🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Lab-synthesized Heparin Market

Global Lab-synthesized Heparin Market (By Type (Bovine, Porcine, Other Type), By Product (Low Molecular Weight Heparin, Unfractionated Heparin, Other Product), By Application (Venous Thromboembolism, Atrial Fibrillation/Flutter, Coronary Artery Disease, Other Applications), By Distribution Channel (Hospitals, Clinics, Other Distribution Channel), By Region and Companies)

Sep 2024

Healthcare

Pages: 138

ID: IMR1220

Lab-synthesized Heparin Market Overview

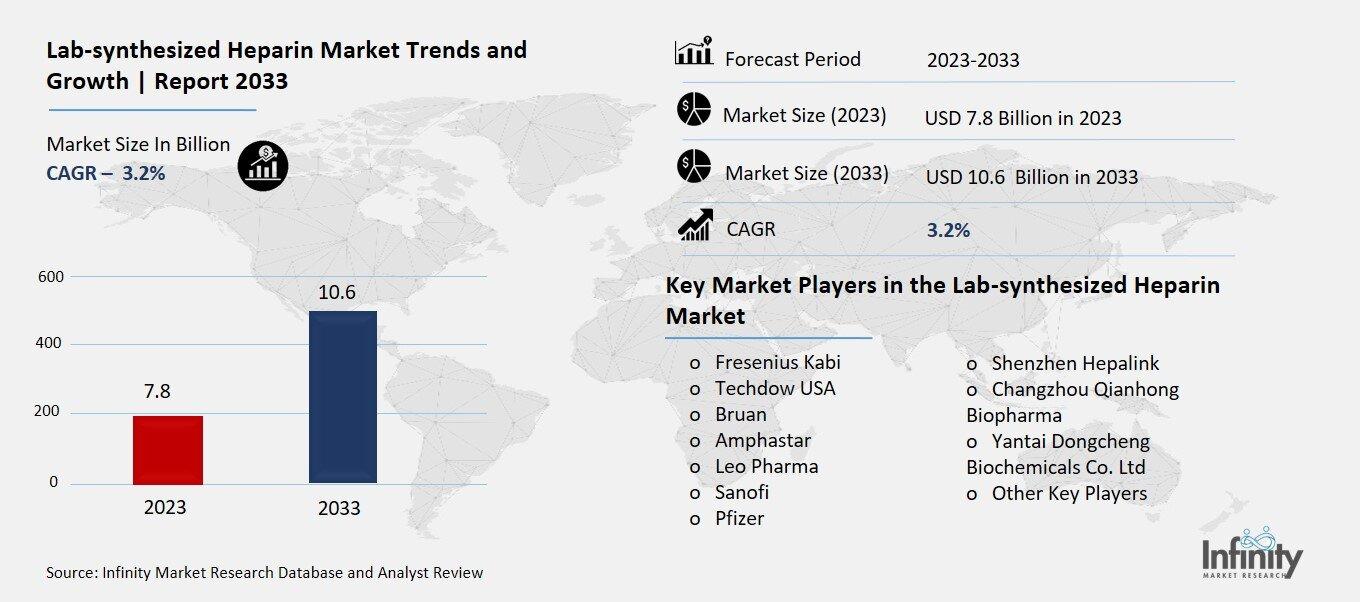

Global Lab-synthesized Heparin Market size is expected to be worth around USD 10.6 Billion by 2033 from USD 7.8 Billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2023 to 2033.

The Lab-synthesized Heparin Market refers to the industry focused on producing heparin, a vital blood-thinning medication, through laboratory methods rather than traditional methods like extracting it from animal tissues. This synthetic approach is more controlled and can reduce risks associated with animal-based products, such as contamination or allergic reactions. Lab-synthesized heparin is used in various medical settings, especially in surgeries and treatments where preventing blood clots is crucial.

This market is growing because of increasing demand for safer and more reliable heparin. As healthcare providers seek better ways to ensure patient safety, the lab-synthesized version is becoming more popular. Additionally, advancements in technology make it easier and more cost-effective to produce heparin in the lab, further driving market growth.

