🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Linear Alpha-Olefin Market

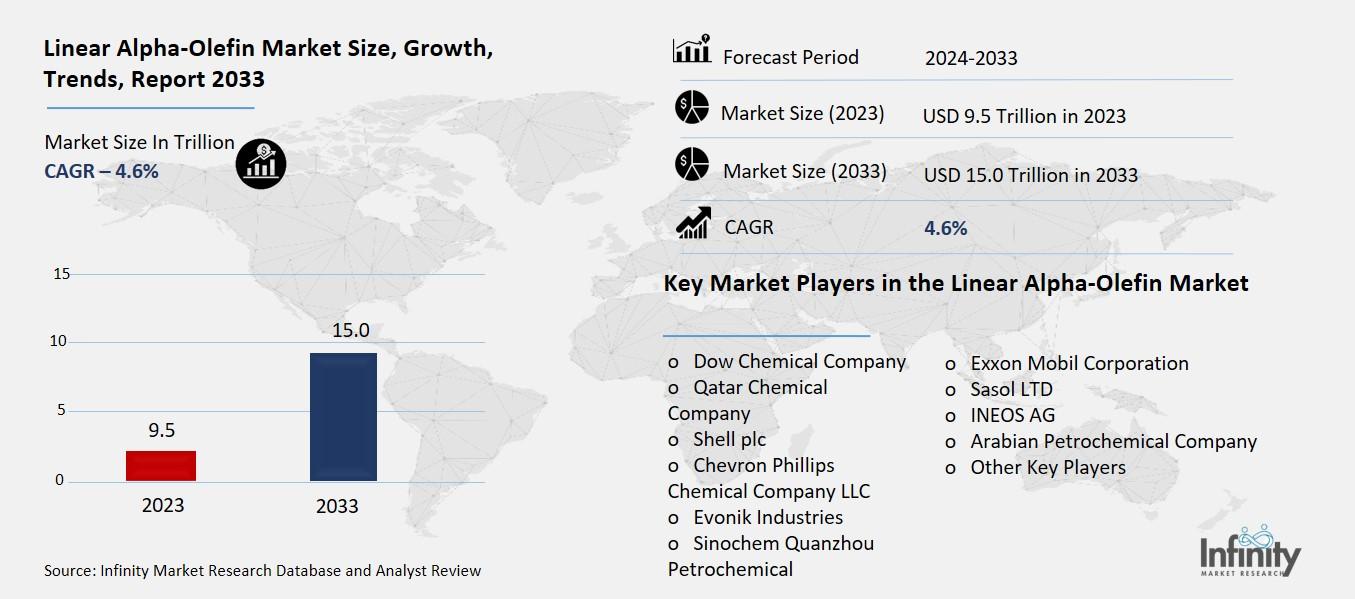

Global Linear Alpha-Olefin Market (By Product Type, Octene, Butene, Hexene, Decene, Hexadecene, Tetradecene, and Other Product Types; By End-use, Lubricants, HDPE, LDPE, LLDPE, and Other Key Players; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1373

Linear Alpha-Olefin Market Overview

Global Linear Alpha-Olefin Market acquired the significant revenue of 9.5 Billion in 2023 and expected to be worth around USD 15.0 Billion by 2033 with the CAGR of 4.6% during the forecast period of 2024 to 2033. The Global Linear Alpha Olefin market forms a high growth area within the chemical industry due to the versatile uses in the production of synthetic lubricants, detergents and Polyethylene. LAOs are mainly obtained from petroleum and are employed as basic chemicals for the synthesis of plastics, surfactants and other specialty chemicals. The market is motivated by the ever-rising importance of renewable raw material and green chemical synthesis to replace petroleum-based feedstock. Pronounced driving forces include the increasing need from the automotive, packaging and consumer goods industries and the emergence of high technology using Ziegler-Natta catalysts for production.

Drivers for the Linear Alpha-Olefin Market

Increasing Demand for Polyethylene

Linear alpha-olefins or LAOs are important for the synthesis of polyethylene, which is perhaps the most popular material for use in different applications. Polyethylene is mainly synthesized by the polymerization of ethylene while LAOs derived from similar feed stocks such as naphtha or natural gas are vital co monomers/intermediate for the production of polyethylene. Especially, LAOs are employed to adjust the polyethylene properties including flexibility, mechanical strength and chemical stability. Polyethylene’s utility makes it widely used in packaging, automotive and consumer goods industries. In packaging, polyethylene films, containers and bottles along with other types of polythene are used due to their mechanical strength, low manufacturing cost and ease of processing. In the car manufacturing industry, polyethylene is like for its properties in making light weight, high impact application such as bumpers and interior trim.

