🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Medical Device Design And Development Services Market

Medical Device Design And Development Services Market (By Services (Designing & Engineering, Machining, Molding, Packaging), By Medical Devices (Cardiovascular Devices, POC Diagnostic Equipment, Hb1Ac Testing, Drug Delivery Devices, Orthopedic Devices, Dental Devices, Surgical Devices, Imagining Devices, Sleep & Respiratory Devices, Ophthalmology Devices, Endoscopy, Diabetes Care, Cochlear Implants, Neurostimulators, Others), By Therapeutic Area (Cardiovascular, Diagnostic, Others), By End-Use (Medical Device Companies, Biotechnology Companies), By Region and Companies)

Aug 2024

Healthcare

Pages: 138

ID: IMR1211

Medical Device Design And Development Services Market Overview

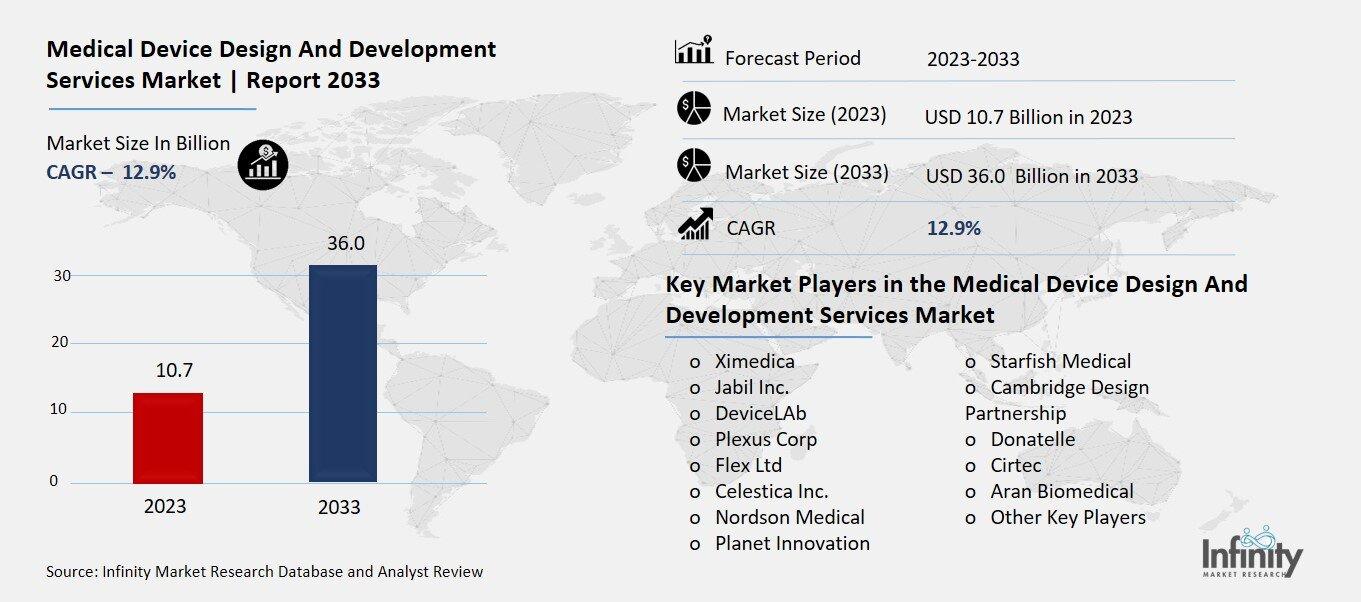

Global Medical Device Design And Development Services Market size is expected to be worth around USD 36.0 Billion by 2033 from USD 10.7 Billion in 2023, growing at a CAGR of 12.9% during the forecast period from 2023 to 2033.

The Medical Device Design and Development Services Market refers to the industry focused on creating and improving medical devices. This includes everything from designing new devices to developing them so they work well and are safe for use. Companies in this market help medical device makers with the entire process, from brainstorming ideas to making prototypes and testing them. They ensure the devices meet medical standards and can be used effectively by doctors and patients.

This market is growing because there’s a constant need for new and better medical devices. As technology advances and the demand for healthcare increases, more companies are turning to design and development experts to create innovative solutions. These services are crucial for bringing new medical technologies to the market and improving existing ones to better serve patients and healthcare providers.

