🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Lithium-ion Battery Anode Market

Global Lithium-ion Battery Anode Market (By Material, Active Anode Materials and Anode Binders; By Battery Type, Cell Pack and Battery Pack; By Process, Automotive and Non-Automotive, By Region and Companies), 2024-2033

Nov 2024

Chemicals and Materials

Pages: 138

ID: IMR1296

Lithium-ion Battery Anode Market Overview

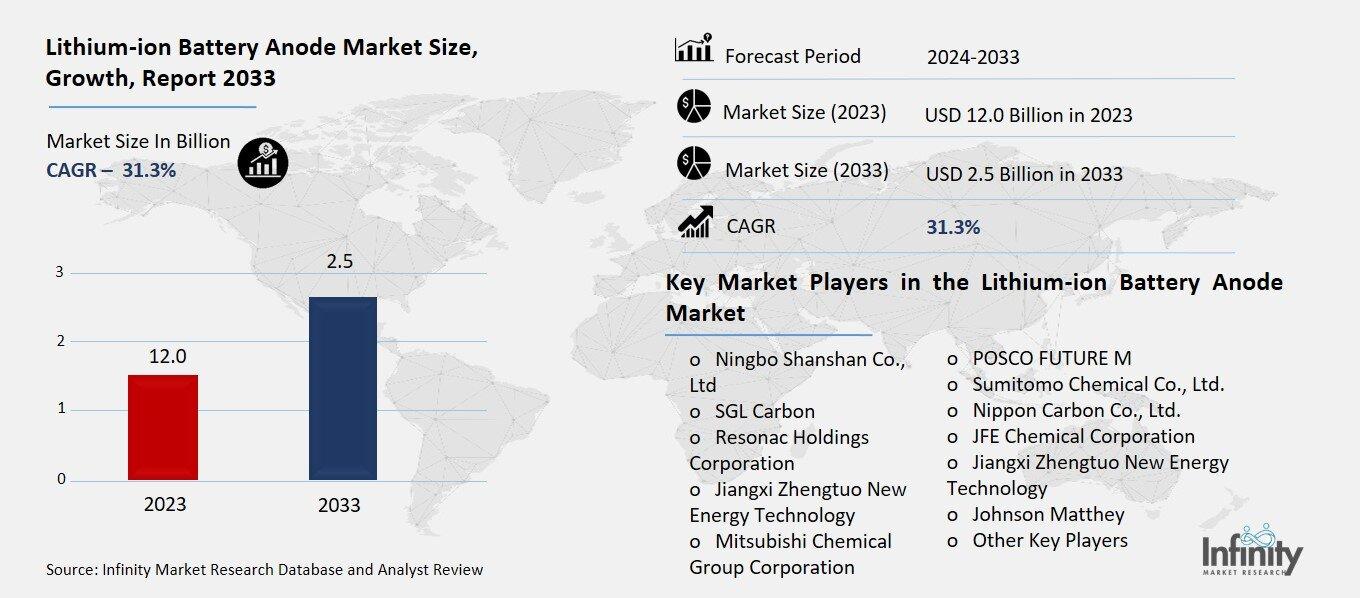

Global Lithium-ion Battery Anode Market acquired the significant revenue of 12.0 Billion in 2023 and expected to be worth around USD 132.8 Billion by 2033 with the CAGR of 31.3% during the forecast period of 2024 to 2033. Lithium-ion battery anode market is projected to grow at a significantly high growth rate due to the growth in battery demand for electric vehicles (EVs), renewable energy storage, and portable electronic devices. Anodes, mostly of graphite, are one of the central choices of lithium-ion batteries; the general performance and lifetime of a battery, together with its charging and discharging capacities, are dictated by the anodes’ characteristics. Current innovations are the attempts to advance silicon based anode which in turn provides high energy density but this structure has problems of volume change during charging-altering cycles.

Currently, there is more emphasis on improving the performance of the anode with major investments in Research and Development and increased use of sustainable materials. Due to sound supply chain management and the increasing EV industry, Asia-Pacific, specifically china and Japan lead in the assemblage of electric vehicles.