Restraints for the Linear Alpha-Olefin Market

Fluctuations in Crude Oil Prices

Since linear alpha-olefins (LAOs) are primarily derived from petroleum-based feedstocks, fluctuations in crude oil prices can have a significant impact on both production costs and overall market stability. The production of LAOs is heavily tied to the cost of raw materials like naphtha and natural gas liquids, which are derived from crude oil. When crude oil prices increase, the cost of these feedstocks rises, leading to higher production costs for LAOs. This, in turn, can lead to higher prices for end-products like polyethylene, lubricants, and other chemicals, which depend on LAOs as key ingredients.

On the other hand, if crude oil prices decrease, the production costs for LAOs can fall, potentially resulting in lower prices for finished products. These fluctuations can create uncertainty in the market, making it challenging for manufacturers to predict costs and profits, particularly for companies that rely on long-term contracts or fixed-price agreements.

Opportunity in the Linear Alpha-Olefin Market

Shift Towards Bio-based Feedstocks

The growing trend towards sustainability presents significant opportunities for the development of bio-based linear alpha-olefins (LAOs), which can help address the increasing demand for these materials while reducing the environmental impact associated with their production. Traditional LAOs are primarily derived from petroleum, which contributes to carbon emissions and dependence on finite natural resources. However, with the rising global emphasis on reducing the carbon footprint and adopting eco-friendly practices, there is an emerging interest in sourcing LAOs from renewable feedstocks, such as biomass or plant-based oils.

Bio-based LAOs offer the potential for a more sustainable production process, as they can be derived from renewable resources that have a lower environmental impact compared to fossil fuels. These bio-based alternatives can help meet the demand for LAOs used in packaging, automotive, and consumer goods while aligning with corporate sustainability goals and regulatory pressures on reducing greenhouse gas emissions.

Trends for the Linear Alpha-Olefin Market

Growing Demand for Eco-friendly Products

With increasing environmental concerns, there is a growing trend towards eco-friendly and sustainable alternatives to traditional linear alpha-olefins (LAOs) derived from petrochemical sources. As industries face mounting pressure to reduce their carbon footprints and comply with stricter environmental regulations, there is a strong push toward finding greener alternatives to petroleum-based feedstocks. Traditional LAOs, while essential in various applications like polyethylene production, contribute to environmental challenges due to their dependence on fossil fuels, which are finite and emit significant greenhouse gases during extraction and processing. In response, there has been a shift towards bio-based or renewable feedstock options for LAO production, such as using plant oils, algae, or waste biomass. These alternatives not only reduce the reliance on petrochemicals but also help mitigate the environmental impact by lowering carbon emissions and offering a more sustainable life cycle.

Segments Covered in the Report

By Product Type

o Octene

o Butene

o Hexene

o Decene

o Hexadecene

o Tetradecene

o Other Product Types

By End-use

o Lubricants

o HDPE

o LDPE

o LLDPE

o Other End Users

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into octene, butene, hexene, decene, hexadecene, tetradecene, and other product types. Among these, butene segment acquired the significant share in the market owing to its versatile applications and essential role in the production of high-value chemicals. Butene is primarily used as a co-monomer in the production of polyethylene, particularly in the manufacturing of low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE). These materials are widely used in the packaging industry, automotive components, and consumer goods, making butene a critical component in various end-use applications. The butene segment also benefits from its use in the production of synthetic lubricants, plasticizers, and alkylates, which are essential in a range of industries including automotive, industrial, and personal care.

