🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Logistics Market

Logistics Market (By Transportation Type (Airways, Waterways, Railways, Roadways), By Logistic Type (First Party, Second Party, Third-Party), By End-User (Industrial and Manufacturing, Retail, Healthcare, Oil & Gas, Others), By Region and Companies)

Jul 2024

Packaging And Transportation

Pages: 190

ID: IMR1159

Logistics Market Overview

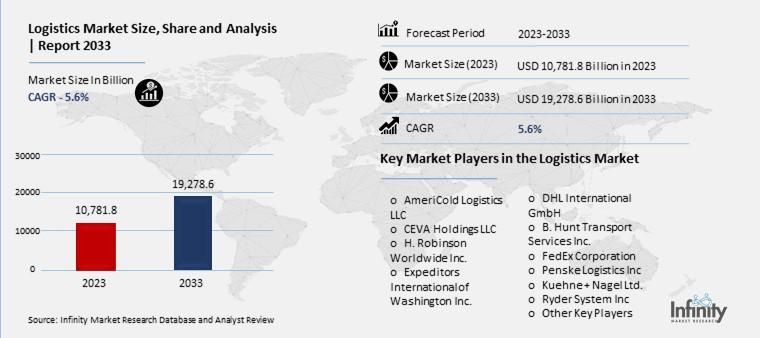

Global Logistics Market size is expected to be worth around USD 19,278.6 Billion by 2033 from USD 10,781.8 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

The logistics market refers to all the activities involved in transporting goods from one place to another. This includes things like shipping, warehousing, and managing inventory. Think of it as everything that happens to get a product from the factory to the store shelves or directly to your doorstep. Companies in the logistics market make sure that goods are moved efficiently and on time, whether it's by truck, train, ship, or airplane.

In simple terms, the logistics market is like the backbone of trade and commerce. Without it, businesses wouldn't be able to get their products to customers. This market involves many players, including shipping companies, freight carriers, and warehousing services, all working together to ensure smooth and reliable delivery of goods. It's an essential part of our everyday lives, even if we don't always see it in action.

Drivers for the Logistics Market

E-Commerce Expansion

One of the biggest drivers of the logistics market is the rapid growth of e-commerce. The rise of online shopping has led to an increased demand for efficient logistics services to ensure quick and reliable delivery of goods to customers. This trend is not just limited to urban areas but is also expanding to rural regions, creating a vast network of logistics needs. E-commerce giants like Amazon and Alibaba are continuously investing in their logistics infrastructure to maintain customer satisfaction and manage the surge in online orders.

Technological Advancements

Technological advancements play a crucial role in driving the logistics market. The integration of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and automation has revolutionized logistics operations. These technologies help in real-time tracking of shipments, predictive maintenance of vehicles, and optimizing delivery routes, leading to increased efficiency and reduced operational costs. Autonomous vehicles and drones are also being explored to further enhance delivery capabilities and speed.

Globalization of Trade

The ongoing globalization of trade has significantly boosted the logistics market. As businesses expand their reach across borders, the need for efficient logistics solutions to manage international shipments has become imperative. Trade agreements and partnerships between countries have facilitated smoother and more cost-effective movement of goods, further driving the demand for logistics services. The expansion of manufacturing bases in regions like Asia-Pacific also contributes to this growth, as products need to be transported to various global markets.

Consumer Demand for Faster Delivery

With the increasing consumer demand for faster delivery times, logistics companies are under pressure to enhance their delivery speed and reliability. Same-day and next-day delivery options are becoming standard expectations among consumers, pushing logistics providers to optimize their supply chain operations. Innovations in warehouse management and distribution strategies are crucial in meeting these demands, ensuring that goods reach customers promptly and accurately.

Environmental Sustainability

Environmental sustainability is becoming a significant driver in the logistics market. Companies are increasingly adopting eco-friendly practices to reduce their carbon footprint and meet regulatory requirements. The use of electric vehicles (EVs), optimizing delivery routes to minimize fuel consumption, and incorporating renewable energy sources in logistics operations are some of the measures being taken. Consumers are also becoming more environmentally conscious, preferring businesses that demonstrate a commitment to sustainability.

