🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

MCA Market

MCA Market Global Industry Analysis and Forecast (2024-2032) By Type (Merchant Cash Advance (MCA), Factor-based MCA, Hybrid MCA), By Application (Retail, Hospitality, Healthcare, Transportation & Logistics, Construction, Other SMEs), By End-User (Small and Medium Enterprises (SMEs), Large Enterprises) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1737

MCA Market Synopsis

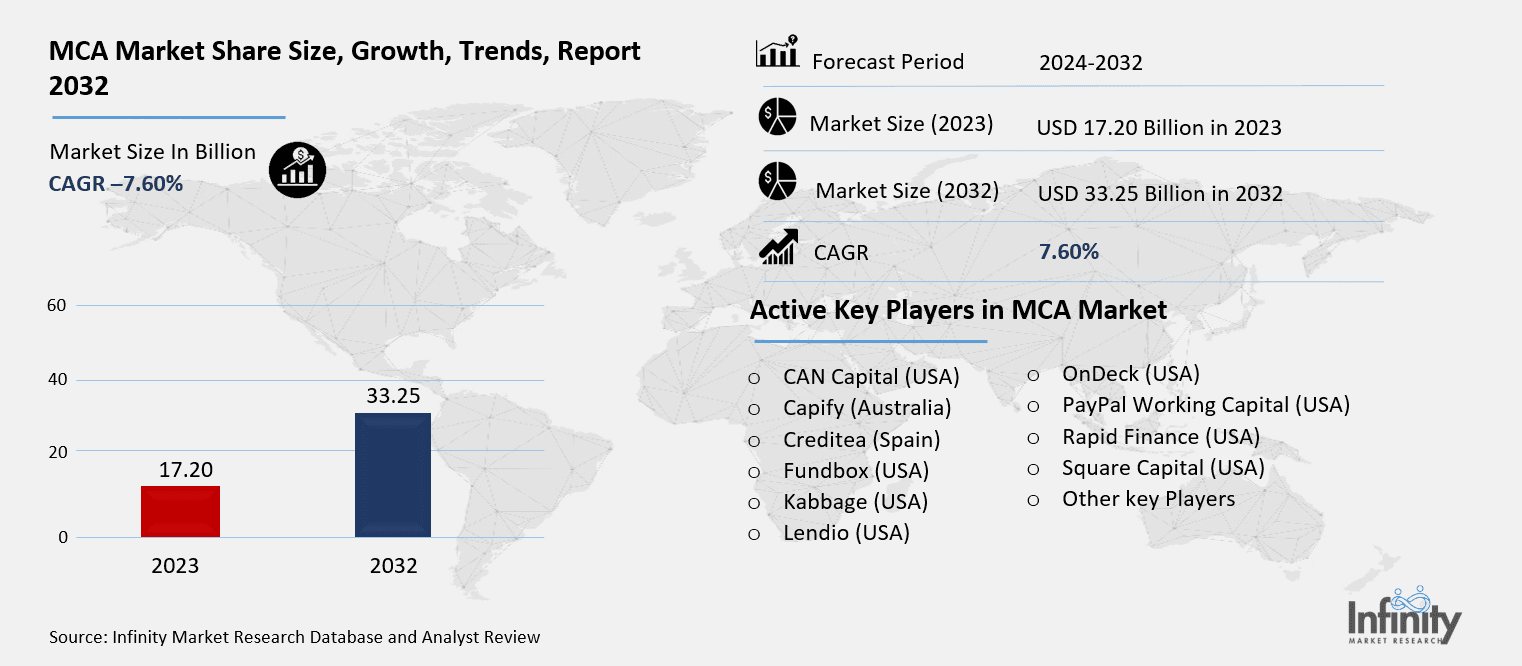

MCA Market Size Was Valued at USD 17.20 Billion in 2023, and is Projected to Reach USD 33.25 Billion by 2032, Growing at a CAGR of 7.60 % From 2024-2032.

The definition of the Merchant Cash Advance (MCA) market is a financial service of obtaining small working capital credit within days coupled with SMEs weekly or daily sales of credit card receipts as payment. While MCAs are a type of business financing, merchants repay them on a daily basis through fixed percentage sales which means they are convenient especially for business that may unable to secure conventional financing before due to poor credit or other financial problems.