Drivers for the Medical Device Design And Development Services Market

Growing Demand for Advanced Medical Devices

The increasing demand for advanced medical devices is a major driver for the medical device design and development services market. As healthcare technology evolves, there is a growing need for innovative devices that can offer better diagnostic, therapeutic, and monitoring capabilities. Hospitals and clinics are constantly seeking new solutions to improve patient care, manage chronic diseases, and enhance the efficiency of medical procedures. This demand pushes companies to invest in the design and development of cutting-edge devices that meet these needs.

Technological Advancements

Technological advancements are significantly driving the market. Innovations such as artificial intelligence, robotics, and wearable technology are transforming the medical device industry. These technologies allow for the creation of more precise, effective, and user-friendly devices. For example, AI can enhance diagnostic accuracy, while wearable devices can monitor patients' health in real-time. Companies offering design and development services are at the forefront of integrating these technologies into new medical devices, which drives market growth.

Increasing Focus on Personalized Medicine

The trend towards personalized medicine is another key driver. Personalized medicine involves tailoring medical treatments and devices to the individual characteristics of each patient. This approach requires custom-designed devices that can accommodate diverse patient needs and conditions. As personalized medicine becomes more prevalent, there is a growing need for design and development services that can create devices tailored to specific patient profiles, driving the demand for these services.

Regulatory Changes and Compliance

Regulatory changes and the need for compliance also impact the market. Medical devices must meet strict regulations and standards set by health authorities to ensure safety and efficacy. This compliance requires ongoing design and development efforts to adapt to new regulations and standards. Companies that specialize in medical device design and development play a crucial role in helping device manufacturers navigate these regulatory requirements and achieve compliance, which boosts the demand for their services.

Rising Investments in Healthcare Research and Development

Increased investments in healthcare research and development (R&D) contribute to the growth of the medical device design and development services market. Both public and private sectors are investing heavily in R&D to develop new and improved medical technologies. These investments support the innovation of new devices and technologies, leading to a greater need for specialized design and development services. As R&D efforts expand, so does the demand for expert services in designing and developing cutting-edge medical devices.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure, particularly in emerging markets, is another important driver. As healthcare systems in developing countries improve and expand, there is a growing need for advanced medical devices and technologies. This creates opportunities for design and development service providers to enter these markets and offer their expertise. The expansion of healthcare facilities and services globally increases the demand for new medical devices, driving growth in the design and development services sector.

Restraints for the Medical Device Design And Development Services Market

High Costs of Development

One major restraint for the medical device design and development services market is the high cost associated with developing new medical devices. Designing and developing medical devices involves extensive research, testing, and compliance with regulatory standards, all of which can be very expensive. The costs of prototyping, clinical trials, and obtaining necessary certifications add up, making it challenging for companies, especially smaller firms or startups, to afford these investments. This financial burden can limit the number of new devices entering the market and slow down innovation.

Regulatory Challenges

Regulatory challenges present another significant restraint. Medical devices are subject to rigorous regulatory requirements to ensure they are safe and effective for use. Navigating these regulations can be complex and time-consuming. Different countries have varying regulations and standards, which can complicate the design and development process for companies that want to market their devices internationally. This regulatory complexity can delay product launches and increase costs, impacting the overall efficiency of the design and development process.

Technological Complexity

The increasing complexity of medical technologies also poses a challenge. As devices become more advanced, they require more sophisticated design and development processes. This complexity can strain the resources of companies specializing in medical device design, particularly those without the necessary expertise or infrastructure to handle advanced technologies. Staying updated with the latest technological trends and integrating them into new devices requires significant expertise and investment, which can be a barrier for some companies.

Risk of Failure and Liability

The risk of failure and potential liability issues are also concerns in the medical device design and development sector. Developing a new medical device involves numerous stages, from design to testing, and each stage carries the risk of failure. If a device fails to perform as expected or causes harm to patients, the company behind it may face legal and financial consequences. The potential for such risks can deter investment and innovation in the market, as companies must carefully manage and mitigate these risks to avoid costly repercussions.