Drivers for the Lithium-ion Battery Anode Market

Rising Demand for Electric Vehicles (EVs)

The pace at which electric vehicle is being adopted is actually revolutionizing the need for lithium-ion batteries, especially focusing on high efficient and high performing anode material. Growing importance of long drive range, fast charging and durability has shifted the focus on anode materials as automakers as well as consumers are becoming conscious about finding solutions for batteries. Current graphite anodes are being refined for higher value, new materials such as silicon are also being considered as a means of obtaining enhanced energy density. High-performance anodes influence the amount of energy a battery is capable of delivering, and how many charge and discharge cycles they can handle, the feature that is critical as electric vehicles are now considered to becoming mainstream transport means.

Moreover, governmental benefits such as subsidies and higher emission standards are pushing the demand for EVs and the competition between key participants in the development of battery components is in progress. By demanding higher energy density and lower costs for lithium-ion batteries to power electric cars, this uptick also exacerbates the requirement for more sophisticated anode technologies and becomes a key area for development of improved next-generation energy storage systems.

Restraints for the Lithium-ion Battery Anode Market

Supply Chain Challenges for Key Materials

Shortages and rising costs of raw materials, especially graphite, are putting pressure on lithium-ion battery production. As demand for batteries surges due to growth in electric vehicles and renewable energy storage, the supply of graphite a critical anode material is struggling to keep pace. Graphite mining and processing require extensive resources and specialized infrastructure, factors that can lead to production bottlenecks. Moreover, geopolitical factors and environmental regulations further complicate supply chains, driving up costs and affecting availability. These challenges impact production efficiency and raise overall battery costs, prompting manufacturers to seek alternative materials and more resilient supply chains to meet market demands.

Opportunity in the Lithium-ion Battery Anode Market

Investment in Sustainable and Recyclable Materials

The push for eco-friendly anodes presents significant opportunities to meet the rising demand for sustainable battery solutions. As consumers, industries, and governments prioritize reducing environmental impact, battery manufacturers are investing in anode materials that are less harmful to produce and easier to recycle. Alternatives like bio-based carbon sources, recycled graphite, and silicon from agricultural waste are gaining traction, promising lower environmental footprints and a reduced reliance on traditional mining. These eco-friendly anodes not only appeal to the environmentally conscious market but also align with regulatory goals aimed at decreasing carbon emissions and waste. As these green technologies advance, they offer battery makers a competitive edge by meeting sustainability criteria while maintaining or enhancing performance standards, thus positioning eco-friendly anodes as a vital component of the evolving energy storage ecosystem.

Trends for the Lithium-ion Battery Anode Market

Focus on Solid-State Battery Development

The rise of solid-state batteries is driving a shift in anode research and development, as these batteries demand distinct properties compared to traditional lithium-ion batteries. Solid-state batteries replace the liquid electrolyte with a solid one, offering higher energy density, improved safety, and a longer lifespan. However, this design requires anodes with materials that are stable and compatible with solid electrolytes, pushing research beyond conventional graphite toward options like lithium metal, lithium-silicon, and composite materials. These anodes can improve ionic conductivity and minimize issues like dendrite formation, which can compromise safety.

As a result, companies are channeling R&D efforts into creating anodes that optimize the unique benefits of solid-state batteries, accelerating the commercialization of this promising technology for electric vehicles and renewable energy storage.

Segments Covered in the Report

By Material

o Active Anode Materials

o Anode Binders

By Battery Type

o Cell Pack

o Battery Pack

By Process

o Automotive

o Non-Automotive

Segment Analysis

By Material Analysis

On the basis of material, the market is divided into active anode materials and anode binders. Among these, active anode segment acquired the significant share in the market. Active anode materials, primarily graphite, silicon, and lithium alloys, are essential for enabling the charge storage and energy density that determine a battery’s power output, lifespan, and charging speed. Due to growing demand for high-capacity energy storage in electric vehicles and portable electronics, these materials have seen extensive investment in research and development.

