🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Magnesium Alloy Ingot Market

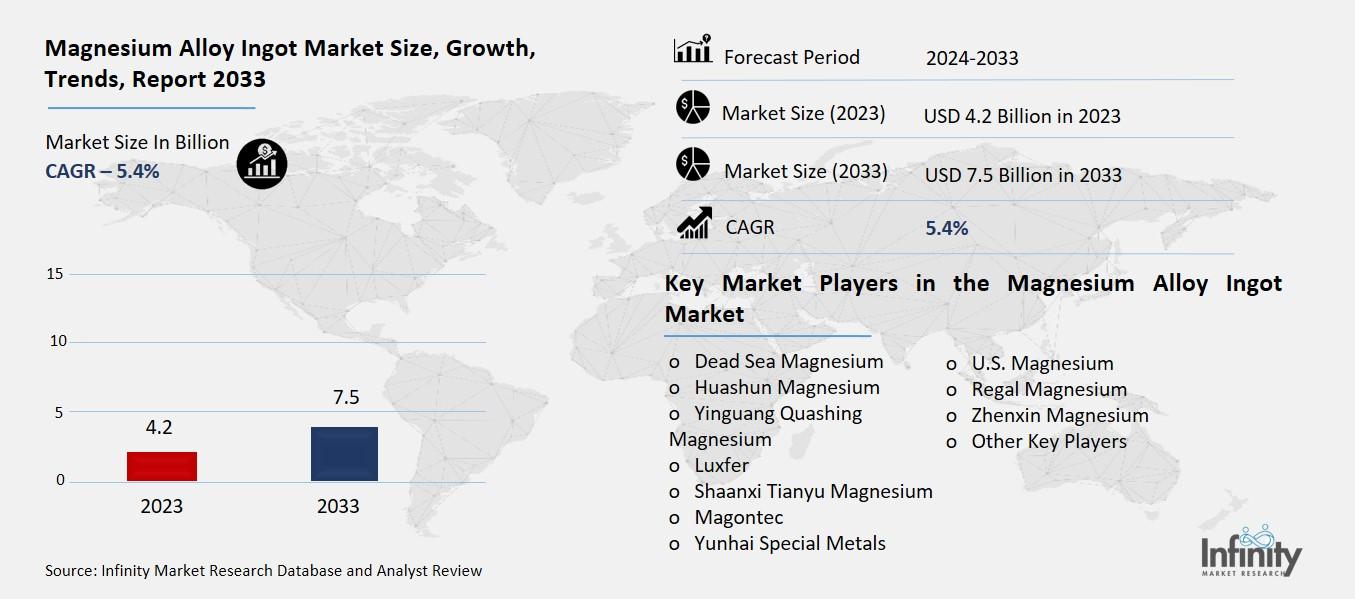

Magnesium Alloy Ingot Market (By Type, Wrought Alloys, Cast Alloys, and Other Types; By Application, Aerospace and Defense, Consumer Electronics, Automotive and Transportation, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1386

Magnesium Alloy Ingot Market Overview

Magnesium Alloy Ingot Market acquired the significant revenue of 4.2 Billion in 2023 and expected to be worth around USD 7.5 Billion by 2033 with the CAGR of 5.4% during the forecast period of 2024 to 2033. The magnesium alloy ingot is a market within the expansion of the metal industry as a whole on account of rising application demand for lightweight and applications from automobile manufacturing, aircraft, electronics manufacturing, construction and industries and sectors. Despite it being more expensive than other materials, magnesium alloy ingots have the features of great strength-to-weight ratio, corrosion resistance, and good machinability which made them suitable for use in a vehicle’s powertrain system that demands efficiency and performance.

The market players, key innovations; increasing technological improvements in manufacturing processes which improve the productivity, increasing environmental concern for lightweight vehicles and increasing tendency to use magnesium alloys in manufactures of electric and vehicles (EV). However, potential threats are high production cost and scarcity of raw materials that may impair growth in the manner described. Players are particularly keen on new developments in the alloying variations and raw materials supply to build a competitive advantage in this competitive segment.

Drivers for the Magnesium Alloy Ingot Market

Increasing Demand for Lightweight Materials

The magnesium alloy ingot finds broad applications in automobile and aerospace industries owing to high strength to weight ratio. These alloys are considerably lighter than metals that have conventional applications such as steel and aluminum and therefore have the attribute of decreasing the overall weights of most automobiles and airplanes. As they reduce its weight, they increase fuel economy, which not only decreases operating expenses but also diminishes greenhouse gas emissions keeping pace with the modern world and its concern for the environment. In automotive applications, automotive uses which include engine blocks, transmission cases and structural parts; while aerospace uses the magnesium alloys in frames and interior panels of aircrafts as well as other high performing parts where light weight parts are needed. Thus the enhancements of efficiency and the minimization of harm on the environment are major reasons requiring the use of magnesium alloy ingots in current transportation industries.