Intellectual Property Issues

Intellectual property (IP) issues can be a restraint as well. The medical device industry relies heavily on patents and proprietary technologies to protect innovations. However, disputes over IP rights can arise, leading to legal battles that can delay product development and increase costs. Protecting intellectual property while ensuring that new designs do not infringe on existing patents requires careful planning and legal oversight, adding another layer of complexity and potential restraint to the design and development process.

Opportunity in the Medical Device Design And Development Services Market

Emergence of Wearable Health Technologies

One of the significant opportunities in the medical device design and development services market is the rise of wearable health technologies. Wearable devices, such as fitness trackers and smartwatches, are becoming increasingly popular for monitoring health and managing chronic conditions. These devices offer real-time data on vital signs, physical activity, and other health metrics. As technology advances, there is a growing opportunity for companies to design and develop innovative wearable health devices that provide more accurate and comprehensive health monitoring. This trend opens doors for new products and services, enhancing patient care and creating new business prospects in the market.

Advancements in Telemedicine

Advancements in telemedicine present another promising opportunity. Telemedicine, which involves providing healthcare services remotely using digital technologies, has gained traction, especially following the COVID-19 pandemic. Medical devices that support telemedicine, such as remote monitoring tools and telehealth platforms, are in high demand. Design and development services can play a crucial role in creating and refining these devices, enabling healthcare providers to offer remote consultations, monitor patients from a distance, and improve access to care. This growing field provides ample opportunities for companies to innovate and expand their offerings in the medical device market.

Increasing Focus on Personalized Medicine

Personalized medicine is a key area of growth in the medical device industry. This approach tailors medical treatment to individual patients based on their unique genetic, environmental, and lifestyle factors. The demand for devices that support personalized medicine is rising, as they can help in customizing treatments and improving outcomes. Companies specializing in design and development services have the opportunity to create devices that integrate with personalized medicine approaches, such as genetic testing tools and customized drug delivery systems. This trend offers substantial growth potential as healthcare moves towards more individualized care.

Growing Aging Population

The growing aging population also creates significant opportunities in the medical device market. As people live longer, there is an increasing need for devices that address age-related health issues, such as mobility aids, monitoring systems, and diagnostic tools. The design and development of devices that cater to the specific needs of elderly patients can meet this demand. Companies can focus on creating user-friendly and effective devices to improve the quality of life for seniors, which presents a lucrative market segment with substantial growth potential.

Expansion in Emerging Markets

The expansion of healthcare infrastructure in emerging markets provides another valuable opportunity. As healthcare systems in developing countries improve, there is a growing need for modern medical devices and technologies. Companies in the design and development sector can tap into these emerging markets by providing innovative solutions tailored to the local needs and conditions. This expansion offers opportunities for growth and increased market presence in regions with rising healthcare demands and improving economic conditions.

Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence (AI) and machine learning, into medical devices offers new opportunities. These technologies can enhance device functionality, improve diagnostics, and streamline data analysis. Companies that incorporate AI and machine learning into their designs can create more sophisticated and effective medical devices. This opportunity aligns with the ongoing trend towards smarter, data-driven healthcare solutions and presents a chance for companies to stay at the forefront of innovation in the medical device industry.

Trends for the Medical Device Design And Development Services Market

Increased Use of Digital Health Technologies

One of the major trends in the medical device design and development services market is the increased use of digital health technologies. Digital health encompasses a range of technologies including mobile health apps, wearable devices, and telehealth platforms. These technologies are revolutionizing the way healthcare is delivered by enabling remote monitoring and virtual consultations. Companies are focusing on integrating these digital tools into new medical devices to provide more comprehensive and convenient care solutions. This trend reflects a shift towards more connected and patient-centered healthcare systems, driving innovation and growth in the market.

Growth of Minimally Invasive Procedures

The growth of minimally invasive procedures is another significant trend. Minimally invasive techniques, such as laparoscopic surgeries and robotic-assisted procedures, are becoming more common due to their benefits, including reduced recovery times and lower risk of complications. This trend is driving demand for advanced medical devices that can support these procedures. Companies are investing in designing and developing sophisticated instruments and technologies that enhance the precision and effectiveness of minimally invasive procedures, aligning with the healthcare industry's push towards less invasive and more efficient treatment options.