Drivers for the Lab-synthesized Heparin Market

Growing Demand for Safer and Contaminant-Free Heparin

One of the major drivers for the lab-synthesized heparin market is the increasing demand for safer and contaminant-free anticoagulant options. Traditional heparin, derived from animal sources such as pig intestines, carries risks like contamination, inconsistent quality, and potential transmission of animal-borne diseases. In the past, there have been several cases where animal-derived heparin was contaminated, leading to adverse reactions and even fatalities. This has prompted healthcare providers and regulatory bodies to explore more reliable alternatives. Lab-synthesized heparin offers a more controlled production process, ensuring consistent purity and reducing the risk of harmful impurities.

The growing emphasis on patient safety and strict regulatory guidelines encourage pharmaceutical companies to shift toward synthetic heparin. In developed markets like the U.S. and Europe, the need for compliance with stringent quality standards is pushing manufacturers to adopt lab-synthesized heparin. Moreover, technological advancements have made producing heparin in the lab more feasible at a competitive cost, further enhancing its appeal. As a result, hospitals and clinics are increasingly opting for synthetic versions to minimize risks and improve treatment outcomes.

The rising prevalence of conditions requiring anticoagulation, such as cardiovascular diseases, deep vein thrombosis, and surgeries, is also boosting demand. With the global population aging and chronic diseases becoming more common, the need for effective blood-thinning medications is on the rise. Synthetic heparin provides a reliable solution that can be produced at scale to meet growing healthcare demands. Additionally, lab-synthesized heparin is not dependent on animal supplies, making it more sustainable and less vulnerable to supply chain disruptions caused by diseases affecting livestock. This resilience adds to its attractiveness in the market.

Pharmaceutical companies are also investing heavily in research and development to improve lab-synthesized heparin. Continuous innovation in the production process and new formulations are expected to lower costs and make these products more accessible. The shift towards more personalized medicine is another factor driving the market, as synthetic heparin can be tailored for specific patient needs with greater precision than animal-derived versions. This adaptability supports its growing use in specialized treatments and complex medical conditions. Overall, the push for safer, more reliable, and scalable anticoagulants is a significant force propelling the lab-synthesized heparin market forward.

Restraints for the Lab-synthesized Heparin Market

Complex Manufacturing Processes And High Production Costs

One of the major restraints facing the lab-synthesized heparin market is the high production costs and complex manufacturing processes involved. Unlike traditional heparin, which is extracted from animal tissues using relatively straightforward methods, lab-synthesized heparin requires advanced biotechnological techniques. The process involves sophisticated chemical synthesis or recombinant technology, which demands significant expertise, specialized equipment, and high-quality raw materials. As a result, the cost of producing lab-synthesized heparin is considerably higher, making it less affordable for many healthcare providers, particularly in regions with limited healthcare budgets.

The intricate manufacturing process also leads to challenges in scaling up production. Synthesizing heparin in a laboratory setting involves multiple steps, each requiring precise conditions to ensure the product's safety and efficacy. Any deviation or contamination during production can lead to significant losses, making the process riskier and less efficient. These complexities also require a skilled workforce and strict quality control measures, further driving up operational costs. For smaller pharmaceutical companies or those in developing regions, these barriers make it difficult to enter the market or compete effectively with established players.

Another issue linked to high production costs is the price passed on to end users. Lab-synthesized heparin is generally more expensive for hospitals and patients, which can limit its adoption, especially when more affordable animal-derived alternatives are available. While synthetic heparin offers benefits in terms of safety and consistency, the cost difference remains a significant hurdle. In many markets, healthcare systems and insurance providers are price-sensitive and may be reluctant to cover the higher costs associated with synthetic versions unless clear evidence shows superior benefits. This cost-sensitive environment restricts market growth, particularly in countries where healthcare spending is constrained.

Regulatory challenges also contribute to the high costs and slow down-market expansion. Lab-synthesized heparin must undergo rigorous testing and approval processes to meet stringent safety and efficacy standards. The complexity of gaining regulatory approval adds time and expense, which can be a significant burden for companies looking to bring new products to market. These challenges are even more pronounced for companies trying to enter multiple international markets, where differing regulatory requirements may require additional testing, adjustments in formulations and compliance with varying standards.