Restraints for the Magnesium Alloy Ingot Market

Limited Raw Material Availability

The scarcity of magnesium ore in certain regions creates significant supply chain challenges for the magnesium alloy ingot market, leading to fluctuations in production and pricing. Limited availability of raw materials restricts the ability of manufacturers to meet growing demand, particularly in industries like automotive and aerospace that rely heavily on magnesium alloys. Additionally, regions with insufficient magnesium ore deposits often depend on imports, making them vulnerable to geopolitical tensions, trade restrictions, and transportation costs. This imbalance in resource distribution affects market stability, driving up costs and limiting the competitiveness of magnesium alloys compared to alternative materials. To address these challenges, industry players are exploring sustainable mining practices, recycling initiatives, and the development of synthetic magnesium substitutes.

Opportunity in the Magnesium Alloy Ingot Market

Rising Investments in Electric Vehicles

The rapid expansion of the electric vehicle (EV) market offers significant opportunities for magnesium alloy applications, driven by the industry's focus on lightweight and energy-efficient designs. Magnesium alloys, with their excellent strength-to-weight ratio, are increasingly used in EV components such as battery enclosures, motor housings, and structural parts to reduce overall vehicle weight. This weight reduction enhances the efficiency and range of EVs, addressing one of the key challenges in EV adoption range anxiety.

Furthermore, lightweight designs improve performance while adhering to stringent regulatory standards for energy efficiency and emissions. As EV manufacturers strive for innovation and competitiveness, the demand for advanced materials like magnesium alloys is expected to rise, creating a lucrative market for their application.

Trends for the Magnesium Alloy Ingot Market

Integration with 3D Printing Technologies

Magnesium alloy ingots are gaining prominence in additive manufacturing due to their unique ability to produce complex, lightweight structures that meet the demands of modern industries. Additive manufacturing, or 3D printing, enables the precise layering of magnesium alloy material to create intricate designs that would be difficult or impossible to achieve with traditional manufacturing methods. This approach not only reduces material waste but also enhances design flexibility, making it ideal for applications in aerospace, automotive, and medical industries. Components created through this method benefit from magnesium's excellent strength-to-weight ratio, improving performance while minimizing overall weight. As additive manufacturing technologies continue to advance, the use of magnesium alloy ingots in creating innovative and tailored solutions is expected to grow significantly.

