🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Iridium Market

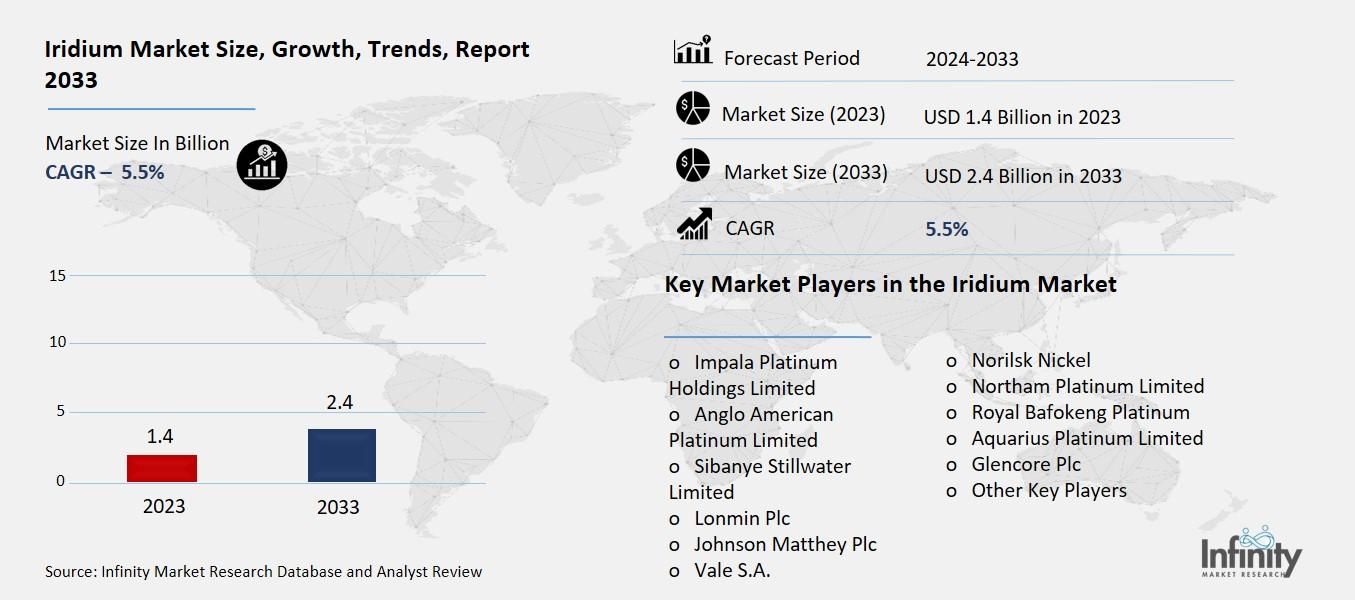

Global Iridium Market (By Product Type, Iridium Metal, Iridium Alloys, and Iridium Compounds; By Application, Electronics, Medical, Chemical, Automotive, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1336

Iridium Market Overview

Global Iridium Market acquired the significant revenue of 1.4 Billion in 2023 and expected to be worth around USD 2.4 Billion by 2033 with the CAGR of 5.5% during the forecast period of 2024 to 2033. The global demand for iridium is fosters by its major utility in industrial and technological fields as a catalyst, electronics, and medical applications. Iridium is one of the densest and most chemically inert elements; many of the applications are in automotive electrochemical devices, especially catalytic converters that are integral to glide because of the general awareness on emissions. It also has applications in spark plugs, electrical connectors and as a structural material in models and high temperature and chemical resistant alloys.

The market has received a further boost from its use in hydrogen fuel cells and green technologies due to its usefulness in electrochemical activity. Availability of the metal and most of its allies is restricted due to how it is mined with platinum and palladium in specific locations including South Africa and Russia; flavonoids affect the market chain and pricing.

Drivers for the Iridium Market

Increasing Adoption of Hydrogen Economy

Iridium is a critical component of industrial hydrogen production and fuel cells, essential technologies for generating green energy. Iridium is a vital part of PEM electrolyzers in the generation of hydrogen from water using renewable energy in hydrogen production. They include corrosion resistance and ability to work effectively under the strong acidic conditions due to its durability in use. Likewise, in fuel cells, the metal is used as a catalyst to help in electrochemical reactions, converting hydrogen into electricity with emissions of no carbon. This means it is ideal for use in electric cars, portable electric equipment and stationary electricity generation and storage.

With the rising for clean technologies around the world, the application of iridium in such technologies is poised to grow rapidly despite the supply and cost issues that may come about. However, present efforts to find ways to increase the iridium efficiency and recycling programs will help ease the problem of quantity and ensure the growth of the hydrogen generation systems.

