🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Lubricants Market

Lubricants Market (By Base Oil (Mineral Oil, Synthetic Oil, Bio-based Oil), By Application (Industrial, Automotive, Marine, Aerospace), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 145

ID: IMR1180

Lubricants Market Overview

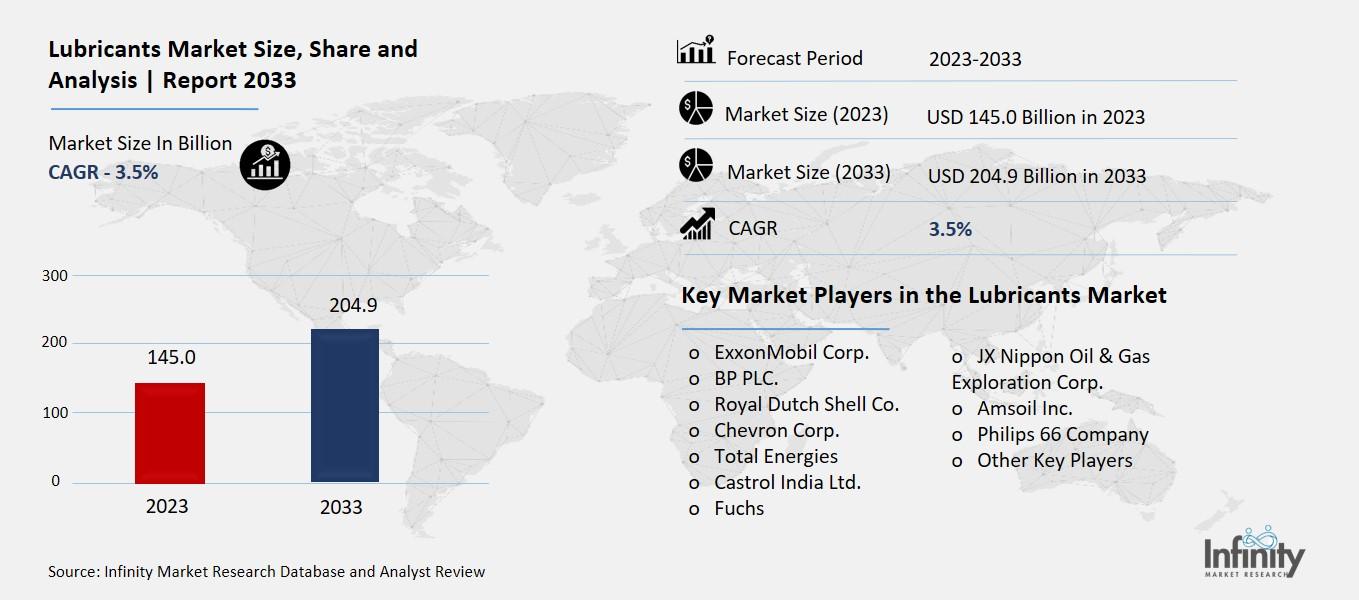

Global Lubricants Market size is expected to be worth around USD 204.9 Billion by 2033 from USD 145.0 Billion in 2023, growing at a CAGR of 3.5% during the forecast period from 2023 to 2033.

The lubricants market refers to the industry that produces and sells lubricants. Lubricants are special oils and greases used to reduce friction between moving parts in machines and engines, making them run more smoothly and last longer. Think about the oil you put in a car engine or the grease used on bicycle chains; these are all examples of lubricants. This market includes a wide range of products used in everything from cars and trucks to industrial machines and even household appliances.

The lubricants market is big business because almost every machine with moving parts needs some kind of lubrication to function properly. Companies in this market focus on creating high-quality lubricants that can handle the specific demands of different machines and environments. They also work on making lubricants more environmentally friendly and efficient. As technology advances, the demand for better and more specialized lubricants continues to grow, making this an important and evolving industry.