Focus on Patient-Centric Design

There is a growing emphasis on patient-centric design in the medical device industry. This trend involves creating devices that are more user-friendly and tailored to the needs of patients. Designing devices with the end-user in mind can improve patient compliance and outcomes. For instance, devices that are easier to use, more comfortable, or offer better feedback can significantly impact patient experience. Companies are increasingly incorporating user feedback and ergonomic principles into their design processes to create devices that enhance usability and patient satisfaction, reflecting a broader shift towards more personalized and accessible healthcare solutions.

Integration of Artificial Intelligence (AI) and Machine Learning

The integration of artificial intelligence (AI) and machine learning into medical devices is a prominent trend. AI and machine learning technologies are being used to enhance diagnostic accuracy, automate routine tasks, and provide predictive insights. For example, AI algorithms can analyze medical imaging data to detect abnormalities or predict patient outcomes more accurately. This trend is leading to the development of more intelligent and responsive medical devices that can assist healthcare professionals in making better-informed decisions. The adoption of AI and machine learning in medical devices represents a significant advancement in the industry, offering new capabilities and improving overall healthcare delivery.

Emphasis on Regulatory Compliance and Data Security

As medical devices become more advanced and interconnected, there is a stronger emphasis on regulatory compliance and data security. Ensuring that devices meet stringent regulatory standards and protect patient data is crucial for maintaining trust and safety in healthcare. Companies are focusing on incorporating robust security measures and adhering to regulatory requirements throughout the design and development process. This trend highlights the importance of safeguarding sensitive health information and ensuring that devices comply with global standards, which is essential for fostering confidence and ensuring the successful deployment of new technologies.

Sustainability in Device Design

Sustainability is becoming a key consideration in the design and development of medical devices. Companies are increasingly focusing on creating environmentally friendly products by using sustainable materials and reducing waste in the manufacturing process. This trend reflects a growing awareness of the environmental impact of medical devices and a commitment to reducing their ecological footprint. By incorporating sustainable practices into their design and development processes, companies can contribute to environmental conservation while meeting the demands of a more eco-conscious market.

Segments Covered in the Report

By Services

o Designing & Engineering

o Machining

o Molding

o Packaging

By Medical Devices

o Cardiovascular Devices

o Ventricular Assist Devices

o Total Artificial Hearts

o Pacemakers

o Implantable Cardioverter Defibrillators (ICDs)

o Cardiac Loop Recorders

o Holter Monitors

o Event Monitors

o ECMO Systems

o Consumables

o POC Diagnostic Equipment

o Blood Glucose Monitor

o Blood Analyzer

o Blood Pressure Monitor

o Pregnancy Test Kit

o Infectious Diseases Testing

o Hb1Ac Testing

o Coagulation Testing Kit

o Cardiac Markers Test

o Thyroid Stimulating Hormone Test

o Others

o Drug Delivery Devices

o Autoinjectors

o Infusion Pumps

o Prefilled Syringes

o Inhalers

o Nebulizers

o Nasal Spray

o Intrauterine Devices (IUDs)

o Transdermal Patches

o Orthopedic Devices

o Prosthetics

o Orthopedic Navigation Systems

o Others

o Dental Devices

o Surgical Devices

o Surgical Robots

o Others

o Imagining Devices

o X-Ray

o MRI Scanners

o Ultrasound

o CT Scanners

o Nuclear Imaging Scanners

o Sleep & Respiratory Devices

o Positive Airway Pressure (PAP) Devices

o Ventilators

o Oxygen Concentrators

o Others

o Ophthalmology Devices

o Fundus Cameras

o Slit Lamps

o Optical Coherence Tomography

o Corneal Topography Systems

o Others

o Endoscopy

o Diabetes Care

o Cochlear Implants

o Bionic Ear

o Bionic Eye

o Neurostimulators

o Spinal Cord Stimulators

o Deep Brain Stimulators

o Others

o Others

By Therapeutic Area

o Cardiovascular

o Diagnostic

o Others

By End-Use

o Medical Device Companies

o Biotechnology Companies

Segment Analysis

By Services Analysis

In terms of services, the designing and engineering segment had the biggest revenue share in 2023, accounting for 34.7%. The market is divided into three segments: designing and engineering, machining, and molding packaging. The design and engineering organizations have demonstrated their competence by meeting severe regulatory criteria, even when the project is extremely complex, diversified, and demanding. Furthermore, pressure to cut costs, increased competition, expanding demand from emerging economies, and technical breakthroughs are encouraging device manufacturers to consider outsourcing design and engineering functions. These reasons are expected to drive the segment.