The MCA market is steadily growing due to the core business problem of SMEs which is to have access to funding outside of traditional bank loans. Thus, MCA is attractive to various businesses that have slow-streaming cash flows and often must apply for quick funding. The demand is rising due to the continuously high demand for access to capital, especially when small businesses cannot qualify for a traditional money source.

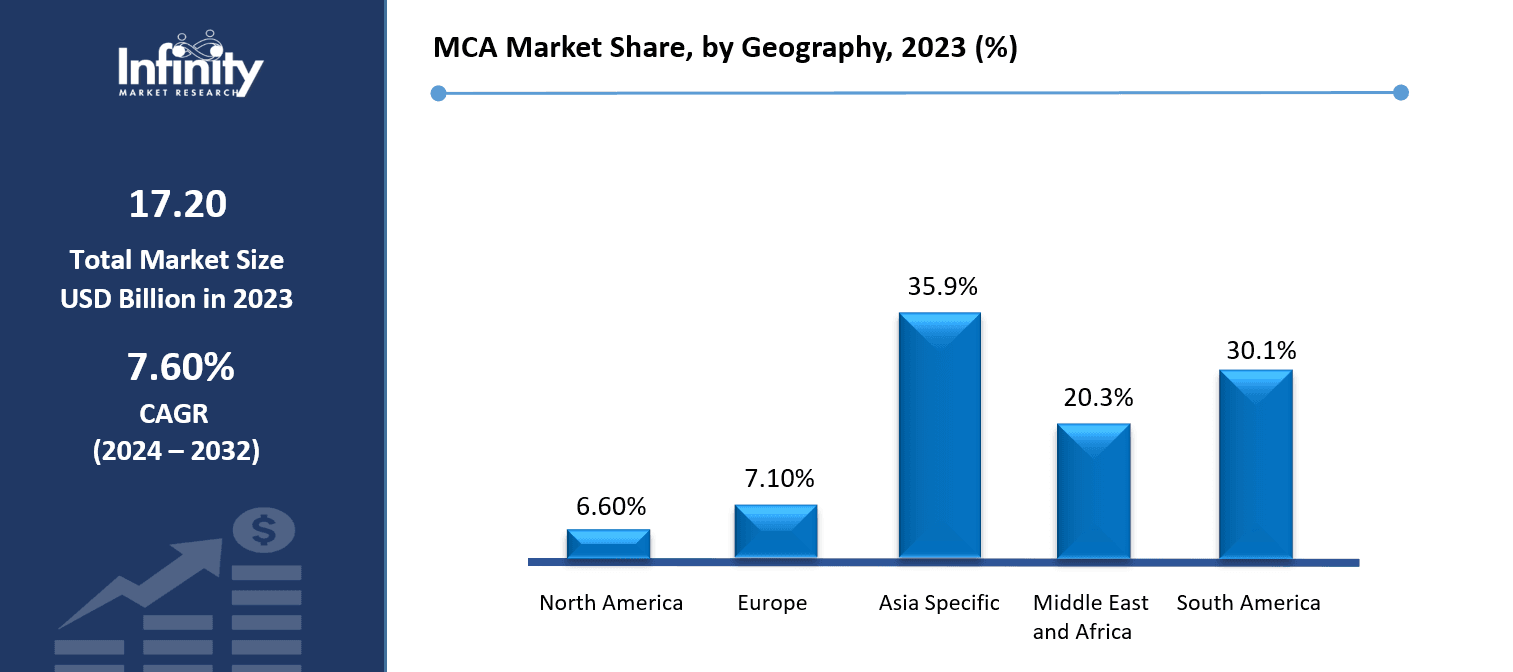

North America region dominates MCA market owing to demand by financial institutions who provide easier and faster access to funds for SMEs. The market in Europe is also expanding due to the consistent growing retention rate of the young businesses seeking the new sources of financing. Nonetheless, the growth of the Asia-Pacific region is anticipated to be the highest in the coming few years primarily due to the fast-growing SMBs and integrative digital financing.

MCA Market Outlook, 2023 and 2032: Future Outlook

MCA Market Trend Analysis

The Rise of Digital Lending, Transforming the MCA Landscape

The MCA market is observed to shift towards online channels as more financial service providers participate so as to obtain funds faster and with ease. This trend has been especially apparent in the Asia-Pacific region that already has a large and expanding interest in electronic payment and trading, further expanding the probability of business usage of MCA for funding. In addition, the field of analytics has advanced to help the financial institutions understand the SMEs’ credit risk more comprehensively; and develop more efficient and more tailored funding solutions.