Drivers for the Lubricants Market

Growing Demand in Automotive and Transportation Industries

The lubricants market is driven significantly by the booming automotive and transportation industries. As more vehicles hit the roads globally, the need for engine oils, transmission fluids, and other lubricants rises. This is especially true in developing countries where vehicle ownership is increasing rapidly. Cars, trucks, motorcycles, and other forms of transportation rely on these lubricants to function smoothly and efficiently. The growth in these sectors directly translates to higher demand for various types of lubricants, thus propelling the market forward.

Expansion of the Industrial Sector

Industrial growth is another major driver of the lubricants market. Industries such as manufacturing, power generation, and construction require large amounts of lubricants to keep machinery running efficiently. As industrial activities expand, particularly in emerging economies, the consumption of lubricants increases. These industries depend on lubricants for reducing friction, wear and tear, and for maintaining the longevity of machines. This consistent need across various industrial applications ensures steady growth in the lubricants market.

Advancements in Machinery and Equipment Design

The continuous advancements in machinery and equipment design have also boosted the demand for high-performance lubricants. Modern machines operate under more demanding conditions, requiring lubricants that can withstand higher temperatures, pressures, and longer operation periods. Innovations in equipment design necessitate lubricants that not only enhance performance but also contribute to energy efficiency and reduced maintenance costs. This need for advanced lubricants that can meet the evolving demands of modern machinery drives market growth.

Increasing Adoption of Electric Vehicles (EVs)

While electric vehicles (EVs) do not require traditional engine oils, they still need specialized lubricants for their transmissions and other components. The increasing adoption of EVs has led to a demand for new types of lubricants tailored for these vehicles. This shift is pushing lubricant manufacturers to innovate and develop products suitable for the unique requirements of EVs, thus opening new avenues for market growth. As EV adoption continues to rise, the lubricants market is adapting to meet these emerging needs.

Growth in Emerging Markets

Emerging markets, particularly in the Asia-Pacific region, are seeing rapid industrialization and urbanization. Countries like China, India, and Indonesia are experiencing significant growth in their automotive and industrial sectors. This regional development is creating a substantial demand for lubricants. As these economies grow, so does the infrastructure and industrial base, leading to increased consumption of lubricants across various applications. The economic expansion in these regions provides a robust growth platform for the lubricants market.

Environmental Regulations and Sustainability Efforts

The push for environmentally friendly products is another key driver for the lubricants market. Stricter environmental regulations are prompting manufacturers to develop bio-based and less polluting lubricants. There is a growing consumer preference for sustainable and eco-friendly products, which is influencing market trends. Lubricant producers are investing in research and development to create products that meet environmental standards without compromising performance. These sustainability efforts are driving innovation and growth in the market as companies strive to align with global environmental goals

Restraints for the Lubricants Market

Electric Vehicle Growth

The rise of electric vehicles (EVs) poses a significant challenge to the lubricants market. Unlike traditional internal combustion engines, EVs require fewer lubricants, primarily due to the absence of engine oil needs. This shift in the automotive industry means a reduced demand for conventional lubricants. As more consumers and governments push for cleaner transportation options, the traditional lubricant market faces a steady decline in one of its major sectors.

Environmental Regulations

Stringent environmental regulations are another restraint impacting the lubricants market. Governments worldwide are implementing policies to reduce carbon emissions and promote the use of eco-friendly products. These regulations often mandate the reduction of harmful chemicals in lubricants, pushing manufacturers to invest heavily in research and development to create compliant products. This increases production costs and can limit the market's growth, especially in regions with rigorous environmental standards.

Fluctuating Raw Material Prices

The lubricants market is heavily dependent on raw materials such as crude oil. Fluctuations in crude oil prices can directly affect the production costs of lubricants. When oil prices rise, it leads to increased costs for base oils, additives, and other ingredients necessary for lubricant production. These cost fluctuations can disrupt supply chains and make it challenging for manufacturers to maintain consistent pricing, ultimately affecting market stability and profitability.

Market Competition

Intense competition within the lubricants market also acts as a restraint. The market is fragmented, with numerous small and large players vying for market share. This high level of competition often leads to price wars and can force companies to reduce their profit margins. Additionally, larger companies with more resources can invest in advanced technologies and marketing strategies, making it difficult for smaller firms to compete effectively and sustain their business.