Additionally, the established supply chain and market presence of animal-derived heparin pose a competitive disadvantage for lab-synthesized alternatives. Traditional heparin has been in use for decades, and its production is well-optimized, leading to lower costs and widespread availability. Displacing such an entrenched product requires lab-synthesized heparin to demonstrate clear and significant benefits, which can be difficult given the cost and complexity involved. Furthermore, healthcare providers accustomed to the traditional product may be hesitant to switch to synthetic versions unless they are convinced of its necessity, further slowing down adoption.

Opportunity in the Lab-synthesized Heparin Market

Expanding Applications in Emerging Markets and Specialized Medical Treatments

One major opportunity for the lab-synthesized heparin market lies in the expanding applications across emerging markets and specialized medical treatments. As healthcare infrastructure improves in developing regions like Asia, Latin America, and parts of Africa, the demand for high-quality anticoagulants is increasing. These regions are experiencing rapid urbanization, rising disposable incomes, and growing investments in healthcare, leading to better access to advanced medical treatments. With an expanding middle class and increased awareness of healthcare options, there is a rising demand for safer and more effective medications, such as lab-synthesized heparin. This creates a significant growth opportunity for companies that can provide reliable, synthetic alternatives in markets that were previously dominated by traditional, animal-derived heparin.

Emerging markets present a promising avenue for expansion because of their large and growing populations, many of whom are increasingly susceptible to chronic diseases like cardiovascular disorders and diabetes. These conditions often require anticoagulation therapies, and synthetic heparin, known for its consistency and lower risk of contamination, is well-positioned to meet this need. Additionally, as these regions build more advanced healthcare facilities and improve their regulatory frameworks, the adoption of lab-synthesized heparin is likely to grow. Companies that can establish early market presence and partnerships in these areas can gain a competitive edge, leveraging the rising healthcare demand to drive long-term market growth.

Another significant opportunity for lab-synthesized heparin lies in its potential for use in specialized and personalized medical treatments. As the global healthcare industry moves toward more personalized medicine, synthetic heparin offers the flexibility to be tailored for specific medical applications. Unlike traditional heparin, which has some variability due to its animal-derived nature, lab-synthesized heparin can be precisely engineered to meet the exact needs of different patient groups. For example, patients with certain allergies or sensitivities, or those requiring unique anticoagulation profiles, can benefit from customized formulations of synthetic heparin. This adaptability opens up opportunities in niche markets, such as high-risk surgeries, pediatric care, and treatments for patients with complex conditions.

Moreover, the ongoing advancements in biotechnology and manufacturing processes are driving down production costs, making lab-synthesized heparin more economically viable. As these costs decrease, synthetic heparin will become more competitive with traditional versions, enhancing its adoption across a broader range of healthcare settings. Pharmaceutical companies and healthcare providers are increasingly recognizing the value of investing in lab-synthesized options, not only for their safety and consistency but also for their potential to expand treatment possibilities. Research and development efforts are likely to focus on optimizing production methods and developing new formulations, further boosting market opportunities.

Furthermore, the push for sustainability in the pharmaceutical industry also presents a growth opportunity. Traditional heparin relies heavily on animal sources, raising ethical and environmental concerns. As global consciousness shifts toward more sustainable and ethical practices, lab-synthesized heparin aligns with these values by offering a product that is not dependent on livestock farming and does not contribute to the depletion of animal resources. This alignment with environmental goals is particularly appealing to governments, NGOs, and consumers who prioritize ethical sourcing in healthcare. Companies that position their lab-synthesized heparin as a more sustainable and humane alternative could tap into this growing demand.

Trends for the Lab-synthesized Heparin Market

Increasing Focus on Biotechnological Advancements and Precision Medicine

A major trend driving the lab-synthesized heparin market is the growing focus on biotechnological advancements and the shift toward precision medicine. With the rise of innovative biotechnology, the production of synthetic heparin is becoming more efficient and sophisticated. Researchers and pharmaceutical companies are investing heavily in improving the processes used to create lab-synthesized heparin, which is leading to more refined and consistent products. These advancements allow for better control over the molecular structure, ensuring higher purity and reducing variability, which are critical for safe and effective anticoagulant therapies.