Increasing Investments and Partnerships

The logistics market is witnessing substantial investments and strategic partnerships aimed at expanding service offerings and geographical reach. Major logistics companies are investing in research and development to innovate in areas such as autonomous vehicles, drone delivery, and smart warehousing. Strategic acquisitions and collaborations help companies strengthen their market position and offer comprehensive logistics solutions to their clients.

Restraints for the Logistics Market

Infrastructure Challenges

One of the significant restraints for the logistics market is the inadequacy and inconsistency of infrastructure in various regions. Efficient logistics operations heavily rely on robust infrastructure, including roads, railways, ports, and airports. In many developing countries, poor infrastructure leads to delays, increased transportation costs, and inefficiencies in the supply chain. The lack of advanced warehousing facilities and poor connectivity further exacerbate these challenges, making it difficult to ensure timely delivery of goods.

Regulatory and Compliance Issues

Logistics companies face numerous regulatory and compliance hurdles across different countries. The absence of standardized regulations and varying customs procedures can significantly slow down the movement of goods. Moreover, logistics providers often have to navigate complex legal frameworks, which can result in increased operational costs and delays. These regulatory barriers are especially prominent in cross-border logistics, where different countries have different compliance requirements.

Rising Fuel Costs

Fuel costs constitute a major part of logistics expenses. Fluctuations in fuel prices can drastically impact the overall cost of logistics services. When fuel prices rise, transportation costs increase, leading to higher prices for end consumers. This volatility in fuel prices creates uncertainty for logistics companies, making it challenging to maintain consistent pricing and profitability. As a result, companies are often forced to find alternative strategies to mitigate these costs, such as investing in more fuel-efficient vehicles or optimizing routes.

Labor Shortages

The logistics industry is facing a significant labor shortage, particularly in skilled roles such as truck drivers, warehouse workers, and logistics managers. The aging workforce, coupled with the high turnover rates in these positions, has created a gap that is hard to fill. This shortage leads to increased labor costs and can disrupt logistics operations. Companies must invest in training and retention programs to attract and keep skilled workers, which adds to their operational costs.

Technological Barriers

While technology can greatly enhance logistics efficiency, its implementation poses several challenges. Small and medium-sized logistics companies often lack the financial resources to invest in advanced technologies like automation, IoT, and AI. Moreover, there is a learning curve associated with adopting new technologies, which can temporarily disrupt operations. Cybersecurity threats also pose a risk, as the increasing reliance on digital systems makes logistics companies vulnerable to cyber-attacks.

Opportunity in the Logistics Market

E-Commerce Boom

One of the most significant opportunities in the logistics market is the continuous rise of e-commerce. Online shopping has surged globally, with retail e-commerce sales nearly doubling from USD 3.3 trillion in 2019 to an estimated USD 6.3 trillion in 2023. This growth is driving demand for efficient logistics services to handle the increased volume of packages, particularly in the last-mile delivery segment. Companies are investing in advanced technologies and digitalization to enhance customer experience and streamline operations.

Digital Transformation

The logistics industry is undergoing a digital transformation, leveraging technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain to optimize supply chain processes. AI can improve route planning and demand forecasting, while IoT devices provide real-time tracking of goods. Blockchain technology offers enhanced transparency and security in transactions. These technological advancements are enabling logistics providers to offer faster, more reliable, and cost-effective services.

Green Logistics

Sustainability is becoming a crucial focus in logistics. Companies are adopting green logistics practices to reduce their carbon footprint and comply with environmental regulations. Initiatives like the use of electric vehicles, investment in renewable energy sources, and implementation of energy-efficient practices in warehouses are gaining traction. For example, DHL's GoGreen Plus service aims to decarbonize road freight with low- and zero-emission technologies.

Growth in Emerging Markets

Emerging markets, particularly in the Asia-Pacific region, present vast opportunities for the logistics sector. Rapid industrialization and rising export activities in countries like China, India, and Southeast Asia are driving the demand for advanced logistics services. Investments in infrastructure, such as modern ports, special economic zones, and cold storage facilities, are further enhancing the logistics capabilities in these regions.