Consumer Awareness and Preferences

Increasing consumer awareness regarding the environmental impact of traditional lubricants is influencing market dynamics. Many consumers are now opting for bio-based and environmentally friendly alternatives. While this shift is positive for the environment, it presents a challenge for traditional lubricant manufacturers. Transitioning to the production of eco-friendly lubricants requires significant investment in new technologies and processes, which can be a financial strain, especially for smaller companies.

Opportunity in the Lubricants Market

Growth in Industrialization

The industrial sector is expanding globally, especially in developing regions like Asia-Pacific. As countries industrialize, the demand for machinery and equipment increases, which in turn boosts the need for lubricants to ensure smooth operation and reduce wear and tear. This growth in industrial activities creates a significant opportunity for the lubricants market, as more industries require high-performance lubricants to maintain their machinery and enhance productivity.

Rising Automotive Production

The automotive industry is a major consumer of lubricants. With the continuous growth in vehicle production and sales, particularly in emerging economies, the demand for automotive lubricants is set to rise. This includes engine oils, transmission fluids, and greases, which are essential for the proper functioning and maintenance of vehicles. The increasing preference for high-performance and synthetic lubricants, which offer better efficiency and longer service life, further drives market growth.

Advancements in Technology

Technological advancements in lubricant formulation and production are opening new avenues for market players. Innovations such as synthetic and bio-based lubricants are gaining traction due to their superior properties and environmental benefits. These advancements not only improve the performance of lubricants but also help in reducing environmental impact, aligning with the global shift towards sustainability. This trend is likely to create substantial opportunities for companies investing in research and development of advanced lubricants.

Expanding Renewable Energy Sector

The growing renewable energy sector, particularly wind and solar power, presents a lucrative opportunity for the lubricants market. Wind turbines and solar panels require specialized lubricants to operate efficiently and withstand extreme conditions. As investments in renewable energy projects increase, so does the demand for high-quality lubricants designed for these applications. This sector offers a promising growth avenue as the world moves towards cleaner energy sources.

Emerging Markets and Urbanization

Urbanization in emerging markets is another key factor driving the demand for lubricants. As more people move to urban areas, there is an increase in construction activities, transportation, and manufacturing, all of which require lubricants. The construction of new infrastructure and the expansion of existing facilities in urban areas necessitate the use of various lubricants for equipment and vehicles, thus creating significant market opportunities.

Enhanced Focus on Sustainability

Environmental regulations and the push towards sustainability are influencing the lubricants market. Companies are increasingly adopting eco-friendly practices and developing biodegradable lubricants to meet regulatory requirements and cater to environmentally conscious consumers. This shift not only helps in complying with stringent environmental standards but also opens new market segments for green lubricants, providing a competitive edge to businesses that prioritize sustainability.

Trends for the Lubricants Market

Growing Demand for Bio-Based Lubricants

One of the significant trends in the lubricants market is the increasing demand for bio-based lubricants. As environmental awareness rises globally, both consumers and industries are seeking more sustainable and eco-friendly products. Bio-based lubricants, derived from renewable sources like vegetable oils, are gaining popularity due to their lower environmental impact and biodegradability. This shift is driven by stringent environmental regulations and a growing preference for sustainable solutions in various industries, including automotive and industrial sectors.

Advancements in Synthetic Lubricants

Synthetic lubricants are becoming more prevalent due to their superior performance characteristics compared to traditional mineral-based lubricants. They offer better viscosity, stability, and efficiency at extreme temperatures, making them ideal for high-performance engines and machinery. Advancements in synthetic lubricant formulations are enabling longer oil change intervals, better fuel efficiency, and enhanced protection for engines and equipment, contributing to their increasing adoption in automotive, aerospace, and industrial applications.