Segments Covered in the Report

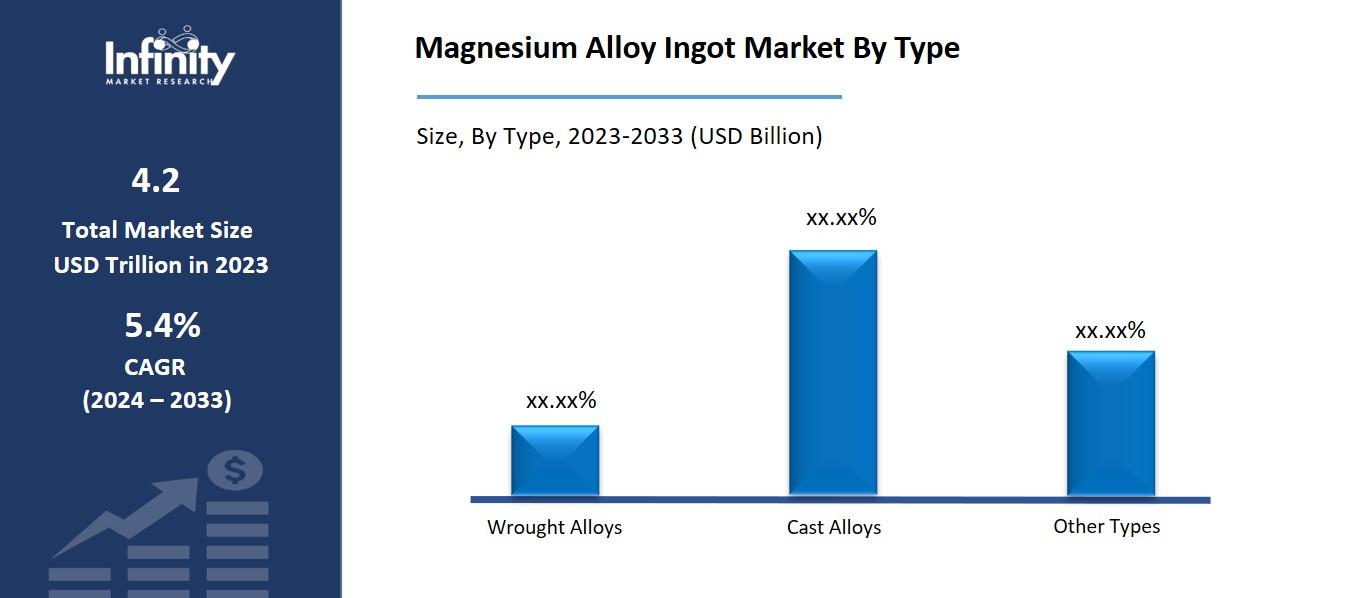

By Type

o Wrought Alloys

o Cast Alloys

o Other Types

By Application

o Aerospace and Defense

o Consumer Electronics

o Automotive and Transportation

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into wrought alloys, cast alloys, and other types. Among these, cast alloys segment acquired the significant share in the market owing to its extensive use in industries such as automotive and aerospace. Cast magnesium alloys are highly preferred due to their excellent superior dimensional stability, and ability to form complex shapes. These properties make them ideal for manufacturing lightweight components like engine blocks, transmission housings, and structural parts. Additionally, their high strength-to-weight ratio and cost-effectiveness in large-scale production further enhance their demand. The growing focus on lightweight materials in transportation and advancements in die-casting technologies have further solidified the dominance of cast alloys in the magnesium alloy ingot market.

By Application Analysis

On the basis of application, the market is divided into aerospace and defense, consumer electronics, automotive and transportation, and other applications. Among these, automotive and transportation segment held the prominent share of the market due to the growing demand for lightweight materials to improve fuel efficiency and reduce emissions. Magnesium alloys are increasingly used in the production of automotive components such as engine blocks, transmission cases, steering wheels, and seat frames, as they offer a superior strength-to-weight ratio and excellent machinability. The shift toward electric vehicles (EVs) has further accelerated the demand for magnesium alloys, as lightweight components are critical for enhancing battery range and overall vehicle performance.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.1% of the market due to the region's robust manufacturing base, particularly in countries like China, Japan, and South Korea, which are key producers and consumers of magnesium alloys. China, in particular, is a global leader in magnesium production and has established a strong supply chain for magnesium alloy ingots, supported by abundant raw material availability and low production costs.

Additionally, the region's thriving automotive, aerospace, and electronics industries drive substantial demand for lightweight materials. The rapid industrialization, growing adoption of electric vehicles, and increasing investments in infrastructure projects across Asia-Pacific further boost market growth. This combination of factors positions Asia-Pacific as the leading region in the magnesium alloy ingot market.

Competitive Analysis

The competitive landscape of the magnesium alloy ingot market is characterized by the presence of several key players striving to gain a competitive edge through innovation, strategic partnerships, and capacity expansions. Major companies focus on developing advanced alloys with enhanced properties such as increased strength, corrosion resistance, and recyclability to cater to diverse industry needs. Additionally, players are investing in sustainable production technologies and establishing robust supply chains to mitigate raw material scarcity and reduce costs. Collaborations with automotive and aerospace manufacturers to create customized solutions have also emerged as a key competitive strategy.

Recent Developments

In March 2023, Western Magnesium Corporation revealed its plans to enhance its operations by building a commercial plant and a Research & Development (R&D) Center in Nevada.

Key Market Players in the Magnesium Alloy Ingot Market

o Dead Sea Magnesium

o Huashun Magnesium

o Yinguang Huasheng Magnesium

o Luxfer

o Shaanxi Tianyu Magnesium

o Magontec

o Yunhai Special Metals

o U.S. Magnesium

o Regal Magnesium

o Zhenxin Magnesium

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 4.2 Billion |

|

Market Size 2033 |

USD 7.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Dead Sea Magnesium, Huashun Magnesium, Yinguang Huasheng Magnesium, Luxfer, Shaanxi Tianyu Magnesium, Magontec, Yunhai Special Metals, U.S. Magnesium, Regal Magnesiumm, Zhenxin Magnesium, and Other Key Players. |

|

Key Market Opportunities |

Rising Investments in Electric Vehicles |

|

Key Market Dynamics |

Increasing Demand for Lightweight Materials |

📘 Frequently Asked Questions

1. Who are the key players in the Magnesium Alloy Ingot Market?

Answer: Dead Sea Magnesium, Huashun Magnesium, Yinguang Huasheng Magnesium, Luxfer, Shaanxi Tianyu Magnesium, Magontec, Yunhai Special Metals, U.S. Magnesium, Regal Magnesiumm, Zhenxin Magnesium, and Other Key Players.

2. How much is the Magnesium Alloy Ingot Market in 2023?

Answer: The Magnesium Alloy Ingot Market size was valued at USD 7.5 Billion in 2023.

3. What would be the forecast period in the Magnesium Alloy Ingot Market?

Answer: The forecast period in the Magnesium Alloy Ingot Market report is 2024-2033.

4. What is the growth rate of the Magnesium Alloy Ingot Market?

Answer: Magnesium Alloy Ingot Market is growing at a CAGR of 5.4% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.