Restraints for the Iridium Market

Geopolitical Risks

The global iridium supply is heavily dependent on a few politically sensitive regions, notably South Africa and Russia, which account for the majority of its production as a by-product of platinum and palladium mining. This concentration creates vulnerabilities in the supply chain, as geopolitical tensions, regulatory changes, or labor strikes in these regions can significantly disrupt production and availability. For instance, international sanctions or trade restrictions on Russia or operational challenges in South Africa, such as energy shortages or infrastructure issues, can lead to supply bottlenecks and price volatility. Such dependence poses risks for industries reliant on iridium, including green energy, electronics, and automotive sectors.

Opportunity in the Iridium Market

Emerging Applications in Green Technology

Iridium is gaining significant importance in electrochemical applications, particularly in water splitting and renewable energy systems, due to its unique properties. In water splitting, iridium serves as a key catalyst in proton exchange membrane (PEM) electrolyzers, which produce hydrogen from water using renewable electricity. Its high corrosion resistance and ability to perform under acidic conditions make it indispensable for the oxygen evolution reaction (OER), a critical step in the electrolysis process. This application is crucial for generating green hydrogen, which is a cornerstone of decarbonization strategies worldwide.

In renewable energy systems, iridium's role extends to fuel cells, where it supports efficient energy conversion and storage. For instance, hydrogen fuel cells use iridium catalysts to facilitate the reactions needed to convert hydrogen into electricity, emitting only water as a by-product. These systems are vital for powering electric vehicles, renewable-powered grids, and off-grid energy solutions.

Trends for the Iridium Market

Focus on Hydrogen-Based Energy Systems

Iridium's exceptional properties, notably its high corrosion resistance and catalytic efficiency, have made it a focal point in the development of hydrogen technologies, particularly in proton exchange membrane (PEM) electrolyzers. These electrolyzers are essential for producing green hydrogen by splitting water into hydrogen and oxygen using renewable energy sources. However, the limited availability and high cost of iridium pose significant challenges to scaling up these technologies.

To address these issues, researchers and companies are actively seeking methods to reduce iridium usage without compromising performance. For example, a Japanese research team has developed a catalyst that reduces the need for iridium by 95% while maintaining efficiency, paving the way for more sustainable hydrogen production solutions.