Rise of Industrial Automation

The trend towards industrial automation is also influencing the lubricants market. Automated machinery and equipment require high-quality lubricants to ensure smooth operation, reduce wear and tear, and minimize downtime. As industries like manufacturing, mining, and construction continue to embrace automation, the demand for specialized lubricants that can withstand high loads and harsh conditions is growing. This trend is driving innovation in lubricant formulations to meet the specific needs of automated systems.

Increased Focus on Performance and Efficiency

There is a growing focus on performance and efficiency in the lubricants market. End-users are seeking lubricants that can enhance the performance of their machinery and vehicles while reducing energy consumption and maintenance costs. High-performance lubricants that offer better thermal stability, oxidation resistance, and longer service life are in demand. This trend is particularly evident in the automotive and industrial sectors, where efficient lubrication is crucial for optimal operation and cost savings.

Regional Market Dynamics

Regional dynamics play a significant role in the lubricants market. For instance, the United States and Germany are key markets with robust industrial bases and high demand for advanced lubricants. The U.S. market is driven by the need for environmentally sustainable lubricants, while Germany's market is propelled by its strong automotive and machine tools sectors. Each region has unique factors influencing lubricant demand, such as industrial activity, environmental regulations, and technological advancements.

Strategic Collaborations and Expansions

Strategic collaborations and expansions are shaping the competitive landscape of the lubricants market. Major companies are forming alliances to expand their product offerings and reach new markets. For example, TotalEnergies' alliance with Point S and HPCL's collaboration with Chevron Brands International highlight how companies are leveraging partnerships to strengthen their market presence and cater to diverse consumer needs. These strategic moves are essential for companies to stay competitive and meet the evolving demands of the market.

Segments Covered in the Report

By Base Oil

o Mineral Oil

o Synthetic Oil

o Bio-based Oil

By Application

o Industrial

o Process Oils

o General Industrial Oils

o Metalworking Oils

o Industrial Engine Oils

o Greases

o Others

o Automotive

o Engine Oil

o 0W-20

o 0W-30

o 0W-40

o 5W-20

o 5W-30

o 5W-40

o 10W-60

o 10W-40

o 15W-40

o Others

o Gear Oil

o Transmission Fluids

o Brake Fluids

o Coolants

o Greases

o Marine

o Engine Oil

o Hydraulic Oil

o Gear Oil

o Turbine Oil

o Greases

o Others

o Aerospace

o Gas Turbine Oil

o Piston Engine Oil

o Hydraulic Fluids

o Others

Segment Analysis

By Base Oil Analysis

Mineral oil, synthetic, and bio-based lubricants are included in the market segmentation of lubricants based on type. In 2023, the mineral oil category accounted for roughly 29.8% of the total revenue generated by the lubricants industry, holding the lion's share. Because mineral oil is less expensive than synthetic and semi-synthetic alternatives, it is the most often used substance. It is made from crude oil in huge amounts and used in the mining, metal, and oil sectors. There are light and heavy mineral grades, and their eventual usage is entirely determined by the requirements for that purpose. Synthetic ones use thickeners, additives, and base oil. Over the predicted time, it is expected that the synthetic sector will grow rapidly because of these expanding benefits.

By Application Analysis

With a 53.1% revenue share, the automotive segment led the global industry in 2023. The rise in sales of consumer vehicles, including trucks, buses, and other modes of passenger transportation, is the reason for this. Public transportation in emerging economies like China, India, and Brazil has improved as a result of economic growth in these areas. It is anticipated that this tendency will increase demand for commercial vehicle lubricants. Over the projection period, rising sales of construction vehicles like cranes, bulldozers, and concrete mixers as well as commercial vehicles like heavy-duty trucks are anticipated to support the expansion of the Middle East and Africa area. Because of the high levels of industrial production in emerging nations, the industrial category held the second-largest share in 2023.