Urbanization and Smart Cities

The increasing urbanization and development of smart cities are creating new logistics challenges and opportunities. Urban centers require efficient distribution systems to manage the flow of goods. Smart city initiatives are integrating advanced technologies to improve urban logistics, including smart traffic management systems and automated delivery solutions. These developments are essential for managing the growing demands of urban populations and ensuring seamless supply chain operations.

Expansion of Omni-Channel Retailing

The shift towards omni-channel retailing, where consumers can shop seamlessly across various channels (online, in-store, mobile), is another opportunity for the logistics market. This trend requires logistics providers to develop flexible and integrated supply chain solutions that can handle multiple sales channels. Companies are focusing on enhancing their fulfillment strategies, inventory management, and customer service to support this retail evolution.

Trends for the Logistics Market

Growing Demand for Supply Chain Agility

The logistics market is experiencing a significant trend towards enhancing supply chain agility. Companies are increasingly adopting technologies and processes that allow them to respond quickly to market changes and disruptions. This agility is crucial for staying competitive in a fast-paced environment where customer expectations are constantly evolving. Self-managed onboarding and exception management are examples of how companies can maintain control over their supply chains, allowing for immediate response to new opportunities and issues without relying on third-party service providers.

Embracing Automation and Technology

Automation and technology integration are at the forefront of logistics trends. Businesses are leveraging advanced automation tools to streamline operations, reduce costs, and improve efficiency. This includes integrating backend systems like Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) with e-commerce platforms to create seamless data flows. Automation not only speeds up processes but also reduces human error, making logistics operations more reliable and efficient.

Addressing Global Labor Shortages

The logistics industry is also dealing with global labor shortages, which are driving up costs and impacting the efficiency of logistics operations. To mitigate these challenges, companies are turning to automation in both warehousing and transportation. For instance, automated picking and packing systems in warehouses and driverless trucks in transportation are becoming more common. These technologies help fill the gap left by the labor shortage, ensuring that logistics operations can continue smoothly.

Increasing Focus on Sustainability

Sustainability is another key trend in the logistics market. Companies are adopting green logistics practices to reduce their environmental footprint. This includes using electric vehicles (EVs) for deliveries, optimizing delivery routes to cut down on emissions, and implementing eco-friendly packaging solutions. Governments are also supporting these initiatives by promoting policies that encourage sustainable logistics practices, further driving the trend towards greener operations.

Expansion of Digital Freight Marketplaces

Digital freight marketplaces are becoming increasingly popular in the logistics sector. These platforms connect shippers with carriers, making it easier to find and book transportation services. They offer real-time data, transparency, and flexibility, which are highly valued in the logistics industry. By using digital freight marketplaces, companies can optimize their shipping processes, reduce costs, and improve overall efficiency.

Integration of Advanced Data Analytics

Finally, the integration of advanced data analytics is transforming the logistics market. Companies are using big data and analytics to gain insights into their operations, improve forecasting accuracy, and make data-driven decisions. This helps in optimizing supply chains, managing inventory more effectively, and predicting market trends. The ability to analyze large volumes of data in real time allows logistics companies to stay ahead of the curve and maintain a competitive edge.

Segments Covered in the Report

By Transportation Type

o Airways

o Waterways

o Railways

o Roadways

By Logistic Type

o First Party

o Second Party

o Third-Party

By End-User

o Industrial and Manufacturing

o Retail

o Healthcare

o Oil & Gas

o Others

Segment Analysis

By Transportation Type Analysis

With a 32.9% market share, the Roadways Transportation category became the main force in 2023. Its popularity is due to several important aspects, including its enormous road infrastructure, its cost-effectiveness when compared to other modes of transportation like airplanes and canals, and its flexibility in route management.