The machining segment is expected to develop at the fastest CAGR of 12.4% throughout the projection period. Growing demand for miniaturized and complicated gadgets is a key driver of segment growth. The ability to machine complex materials by regulatory specifications, as well as technological advancements in medical machining such as laser micromachining, Computerized Numerical Control (CNC), and micro-precision medical component machining, are expected to boost the machining market.

By Medical Devices Analysis

The drug delivery devices sector dominated the medical device market in 2023, accounting for 16.1% of total revenue. The market is divided into several categories, including cardiovascular devices, point-of-care diagnostic equipment, drug delivery devices, orthopedic devices, dental devices, surgical devices, imaging devices, sleep and respiratory devices, ophthalmology devices, endoscopy, diabetes care, cochlear implants, neurostimulators, and others. The category is divided into auto-injectors, infusion pumps, prefilled syringes, inhalers, nebulizers, nasal sprays, intrauterine devices (IUDs), and transdermal patches. Growing trends in drug delivery, the desire for enhanced medicines, increased cost benefits for both individual patients and the healthcare system, and rapid technical improvements are all driving category expansion. Furthermore, ongoing innovation in novel drug delivery systems that address ease-of-use, sustainability, and safety issues for patients and healthcare professionals across a wide range of therapies has supported the segment's expansion. As a result, devices like autoinjectors, transdermal patches, and infusion pumps have grown significantly in recent years.

The POC diagnostic equipment segment is predicted to increase at the quickest rate of 15.5% throughout the projection period. The point of care (POC) gadget provides speedy, reliable, fit-for-purpose diagnostic findings at the moment of need while posing unique design problems. Furthermore, the design of POC diagnostic equipment ensures that the test sample remains intact while producing reliable results. This has resulted in an increased use of fast diagnostic testing. Furthermore, severe regulations and technological advances are likely to drive market expansion for point-of-care diagnostic equipment.

By Therapeutic Area Analysis

In terms of therapeutic area, the other segment dominated the market in 2023, accounting for 69.8% of revenue. The market is divided into three segments: cardiovascular, diagnostic, and others. Other therapeutic areas include drug delivery, orthopedics, dental, surgical, respiratory, and other medical devices. The benefits, such as improved patient outcomes for numerous diseases and the potential to reduce treatment costs, are expected to fuel category expansion.

The cardiovascular segment is projected to develop at the fastest CAGR of 14.8% throughout the forecast period. Cardiovascular devices help progress the treatment of heart failure, heart disease, arrhythmias, and other cardiac disorders. The segment's growth is attributed to an increase in product pipelines and the continual advancement of cardiovascular devices. The growing emphasis on high-technology, price-sensitive, and quality-competitive new device approvals drives up demand for sturdy devices. Furthermore, market participants' increasing desire for cardiovascular devices with superior quality, safety, performance, feasibility, and manufacturing cost is likely to fuel sector expansion.

By End-Use Analysis

In terms of end-use, medical device businesses dominated the market in 2023, accounting for 79.8% of total revenue. The market is divided into medical device firms and biotechnology companies. This segment's rise can be attributable to the global increase in demand for high-quality medical devices. Furthermore, the aging population and the prevalence of diseases have fueled research in medical device design and development. Furthermore, medical device development companies are driving innovation by embracing the newest technological trends such as miniaturization, portability, increased reliability, and connection. The overall forecast for design services is positive, thanks to trends in sophisticated manufacturing methods, components, and automation techniques.

The biotechnology firms category is projected to develop at the quickest CAGR of 11.9% over the forecast period. Recent trends indicate a massive migration in medical equipment, with major advances in diagnosis and treatment. Furthermore, the related and extensive subject of medical devices in biotechnology firms comprises producing healthcare items and methods that detect, treat, or prevent disease by incorporating pharmaceuticals or biologics. With a strong pipeline of medical devices and rising sales, the industry is likely to have significant market expansion.