Innovations in active anode materials are focused on increasing energy density and cycle life, with silicon anodes offering notable advancements in capacity, although they present challenges such as expansion during charging cycles. This focus on enhancing active anode materials has been key to meeting the market’s demand for longer-lasting, faster-charging, and more efficient batteries, making it the dominant segment within the lithium-ion battery anode market.

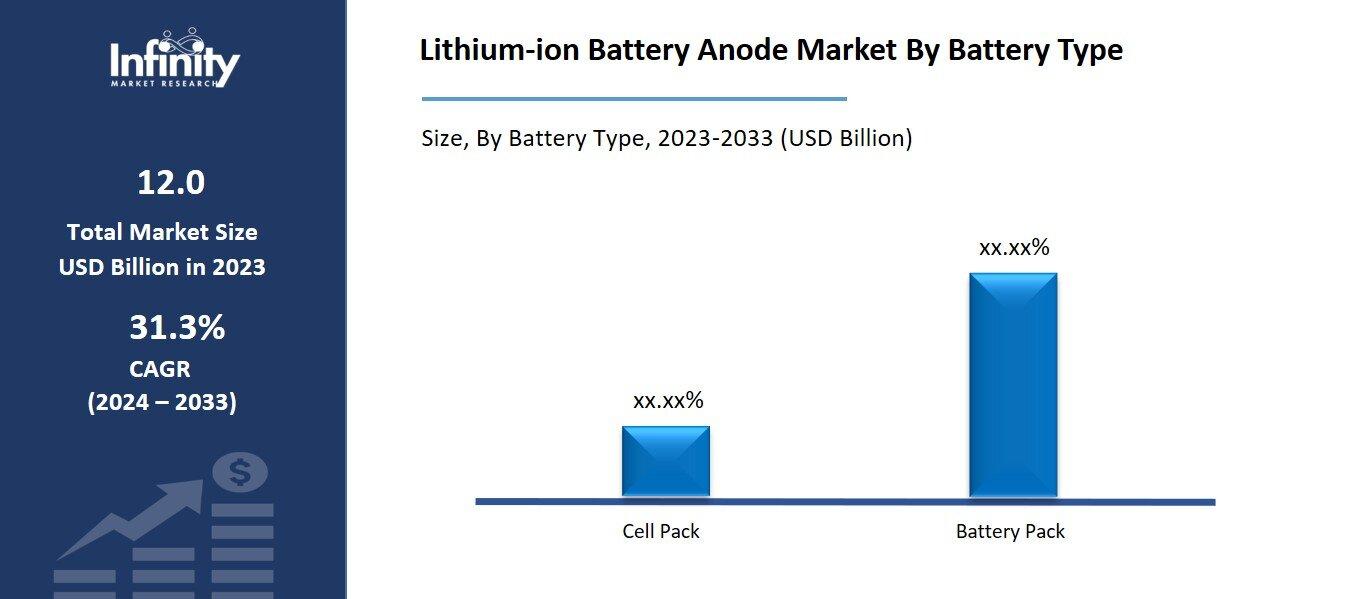

By Battery Type Analysis

On the basis of battery type, the market is divided into cell pack and battery pack. Among these, cell pack segment held the prominent share of the market due to its versatility and widespread application across various industries. Cell packs, composed of individual cells that can be configured in multiple ways, offer manufacturers greater flexibility in designing battery systems tailored to specific energy and power requirements. This adaptability makes cell packs particularly popular in consumer electronics, where compact, lightweight, and high-energy solutions are essential.

Furthermore, in electric vehicles and renewable energy storage, cell packs allow for more efficient heat management, ease of maintenance, and scalability, which are critical for maximizing performance and durability. These advantages have driven strong demand for cell packs, solidifying their lead in the market over battery packs, which are often larger, more complex, and less customizable.