The capacity to deliver goods door-to-door greatly helps the road transportation industry. This is especially useful for last-mile deliveries, which are more convenient and efficient in the age of e-commerce and just-in-time delivery methods. Additionally, improvements in vehicle technology—like higher fuel economy and the incorporation of GPS and Internet of Things technologies—have improved road logistics' operating efficiency, cutting expenses and enhancing service dependability.

Furthermore, governments all over the world are investing a lot of money in road infrastructure to promote economic growth by enhancing regional connectivity, which is fueling the expansion of roads in the logistics sector. These expenditures are frequently a component of larger economic stimulus programs that also drive the industry into more environmentally friendly practices by improving safety and pollution regulations.

On the other hand, the road logistics industry must contend with issues including gridlock, shifting laws, and the pressing need to decarbonize the supply chain. The rate at which this market may incorporate autonomous driving and electric car technology to reduce environmental effects and meet the increasing need for faster, more affordable delivery options will probably determine how big this market can get in the future.

By Logistic Type Analysis

Throughout the projected period, the Third-Party logistics category has demonstrated its supremacy by securing the greatest market share of 38.7%. This dominance is a result of modern organizations' ever-more complicated supply chain requirements and their increasing demand for specialized and scalable logistics solutions.

By handling inventory, warehousing, fulfillment, and shipping operations, third-party logistics providers provide substantial benefits and free up businesses to concentrate on their core skills rather than logistics management. A globalized market with shifting demand and supply dynamics requires firms to have greater operational flexibility and efficiency, which the 3PL model helps them achieve.

The growth of the 3PL market has been especially driven by the advent of e-commerce. Online merchants frequently depend on third-party logistics (3PL) companies to effectively manage their logistics, as they must guarantee prompt delivery times to sustain consumer happiness. In addition, the incorporation of cutting-edge technology like artificial intelligence, machine learning, and data analytics into 3PL firms' services improves supply chain visibility and control, which attracts more potential customers.

Additionally, companies may adapt their logistics operations to the state of the market thanks to the scalability provided by 3PL providers, which is a useful characteristic, particularly in sectors with seasonal demand. Third-party logistics companies hold a strong market position due to their flexibility and the cost reductions that come with outsourcing logistical services.

By End-User Analysis

The leading category is Industrial and Manufacturing, which is expected to hold a significant market share of 29.6% in 2023. The key factor contributing to this industry's leadership is its heavy reliance on the prompt and effective transportation of components, finished goods, and raw materials, all of which are necessary to keep production schedules on track and satisfy consumer demand.

Highly linked supply chain networks that optimize inventory management, lower operating costs, and improve product throughput through streamlined logistics operations are what enable the robustness of industrial and manufacturing logistics. The sector is increasingly recognizing the importance of advanced logistics solutions as evidenced by the adoption of Just-In-Time (JIT) manufacturing processes, which necessitate exact timing of material deliveries to minimize inventory costs.

Innovations in technology like automation, robotics, and the Internet of Things (IoT) have drastically changed how the sector handles logistics. By foreseeing and averting possible supply chain interruptions, these advances allow for real-time tracking and forecasting, which enhances decision-making and decreases downtime.

In addition, as the world grows more interconnected, producers are reaching out to new markets, which calls for a more intricate logistics system that can manage foreign laws, lengthier shipping routes, and a variety of cross-border logistical difficulties. The increasing need for logistics services that are not only effective but also adhere to environmental regulations and international trade norms is being met by this global growth.

Regional Analysis

With almost 39.8% of the worldwide logistics market share, Asia-Pacific is the most dominating area in the industry. Rapid industrialization, an expanding manufacturing base, and rising intraregional trade particularly with China and India are the main drivers of this region's prosperity. Asia-Pacific's logistical frameworks are always being updated to accommodate the region's massive cross-border trade flows and expanding e-commerce industry.

A revolution in logistics is taking place in the Middle East and Africa (MEA) as a result of strategic reforms aimed at diversifying economies away from reliance on oil and investments in infrastructure. To position the area as a vital link between Asia, Europe, and Africa, the establishment of giant logistics hubs in the United Arab Emirates and Saudi Arabia is especially notable.