Regional Analysis

The North American market is estimated to grow at the quickest CAGR of 12.7% over the forecast period. This might be due to the ongoing existence of established manufacturing enterprises and increased innovation for high-quality products. Furthermore, many medical device and biotechnology businesses have transferred their focus to manufacturing service providers to handle the growing volume of medical devices more efficiently. This has resulted in increased demand for market expansion. The US market is fueled by a well-established healthcare infrastructure, expanding medical device outsourcing services, and increased R&D spending.

The European market is predicted to rise at a high CAGR during the forecast period, owing to the increasing use of innovative technologies and the demand for services to improve the performance and safety of new and existing medical devices. The German market is likely to develop at the quickest CAGR over the forecast period, owing to an increasing focus on demand for medical device outsourcing and an increased emphasis on quality, which is expected to drive market growth. The UK market is expected to expand at the highest CAGR over the forecast period. High healthcare spending and continually changing demand for medical equipment drive the growth of medical device design and development services in this region.

In 2023, Asia Pacific dominated the market, accounting for 41.8% of total revenue. The region's large proportion is mostly attributable to the evolving business model of medical device outsourcing and R&D operations. The region's significance in this industry is due to the high cost-efficiency provided by medical device design and development companies in countries such as India and China.

Furthermore, rising demand for innovative medical equipment, favorable pricing, and increased local production drive market demand, supporting innovation and technological knowledge in the region. Furthermore, low-cost manufacturing, a diverse range of complicated and developing medical device regulatory requirements, and a well-developed manufacturing infrastructure for medical device design and development services promote market expansion.

Competitive Analysis

The leading competitors in the market are focusing on inorganic strategic initiatives such as mergers, partnerships, and acquisitions. Companies use a variety of tactics to enhance market presence and revenue, achieve a competitive advantage, and drive market growth, including service launches, mergers and acquisitions/joint ventures, partnerships and agreements, expansions, and others. As a result, increased adoption of inorganic strategic initiatives is expected to improve market share for key players operating throughout the industry.

Recent Developments

May 2023: Nouslogic Telehealth Inc. and DeviceLab announced a strategic cooperation to develop and sell next-generation wireless medical devices and remote patient monitoring solutions.

January 2023: ClariMed Inc. launched MedTech services partner to pursue an integrated, human-centered approach to product development of medical devices.

Key Market Players in the Medical Device Design And Development Services Market

o Ximedica

o Flex Ltd

o Celestica Inc.

o Nordson Medical

o Planet Innovation

o Cambridge Design Partnership

o Donatelle

o Cirtec

o Aran Biomedical

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 10.7 Billion |

|

Market Size 2033 |

USD 36.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

12.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Services, Medical Devices, Therapeutic Area, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ximedica, Jabil Inc., DeviceLAb, Plexus Corp, Flex Ltd, Celestica Inc., Nordson Medical, Planet Innovation, Starfish Medical, Cambridge Design Partnership, Donatelle, Cirtec, Aran Biomedical, Other Key Players |

|

Key Market Opportunities |

Emergence of Wearable Health Technologies |

|

Key Market Dynamics |

Growing Demand for Advanced Medical Devices |

📘 Frequently Asked Questions

1. What is the growth rate of the Medical Device Design And Development Services Market?

Answer: Medical Device Design And Development Services Market is growing at a CAGR of 12.9% during the forecast period, from 2023 to 2033.

2. Who are the key players in the Medical Device Design And Development Services Market?

Answer: Ximedica, Jabil Inc., DeviceLAb, Plexus Corp, Flex Ltd, Celestica Inc., Nordson Medical, Planet Innovation, Starfish Medical, Cambridge Design Partnership, Donatelle, Cirtec, Aran Biomedical, Other Key Players

3. How much is the Medical Device Design And Development Services Market in 2023?

Answer: The Medical Device Design And Development Services Market size was valued at USD 10.7 Billion in 2023.

4. What would be the forecast period in the Medical Device Design And Development Services Market?

Answer: The forecast period in the Medical Device Design And Development Services Market report is 2024-2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.