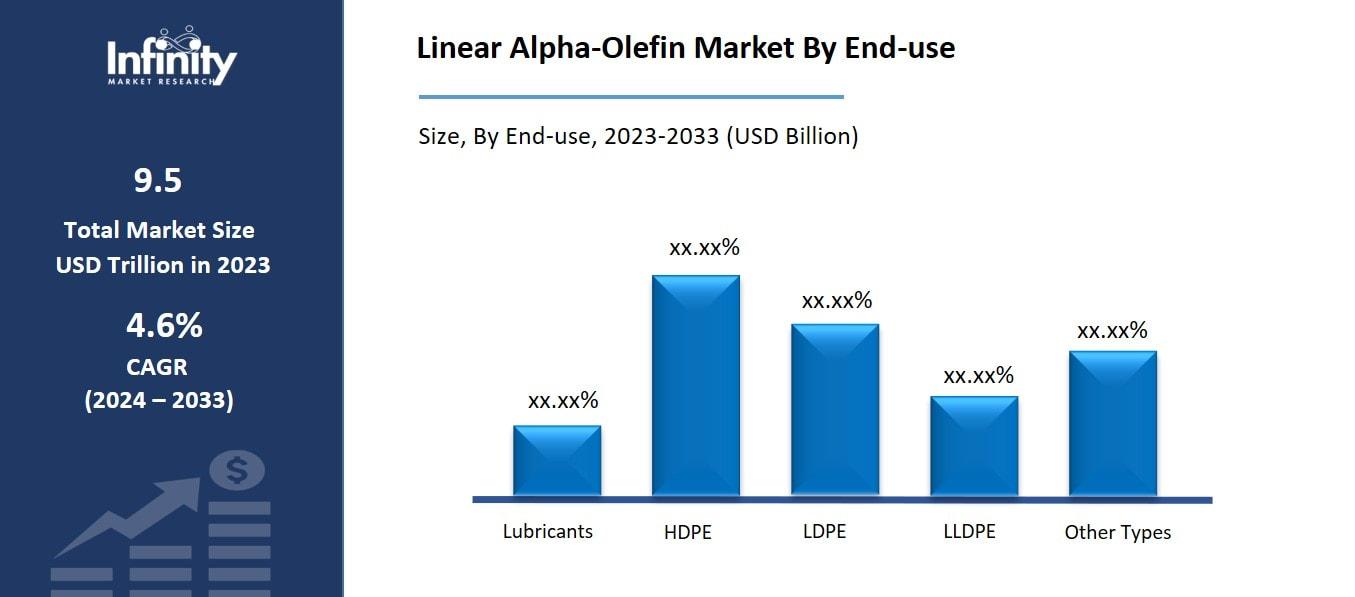

By End-use Analysis

On the basis of end-use, the market is divided into lubricants, HDPE, LDPE, LLDPE, and Other key players. Among these, LLDPE segment held the prominent share of the market due to its growing demand in a variety of industries, driven by its unique properties and versatility. LLDPE is widely used in the production of films, flexible packaging, and agricultural applications due to its excellent tensile strength, impact resistance, and flexibility. These properties make LLDPE ideal for producing high-quality, durable packaging materials, which are increasingly required in the fast-growing e-commerce and food packaging industries. Moreover, LLDPE is also used in the production of containers, bottles, and various molded products, which further boosts its market share.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.1% of the market. The region's dominance can be attributed to its well-established industrial infrastructure, robust chemical manufacturing sector, and high demand for LAOs in various end-use industries, including packaging, automotive, and consumer goods. The United States, in particular, is one of the largest producers and consumers of LAOs, benefiting from advanced production technologies and significant investments in the petrochemical industry. The shale gas boom in North America has also played a crucial role in reducing feedstock costs, enhancing the cost-competitiveness of LAO production. This has allowed local manufacturers to meet both domestic demand and export needs more efficiently.

Furthermore, the North American market is characterized by a growing emphasis on sustainability, with an increasing shift towards bio-based and eco-friendly LAOs, which has spurred innovation and development in this sector. The rising demand for high-performance materials, especially in packaging and automotive industries, has contributed significantly to the market's growth in the region.

Competitive Analysis

The competitive landscape of the global linear alpha-olefin (LAO) market is characterized by a combination of well-established multinational players and emerging regional companies, each vying for market share through innovation, strategic partnerships, and operational efficiencies. The key players in this market include major chemical companies such as Shell, ExxonMobil, SABIC, INEOS, and LyondellBasell, among others. These companies dominate the market due to their vast production capacities, established supply chains, and extensive global reach, which allow them to meet the growing demand for LAOs in a variety of industries.

Recent Developments

In September 2023, ExxonMobil announced that negotiations are currently underway to begin production at a new linear alpha-olefins (LAO) manufacturing facility. At this facility, ExxonMobil plans to produce ten LAO products of exceptional purity, which will be marketed under the brand name Elevexx.

Key Market Players in the Linear Alpha-Olefin Market

o Dow Chemical Company

o Qatar Chemical Company

o Shell plc

o Chevron Phillips Chemical Company LLC

o Evonik Industries

o Sinochem Quanzhou Petrochemical

o Exxon Mobil Corporation

o Sasol LTD

o INEOS AG

o Arabian Petrochemical Company

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 9.5 Billion |

|

Market Size 2033 |

USD 15.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Dow Chemical Company, Qatar Chemical Company, Shell plc, Chevron Phillips Chemical Company LLC, Evonik Industries, Sinochem Quanzhou Petrochemical, Exxon Mobil Corporation, Sasol LTD, INEOS AG, Arabian Petrochemical Company, and Other Key Players. |

|

Key Market Opportunities |

Shift Towards Bio-based Feedstocks |

|

Key Market Dynamics |

Increasing Demand for Polyethylene |

📘 Frequently Asked Questions

1. Who are the key players in the Linear Alpha-Olefin Market?

Answer: Dow Chemical Company, Qatar Chemical Company, Shell plc, Chevron Phillips Chemical Company LLC, Evonik Industries, Sinochem Quanzhou Petrochemical, Exxon Mobil Corporation, Sasol LTD, INEOS AG, Arabian Petrochemical Company, and Other Key Players.

2. How much is the Linear Alpha-Olefin Market in 2023?

Answer: The Linear Alpha-Olefin Market size was valued at USD 9.5 Billion in 2023.

3. What would be the forecast period in the Linear Alpha-Olefin Market?

Answer: The forecast period in the Linear Alpha-Olefin Market report is 2024-2033.

4. What is the growth rate of the Linear Alpha-Olefin Market?

Answer: Linear Alpha-Olefin Market is growing at a CAGR of 4.6% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.