worth around USD 79.7 Billion by 2033 with the CAGR of 5.9% during the forecast period of 2024 to 2033. The global market of industrial nonwovens is growing rapidly in product segments and application areas including automotive, hygiene, medical, construction, filtration and textile industries etc. Nonwoven fabrics are synthetic materials composed of fibers joined adrift in a mechanical, chemical, physicochemical, or thermal techniques, wherein no weaving or knitting is involved. These fabrics have various benefits such as; high strength, light weight and flexibility of use, this puts these fabrics in various uses. Nonwovens are utilized in automotive passageway as filters, heaters and sound absorbers or in healthcare it is used in bandages, dresses and surgical scrubs.

Drivers for the Industrial Nonwovens Market

Increasing Demand for Lightweight and Durable Materials

Nonwovens are gaining popularity across most sectors because they possess tremendous strength, flexibility, and low density. These features turn nonwoven fabrics to be very flexible tools which can satisfy the needs of some particular fields such as automotive industry, medical, and hygiene. In automobiles, nonwovens are used in the insulation layer where insulation and weight savings are important, filter represented element of automotive applications, and for sound proofing where noise reduction is desired. Nonwoven fabrics play an important role in manufacturing such medical apparel as surgical gowns, masks, and articles of wound care where such characteristics as durability and antimicrobial resistance matter.

Likewise, hygiene industry depends on nonwovens for articles such as diapers, sanitary napkins, and adult incontinence products, where these cover properties of absorbency and comfortable are critical. The presence of these attributes fosters the increasing use of nonwoven fabrics in various applications as products that offer functionality at reasonable costs.

Restraints for the Industrial Nonwovens Market

Environmental Impact of Nonwoven Disposal

While there is a strong push for the use of sustainable materials, nonwovens, particularly those made from synthetic fibers like polyester and polypropylene, present significant environmental challenges. These fabrics are often non-biodegradable and have limited recyclability, which contributes to long-term waste accumulation. As nonwoven materials are widely used in disposable products such as diapers, wipes, and medical supplies, they often end up in landfills, where they can persist for years. This environmental impact has raised concerns about the ecological footprint of nonwoven products, prompting calls for the development of eco-friendly alternatives. In response, there is growing interest in producing biodegradable nonwovens, utilizing natural fibers, and improving recycling technologies to reduce the environmental burden associated with synthetic nonwoven materials.

Opportunity in the Industrial Nonwovens Market

Growth in Automotive and Construction Sectors

As the automotive industry increasingly prioritizes lightweight materials to improve fuel efficiency and reduce emissions, the demand for nonwovens is expected to rise significantly. Nonwoven fabrics are being adopted in automotive applications for their lightweight yet durable properties, offering solutions in areas like filtration, soundproofing, and insulation. These materials help reduce the overall weight of vehicles, contributing to better fuel economy and performance. Similarly, the construction sector is driving the demand for nonwovens, particularly in the form of geotextiles, filtration fabrics, and insulation materials. Nonwovens provide excellent durability, water resistance, and cost-effectiveness, making them ideal for use in road construction, drainage systems, and building insulation. As both industries continue to embrace nonwoven solutions, the market for industrial nonwovens is expected to expand, supported by the growing trend of optimizing material performance and sustainability in these sectors.

Trends for the Industrial Nonwovens Market

Increased Use of Nonwoven Fabrics in Automotive

Nonwovens are rapidly becoming an essential material in the automotive sector, where they are used in a variety of components such as filters, interior linings, and insulation. Their popularity stems from their ability to meet both performance and sustainability standards required in modern vehicles. Nonwoven filters, for example, offer excellent filtration capabilities while being lightweight, which is crucial for improving fuel efficiency and engine performance. In interior linings, nonwoven materials provide soundproofing, thermal insulation, and comfort, enhancing the overall driving experience.

Additionally, nonwovens are increasingly used for insulation in areas such as doors, dashboards, and wheel arches, offering benefits in terms of weight reduction and noise control. With the automotive industry placing a growing emphasis on reducing environmental impact and improving fuel efficiency, nonwovens meet the demand for lightweight, durable, and sustainable materials, making them an integral part of vehicle design and production.