Regional Analysis

In 2023, Asia Pacific held a 44.3% revenue share, leading the industry. The automotive industry's explosive growth is ascribed to both industrial development and the existence of automobile manufacturing sectors in nations like China, India, and Japan. In the Asian market, hydraulic fluids, greases, and motor oils for automobiles are the most widely used lubricants. As a result of Asia Pacific's attempts to imitate the regulatory frameworks of the United States and Europe, nations like South Korea and Japan are placing a strong emphasis on lubricants with an eco-label. Furthermore, because of its many ports and growing trade with the United States and other developed economies, Asia Pacific continues to dominate the global marine industry.

Over the projected period, the Indian lubricants market is expected to increase at a 4.9% annual pace. Throughout the projection period, it is expected that the maritime industries in China, Singapore, and India will become major international port operators. It is expected that these factors would increase the amount of lubricant used in different marine applications. China boasts more than 55,000 participating enterprises, making it the largest and most developed market in Asia Pacific. The Society of Tribologists and Lubrication Engineers estimates that China will account for about 65% of the world's newly expanded chemical material capacity in 2020. Therefore, during the projected period, it is expected that the country's increasing industrialization will enhance product demand. In 2023, China experienced an 11.6% surge in automobile production to fulfill the growing demand.

Europe is expected to grow at a substantial rate throughout the forecast period, accounting for a sizeable portion of sales in 2023. As one of the biggest sectors in the world, the automotive sector plays a vital role in the economy of the European Union (EU). Over 9 million cars were produced in the EU in the first three quarters of 2023, a 14% increase over the same period the year before (Q1-Q3).

Roughly 2.6 million workers are directly employed in the automobile manufacturing sector, which accounts for 8.5% of all manufacturing jobs in the European Union, according to the European Commission. Because of financial backing and technological harmonization from many governments, the region is also one of the world's top makers of automobiles, primarily for research and development projects related to automation. The expansion of the industry is probably going to benefit from this.

Competitive Analysis

There are many well-diversified regional, independent small- and large-scale producers and suppliers in the highly competitive global lubricants market. The main areas of competition for small businesses are price, after-sale support, and delivery schedules. On the other hand, huge corporations prioritize marketing strategy, product innovation, and development.

Recent Developments

January 2024: M&I Materials Ltd. sold MIDEL and MIVOLT to Shell U.K. Limited. The latter two's output will be manufactured and supplied as a component of Shell's lubricant line. Through the acquisition, Shell will be able to better position itself in the market for transformer oils, which are used by power distribution companies, utility companies, and offshore wind parks.

September 2023: Following the 2021 launch of the Quartz Xtra pilot project, TotalEnergies Lubrifiants expedited the incorporation of recycled plastics (i.e., 50% PCR high-density polyethylene) in its lubrication bottles. This attempts to lessen the use of virgin plastic and promote a circular economy.

Key Market Players in the Lubricants Market

o BP PLC.

o Castrol India Ltd.

o Fuchs

o JX Nippon Oil & Gas Exploration Corp.

o Philips 66 Company

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 145.0 Billion |

|

Market Size 2033 |

USD 204.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Base Oil, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

ExxonMobil Corp., BP PLC., Royal Dutch Shell Co., Chevron Corp., Total Energies, Castrol India Ltd., Fuchs, JX Nippon Oil & Gas Exploration Corp., Amsoil Inc., Philips 66 Company, Other Key Players |

|

Key Market Opportunities |

Growth in Industrialization |

|

Key Market Dynamics |

Growing Demand in Automotive and Transportation Industries |

📘 Frequently Asked Questions

1. What would be the forecast period in the Lubricants Market?

Answer: The forecast period in the Lubricants Market report is 2024-2033.

2. How much is the Lubricants Market in 2023?

Answer: The Lubricants Market size was valued at USD 145.0 Billion in 2023.

3. Who are the key players in the Lubricants Market?

Answer: ExxonMobil Corp., BP PLC., Royal Dutch Shell Co., Chevron Corp., Total Energies, Castrol India Ltd., Fuchs, JX Nippon Oil & Gas Exploration Corp., Amsoil Inc., Philips 66 Company, Other Key Players

4. What is the growth rate of the Lubricants Market?

Answer: Lubricants Market is growing at a CAGR of 3.5% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.