By Process Analysis

On the basis of process, the market is divided into automotive and non-automotive. Among these, automotive segment held the prominent share of the market. As automakers shift toward electrification, the demand for high-performance anodes tailored for automotive applications has surged. These anodes must support high energy density, long life cycles, and rapid charge/discharge capabilities, which are critical for EV efficiency and user satisfaction. Additionally, government incentives and growing consumer interest in sustainable transportation further boost the automotive sector’s demand for advanced anode materials.

Regional Analysis

Asia-Pacific Dominated the Market with the Highest Revenue Share

Asia-Pacific held the most of the share of 34.1% of the market. Countries like China, Japan, and South Korea lead in battery and anode manufacturing, supported by established supply chains and a strong focus on R&D. With Asia-Pacific being a global hub for electric vehicle production and consumer electronics, demand for high-performance anodes remains strong, further solidified by government initiatives promoting green technology and renewable energy adoption.

The region’s cost-effective production capabilities and access to essential raw materials also contribute to its competitive edge, positioning Asia-Pacific as the key player in the global lithium-ion battery anode market.

Competitive Analysis

The competitive landscape of the lithium-ion battery anode market is characterized by rapid technological advancements and a diverse array of players striving to capture market share. Major manufacturers, including companies like Panasonic, LG Chem, and Samsung SDI, dominate the market through extensive R&D investments and the development of innovative anode materials that enhance battery performance. These companies leverage their established supply chains and production capabilities to maintain a competitive edge. Additionally, emerging players focusing on sustainable and alternative anode materials, such as silicon and recycled graphite, are entering the market, challenging traditional suppliers.

Recent Developments

In March 2022, Umicore announced plans to expand its production capacity for lithium-ion battery materials, specifically targeting active anode materials, to address the increasing demand from the electric vehicle and energy storage markets. The company has launched a new generation of high-performance graphite-based active anode materials designed to enhance energy density, cycle life, and safety features for lithium-ion batteries.

Key Market Players in the Lithium-ion Battery Anode Market

o Ningbo Shanshan Co., Ltd

o SGL Carbon

o Resonac Holdings Corporation

o Jiangxi Zhengtuo New Energy Technology

o Mitsubishi Chemical Group Corporation

o POSCO FUTURE M

o Sumitomo Chemical Co., Ltd.

o Nippon Carbon Co., Ltd.

o JFE Chemical Corporation

o Jiangxi Zhengtuo New Energy Technology

o Johnson Matthey

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 12.0 Billion |

|

Market Size 2033 |

USD 132.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

31.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Material, Battery Type, Process, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ningbo Shanshan Co., Ltd, SGL Carbon, Resonac Holdings Corporation, Jiangxi Zhengtuo New Energy Technology, Mitsubishi Chemical Group Corporation, POSCO FUTURE M, Sumitomo Chemical Co., Ltd., Nippon Carbon Co., Ltd., JFE Chemical Corporation, Jiangxi Zhengtuo New Energy Technology, Johnson Matthey, and Other Key Players. |

|

Key Market Opportunities |

Investment in Sustainable and Recyclable Materials |

|

Key Market Dynamics |

Rising Demand for Electric Vehicles (EVs) |

📘 Frequently Asked Questions

1. Who are the key players in the Lithium-ion Battery Anode Market?

Answer: Ningbo Shanshan Co., Ltd, SGL Carbon, Resonac Holdings Corporation, Jiangxi Zhengtuo New Energy Technology, Mitsubishi Chemical Group Corporation, POSCO FUTURE M, Sumitomo Chemical Co., Ltd., Nippon Carbon Co., Ltd., JFE Chemical Corporation, Jiangxi Zhengtuo New Energy Technology, Johnson Matthey, and Other Key Players.

2. How much is the Lithium-ion Battery Anode Market in 2023?

Answer: The Lithium-ion Battery Anode Market size was valued at USD 12.0 Million in 2023.

3. What would be the forecast period in the Lithium-ion Battery Anode Market?

Answer: The forecast period in the Lithium-ion Battery Anode Market report is 2024-2033.

4. What is the growth rate of the Lithium-ion Battery Anode Market?

Answer: Lithium-ion Battery Anode Market is growing at a CAGR of 31.3% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.