The second notable pattern is the emergence of the products that can be referred as the mix of a conventional MCA and factoring services. It is interesting to a wider number of SMEs because it brings higher flexibility in repayment and amount of funding. If transitions to the hybrid solutions are to happen, MCA market is expected to become even more competitive thereby attracting more participants thereby expanding on its coverage as well as potentiality.

Fast Funds for Fast Growth, The SME Financing Revolution

The main source of drive for the MCA market is the dynamics that has been experienced in the market forces and more particularly by the SMEs who are in need of flexible and quick money. Conventional borrowings from banks involve lengthy processes accompanied by the many documents necessary and are unsuitable for organizations that require instant cash to sustain operations or to exploit new opportunities. The MCA model provides more benefits than the traditional CPA due to the fact that it is much more flexible and takes much less time to complete, which is a definite plus for SME’s operating in rapidly growing industries. Furthermore, with the increased amount of the startup of the e-selling companies whereby cash flows are very essential for some companies, MCA funding becomes very essential.

This is besides arising issues such as emergence of new payment technologies together with advanced sales channels, most of which are in the developing world aspiring to engage more in e-commerce. With an increasing number of businesses carrying out their transactions online, they qualify for MCA funding which is a new prospect for the MCA providers. This was besides enhanced smartphone adoption and Internet connection, especially in the developing world that enables firms to access MCA solutions.

The Cost Conundrum, Why MCA Can Be Pricey for SMEs

Therefore, the following challenges are evident on the MCA market. However, they are relatively expensive for financing through MCA than conventional loans is one of the biggest limitations to their use. MCA providers tend to charge higher fees and include the consideration of business performance risk making the cost of the interest for these services high and very expensive to business that source capital. Therefore, these constraints mean that some of the SMEs may only access MCA providers under extreme circumstances.

Another restrain is the problem with regulation for MCA providers from different parts of the world. This absence of a coherent framework of norms across the distinct countries can also be problematic for the businesses that aim to extend the variety of their MCA options internationally. Sometimes, the governmental authorities set strict requirements explicitly affecting the activity of MCA providers; in this way, these rules may restrict the overall market capacity in particular areas.

Emerging Markets, Emerging Opportunities, The Next Frontier for MCA

Another equally important prospect as to the MCA market is the diversification towards the new markets mainly Asia-Pacific and Latin America. These regions are experiencing rapid economic growth coupled by establishment of numerous small business for which they seek financing. But as these regions expand, there will be a demand for other kinds of funding like the MCA, giving providers of such services market opportunity.

Furthermore, where MCA providers are concerned, as the world goes increasingly digital in terms of operating environments, improvements to the experience of consumers and the funding process is on the table. Enhancing the role of artificial intelligence, machine learning and data analytics, MCA providers can identify the creditworthiness of businesses to offering appropriate financial products. This creates a good chance for competition to begin separating itself and grab a bigger niche of the market.

MCA Market Segment Analysis

MCA Market Segmented on the basis of By Type, By Application and By End-User.

By Type

o Merchant Cash Advance (MCA)

o Factor-based MCA

o Hybrid MCA

By Application

o Retail

o Hospitality

o Healthcare

o Transportation & Logistics

o Construction

o Other SMEs

By End User

o Small and Medium Enterprises (SMEs)

o Large Enterprises

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Merchant Cash Advance (MCA) segment is expected to dominate the market during the forecast period

The MCA market is categorized into three major types which include; Merchant Cash Advance (MCA) Factor-based MCA, and Hybrid MCA. Merchant Cash Advance (MCA) is the oldest form of funding where the business is expected to be paid a lump sum amount in advance against future sales. Meanwhile, factor-based MCA focuses on the sale of business future receivables due and payable, more flexible in the way the funding repaid. Hybrid MCA on the other hand is where one gets to have a blend of MCA and factoring products. This enables businessmen to secure funds in a manner that is most convenient to him/ her depending on their business sales.