The trend towards precision medicine is particularly significant in this market. Unlike traditional, animal-derived heparin, which can vary in composition depending on the source, lab-synthesized heparin can be precisely engineered for specific medical applications. This adaptability aligns with the growing demand for treatments tailored to individual patient needs. For instance, certain patients may require customized anticoagulant profiles due to unique health conditions, allergies, or genetic factors. Lab-synthesized heparin offers the flexibility to develop these targeted therapies, making it a key component in the future of personalized medicine.

Biotechnological progress is also driving down production costs, making lab-synthesized heparin more competitive in the market. New methods, such as recombinant DNA technology and chemical synthesis innovations, are streamlining production, reducing waste, and improving scalability. As these techniques become more widespread, the cost of producing synthetic heparin is expected to decrease, making it more accessible to a broader range of healthcare providers. This cost efficiency is crucial for expanding the adoption of lab-synthesized heparin, especially in markets where traditional heparin remains dominant due to its lower price point.

Moreover, the increasing application of lab-synthesized heparin in specialized areas of healthcare is gaining attention. As medical research continues to explore the potential of heparin beyond its traditional uses, new therapeutic applications are emerging. For example, synthetic heparin is being studied for its role in treating conditions such as cancer, where its anticoagulant properties can be harnessed for specific interventions. This expansion of use cases is expected to open up new growth avenues within the market, driving both innovation and demand.

The regulatory landscape is also evolving in favor of lab-synthesized heparin. As governments and healthcare organizations place greater emphasis on drug safety and quality, synthetic heparin, with its controlled production processes and reduced risk of contamination, is gaining preference. Regulatory bodies are increasingly recognizing the benefits of lab-synthesized options, which could lead to faster approvals and wider acceptance in various regions. The push for stricter safety standards in pharmaceuticals is expected to support the adoption of synthetic heparin over time, particularly in developed markets.

The sustainability aspect is another trend shaping the market. With growing concerns over animal welfare and environmental sustainability, lab-synthesized heparin presents an ethical alternative to traditional methods. By eliminating the need for animal-derived raw materials, synthetic heparin reduces reliance on livestock farming, aligns with the global movement towards sustainable practices, and meets the rising demand for ethically sourced medical products. Companies that emphasize these sustainability credentials in their marketing and production processes are likely to attract environmentally conscious consumers and healthcare providers.

Segments Covered in the Report

By Type

o Bovine

o Porcine

o Other Type

By Product

o Low Molecular Weight Heparin

o Unfractionated Heparin

o Other Product

By Application

o Venous Thromboembolism

o Atrial Fibrillation/Flutter

o Coronary Artery Disease

o Other Applications

By Distribution Channel

o Hospitals

o Clinics

o Other Distribution Channel

Segment Analysis

By Type Analysis

The Lab-synthesized Heparin Market is segmented by source, with porcine and bovine options available. In 2023, the porcine category produced the greatest revenue. Porcines are commonly utilized in the production of heparin, particularly LMWH, such as enoxaparin, which explains this. Furthermore, in unfavorable conditions, pig heparin is easier to neutralize.

The lab-synthesized Heparin segment market for bovines is expected to develop the fastest throughout the forecast period. Heparin from cows only reaches 76% of the maximum plasma concentration, making it less efficient than heparin from pork. Bovine heparin does not increase the anticoagulant activity of porcine heparin. When represented in weight, it achieves 1.5 times the plasma concentration.

By Product Analysis

The Lab-synthesized Heparin Market is segmented by product, including low molecular weight heparin and unfractionated heparin. In 2023, low molecular-weight heparin dominated the market. The rising incidence of deep vein thrombosis has increased the demand for low molecular-weight heparin. According to the Centers for Disease Control and Prevention, this illness kills between 60,000 and 100,000 Americans each year. Furthermore, low molecular weight heparin has a longer shelf life, requires fewer or no visits to medical clinics, and can be self-controlled at home by subcutaneous injection, making it more widely available.