Segments Covered in the Report

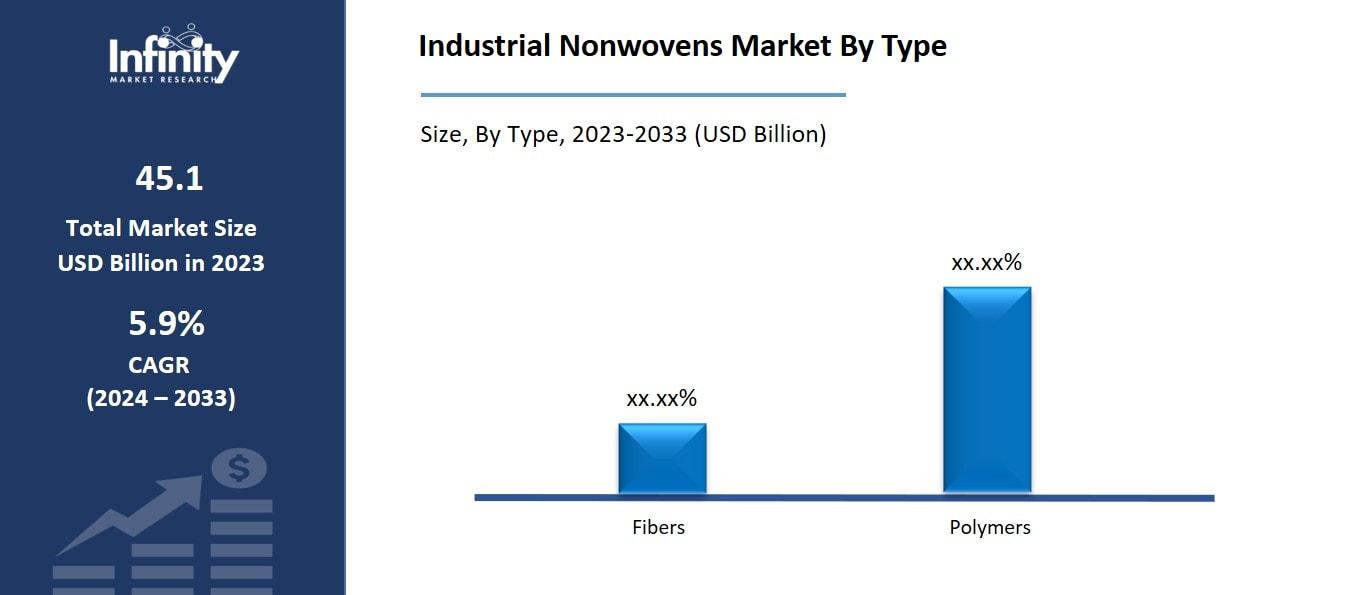

By Type

o Fibers

o Polymers

By Application

o Filtration

o Electric/Electronic

o Geotextiles

o Industrial Sorbents/Mats

o Insulation

o Graphic Arts

o Industrial Wipes

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into fibers and polymers. Among these, polymers segment acquired the significant share in the market owing to the widespread use of synthetic polymers like polypropylene and polyester in the production of nonwoven fabrics. Polymers offer key advantages such as durability, flexibility, and resistance to moisture, making them ideal for a wide range of applications across industries such as automotive, medical, hygiene, and construction. The ability to customize the properties of polymer-based nonwovens such as improving strength, absorption, and filtration has further contributed to their dominant position in the market.

By Application Analysis

On the basis of application, the market is divided into filtration, electric/electronic, geotextiles, industrial sorbents/mats, insulation, graphic arts, industrial wipes, and other applications. Among these, filtration segment held the prominent share of the market due to the growing demand for high-performance filters in various industries. Nonwoven fabrics are widely used in air, water, and liquid filtration due to their excellent filtration capabilities, high dirt-holding capacity, and efficiency in capturing particles. They are essential in industries such as automotive, healthcare, and manufacturing, where reliable and durable filtration systems are critical.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 30.2% of the market driven by rapid industrialization, increased manufacturing activities, and the growing demand for nonwoven materials across various sectors. The region's thriving automotive, healthcare, construction, and hygiene industries have significantly contributed to the high consumption of nonwoven fabrics. With emerging economies like China, India, and Southeast Asian countries experiencing robust growth in infrastructure development, the demand for nonwoven products in applications such as geotextiles, insulation, and filtration has surged.

Additionally, the region benefits from a large, cost-effective labor force, enabling the production of nonwoven fabrics at competitive prices. As consumer preferences shift toward sustainable and lightweight materials, Asia Pacific's focus on innovation and technology in nonwoven manufacturing has further solidified its position as a key market leader.

Competitive Analysis

The competitive landscape of the global industrial nonwovens market is characterized by the presence of both large multinational companies and numerous regional players. Major players in the market include well-established names like Berry Global, Freudenberg Group, Ahlstrom-Munksjö, and Kimberly-Clark, which have strong manufacturing capabilities, extensive distribution networks, and a broad product portfolio. These companies focus on innovation, sustainability, and technological advancements to maintain their competitive edge. Additionally, many of these players are investing in research and development to improve the performance of nonwoven fabrics and expand their applications in high-growth sectors such as automotive, healthcare, and filtration.

Recent Developments

In November 2024, EDANA and INDA released the "Global Nonwoven Markets Report," offering a comprehensive analysis of global nonwoven supply and demand trends. This report provides valuable insights into the market's current state and future outlook.

Key Market Players in the Industrial Nonwovens Market

o Ahlstrom-Munksjö

o Freudenberg Group

o Berry Global Inc.

o DuPont de Nemours, Inc.

o Pegas Nonwovens S.A.

o Kimberly-Clark Corporation

o Fitesa S.A.

o TWE Group

o Johns Manville

o Glatfelter

o Toray Industries, Inc.

o Lydall, Inc.

o Asahi Kasei Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 45.1 Billion |

|

Market Size 2033 |

USD 79.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ahlstrom-Munksjö, Freudenberg Group, Berry Global Inc., DuPont de Nemours, Inc., Pegas Nonwovens S.A., Kimberly-Clark Corporation, Fitesa S.A., TWE Group, Johns Manville, Glatfelter, Toray Industries, Inc., Lydall, Inc., Asahi Kasei Corporation, and Other Key Players. |

|

Key Market Opportunities |

Growth in Automotive and Construction Sectors |

|

Key Market Dynamics |

Increasing Demand for Lightweight and Durable Materials |

📘 Frequently Asked Questions

1. Who are the key players in the Industrial Nonwovens Market?

Answer: Ahlstrom-Munksjö, Freudenberg Group, Berry Global Inc., DuPont de Nemours, Inc., Pegas Nonwovens S.A., Kimberly-Clark Corporation, Fitesa S.A., TWE Group, Johns Manville, Glatfelter, Toray Industries, Inc., Lydall, Inc., Asahi Kasei Corporation, and Other Key Players.

2. How much is the Industrial Nonwovens Market in 2023?

Answer: The Industrial Nonwovens Market size was valued at USD 45.1 Million in 2023.

3. What would be the forecast period in the Industrial Nonwovens Market?

Answer: The forecast period in the Industrial Nonwovens Market report is 2024-2033.

4. What is the growth rate of the Industrial Nonwovens Market?

Answer: Industrial Nonwovens Market is growing at a CAGR of 5.9% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.