By Application, Retail segment expected to held the largest share

The market segment mainly consists of the retail, hospitality, healthcare, transportation and logistics sectors, construction, among others, and other SMEs. In retail business, MCA support the cash flow challenges in strategic business periods like festive seasons or new products release. In hospitality, it finances seasonal business ventures that require finances when other seasons are low. Other industries benefiting from the MCA include healthcare who seek immediate funding for operations, equipment, and payroll, transportation industry such as construction companies. Other businesses who benefit from MCA include tech startups and service providers to help them grow and fill operational gaps.

MCA Market Regional Insights

Asia pacific is Expected to Dominate the Market Over the Forecast period

Currently, Asia-Pacific MCA market is growing at a fast rate due to the increasing numbers of SMEs and increasing popularity of digital and electronic payment solutions. This is due to growing online sales and technology-based companies within the Asian market; including China, India, and Southeast Asian nations requiring the MCA type of flexible financing solution. Moreover, mobile phone uptake and internet usage in the region has continued to grow, thereby improving the availability of MCA products whereby most SMEs can easily access funding online.

Also, the government across the region is coming up with policies in relation to enhancing the SMEs and Financial Access that is serving as a fuelling factor of the MCA market indirectly. The market competition in Asia-Pacific is also changing, with new entrants from international and local suppliers. Therefore, through digital innovation and the accompanying polices, the Asia-Pacific region has emerged as one of the regions with the higher growth rates for MCA services with possibilities to expand their reach to underserved rural and semi-urban populations.

MCA Market Share, by Geography, 2023 (%)

Active Key Players in the MCA Market

o CAN Capital (USA)

o Capify (Australia)

o Creditea (Spain)

o Fundbox (USA)

o Kabbage (USA)

o Lendio (USA)

o OnDeck (USA)

o PayPal Working Capital (USA)

o Rapid Finance (USA)

o Square Capital (USA)

o Other key Players

Global MCA Market Scope

|

Global MCA Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.20 Billion |

|

Forecast Period 2024-32 CAGR: |

7.60 % |

Market Size in 2032: |

USD 33.25 Billion |

|

Segments Covered: |

By Type |

· Merchant Cash Advance (MCA) · Factor-based MCA · Hybrid MCA | |

|

By Application |

· Retail · Hospitality · Healthcare · Transportation & Logistics · Construction · Other SMEs | ||

|

By End-User |

· Small and Medium Enterprises (SMEs) · Large Enterprises | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Digital Payments and MCA, A Match Made for the Future | ||

|

Key Market Restraints: |

· Regulatory Hurdles, Challenges in MCA Market Expansion | ||

|

Key Opportunities: |

· Tech-Driven Growth, How AI and Data Analytics Are Redefining MCA | ||

|

Companies Covered in the report: |

· CAN Capital (USA), Square Capital (USA), Lendio (USA), OnDeck (USA), Rapid Finance (USA), Kabbage (USA), Fundbox (USA), Creditea (Spain), Capify (Australia), PayPal Working Capital (USA) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the MCA Market research report?

Answer: The forecast period in the MCA Market research report is 2024-2032.

2. Who are the key players in the MCA Market?

Answer: CAN Capital (USA), Square Capital (USA), Lendio (USA), OnDeck (USA), Rapid Finance (USA), Kabbage (USA), Fundbox (USA), Creditea (Spain), Capify (Australia), PayPal Working Capital (USA) and Other Major Players.

3. What are the segments of the MCA Market?

Answer: The MCA Market is segmented into By Type, By Application, By End-User and region. By Type, the market is categorized into Merchant Cash Advance (MCA), Factor-based MCA, Hybrid MCA. By Application, the market is categorized into Retail, Hospitality, Healthcare, Transportation & Logistics, Construction, Other SMEs. By End-User, the market is categorized into Small and Medium Enterprises (SMEs), Large Enterprises. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the MCA Market?

Answer: The definition of the Merchant Cash Advance (MCA) market is a financial service of obtaining small working capital credit within days coupled with SMEs weekly or daily sales of credit card receipts as payment. While MCAs are a type of business financing, merchants repay them on a daily basis through fixed percentage sales which means they are convenient especially for business that may unable to secure conventional financing before due to poor credit or other financial problems.

5. How big is the MCA Market?

Answer: MCA Market Size Was Valued at USD 17.20 Billion in 2023, and is Projected to Reach USD 33.25 Billion by 2032, Growing at a CAGR of 7.60 % From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.