The unfractionated heparin category is expected to be the most rapidly rising. UFH is commonly used as an anticoagulant in surgical procedures, particularly those that involve cardiopulmonary bypass or vascular surgery. It reduces the risk of postoperative complications, such as thrombosis and embolism, by preventing blood clot formation both during and after surgery.

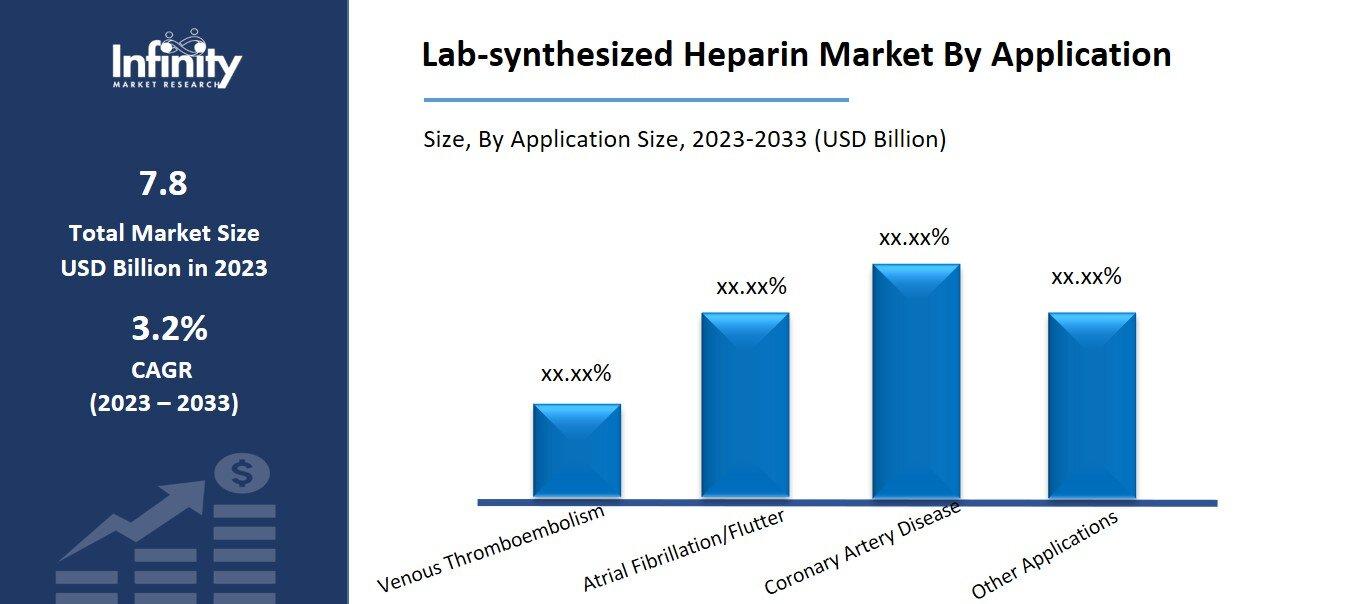

By Application Analysis

The Lab-synthesized Heparin Market is segmented by application, which includes venous thromboembolism, atrial fibrillation/flutter, coronary artery disease, and others. The venous thromboembolism segment dominates the market. The increased incidence of venous thromboembolism makes heparin more necessary. The market is also expanding as a result of recent advances in the development of novel heparin formulations that overcome the limits of conventional venous thromboembolism treatments. The heparin market has a high development potential as various industry participants focus on developing superior heparin capabilities to increase their presence.

The coronary artery disease sector of the lab-synthesized heparin market is expected to grow the quickest during the forecast period. Acute myocardial infarction patients are administered lab-synthesized heparin to reduce myocardial damage and prevent coronary thrombosis from spreading. To achieve the optimum antithrombotic results, it is usually used with antiplatelet medicines such as aspirin and P2Y12 inhibitors.

By Distribution Channel Analysis

The Lab-synthesized Heparin Market is segmented by distribution channels, which include hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacy category dominates the market. Hospital pharmacies collaborate with pharmacy and therapeutics (P&T) committees to explore the potential inclusion of lab-synthesized heparin in the hospital formulary. They conduct drug use assessments to determine the acceptability, security, and financial viability of heparin therapy within the facility.