Segments Covered in the Report

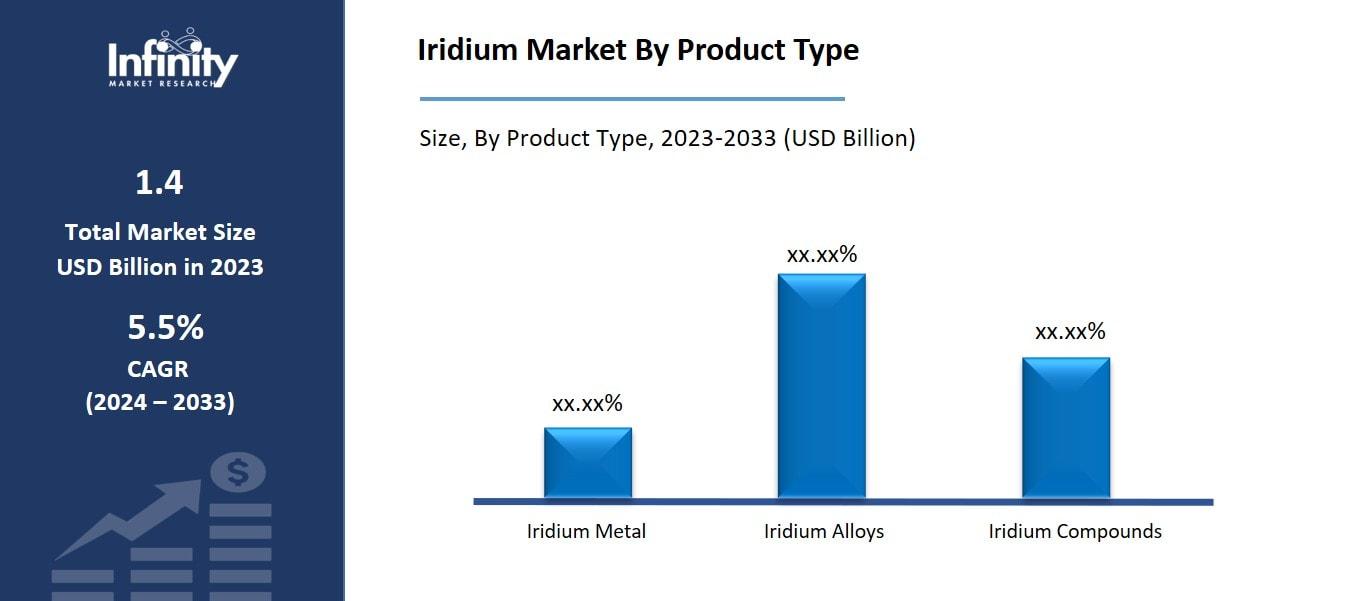

By Product Type

o Iridium Metal

o Iridium Alloys

o Iridium Compounds

By Application

o Electronics

o Medical

o Chemical

o Automotive

o Other Applications

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into iridium metal, iridium alloys, and iridium compounds. Among these, iridium metal segment acquired the significant share in the market owing to its extensive use in high-performance industrial applications. Its exceptional properties, including unparalleled corrosion resistance, high melting point, and excellent conductivity, make it indispensable in a variety of sectors. Iridium metal is primarily utilized in manufacturing spark plugs, electrodes, and crucibles for high-temperature applications, as well as in aerospace and electronics industries where durability and performance are critical.

By Application Analysis

On the basis of application, the market is divided into electronics, medical, chemical, automotive, and other applications. Among these, electronics segment held the prominent share of the market due to the metal's critical role in high-performance and precision electronic components. Iridium's exceptional electrical conductivity, high melting point, and resistance to corrosion make it an ideal material for manufacturing durable electrical contacts, spark plugs, and electrodes.

Moreover, its use in OLED (organic light-emitting diode) display technologies, which are increasingly popular in smartphones, televisions, and wearable devices, significantly drives demand in this segment. Iridium compounds serve as key components in phosphorescent materials, enabling high-efficiency light emission in OLED displays.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market. The region's well-established automotive, electronics, and chemical industries heavily rely on iridium for catalytic converters, high-performance electrical components, and corrosion-resistant equipment. The growing focus on green energy technologies, such as hydrogen production and fuel cells, has further propelled iridium demand, particularly in the United States, which leads in investments in renewable energy infrastructure.

Additionally, North America's leadership in research and development for innovative applications, including aerospace and medical technologies, has boosted the consumption of iridium alloys and compounds. The presence of major manufacturers, coupled with robust recycling capabilities, supports a consistent supply chain in the region.

Competitive Analysis

The competitive landscape of the global iridium market is shaped by a few key players, including mining companies, manufacturers, and suppliers that dominate the production and distribution of iridium. Major producers such as Anglo American Platinum, Impala Platinum, and Sibanye Stillwater control a significant portion of the iridium supply, as they extract the metal as a by-product of platinum and palladium mining in regions like South Africa and Russia. These companies are essential in shaping market dynamics, with their ability to influence pricing and availability due to their concentrated control over production.

Recent Developments

In October 2024, Sidus Space, a forward-thinking and flexible space mission enabler, revealed a strategic upgrade to its LizzieSat™ platform, incorporating Iridium-enabled technology into upcoming satellites to provide low-latency data transmission from space.

Key Market Players in the Iridium Market

o Impala Platinum Holdings Limited

o Anglo American Platinum Limited

o Sibanye Stillwater Limited

o Lonmin Plc

o Johnson Matthey Plc

o Vale S.A.

o Norilsk Nickel

o Northam Platinum Limited

o Royal Bafokeng Platinum

o Aquarius Platinum Limited

o Glencore Plc

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.4 Billion |

|

Market Size 2033 |

USD 2.4 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Impala Platinum Holdings Limited, Anglo American Platinum Limited, Sibanye Stillwater Limited, Lonmin Plc, Johnson Matthey Plc, Vale S.A., Norilsk Nickel, Northam Platinum Limited, Royal Bafokeng Platinum, Aquarius Platinum Limited, Glencore Plc, and Other Key Players. |

|

Key Market Opportunities |

Emerging Applications in Green Technology |

|

Key Market Dynamics |

Increasing Adoption of Hydrogen Economy |

📘 Frequently Asked Questions

1. Who are the key players in the Iridium Market?

Answer: Impala Platinum Holdings Limited, Anglo American Platinum Limited, Sibanye Stillwater Limited, Lonmin Plc, Johnson Matthey Plc, Vale S.A., Norilsk Nickel, Northam Platinum Limited, Royal Bafokeng Platinum, Aquarius Platinum Limited, Glencore Plc, and Other Key Players.

2. How much is the Iridium Market in 2023?

Answer: The Iridium Market size was valued at USD 1.4 Billion in 2023.

3. What would be the forecast period in the Iridium Market?

Answer: The forecast period in the Iridium Market report is 2024-2033.

4. What is the growth rate of the Iridium Market?

Answer: Iridium Market is growing at a CAGR of 5.5% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.