🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Industrial Oxygen Market

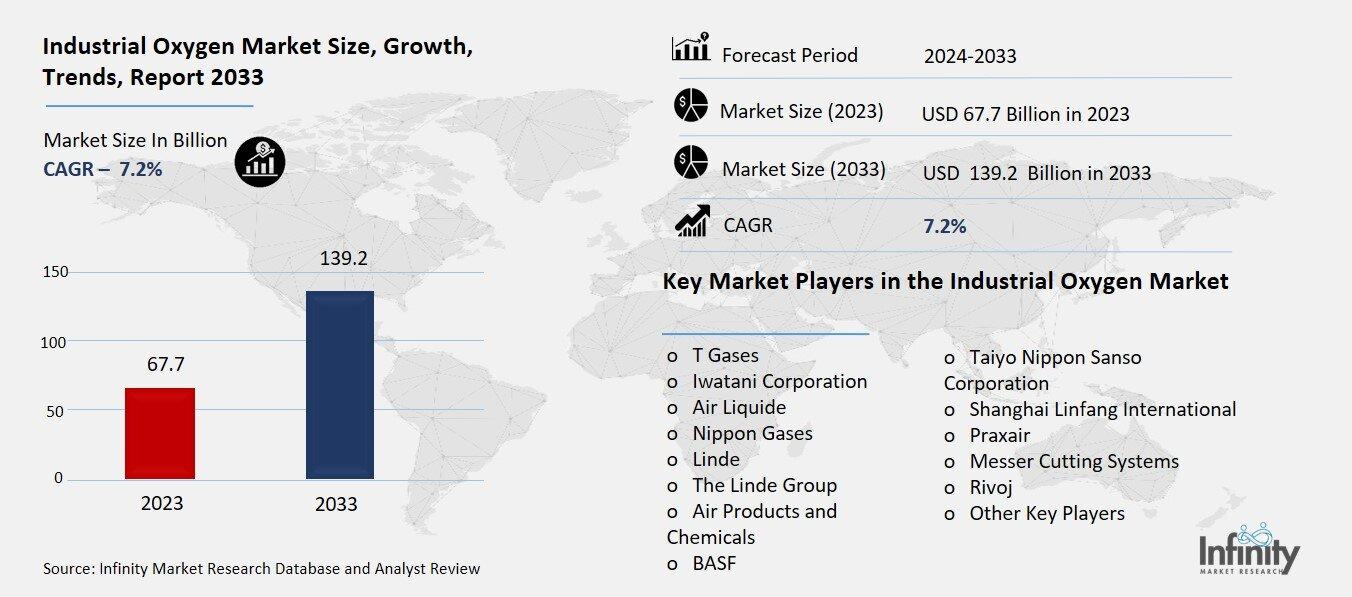

Global Industrial Oxygen Market (By Product Type, Compressed Oxygen Gas and Liquefied Oxygen; By End-Use, Energy, Automotive & Aerospace, and Chemical Processing; By Region and Companies), 2024-2033

Nov 2024

Industrial Automation and Equipment

Pages: 138

ID: IMR1315

Industrial Oxygen Market Overview

Global Industrial Oxygen Market acquired the significant revenue of 67.7 Billion in 2023 and expected to be worth around USD 139.2 Billion by 2033 with the CAGR of 7.2% during the forecast period of 2024 to 2033. The industrial oxygen market is a significant segment of the global industrial gas market due to the rising demand for oxygen in various industries including healthcare, manufacturing, chemical processing industries, and metallurgy industries. Another widespread industrial gas is oxygen; it is used in blast furnaces in steel industries for the improvement of combustion and other industries, plus in medical facounds for extra oxygen supply and many medical uses. The market is also driven by increasing eco concerns such as oxygen performing several functions and used in water treatment, wastewater treatment and air treatment.

Also, the higher appliance of oxygen in various industrial uses, including aerospace and electronics industries, is also acting as a driving force to the market. The market is comprised of major players such as Air Liquide, Linde, and Praxair established in the market, as well as regional players who intend to further enter the market and capture market demand.

Drivers for the Industrial Oxygen Market

Increased Demand in Healthcare

The rising demands for medial oxygen can be attributed to the global demography, much specifically the ageing population who develop chronic respiratory diseases including COPD, asthma or other pulmonary diseases. As the global ageing population continues to grow and there is a shift towards more developed countries, the need for medical oxygen should similarly remain strong. This demand is further fueled by other conditions such as lifestyle diseases including smoking diseases and obesity leading to respiratory problems. Hospitals obviously use medical oxygen for the treatment of patients, but it is also used in emergency medical services to provide stabilization to patients with severe injuries such as trauma, suffocation, or heart attack, or for patients experiencing respiratory collapse.

Restraints for the Industrial Oxygen Market

Safety Concerns

Oxygen, due to its highly reactive nature, poses significant safety challenges in its handling, storage, and transportation, which can limit its widespread adoption in certain industries. As an oxidizing agent, oxygen can accelerate combustion, making it dangerous if not carefully controlled. In environments where oxygen levels are not properly regulated, there is a heightened risk of fire or explosion, particularly in industrial settings such as chemical manufacturing, oil and gas, and metal processing. These safety concerns necessitate strict adherence to safety protocols, such as the use of specialized equipment, proper ventilation, and continuous monitoring systems. In regions or sectors where safety standards are not easily met, the risks associated with oxygen handling can deter investment and limit growth.

Opportunity in the Industrial Oxygen Market

Adoption of Green Technologies

The increasing emphasis on sustainable energy sources and technologies has created significant opportunities for oxygen in green applications, particularly in areas like fuel cell technology, renewable energy production, and carbon capture. As the world shifts toward reducing reliance on fossil fuels, oxygen plays a critical role in facilitating cleaner and more efficient energy production processes.