The retail segment of the Lab-Synthesized Heparin market is expected to expand rapidly over the forecast period. Patients who require self-administered injections or infusions at home may be able to get lab-synthesized heparin products from retail pharmacies that specialize in home health care supplies. Patients receiving medicine at these pharmacies may be instructed on safe administration procedures.

Regional Analysis

The market for lab-synthesized heparin in North America will be the largest. The lab-synthesized market in the United States is also predicted to grow due to an increase in product endorsements and continued progress. For example, in February 2022, Compact Disc Bioparticles, a leading manufacturer and provider of various medication conveyance labor and goods, sent off a few Heparin items, including Heparin Biotin, Heparin Amine, and Heparin Thiol, and made them available to aid in drug delivery study. As a result of the aforementioned factors, the North American region is expected to account for a considerable portion of the global heparin market, with the United States being the largest country within it over the review's forecast period.

Europe has the second-largest market share for lab-synthesized heparin. The rising prevalence of venous thromboembolism, ischemic coronary illness, and other cardiovascular diseases that cause blood cluster formation has increased the demand for heparin in Europe. According to the European Culture of Cardiology, cardiovascular disease causes over 3.9 million deaths in the region each year. Regional growth can also be attributable to increased knowledge of clever oral anticoagulants. Furthermore, the German lab-synthesized heparin market had the highest market share, while the UK lab-synthesized heparin market was the fastest-growing in Europe.

Competitive Analysis

The lab-synthesized heparin market will continue to expand as leading industry players make large R&D investments to expand their product offerings. Significant market changes include new product releases, contractual agreements, mergers and acquisitions, increased investment, and collaboration with other firms. Market companies also take various strategic initiatives to expand their global reach. To grow and survive in a more competitive and dynamic market, the laboratory-synthesized heparin sector must offer inexpensive products and services.

Recent Developments

In 2023: Fresenius Kabi reported sales exceeding €8 billion, driven partly by advancements in its pharmaceutical and biosimilar segments, which include heparin products.

In 2023: Techdow USA, the company made strides by expanding its portfolio, notably launching Heparin Sodium Injection, which is a key product used in blood clot prevention during surgeries and other medical treatments.

Key Market Players in the Lab-synthesized Heparin Market

o Fresenius Kabi

o Techdow USA

o Bruan

o Amphastar

o Leo Pharma

o Sanofi

o Pfizer

o Shenzhen Hepalink

o Changzhou Qianhong Biopharma

o Yantai Dongcheng Biochemicals Co. Ltd

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 7.8 Billion |

|

Market Size 2033 |

USD 10.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Product, Application, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Fresenius Kabi, Techdow USA, Bruan, Amphastar, Leo Pharma, Sanofi, Pfizer, Shenzhen Hepalink, Changzhou Qianhong Biopharma, Yantai Dongcheng Biochemicals Co., Ltd, Other Key Players |

|

Key Market Opportunities |

Expanding Applications in Emerging Markets and Specialized Medical Treatments |

|

Key Market Dynamics |

Growing Demand for Safer and Contaminant-Free Heparin |

📘 Frequently Asked Questions

1. Who are the key players in the Lab-synthesized Heparin Market?

Answer: Fresenius Kabi, Techdow USA, Bruan, Amphastar, Leo Pharma, Sanofi, Pfizer, Shenzhen Hepalink, Changzhou Qianhong Biopharma, Yantai Dongcheng Biochemicals Co., Ltd, Other Key Players

2. How much is the Lab-synthesized Heparin Market in 2023?

Answer: The Lab-synthesized Heparin Market size was valued at USD 7.8 Billion in 2023.

3. What would be the forecast period in the Lab-synthesized Heparin Market?

Answer: The forecast period in the Lab-synthesized Heparin Market report is 2023-2033.

4. What is the growth rate of the Lab-synthesized Heparin Market?

Answer: Lab-synthesized Heparin Market is growing at a CAGR of 3.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.