Despite being smaller in contrast, Latin America's logistics sector is expanding as a result of rising agricultural exports and e-commerce adoption. Improvements in connectivity and logistical efficiency are being made despite obstacles including political unpredictability and inadequate infrastructure.

Competitive Analysis

By 2023, the global logistics market will be shaped by the calculated actions of a few major firms that are all responding to and spearheading the industry's swift changes. Profiting from the rising demand for perishable goods, AmeriCold Logistics LLC maintains its position as a leader in temperature-controlled warehousing and transportation services. C.H. Robinson Worldwide, Inc. improves supply chain efficiency in a variety of industries by utilizing its strong freight and transportation management services. With an emphasis on contract logistics as well as freight management, CEVA Holdings LLC sets itself apart and has a strong market position in emerging regions.

Maintaining its position as a dominant force in the worldwide logistics industry, DHL International GmbH is investing heavily in digital transformations and sustainability projects to improve customer service quality and operational efficiencies. Expeditors International of Washington Inc. is still a freight forwarding leader in the industry, specializing in unique logistics solutions.

FedEx Corporation is extending its reach beyond conventional delivery services by integrating robotics and artificial intelligence to effectively manage the growing demands of e-commerce. To improve efficiency, J.B. Hunt Transport Services, Inc. is concentrating on technology-driven solutions for its intermodal transport services. Kuehne + Nagel Ltd. is primarily concerned with digital innovation, especially when it comes to logistics solutions that are ecologically friendly.

Both Ryder System, Inc. and Penske Logistics, Inc. stress the value of supply chain solutions and fleet management that are customized to meet the demands of certain industries. They also use cutting-edge technology to increase visibility and control throughout their networks.

Recent Developments

May 2024: Following the release of strong quarterly and annual financial results for FY24, which demonstrated robust growth in both revenue and profit amid a positive outlook for the logistics sector, as reported by the BSE Sensex Index and NSE Nifty-50 Index, Patel Integrated Logistics Ltd. saw a notable spike in its stock price of 5.47% to Rs 22.75.

March 2024: According to The Wall Street Journal, Shein, a pioneer in fast fashion globally, is growing its business model by providing its "supply chain as a service" to other brands and suppliers. Shein does this by utilizing its superior technology and small-batch manufacturing to improve fashion efficiency and innovation.

Key Market Players in the Logistics Market

o AmeriCold Logistics LLC

o CEVA Holdings LLC

o H. Robinson Worldwide Inc.

o Expeditors International of Washington Inc.

o DHL International GmbH

o B. Hunt Transport Services Inc.

o Penske Logistics Inc

o Kuehne + Nagel Ltd.

o Ryder System Inc

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 10,781.8 Billion |

|

Market Size 2033 |

USD 19,278.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2023-2033 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Transportation Type, Logistic Type, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

AmeriCold Logistics LLC, CEVA Holdings LLC, H. Robinson Worldwide Inc., Expeditors International of Washington Inc., DHL International GmbH, B. Hunt Transport Services Inc., FedEx Corporation, Penske Logistics Inc, Kuehne + Nagel Ltd., Ryder System Inc, Other Key Players |

|

Key Market Opportunities |

Expansion of Omni-Channel Retailing |

|

Key Market Dynamics |

Consumer Demand for Faster Delivery |

📘 Frequently Asked Questions

1. Who are the key players in the Stainless Steel Market?

Answer: AmeriCold Logistics LLC, CEVA Holdings LLC, H. Robinson Worldwide Inc., Expeditors International of Washington Inc., DHL International GmbH, B. Hunt Transport Services Inc., FedEx Corporation, Penske Logistics Inc, Kuehne + Nagel Ltd., Ryder System Inc, Other Key Players

2. How much is the Stainless Steel Market in 2023?

Answer: The Stainless Steel Market size was valued at USD 10,781.8 Billion in 2023.

3. What would be the forecast period in the Stainless Steel Market?

Answer: The forecast period in the Stainless Steel Market report is 2023-2033.

4. What is the growth rate of the Stainless Steel Market?

Answer: Stainless Steel Market is growing at a CAGR of 5.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.