In fuel cell technology, oxygen is an essential component in the electrochemical reaction that generates electricity in hydrogen fuel cells, which are seen as a promising alternative to traditional energy sources. The use of oxygen in fuel cells allows for the efficient conversion of hydrogen into electricity with only water and heat as byproducts, making it an environmentally friendly solution for powering vehicles, buildings, and even portable devices.

Trends for the Industrial Oxygen Market

Integration of IoT and Automation

The integration of Internet of Things (IoT) technologies into oxygen supply systems is rapidly emerging as a key trend, transforming the way oxygen is monitored, managed, and delivered across various industries. IoT-enabled oxygen systems allow for real-time monitoring, which provides continuous data on the flow, pressure, and purity of oxygen, ensuring that these critical parameters are maintained at optimal levels. This real-time tracking enables more efficient management, reducing the risk of supply disruptions and enhancing overall system reliability.

Additionally, IoT technologies contribute to the optimization of oxygen usage, especially in industrial applications where precision and efficiency are crucial. For example, in large-scale manufacturing or medical facilities, IoT can help adjust oxygen delivery based on demand fluctuations, ensuring that the supply meets the required levels without excess waste, ultimately lowering operational costs.

Segments Covered in the Report

By Product Type

o Compressed Oxygen Gas

o Liquefied Oxygen

By End-Use

o Energy

o Automotive & Aerospace

o Chemical Processing

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into oxygen gas and liquefied oxygen. Among these, liquefied oxygen segment acquired the significant share in the market owing to its advantages in storage and transportation. Liquefied oxygen, produced by cooling oxygen gas to extremely low temperatures, occupies less volume compared to its gaseous form, making it more efficient for storage and distribution, especially in large quantities. This efficiency is particularly beneficial for industries such as steel manufacturing, chemical processing, and healthcare, where a consistent and substantial supply of oxygen is essential. The ability to store and transport oxygen in liquid form reduces logistical challenges and costs, thereby driving its adoption across various industrial applications.

By End-Use Analysis

On the basis of end-use, the market is divided into energy, automotive & aerospace, and chemical processing. Among these, chemical processing segment held the prominent share of the market due to oxygen's essential role in various chemical reactions and synthesis processes. Oxygen is utilized in the production of chemicals such as ethylene oxide, propylene oxide, and hydrogen peroxide, among others. Its use enhances reaction rates and yields, making it indispensable in the chemical industry. Additionally, oxygen is employed in wastewater treatment and pollution control, further driving its demand in this sector.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market due to the region's well-established industrial base, advanced healthcare infrastructure, and significant investments in technology and innovation. The United States, in particular, is home to some of the world's largest manufacturing industries, including steel production, chemicals, and automotive, which are major consumers of industrial gases like oxygen.

Additionally, the healthcare sector in North America is one of the largest and most advanced globally, driving significant demand for medical oxygen, especially with the aging population and the increasing prevalence of chronic respiratory diseases.

Competitive Analysis

The competitive landscape of the industrial oxygen market is characterized by the presence of several key players, including both multinational corporations and regional suppliers, which dominate the market through strategic partnerships, technological advancements, and diverse product offerings. Major companies such as Air Liquide, Linde, Praxair, Air Products and Chemicals, and Messer Group lead the market due to their extensive global networks, large-scale production capabilities, and strong brand presence. These industry giants offer a wide range of industrial gases, including oxygen, and serve a variety of sectors such as healthcare, chemicals, steel manufacturing, and energy.

Recent Developments

In June 2024, ExxonMobil Corp. has teamed up with Air Liquide to assist in the production of hydrogen and ammonia at its integrated refining and petrochemical complex in Baytown, Texas, which processes 561,000 barrels per day.

In October 2024, Praxair Inc. revealed plans to invest USD 300 million to increase its oxygen production capacity in the United States. The funds will be used to construct new air separation units (ASUs) and expand the capacity of existing ones.

Key Market Players in the Industrial Oxygen Market

o T Gases

o Iwatani Corporation

o Air Liquide

o Nippon Gases

o Linde

o The Linde Group

o Air Products and Chemicals

o BASF

o Taiyo Nippon Sanso Corporation

o Shanghai Linfang International

o Praxair

o Messer Cutting Systems

o Rivoj

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 67.7 Billion |

|

Market Size 2033 |

USD 139.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

T Gases, Iwatani Corporation, Air Liquide, Nippon Gases, Linde, The Linde Group, Air Products and Chemicals, BASF, Taiyo Nippon Sanso Corporation, Shanghai Linfang International, Praxair, Messer Cutting Systems, Rivoj, and Other Key Players. |

|

Key Market Opportunities |

Adoption of Green Technologies |

|

Key Market Dynamics |

Increased Demand in Healthcare |

📘 Frequently Asked Questions

1. Who are the key players in the Industrial Oxygen Market?

Answer: T Gases, Iwatani Corporation, Air Liquide, Nippon Gases, Linde, The Linde Group, Air Products and Chemicals, BASF, Taiyo Nippon Sanso Corporation, Shanghai Linfang International, Praxair, Messer Cutting Systems, Rivoj, and Other Key Players.

2. How much is the Industrial Oxygen Market in 2023?

Answer: The Industrial Oxygen Market size was valued at USD 67.7 Billion in 2023.

3. What would be the forecast period in the Industrial Oxygen Market?

Answer: The forecast period in the Industrial Oxygen Market report is 2024-2033.

4. What is the growth rate of the Industrial Oxygen Market?

Answer: Industrial Oxygen Market is growing at a CAGR of 7.2% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.